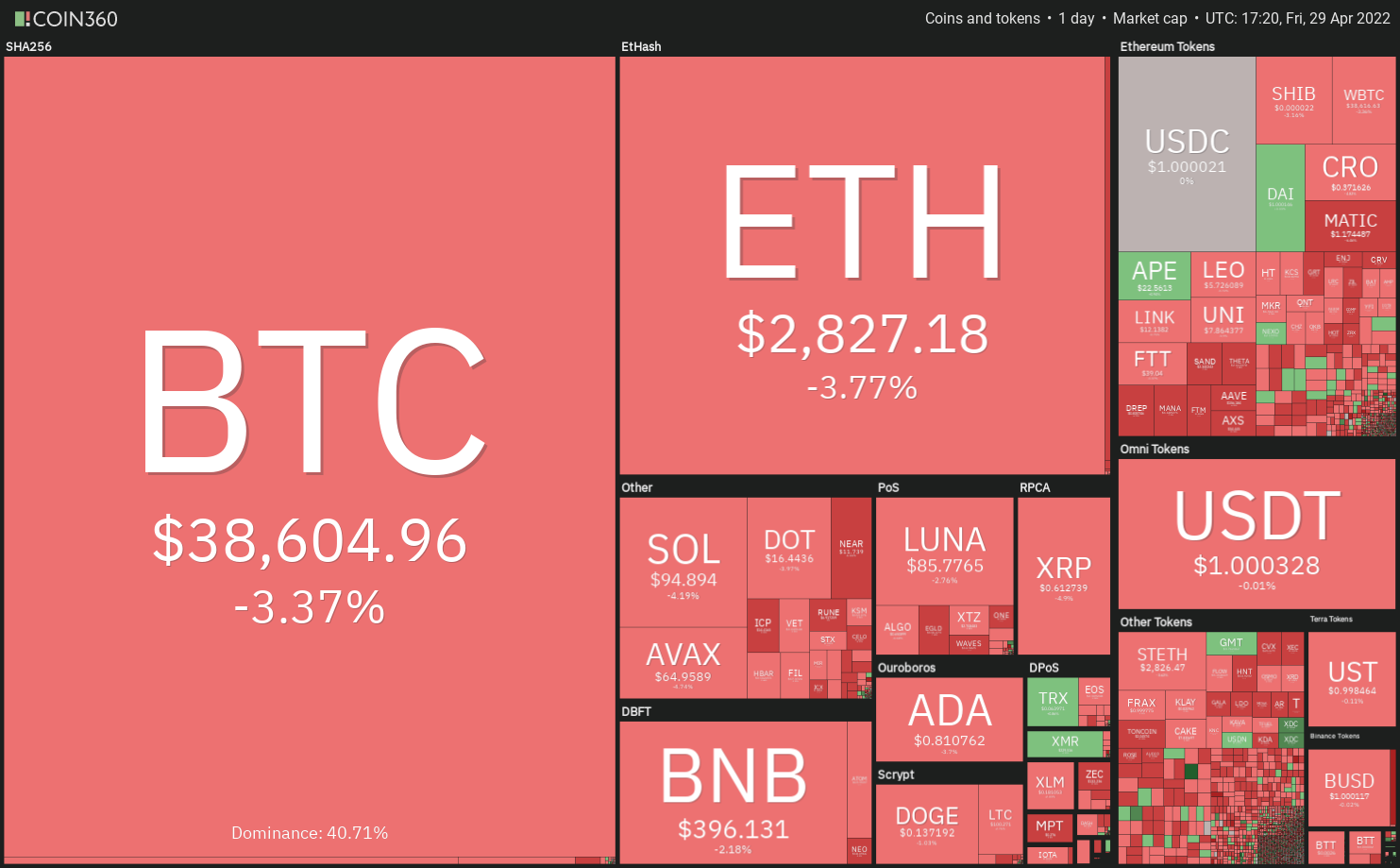

The U.S. dollar index (DXY) switched lower from the 20-year at the top of April 29 however that hasn’t altered the bearish cost action observed in Bitcoin (BTC) and also the U.S. equity markets. Equities remain pressurized and now, Amazon . com stock saw its greatest intraday drop since 2014 after uncertainty within the U.S. Federal Reserve’s tightening measures placed investor sentiment back to choppy waters.

