Bitcoin’s (BTC) bounce fizzled out near $24,500 on August. 17, indicating the recovery still faces stiff resistance in the bears. On-chain monitoring resource Material Indicators stated the ask liquidity around the Fire Charts looked like prior local tops.

One more reason for caution among crypto investors could be that the recovery within the S&P 500 was reaching extreme overbought levels soon. Jurrien Timmer, director of worldwide macro at asset manager Fidelity Investments, stated that 88% of stocks within the S&P 500 were buying and selling above their 50-day moving average, that was “stunning.”

Some were also careful as Michael Burry, the investor who famously shorted the 2008 housing bubble, almost emptied his equity portfolio within the second quarter of the year in expectation of the sharp fall within the stock markets.

As the short-term looks uncertain, corporate investors who tend to be hanging around for that lengthy term have elevated their investments within the blockchain industry, such as the crypto space. The very best 40 openly traded companies invested roughly $6 billion into blockchain startups between September 2021 to June 2022, based on your blog by Blockdata on August. 17. That’s greater than three occasions the $1.9 billion invested by corporations between The month of january 2021 to September 2021.

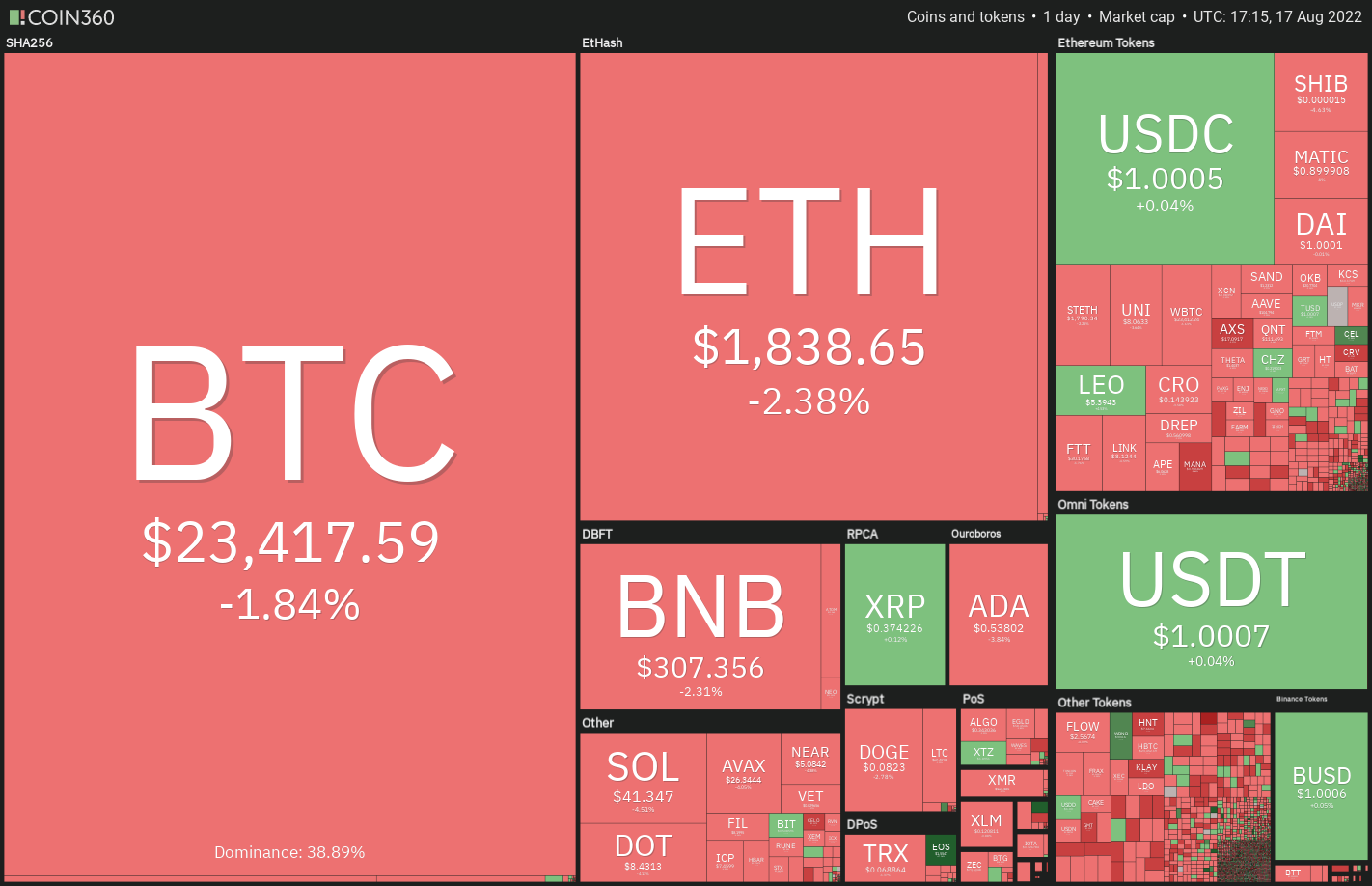

Do you know the critical levels around the downside which will claim that the recovery might be faltering? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

The bulls tried to push Bitcoin over the overhead resistance at $24,668 on August. 17 however the lengthy wick around the candlepower unit implies that bears are protecting the amount strongly. The cost switched lower and it has arrived at the 20-day exponential moving average (EMA) ($23,496). This level will probably attract strong buying through the bulls.

The 20-day EMA has flattened out and also the relative strength index (RSI) has dropped near to the midpoint, indicating an account balance between demand and supply. When the cost sustains underneath the 20-day EMA, the total amount could tilt in support of the bears and also the pair may drop towards the 50-day SMA ($22,160).

