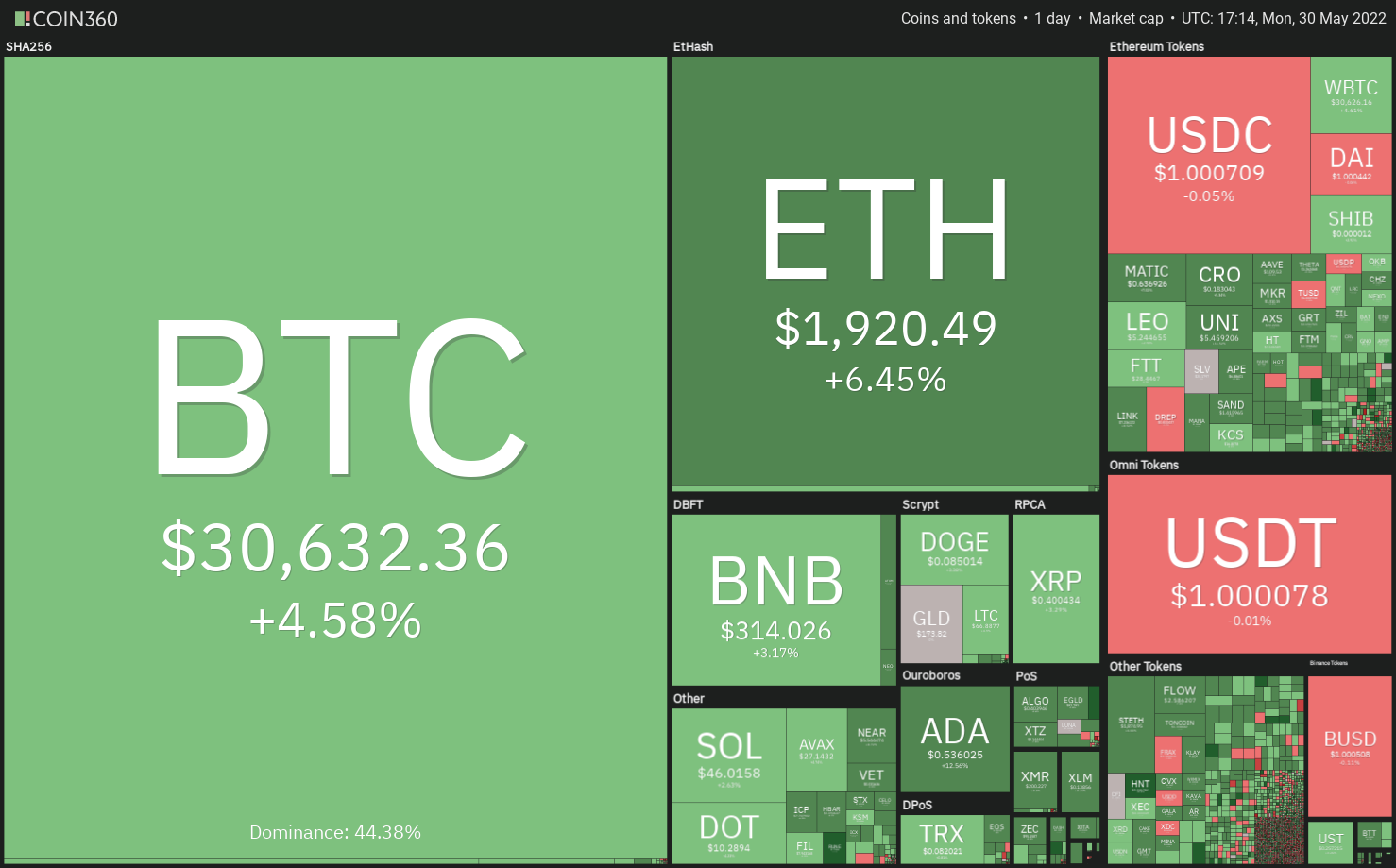

After allowing the dubious record of nine successive red weekly closes, Bitcoin (BTC) is trying to make amends by beginning a cost recovery to finish the losing streak. Analysts have frequently stated that investors shouldn’t fear a bear market since it is among the best occasions to purchase essentially strong projects in preparation for the following bull phase.

