FTX’s collapse worked a significant blow towards the already fragile sentiment among cryptocurrency investors. Although a fast recovery is not likely, Blockchain analysis firm Chainalysis stated the crypto world could emerge more powerful out of this crisis. Chainalysis’ research lead Eric Jardine showed up by the end after evaluating FTX’s fall to that particular of Mt. Gox.

Another calming statement originated from Bloomberg Intelligence exchange-traded fund analyst James Seyffart, who stated there would be a “99.9% chance” the Grayscale Bitcoin Trust (GBTC) held the Bitcoin (BTC) it claimed. He added that GBTC was “unlikely” to become liquidated.

The negative occasions of history couple of days don’t appear to possess scared away the little investors who stick to an accumulating spree. Based on blockchain analytics company Glassnode, the amount of wallets holding a minumum of one Bitcoin or even more soared in November and arrived at 950,000.

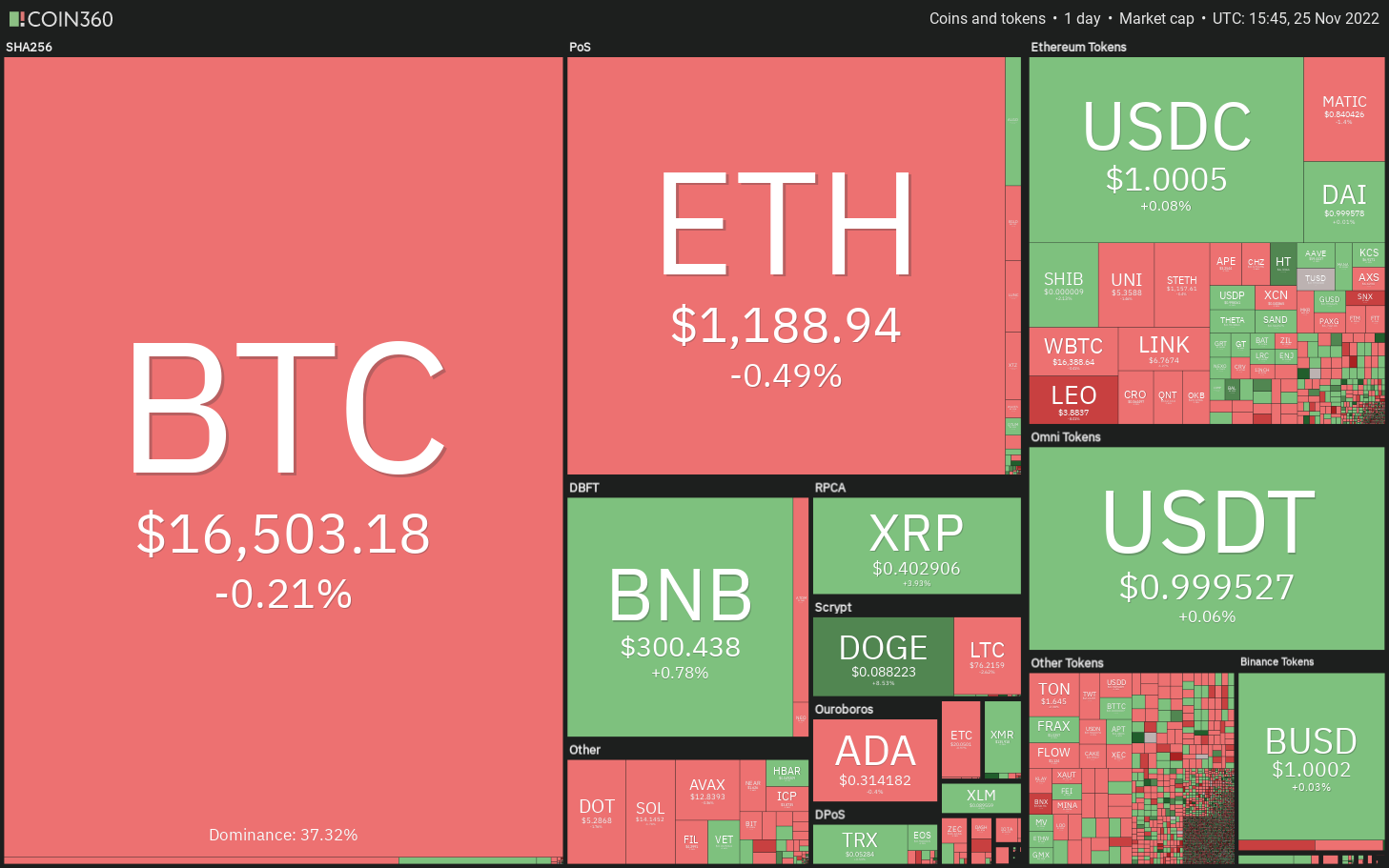

Could Bitcoin and altcoins extend their recovery soon? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin rebounded off $15,476 on November. 21, indicating that ‘abnormal’ amounts are attracting buying through the aggressive bulls. The relative strength index (RSI) has created a bullish divergence, suggesting the bears might be losing their grip.

Buyers will attempt to push the cost over the overhead resistance zone between your 20-day exponential moving average ($17,186) and $17,622. When they manage to achieve that, the BTC/USDT pair could indicate a potential alternation in trend.

The happy couple could then rise towards the 50-day simple moving average ($18,718) and after that challenge the mental degree of $20,000.

Unlike this assumption, when the cost turns lower in the current level or even the overhead resistance, it’ll claim that bears remain sellers on relief rallies. The bears will on the other hand make an effort to sink the happy couple below $15,588 and resume the downtrend. The following support on however at $12,200.

