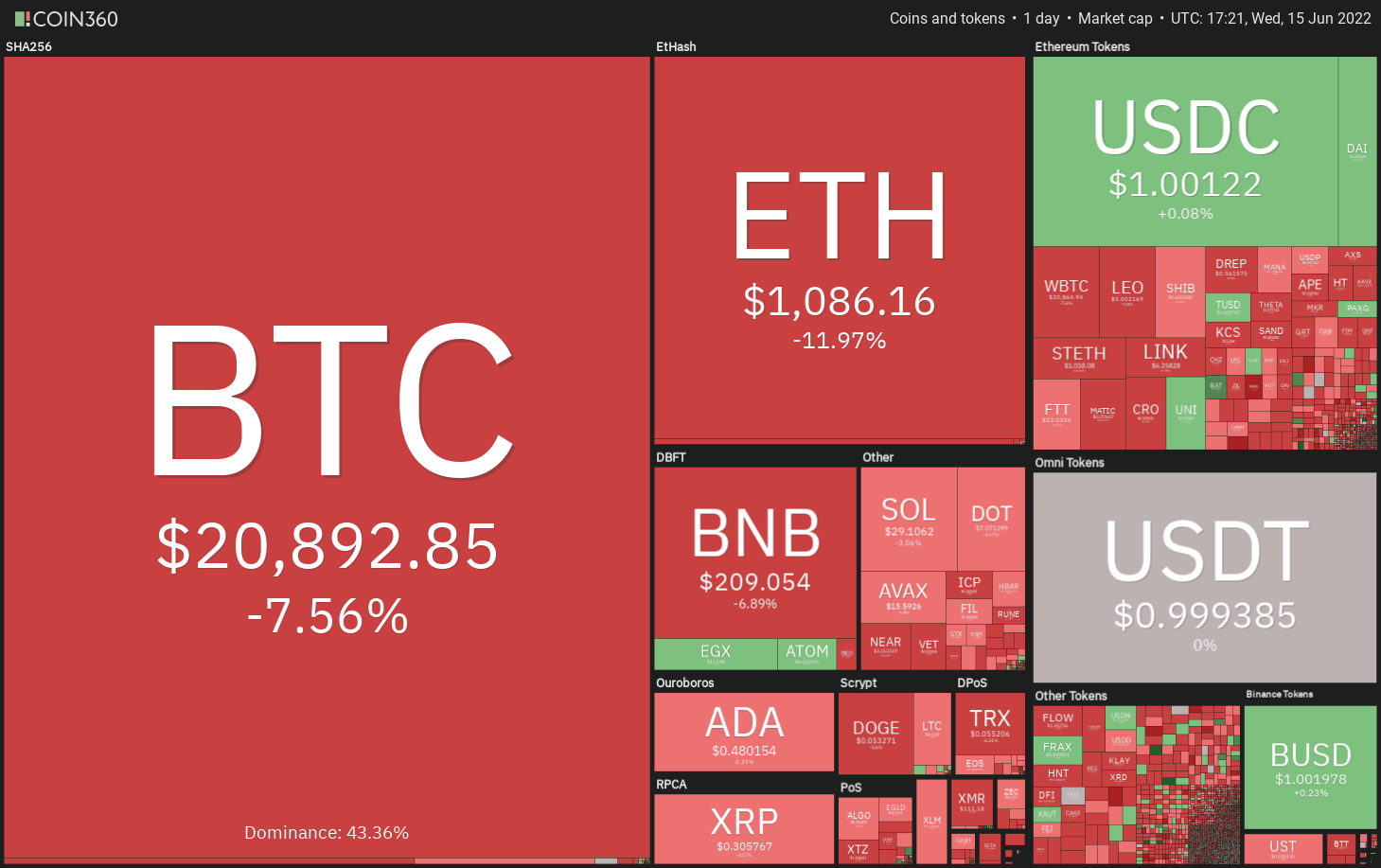

Bitcoin (BTC) plummeted near to the crucial support of $20,000 as traders panicked and dumped their holdings, fearing a hostile rate hike through the U . s . States Fed on June 15. One more reason for that sell-off might be fears of possible contagion if lending platform Celsius and crypto investment capital firm Three Arrows Capital (3AC) go belly up.

