It’s the ultimate month of the season and analysts are by helping cover their their projections for the following year. Inside a note to investors, Standard Chartered recommended that “The financial-market surprises of 2023” includes Bitcoin (BTC) cost diving to $5,000 at some time around. The autumn is going to be triggered with a liquidity crunch, which could cause more bankruptcies along with a fall in investor confidence within the crypto sector.

If the seems like a serious, venture capitalist Tim Draper went within the other direction and predicted that Bitcoin could skyrocket to $250,000 by the center of 2023. While talking to CNBC, Draper stated that Bitcoin’s massive rally will probably be fuelled by elevated participation from ladies who control most of retail spending.

For the short term, analysts remain divided around the prospects of the Bitcoin rally. Although some analysts expect a Christmas rally to push Bitcoin toward $19,000, other medication is not too positive.

Is the S&P 500 index (SPX) witness profit booking soon? May be the U.S. dollar index (DXY) ripe for any recovery? What’s the effect of the asset classes on cryptocurrencies? Let’s read the charts to discover.

SPX

The S&P 500 index rebounded from the 20-day exponential moving average (3,967) on November. 30, indicating that bulls still see the dips like a buying chance.

The cost arrived at the downtrend line on 12 ,. 1 however the bulls unsuccessful to pierce this resistance. This signifies the downtrend line will probably behave as a formidable resistance. The cost could oscillate between your downtrend line and also the 20-day EMA for any couple of days.

The upsloping 20-day EMA and also the relative strength index (RSI) within the positive territory indicate the road to least resistance would be to the upside.

When the cost closes over the downtrend line, the bullish momentum could get further and also the index may rally to 4,300.

This positive view could invalidate soon when the cost turns lower and breaks underneath the 20-day EMA. That may pull the index towards the 50-day simple moving average (3,818).

DXY

The relief rally within the U.S. dollar index (DXY) fizzled out in the 20-day EMA (107) on November. 30. This implies that the sentiment has switched bearish and traders can sell on rallies towards the 20-day EMA.

The bears pulled the cost underneath the strong support of 105 on 12 ,. 1 and thwarted attempts through the bulls to push the cost back above 105 on 12 ,. 2. Even though the downsloping moving averages and also the RSI within the negative territory indicate benefit to bears, they couldn’t take advantage of the breakdown and resume the downtrend.

Buyers have pressed the cost back above 105 on 12 ,. 5. If bulls sustain the cost above this level, the index could ascend towards the 20-day EMA. This level could again behave as an obstacle but when bulls catapult the cost above it, the index could rally to 108.