CryptoQuant Chief executive officer Ki Youthful Ju highlighted that unspent transaction outputs (UTXOs) which are over the age of six several weeks reflect 62% from the recognized cap, which has similarities to the stage seen throughout the March 2020 crash. Hence, Ki stated that Bitcoin might be near to developing a cyclic bottom.

In the present bearish atmosphere, it is not easy to fathom a Bitcoin rally to $250,000 but millionaire investor Tim Draper continues to be bullish. While speaking on the YouTube display on May 24, Draper stated when more retailers start accepting Bitcoin, participation from women increases because they tends to buy things with Bitcoin. Based on Draper, this might boost Bitcoin’s cost above his target purpose of $250,000.

With several analysts with a bottom in Bitcoin, could it be a great time to purchase? Is the crypto markets begin a recovery for the short term? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin broke over the downtrend line on May 30 and also the bulls are trying to sustain the cost over the 20-day exponential moving average ($30,562). When they succeed, it will likely be the very first indication the bears might be losing their grip.

When the cost sustains over the 20-day EMA, the BTC/USDT pair could rise to $32,659 and then towards the 50-day simple moving average ($34,954). The 20-day EMA is flattening out and also the relative strength index (RSI) has risen above 46, suggesting that bulls try a comeback.

On the other hand, when the cost turns lower in the 20-day EMA, it’ll claim that the sentiment remains negative and traders can sell on rallies. The bears will make another make an effort to pull the happy couple below $28,630 and challenge the May 12 intraday low at $26,700. A rest below this support could signal the resumption from the downtrend.

ETH/USDT

Ether (ETH) bounced from the vital support at $1,700 on May 28 and it is marching toward the 20-day EMA ($2,026). This means that bulls are trying to begin a sustained recovery.

The RSI is showing a bullish divergence suggesting the selling pressure might be reducing. The buyers will attempt to push the cost over the 20-day EMA and challenge the breakdown level at $2,159. If bulls neglect to obvious this hurdle, the BNB/USDT pair risk turning lower and consolidate between $1,700 and $2,159.

If bulls thrust the cost above $2,159, it’ll claim that $1,700 could be the bottom for the short term. The happy couple could then rally towards the 50-day SMA ($2,504). This bullish view might be invalidated when the cost turns lower and plummets below $1,700.

BNB/USDT

Binance Gold coin (BNB) required support close to the immediate support at $286 on May 27, suggesting that traders are purchasing the dips. The bulls will again make an effort to push the cost over the overhead resistance at $320.

When they succeed, the BNB/USDT pair could rally to $350. The more the cost sustains above $320, the higher the possibility the bottom has been created on May 12. If bulls overcome the barrier at $350, the rally could achieve $400.

However, when the cost turns lower in the current level or $350, it’ll claim that bears can sell on rallies. That may again pull the cost towards the immediate support at $286. If the support cracks, the happy couple could decline to $260.

XRP/USDT

Although Ripple (XRP) dipped below $.38 on May 26, the bears couldn’t keep up with the selling pressure. This began a recovery on May 28, that has arrived at the downtrend line.

The bears have frequently mounted a powerful defense in the downtrend line, hence it is really an important potential to deal with keep close track of. When the cost reverses direction in the downtrend line, the bears will attempt to drag the XRP/USDT pair below $.37 and challenge the important support at $.33.

On the other hand, if buyers drive and sustain the cost over the 20-day EMA ($.43), it’ll claim that the sellers might be losing their grip. The happy couple could then rally towards the mental level at $.50.

ADA/USDT

Cardano (ADA) broke underneath the minor support at $.46 on May 27 however the bears couldn’t build upon the benefit. The bulls purchased this dip and began a recovery on May 28.