Data from on-chain analytics platform CryptoQuant demonstrated 24-hour exchange inflows of 59,376 Bitcoin on June 14, the greatest inflows since November 30, 2018. The Bitcoin miners also became a member of other investors in delivering Bitcoin towards the exchanges. The Bitcoin Miners to switch flow metric arrived at a seven-month a lot of 9,476, indicating the miners might be anticipating an additional fall soon.

Prominent investors are divided on whether a bottom has been created in Bitcoin or otherwise. Universe Digital Holdings chairman and Chief executive officer Mike Novogratz believes that Bitcoin could hold $20,000 and Ether (ETH) may bottom out at $1,000. These levels were also called by Arthur Hayes, co-founder and former chief of BitMEX, who cautioned when the amount crack, it can lead to “massive sell pressure in place markets.”

Do you know the important levels to take into consideration on Bitcoin and major altcoins? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin remains inside a firm bear grip. The bulls attempted to begin a recovery on June 14, as seen in the lengthy wick around the day’s candlepower unit, however the bears were in no mood to relent. They offered strongly and pulled the cost to $20,111 on June 15.

The sharp selling previously couple of days has pulled the relative strength index (RSI) near 21. This means that the rebound can be done for the short term. The BTC/USDT pair could rise towards the 38.2% Fibonacci retracement degree of $24,562 after which towards the 50% retracement level at $25,938. The bears are anticipated to mount a powerful defense within this zone.

When the cost turns lower out of this overhead zone, the bears will endeavour to resume the downtrend by pulling the happy couple below $20,000. When they succeed, the happy couple could drop to another support at $17,500 and then $16,000.

The buyers will need to push and sustain the cost over the 20-day exponential moving average ($27,748) to point a possible trend change.

ETH/USDT

Ether is within a powerful downtrend. The buyers attempted to stall the decline on June 14 but they couldn’t sustain the greater levels. The bears restored their selling on June 15 however the bulls are protecting the mental degree of $1,000 with all of their might.

The incessant selling of history couple of days has pulled the RSI into deeply oversold territory. This means the selling might have been overdone for the short term. This could cause a powerful bear market rally that could get momentum above $1,268. The ETH/USDT pair could then rally towards the 20-day EMA ($1,636).

Alternatively, when the cost continues lower and breaks below $1,000, it’ll suggest the resumption from the downtrend. The happy couple could then drop to $900 in which the bulls will again attempt to arrest the decline.

BNB/USDT

Binance Gold coin (BNB) is witnessing a difficult fight between your bulls and also the bears close to the crucial degree of $211. The bulls attempted to begin a rebound on June 14 but they couldn’t sustain the greater levels.

The bears required benefit of this and pulled the cost below $211 on June 15. Even though the downsloping moving averages indicate benefit to bears, the deeply oversold level around the RSI suggests a relief rally for the short term.

If bulls sustain the cost above $211, the BNB/USDT pair could chance a rally towards the 20-day EMA ($275). A rest and shut above this resistance could claim that the happy couple may remain stuck in a wide range between $211 and $350 for many more days.

On the other hand, when the cost turns lower in the current level or even the 20-day EMA, the bears will attempt to resume the downtrend. The following support on however at $186.

ADA/USDT

The bears attempted to drag Cardano (ADA) underneath the support at $.44 on June 13 and June 14 but unsuccessful to sustain the low levels. This means the bulls are protecting the support zone between $.44 and $.40 strongly.

The bulls will endeavour to push the cost over the 50-day simple moving average ($.60). When they manage to achieve that, the ADA/USDT pair could rise to $.69 after which to $.74. The bears will probably defend this overhead zone with vigor.

Unlike this assumption, when the cost turns lower in the 20-day EMA ($.54), it’ll claim that the sentiment remains negative and traders can sell on minor rallies.

The bears will make yet another make an effort to sink the cost underneath the support zone. When they succeed, the happy couple could signal the beginning of the following leg from the downtrend. The following support on however $.30.

XRP/USDT

Ripple (XRP) dropped to $.30 on June 13 the pattern target from the break underneath the climbing down triangular. The bears pulled the cost underneath the support on June 14 however the bulls purchased the dip as seen in the lengthy tail around the day’s candlepower unit.