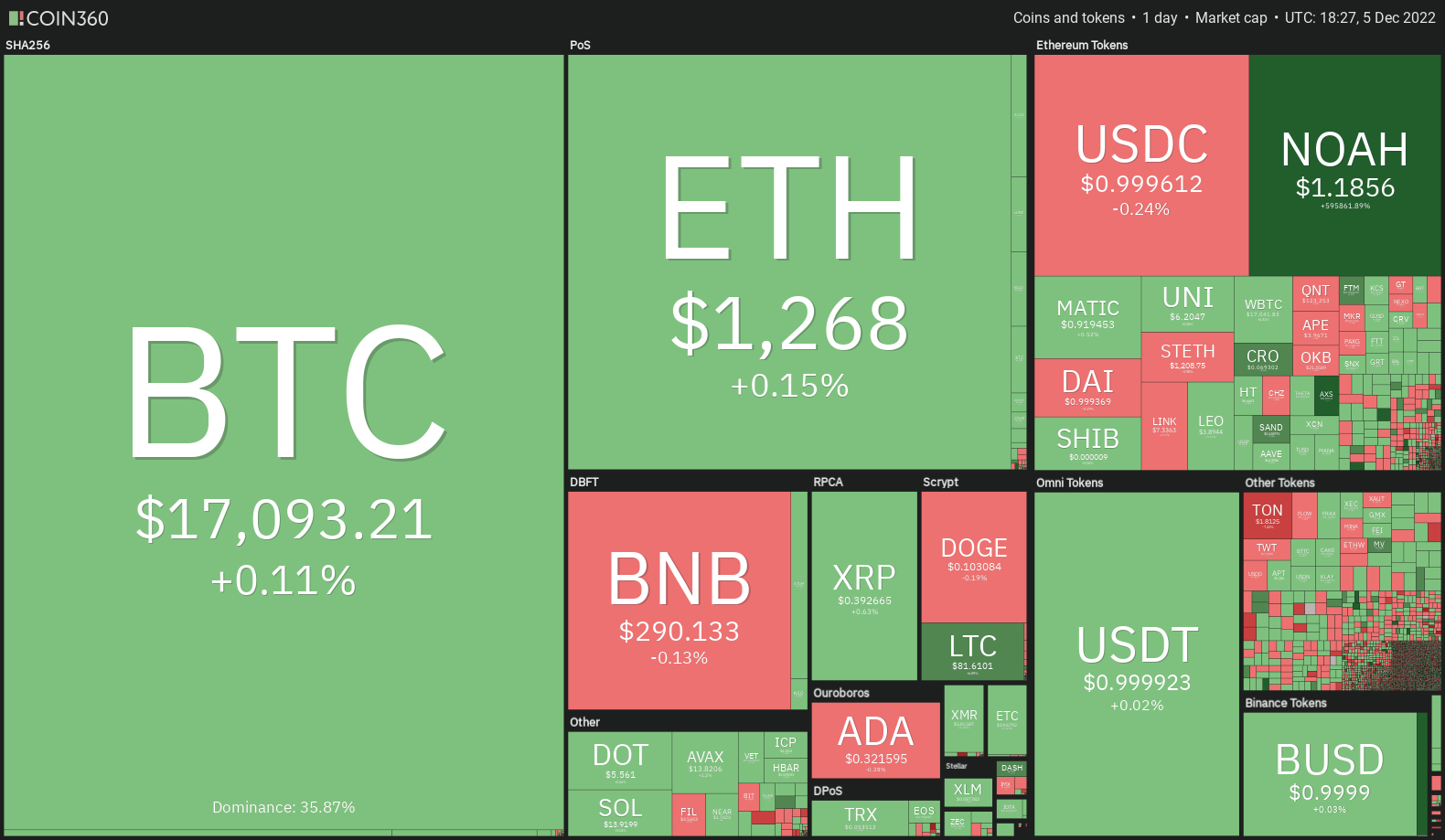

BTC/USDT

After buying and selling close to the 20-day EMA ($16,979) within the last four days, Bitcoin attempted moving greater on 12 ,. 5. However, the lengthy wick around the day’s candlepower unit suggests selling at greater levels.

The bears are anticipated to protect the overhead zone between $17,622 and also the 50-day SMA ($18,223) with vigor. When the cost turns lower in the zone but doesn’t break underneath the 20-day EMA, it’ll claim that traders are purchasing on dips. That may increase the probability of a rally to $20,000 and after that to $21,500.

Alternatively, when the cost turns lower in the overhead resistance and plummets underneath the 20-day EMA, it’ll claim that the BTC/USDT pair could remain range-bound between $15,476 and $18,200 for any couple of days.

ETH/USDT

The bears attempted to sink Ether (ETH) back underneath the 20-day EMA ($1,251) on 12 ,. 3 however the bulls held their ground. This means the buyers are protecting the 20-day EMA strongly.

The 20-day EMA has began to show up progressively and also the RSI is simply over the midpoint, indicating that bulls possess a slight edge. This increases the prospects of the break over the 50-day SMA ($1,334).

In the event that happens, the ETH/USDT pair could get momentum and rally towards the resistance type of the climbing down funnel that could behave as a significant roadblock.

Around the downside, a rest and shut below $1,236 could claim that bears try a comeback. The happy couple could then slide to $1,150.

BNB/USDT

BNB’s (BNB) cost continues to be buying and selling close to the moving averages within the last 72 hours. This signifies a tussle between your bulls and also the bears to achieve top of the hands.

