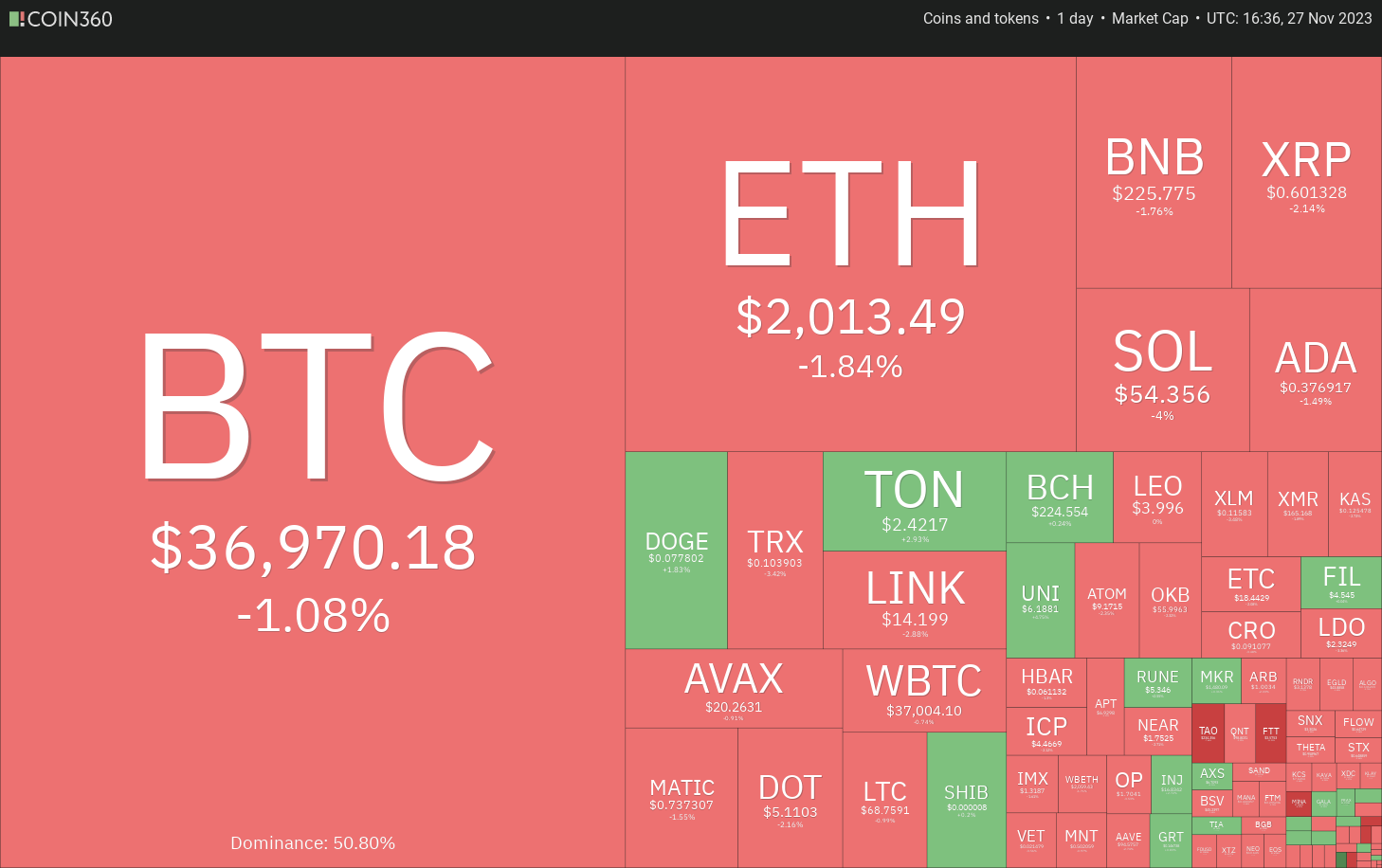

Bitcoin (BTC) has began a few days on the negative note. The failure from the bulls to pierce and sustain over the $38,000 resistance has provided a little window of chance for that bears to create a comeback. Strong selling has pulled the cost below $37,000 on November. 27.

However, ‘abnormal’ amounts will probably attract buyers because the bulls may wish to keep up with the momentum entering the ultimate month of the season. The bears will probably produce other plans because they will endeavour to deepen the correction. That may boost volatility within the last couple of times of November as both bulls and also the bears apply for a regular monthly closing within their favor.

While near-term uncertainty remains, Wealthy Father Poor Father author Robert Kiyosaki reiterated his lengthy-term bullish take on Bitcoin, silver and gold inside a X (formerly Twitter) publish on November. 26. He cautioned investors to get away from fiat money, calling it a “FAKE money system.”

Will Bitcoin and altcoins bounce business particular strong support levels, or will the bears prevail? Let’s evaluate the charts to discover.

S&P 500 Index cost analysis

The S&P 500 Index (SPX) ongoing its northward march greater after skyrocketing over the downtrend line. This signifies strong demand at greater levels.