If Bitcoin extends its correction, on-chain analysis platform Whalemap believes the $25,000 to $27,000 zone could be the best spot “to go all-in” on Bitcoin.

Lengthy-term investors don’t seem to be panicking within the current weakness in Bitcoin as well as on-chain data from CryptoQuant implies that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2018.

The HODL mentality isn’t restricted to Bitcoin investors alone. A nonfungible token (NFT) survey report by CoinGecko demonstrated which more than 50% of respondents stated there is a HODL mentality simply because they believe NFTs might be important products in games. The report added the Metaverse turn into an $800 billion market within the next 2 yrs.

Could Bitcoin and altcoins decline further or perhaps is a reversal around the cards? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin retracted towards the 20-day exponential moving average (EMA) ($40,363) on April 28 however the lengthy wick around the day’s candlepower unit shows that bears can sell on rallies for this level.

The downsloping 20-day EMA and also the relative strength index (RSI) below 41 indicate the road to least resistance would be to the down-side. If bears sink and sustain the cost underneath the support type of the funnel, the BTC/USDT pair could extend its decline to $34,300 and then to $32,917.

To invalidate this negative view, the buyers will need to push and sustain the cost over the 50-day simple moving average (SMA) ($41,981). When they succeed, the happy couple could start its northward journey towards the 200-day SMA ($47,433) in which the bears may again pose a stiff challenge.

ETH/USDT

Ether (ETH) retracted towards the 20-day EMA ($2,991) previously 2 days however the bulls couldn’t push the cost above it. This means the sentiment remains negative and traders can sell on rallies.

The bears will make an effort to sink the cost towards the upward trend line. It is really an important level for that bulls to protect just because a break and shut below it might invalidate the developing climbing triangular pattern. The ETH/USDT pair could then decline to $2,450.

This negative view could invalidate for the short term when the cost appears and breaks over the 50-day SMA ($3,045). That may attract clients who will then push the happy couple towards the 200-day SMA ($3,464). A rest and shut above this level could signal the beginning of a brand new up-move.

BNB/USDT

BNB dropped below $391 on April 26 however the bears couldn’t sustain the low levels. The cost rose back over the breakdown level on April 27. This means demand at ‘abnormal’ amounts.

The bulls pressed the cost towards the 50-day SMA ($410) on April 28 but tend to not obvious this hurdle. This means that bears can sell on rallies. The bears will make an effort to pull the cost underneath the $391 to $380 support zone.

When they manage to achieve that, the BNB/USDT pair could drop towards the strong support at $350. The buyers are anticipated to mount a powerful defense only at that level. Rapid-term trend could turn positive if bulls push and sustain the cost over the 50-day SMA.

SOL/USDT

Solana (SOL) bounced from the support type of the climbing funnel on April 27 however the bulls couldn’t sustain the positive momentum and obvious the overhead hurdle in the 20-day EMA ($101).

The bears now sense an chance and can attempt to sink the cost underneath the support type of the funnel. When they manage to achieve that, the selling could accelerate and also the SOL/USDT pair could slide towards the strong support at $75. It is really an important level for that bulls to protect just because a break and shut below it might signal the resumption from the downtrend.

This negative view could invalidate for the short term when the cost appears and breaks over the 20-day EMA. The happy couple could then rise to $110 and then chance a rally to $122.

LUNA/USDT

The failure from the bulls to push Terra’s LUNA token over the mental resistance at $100 might have enticed short-term traders to reserve profits. That pulled the cost underneath the minor support at $86 on April 29.