The flattish moving averages and also the RSI close to the midpoint tendency to slack a obvious advantage with the idea to the bulls or even the bears. Buyers will need to push and sustain the cost above $300 to point strength. The BNB/USDT pair could then rise to $318 and after that to $338.

On the other hand, when the cost turns lower and breaks below $285, the selling could intensify and also the pair may drop to $275. There’s a small support only at that level but when it does not hold, the decline could include the vital support at $250.

XRP/USDT

XRP (XRP) is facing resistance at $.41 but finding support in the upward trend line. The cost action of history couple of days has created an climbing triangular pattern, that will complete away and shut above $.41.

In the event that happens, it’ll advise a potential trend reversal and also the XRP/USDT pair could start an up-proceed to $.45 and then to $.51.

Alternatively, when the cost turns lower and breaks underneath the upward trend line, it’ll invalidate the bullish setup. That may sink the cost to $.37 after which to $.34. This type of move will claim that the happy couple may extend its stay within the large range from $.30 and $.41 for any couple of more days.

The flattish 20-day EMA and also the RSI close to the midpoint also advise a consolidation soon.

ADA/USDT

Cardano (ADA) nudged over the 20-day EMA ($.32) on 12 ,. 5 however the bulls couldn’t sustain the greater levels. This means that bears can sell on relief rallies.

For that recovery to bolster further, the bulls will need to sustain the cost over the 20-day EMA. The ADA/USDT pair could then rally towards the 50-day SMA ($.35) and subsequently towards the downtrend line. This level offer a powerful potential to deal with the bulls.

The 20-day EMA has flattened out and also the RSI is simply underneath the midpoint, suggesting a variety-bound action soon. The bears will need to sink the cost below $.29 to signal the resumption from the downtrend.

Related: Litecoin eyes $100 after ‘rare’ LTC cost breakout

DOGE/USDT

Dogecoin’s (DOGE) recovery rose over the 38.2% Fibonacci retracement degree of $.10 and arrived at close to the 50% retracement degree of $.11.

The lengthy wick around the 12 ,. 5 candlepower unit implies that the bears are protecting the zone between your 50% retracement at $.11 and also the 61.8% retracement at $.13. The very first type of support to take into consideration on however the 20-day EMA ($.09).

A powerful rebound off this level will claim that ‘abnormal’ amounts are attracting buyers which could increase the potential of a rally above $.13. The happy couple could then develop a 100% retracement and rise to $.16.

This bullish view might be negated when the cost turns lower and plummets underneath the moving averages.

MATIC/USDT

Polygon (MATIC) bounced from the 20-day EMA ($.90) on 12 ,. 4, indicating that bulls are trying to switch the amount into support.

The 20-day EMA has began to slope up and also the RSI is simply over the midpoint, indicating that buyers possess a slight edge. There’s a small resistance at $.97 but chances are it will be entered. The MATIC/USDT pair could then rally to $1.05 in which the bears may attempt to stall the recovery.

When the cost turns lower from $1.05, the happy couple could again drop towards the 20-day EMA. A powerful bounce off it might improve the likelihood of a rest above $1.05. Contrarily, a rest underneath the moving averages could create a decline towards the upward trend line.

Us dot/USDT

Polkadot (Us dot) broke over the 20-day EMA ($5.54) on 12 ,. 2 and also the bulls effectively defended the retest on 12 ,. 3. Buyers attempted to propel the cost towards the 50-day SMA ($5.92) on 12 ,. 5 but met with significant resistance at greater levels.

The 20-day EMA has flattened out and also the RSI has risen towards the midpoint, indicating the downward momentum is weakening. This increases the potential of a rest over the 50-day SMA. If the level is entered, the Us dot/USDT pair could rise towards the downtrend line. This level will probably behave as a significant obstacle for that bulls.

However, when the cost turns lower and slips underneath the 20-day EMA, the happy couple could decline to $5.30 after which to $5.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.