The rally of history couple of days has pressed the relative strength index (RSI) in to the overbought zone, indicating that the minor correction or consolidation can be done soon. The 20-day exponential moving average (4,448) may be the crucial level to take into consideration around the downside.

When the cost appears out of this level, it’ll claim that the sentiment remains bullish and traders view dips like a buying chance. That improves the prospects of the break above 4,650.

On the other hand, an autumn underneath the 20-day EMA will indicate the bulls are losing their grip. The index will then slump towards the 50-day simple moving average (4,346).

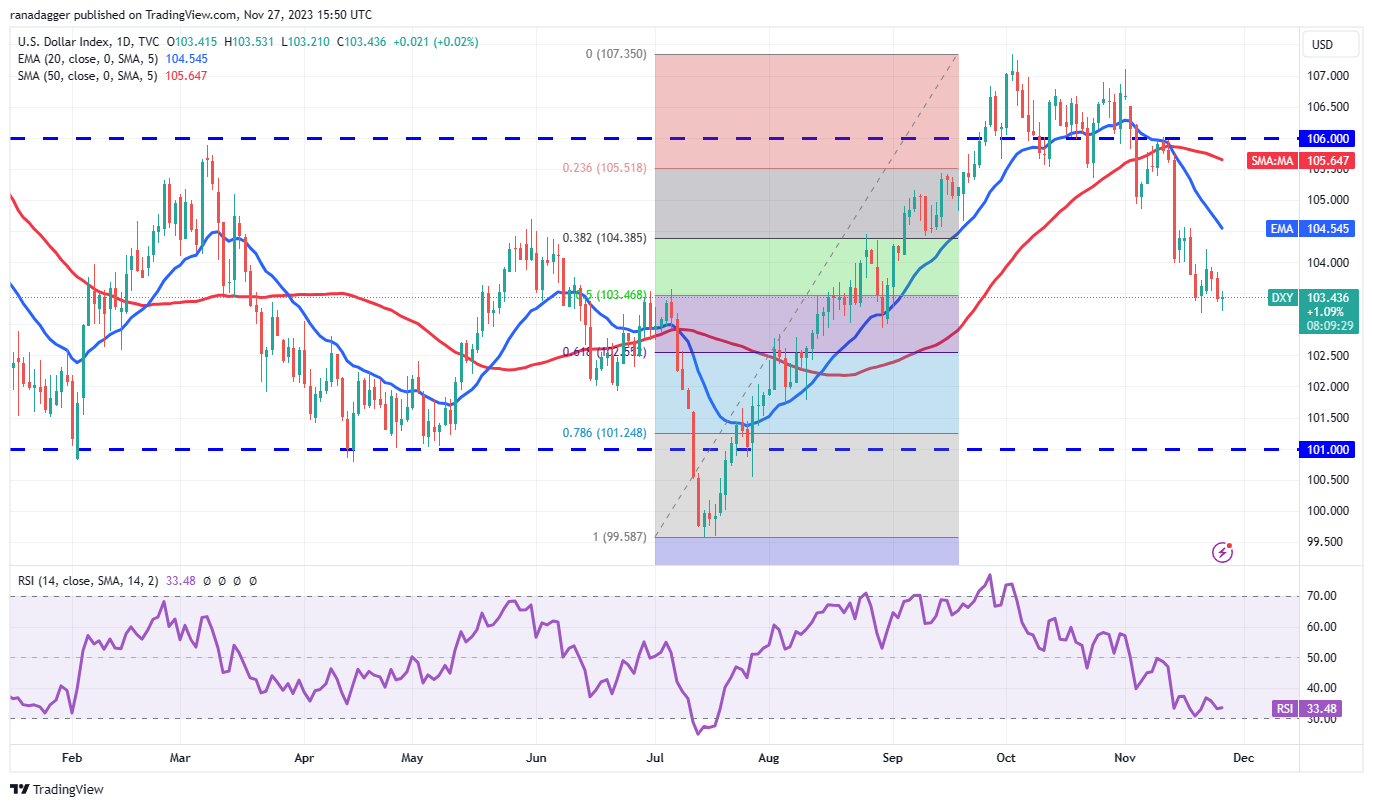

U.S. Dollar Index cost analysis

The U.S. Dollar Index (DXY) attempted a recovery in the 50% Fibonacci retracement degree of 103.46 on November. 21, however the bears were in no mood to relent.

Sellers stalled the relief rally at 104.21 on November. 22 and are attempting to sink the cost toward the 61.8% Fibonacci retracement degree of 102.55. The downsloping 20-day EMA (104.54) and also the RSI close to the oversold zone indicate that bears have been in command.

The very first manifestation of strength is a break and shut over the 20-day EMA. This type of move will claim that the correction might be over. The index will then chance a rally toward the stiff resistance at 106.

Bitcoin cost analysis

Bitcoin’s cost action of history couple of days is developing an climbing triangular pattern, that will complete away and shut above $38,000.

The upsloping moving averages and also the RSI within the positive territory indicate the road to least resistance would be to the upside. When the $38,000 resistance is scaled, the BTC/USDT pair may climb to $40,000. This level may again behave as a roadblock, but when removed, the happy couple may rise towards the pattern target of $41,160.