The relief rally selected up momentum on May 30 and also the bulls are trying to push the cost over the 20-day EMA ($.54). When they succeed, it’ll claim that the ADA/USDT pair is trying to form a bottom. The happy couple could then rise to $.61 and then chance a rally towards the breakdown degree of $.74.

This positive view might be negated when the cost turns lower in the 20-day EMA. In the event that happens, the bears will again attempt to sink the happy couple below $.40 and begin the following leg from the downward move.

SOL/USDT

Solana (SOL) retrieved from $40 on May 28, indicating that ‘abnormal’ amounts still attract buying through the bulls. The buyers will attempt to push the cost towards the 20-day EMA ($53).

If bulls propel the cost over the 20-day EMA, it’ll claim that the downtrend might be weakening. The SOL/USDT pair will then rise to $60 and after that rally towards the 50% Fibonacci retracement degree of $66.

On the other hand, when the cost turns lower in the current level or even the 20-day EMA, it’ll claim that bears still sell on rallies. That may increase the potential of a retest of $37.37. A rest below this support may begin the following leg from the downtrend.

DOGE/USDT

Dogecoin (DOGE) stepped below $.08 on May 26 but designed a strong comeback on May 27. This means aggressive buying at ‘abnormal’ amounts however the bears aren’t ready to stop their advantage because they still defend the 20-day EMA ($.09) with vigor.

The bulls will again attempt to push the cost over the 20-day EMA. When they do this, the DOGE/USDT pair could rise towards the mental level at $.10. This level may again behave as a resistance but when bulls overcome this hurdle, the happy couple could rally to $.12.

Alternatively, when the cost turns lower in the 20-day EMA or $.10, it’ll claim that bears are active at greater levels. That may pull the happy couple lower to $.08 and then towards the May 12 intraday low of $.06.

Related: Bitcoin ‘ready’ for $32.8K after consolidation as BTC cost gains 6.3%

Us dot/USDT

Polkadot (Us dot) created a Doji candlepower unit pattern on May 27, suggesting indecision one of the bulls and also the bears. This uncertainty resolved towards the upside and bulls pressed the cost towards the overhead resistance at $10.37.

If buyers propel the cost over the overhead resistance, it might open the doorways for any possible rally to $12. If bulls obvious this hurdle, the following stop might be $14. A rest and shut above this resistance could indicate the Us dot/USDT pair might have bottomed out.

This positive view could invalidate when the cost turns lower dramatically in the current level and breaks below $8.56. That could cause a decline towards the May 12 intraday low of $7.30. The bears will need to sink the cost below this level to point the resumption from the downtrend.

AVAX/USDT

Avalanche (AVAX) dipped underneath the strong support at $23.51 on May 26 however the bears couldn’t take advantage of this advantage. The bulls bought the dip on May 27 and began a recovery on May 28.

The bulls will endeavour to push the cost towards the 20-day EMA ($32.42), which is a vital level to keep close track of. When the cost turns lower out of this resistance, the bears will attempt to retest the May 27 intraday low at $21.35. If the support cracks, the AVAX/USDT pair could slide towards the mental level at $20.

The RSI is showing an optimistic divergence, indicating the selling pressure might be reducing. If bulls push the cost over the 20-day EMA, the happy couple could rally to $38 and then attempt an up-proceed to $46.

SHIB/USDT

The bulls effectively defended the support at $.000010 on May 27, which led to a rebound on May 28. Shiba Inu (SHIB) ongoing its recovery and it has arrived at the 20-day EMA ($.000012) which will probably behave as a powerful resistance.

When the cost turns lower in the 20-day EMA, the bears will again make an effort to sink the SHIB/USDT pair below $.000010. In the event that happens, the happy couple could retest the critical support at $.000009.

Alternatively, if bulls push the cost over the 20-day EMA, it’ll claim that the downtrend might be weakening. The happy couple could then chance a rally to $.000014 and then towards the breakdown level at $.000017. The bulls will need to obvious this overhead hurdle to signal a possible alternation in trend.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.