ETH/USDT

Ether (ETH) rebounded from the strong support near $1,073 on November. 22 and broke over the downtrend line on November. 24. This means the bulls try a comeback.

The ETH/USDT pair could next rise towards the 20-day EMA ($1,248), which is a vital level to take into consideration. If buyers overcome this barrier, the happy couple could chance a rally towards the resistance type of the climbing down funnel pattern.

However, when the cost turns lower in the 20-day EMA, it’ll claim that the sentiment remains negative and traders can sell on rallies. The bears will try to pull the cost towards the support type of the funnel. If the support cracks, the happy couple could plunge towards the critical support zone between $1,000 and $881.

BNB/USDT

BNB (BNB) broke underneath the strong support of $258 on November. 21 however this demonstrated to become a bear trap. The cost switched on November. 22 and also the momentum selected up further on November. 23. This drove the cost towards the overhead resistance at $300.

The bulls and also the bears are witnessing a difficult fight at $300 as seen in the Doji candlepower unit pattern created on November. 24 and 25. If bulls emerge on the top, the BNB/USDT pair could climb to $338 in which the bears may again mount a powerful defense.

On the other hand, when the cost turns lower in the current level and breaks underneath the moving averages, it’ll claim that the happy couple may remain range-bound between $258 and $300 for any couple of more days.

XRP/USDT

XRP (XRP) switched up from $.34 on November. 21 and increased over the symmetrical triangular and also the 20-day EMA ($.40) on November. 24. This demonstrated the uncertainty between your consumers resolved in support of the bulls.

The buyers are attempting to build upon the benefit by pushing the cost over the overhead resistance at $.41. When they succeed, the XRP/USDT pair could get momentum and rise to $.50 after which to $.56.

However, the bears will probably produce other plans. They’ll attempt to stall the recovery at $.41 and pull the cost into the triangular. In the event that happens, the aggressive bulls could get trapped and also the pair could then plummet towards the support line.

ADA/USDT

Cardano (ADA) is within a powerful downtrend. The bulls purchased the dip below $.30 on November. 22 but they are battling to push the cost towards the 20-day EMA ($.33).

The downsloping moving averages indicate that bears possess the upper hands however the RSI is developing a bullish divergence, which implies the selling pressure might be reducing. The very first manifestation of strength is a break over the 20-day EMA. The ADA/USDT pair could then chance a rally towards the 50-day SMA ($.36) and subsequently towards the downtrend line.

Rather, when the cost turns lower in the current level or even the 20-day EMA, the happy couple could extend its downtrend and drop towards the support line.

DOGE/USDT

Dogecoin (DOGE) rebounded from the support at $.07 on November. 21, indicating the bulls are attempting to set up a greater low only at that level.

The relief rally has arrived at $.09 in which the bulls will probably encounter strong resistance in the bears. When the cost turns lower in the current level, the DOGE/USDT pair could remain range-bound between $.07 and $.09 for a while.

Contrarily, if buyers propel the cost over the overhead resistance, the bullish momentum could get and also the pair may begin a rally towards the 38.2% Fibonacci retracement degree of $.10 after which towards the 50% retracement degree of $.11.

MATIC/USDT

Polygon (MATIC) rebounded from the upward trend line on November. 21 however the relief rally switched lower in the moving averages on November. 24. This means the bears are active at greater levels.

The sellers may once more make an effort to sink the cost underneath the upward trend line. When they manage to achieve that, the MATIC/USDT pair could drop towards the important support at $.69. The bulls are anticipated to intensely defend this level if it cracks, the happy couple could begin a new lower move and drop to $.52.

On the other hand, when the cost appears and increases over the moving averages, rapid-term advantage could tilt in support of the bulls. The happy couple could then rally to $.97 and then to $1.05.

Related: Will Bitcoin hit $110K in 2023? three reasons to become bullish on BTC now

Us dot/USDT

Polkadot’s (Us dot) rebound off $5 is facing resistance close to the 20-day EMA ($5.69). This means that bears still see the rallies like a selling chance.

When the cost turns lower out of this level, the bears will attempt to drag the Us dot/USDT pair towards the crucial support at $5. A rest and shut below this level will indicate the resumption from the downtrend. The happy couple could then decline to $4.32.

To invalidate this negative view, the bulls will need to push and sustain the cost over the moving averages. Whether they can accomplish it, it’ll claim that the downtrend might be ending. The happy couple could then rally to $7.43.

LTC/USDT

Litecoin (LTC) surged and closed over the overhead resistance of $75 on November. 23 however the bulls couldn’t build upon the breakout. The bears are trying to pull the cost back below $75 on November. 25.

When they succeed, the LTC/USDT pair could drop towards the 20-day EMA ($65). It is really an important level to keep close track of just because a strong bounce off it’ll suggest a general change in sentiment from selling on rallies to purchasing on dips. The bulls will make an effort to push the cost above $84 and open the doorways for any possible rally to $104.

Alternatively, if bears pull the cost underneath the 20-day EMA, it’ll indicate that greater levels still attract sellers. The happy couple could then drop towards the 50-day SMA ($58).

UNI/USDT

Uniswap (UNI) has created a sizable symmetrical triangular pattern, suggesting indecision one of the bulls and also the bears. The cost rebounded from the support type of the triangular on November. 22, indicating buying at ‘abnormal’ amounts.

The recovery attempt could face resistance in the moving averages. When the cost turns lower from this, the bears will again attempt to sink the UNI/USDT pair underneath the triangular. In the event that happens, the happy couple could drop to $3.33.

Unlike this assumption, if bulls drive the cost over the moving averages, the happy couple could climb towards the resistance type of the triangular. This level could behave as a significant hurdle but when bulls overcome it, the happy couple could rise to $8 and after that chance a rally to $10.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.