The RSI has dipped in to the negative zone, indicating the bullish momentum has weakened. If bears sustain the cost below $86, the LUNA/USDT pair could drop towards the strong support at $75. The bulls are anticipated to protect the zone between $75 and also the 200-day EMA ($69) strongly.

Around the upside, the buyers will need to overcome the stiff barrier at $100 to setup a possible retest from the all-time high at $119. A rest and shut above this level could signal the resumption from the upward trend.

XRP/USDT

Ripple (XRP) rebounded from the support at $.62 on April 26 however the weak rebound recommended too little aggressive buying. The selling started again on April 29 and also the bears have pulled the cost underneath the critical support.

The 20-day EMA ($.71) is sloping lower and also the RSI is incorporated in the oversold zone, suggesting the road to least resistance would be to the down-side. When the cost sustains below $.62, the XRP/USDT pair could plummet to $.55 and then challenge the mental support at $.50.

Unlike this assumption, when the cost rebounds from the current level, the buyers can make yet another make an effort to push the happy couple over the 20-day EMA. When they succeed, it’ll claim that the happy couple may consolidate between $.62 and $.91 for a while.

ADA/USDT

Cardano (ADA) attempted to begin a relief rally from $.81 on April 27 but unsuccessful to achieve the 20-day EMA ($.91). The selling started again on April 29 and also the bears will make an effort to pull the cost towards the strong support at $.74.

The 20-day EMA is sloping lower and also the RSI is close to the oversold territory, suggesting that bears possess the edge. If bears sink the cost below $.74, the selling could intensify and also the ADA/USDT pair could plummet to $.68.

Unlike this assumption, when the cost rebounds off $.74, the bulls will attempt to push the happy couple over the 20-day EMA. When they succeed, the happy couple could rally towards the mental level at $1, which will probably behave as a stiff resistance.

Related: three reasons why Dogecoin cost are now able to gain 50% by September

DOGE/USDT

Dogecoin (DOGE) has were able to stay over the 50-day SMA ($.13) within the last 72 hours however the bulls haven’t been in a position to sustain the cost over the 20-day EMA ($.14). This means the bears can sell at greater levels.

The failure to bounce may attract further selling, that could pull the cost underneath the 50-day SMA. In the event that happens, the DOGE/USDT pair could drop to $.12 and then towards the mental support at $.10.

Unlike this assumption, when the cost increases and sustains over the 20-day EMA, the buyers will attempt to push the happy couple towards the overhead resistance at $.17. The bulls will need to obvious this hurdle to signal a potential alternation in trend.

AVAX/USDT

Avalanche (AVAX) has declined towards the strong support at $65. The bulls had defended this support on two previous occasions hence, they’ll again attempt to arrest the decline only at that level.

However, the bears will probably produce other plans. The downsloping 20-day EMA ($74) and also the RSI close to the oversold territory favor the bears. When the cost breaks below $65, the AVAX/USDT pair could drop towards the critical support at $51.

Alternatively, when the cost rebounds off $65, the happy couple will probably hit a wall in the 20-day EMA. When the cost turns lower out of this resistance, the prospects of the break below $65 increase.

The bulls will need to push and sustain the cost over the 20-day EMA to point the bears might be losing control. The happy couple could then rise towards the 200-day SMA ($85).

Us dot/USDT

The bulls are protecting the support from the large range from $16 and $23 but haven’t had the ability to acquire a strong rebound off it. This means that demand dries up for Polkadot (Us dot) at greater levels.

The downsloping 20-day EMA ($18) and also the RSI within the negative territory indicate benefit to sellers. The bears will make an effort to pull the cost underneath the $16 support and when they manage to achieve that, the Us dot/USDT pair may drop to $14.

The buyers will need to push and sustain the cost over the 50-day SMA ($19) to signal the corrective phase might be over. The happy couple could then start its journey toward the overhead resistance at $23.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.