The bears will need to pull the cost underneath the upward trend line to invalidate the bullish setup. That could open the doorways for any fall to $34,800. When the cost rebounds off this level, it’ll advise a range-bound action between $34,800 and $38,000. The bears will gain top of the hands away and shut below $34,800.

Ether cost analysis

Ether (ETH) surged near to the overhead resistance of $2,137 on November. 24, however the bulls couldn’t overcome this barrier. That could have brought to learn-booking, as seen in the lengthy wick around the day’s candlepower unit.

The bears are attempting to tug the cost underneath the 20-day EMA ($1,998). Whether they can accomplish it, the ETH/USDT pair may fall to $1,904. A rest below this support will develop a double-top pattern. This reversal setup could begin a much deeper correction towards the 50-day SMA ($1,834).

Rather, when the cost snaps away from the 20-day EMA, it’ll claim that ‘abnormal’ amounts still attract buyers. The happy couple will then climb towards the overhead resistance zone between $2,137 and $2,200. Buyers will need to ascend this zone to accomplish a sizable climbing triangular pattern.

BNB cost analysis

BNB’s (BNB) rejection in the 20-day EMA ($237) on November. 23 signifies the bears are attempting to switch the amount into resistance.

The bears maintained their selling pressure and also have pulled the cost underneath the 50-day SMA ($229). The BNB/USDT pair could next slide towards the solid support at $223 and below it to $219. Buyers will probably defend this zone with vigor.

Around the upside, the bulls will need to push and sustain the cost above $240 to point out the selling pressure is reducing. That could begin a rally to $255 and then towards the major resistance at $265.

XRP cost analysis

XRP (XRP) bounced from the 50-day SMA ($.58) on November. 22 but hit a wall in the 20-day EMA ($.61). This means the bears are attempting to switch the 20-day EMA into resistance.

Sellers will attempt to sink the cost underneath the 50-day SMA and challenge the vital support at $.56. If the level is breached, it’ll claim that bears have returned in command. The XRP/USDT pair will then progressively collapse to $.46.

On the other hand, when the cost appears in the current level or $.56 and increases over the 20-day EMA, it’ll indicate the pair will continue to oscillate within the large range from $.56 and $.74.

Solana cost analysis

Solana (SOL) switched lower in the immediate resistance at $59 on November. 26, indicating the bears are attempting to halt the relief rallies only at that level.

The bears will attempt to bolster their position further by pulling the cost underneath the 20-day EMA ($53). The SOL/USDT pair will develop a mind-and-shoulders pattern whether it breaks underneath the neckline at $51. That may begin a steep correction towards the 50-day SMA ($40) and after that towards the pattern target of $34.

The bulls will probably produce other plans. They’ll attempt to arrest the decline near $51. When the bounce off this level increases above $59, it’ll indicate that bulls are during the driver’s seat. The happy couple will then retest the neighborhood high at $68.

Related: BTC cost eyes $40K among record hash rate — 5 items to know in Bitcoin now

Cardano cost analysis

Cardano (ADA) unsuccessful to interrupt over the overhead resistance of $.40 previously 72 hours. That could have enticed short-term traders to reserve profits.

The ADA/USDT pair could slide towards the 20-day EMA ($.37), which will probably attract buyers. When the cost bounces off this level with vigor, it’ll signal the trend remains positive and traders are purchasing on dips. The bulls will make yet another make an effort to overcome the obstacle at $.40. When they succeed, the happy couple may soar to $.46.

Contrarily, when the 20-day EMA cracks, the happy couple may slump to $.34. Buyers are anticipated to protect this level if it provides way, the happy couple may achieve the 50-day SMA ($.32).

Dogecoin cost analysis

The bears attempted to yank Dogecoin (DOGE) underneath the 20-day EMA ($.08) on November. 26, however the bulls purchased the dip as seen in the lengthy tail around the candlepower unit.

The bulls pressed the cost over the $.08 resistance on November. 27, however the lengthy wick around the candlepower unit shows solid selling at greater levels. When the cost dips underneath the 20-day EMA, the DOGE/USDT pair could slump towards the 50-day SMA ($.07).

On the other hand, when the cost once more rebounds from the 20-day EMA, it’ll suggest demand at ‘abnormal’ amounts. The bulls will on the other hand attempt to kick and sustain the cost above $.08. When they do this, the happy couple may get momentum and surge toward $.10.

Chainlink cost analysis

Chainlink (LINK) broke over the downtrend line on November. 26, however the bulls unsuccessful to construct upon the momentum. This might have attracted selling, which pulled the cost underneath the downtrend line on November. 27.

The 20-day EMA ($14) continues to be the key support to take into consideration soon. When the cost sinks and sustains underneath the 20-day EMA, it’ll claim that the bears try a comeback. The HyperlinkOrUSDT pair could then decline towards the 61.8% Fibonacci retracement degree of $12.83.

However, when the cost rebounds from the 20-day EMA, it’ll claim that the sentiment remains positive and traders are purchasing on dips. Which will boost the prospects of the rally towards the overhead resistance of $16.60.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.