On the other hand, when the cost rebounds from the current level and breaks above $25,200, it’ll claim that bulls have returned in command. The BTC/USDT pair could then rally to $28,000 in which the bears may again mount a powerful defense.

ETH/USDT

Ether (ETH) switched up from $1,853 on August. 16 and also the bulls attempted to push the cost above $2,000 on August. 17. However, the lengthy wick around the day’s candlepower unit shows that traders might be lightening positions on rallies.

The bears will attempt to benefit from the problem and try to pull the cost towards the strong support zone between your 20-day EMA ($1,772) and $1,700. It is really an important zone for that bulls to protect if they would like to keep your upward trend intact.

When the cost rebounds off this support zone, the ETH/USDT pair could retest the resistance at $2,030. A rest and shut above this level could obvious the road for any rally towards the downtrend line.

Rather, when the $1,700 support cracks, the happy couple could drop towards the 50-day SMA ($1,492). That may delay the beginning of the following leg from the up-move and the happy couple range-bound for any couple of days.

BNB/USDT

The buyers attempted to push BNB higher on August. 17 however the lengthy wick around the candlepower unit shows that bears are active at greater levels. That pulled the cost towards the 20-day EMA ($307).

When the cost slips underneath the 20-day EMA, the BNB/USDT pair could decline towards the 50-day SMA ($270). This level may again attract buying and when the cost rebounds off it, the happy couple could consolidate between $270 and $338 for a while.

Another possibility would be that the cost rebounds from the current level with strength. In the event that happens, it’ll claim that the sentiment remains positive and traders are purchasing on dips. The bulls will on the other hand make an effort to obvious the overhead resistance zone between $338 and $350. When they succeed, the happy couple could begin a rally to $383 after which to $413.

XRP/USDT

The bulls effectively defended the zone between your moving averages and attempted to push Ripple (XRP) over the overhead resistance at $.39 on August. 17. The lengthy wick around the day’s candlepower unit implies that bears will not surrender plus they still defend the overhead resistance with vigor.