The buyers are trying to begin a recovery that may achieve the breakdown degree of $.38. If bears switch this level into resistance, it’ll claim that the sentiment remains negative. The sellers will attempt to resume the downtrend and sink the XRP/USDT pair to another strong support at $.24.

On the other hand, if bulls drive and sustain the cost above $.38, it’ll suggest strong buying at ‘abnormal’ amounts. The buyers will attempt to push the happy couple towards the 50-day SMA ($.45). The bears will probably pose a powerful challenge within the zone between $.46 and $.50.

SOL/USDT

Solana (SOL) is attempting to sustain over the $26 level. The bulls attempted to push the cost back over the breakdown degree of $35 on June 14 however the bears held their ground. This means the bears are attempting to switch the $35 level into resistance.

When the cost turns lower and breaks below $26, it’ll suggest the resumption from the downtrend. The SOL/USDT pair could then decline to $22 and then towards the mental level at $20.

This bearish view could invalidate for the short term if buyers push and sustain the cost over the 20-day EMA ($38). In the event that happens, the aggressive bears and also require joined short positions below $35 may hurry towards the exit. That could cause a brief squeeze and push the happy couple toward the overhead resistance at $60.

DOGE/USDT

The buyers are attempting to sustain Dogecoin (DOGE) over the mental degree of $.05. The deeply oversold levels around the RSI indicate that the relief rally can be done for the short term.

When the cost rebounds from the current level, the bulls will attempt to push the DOGE/USDT pair towards the 20-day EMA ($.07). When the cost turns lower out of this level, the bears will again attempt to resume the downtrend and sink the happy couple to $.04.

Unlike this assumption, when the cost breaks over the 20-day EMA, the bullish momentum could get and also the pair could rally towards the 50-day SMA ($.09). This type of move will claim that the happy couple might have bottomed out soon.

Related: NEXO cost drops 40% in 72 hours on contagion fears from ‘insolvent’ crypto fund

Us dot/USDT

Polkadot (Us dot) continues to be buying and selling close to the crucial support of $7.30 within the last 2 days. Although bears pulled the cost below $7.30, they couldn’t sustain the low levels. This signifies strong buying on dips.

If buyers sustain the cost above $7.30, the Us dot/USDT pair could rise towards the 20-day EMA ($8.80). It is really an important level to keep close track of just because a break and shut above it’ll claim that the happy couple may consolidate between $6.36 and $12.44 for a while.

On the other hand, when the cost turns lower in the 20-day EMA, it’ll claim that bears are active at greater levels. A rest and shut below $6.36 could signal the resumption from the downtrend. The happy couple could then decline to $5 and then to $4.23.

LEO/USD

UNUS SED LEO (LEO) dipped underneath the moving averages on June 13 however the lengthy tail around the day’s candlepower unit shows aggressive buying at ‘abnormal’ amounts. Which was adopted by an internal-day candlepower unit pattern on June 14, indicating indecision one of the consumers.

The bulls attempted to push the cost toward the resistance type of the climbing down funnel on June 15 however the bears had other plans. They’ve pulled the cost back underneath the moving averages, growing the potential of a drop towards the support type of the funnel.

When the cost rebounds from the support line with strength, it’ll indicate the LEO/USD pair may extend its stay within the funnel for any couple of more days. The following trending move could begin if bears sink the happy couple underneath the funnel or bulls thrust the cost over the resistance line.

SHIB/USDT

The bulls are trying to defend the $.000007 level strongly. Shiba Inu (SHIB) created a Doji candlepower unit pattern on June 14, indicating indecision one of the bulls and also the bears.

When the uncertainty resolves towards the upside and bulls push the cost above $.000009, the SHIB/USDT pair could rise towards the breakdown degree of $.000010. When the cost turns lower out of this level, it’ll claim that the popularity remains negative and traders can sell on rallies. The bears will make an effort to resume the downtrend and sink the happy couple to $.000006.

Alternatively, if bulls drive the cost over the downtrend line, it might open the doorways for any possible rally to $.000014. This type of move could claim that the happy couple might have bottomed out.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.