When the cost breaks and closes underneath the 20-day EMA ($.37), the following stop may be the 50-day SMA ($.35). It is really an important level for that bulls to protect just because a break and shut below it might claim that the XRP/USDT pair may continue its range-bound action between $.30 and $.39 for any couple of more days.

Alternatively, when the cost rebounds from the moving averages, the bulls will again attempt to obvious the overhead hurdle at $.39. When they succeed, the happy couple could rally to $.48 after which to $.54.

ADA/USDT

Cardano (ADA) bounced from the breakout degree of $.55 on August. 16 however the bears still pose a powerful challenge at greater levels as seen in the lengthy wick around the August. 17 candlepower unit.

Sharp selling through the bears has pulled the cost towards the important support in the $20-day EMA ($.53). A rest and shut below this level will claim that rapid-term advantage has tilted in support of the sellers. The ADA/USDT pair could then decline towards the 50-day SMA ($.49).

On the other hand, when the cost rebounds from the 20-day EMA, it’ll suggest strong demand at ‘abnormal’ amounts. The bulls will attempt to resume the up-move by pushing the happy couple above $.60. That may open the doorways for any possible rally to $.63 after which to $.70.

SOL/USDT

Solana (SOL) attempted a rebound from the 20-day EMA ($42) however the lengthy wick around the August. 17 candlepower unit implies that the bears can sell on every minor rise.

The bears will attempt to sink the cost underneath the support line. When they manage to achieve that, it’ll invalidate the developing bullish climbing triangular pattern. The SOL/USDT pair could then decline to $37.50 and then to $34.50.

Alternatively, when the cost rebounds from the moving averages, it’ll indicate that bulls might be accumulating on dips. The buyers will attempt to push the cost over the overhead resistance at $48. When they succeed, the bullish setup will complete and also the pair may begin a rally to $60.

DOGE/USDT

The bears pulled Dogecoin (DOGE) underneath the breakout degree of $.08 on August. 15 but tend to not sustain the low levels. The bulls purchased the dip strongly and started again the recovery on August. 16.

The bears are attempting to stall the recovery at $.09 but when bulls do not let the cost to dip below $.08, the probability of a rally to $.10 increases. It is really an important level to keep close track of just because a break and shut above it might signal a possible trend change.

The 20-day EMA ($.07) has began to show up and also the RSI is incorporated in the positive territory, indicating that bulls possess the upper hands. To invalidate this bullish view, the bears will need to sink and sustain the cost underneath the trendline from the triangular.

Related: Fake Manchester U . s . token soars 3,000% after Elon Musk jokes about buying team

Us dot/USDT

The bulls effectively defended the 20-day EMA ($8.62) on August. 15 and 16 but tend to not acquire a strong rebound off it. Attempts through the bulls to push Polkadot (Us dot) over the overhead resistance at $9 met with stiff resistance on August. 17.

The bears are trying to sustain the cost underneath the 20-day EMA. When they succeed, it might trap several aggressive bulls and also require bought at greater levels. That may sink the Us dot/USDT pair towards the 50-day SMA ($7.72).

On the other hand, when the cost appears in the current level and increases above $9, it’ll claim that bulls are purchasing strongly at ‘abnormal’ amounts. The bulls will make an effort to push the happy couple over the overhead resistance at $9.68 and resume the recovery. The happy couple could then rally to $10.80 and then to $12.44.

SHIB/USDT

Shiba Inu’s (SHIB’s) correction stalled at $.000015 on August. 15 however the bulls are facing stiff resistance in the overhead resistance of $.000017 as seen in the lengthy wick around the August. 16 and 17 candlesticks.

The failure to obvious the overhead hurdle may embolden the bears who’ll attempt to pull the cost towards the strong support at $.000014. It is really an important level for that bulls to protect just because a break and shut below it might weaken the positive momentum.

The SHIB/USDT pair could then remain stuck inside a wide range between $.000010 and $.000018 for any couple of days.

Alternatively, when the cost appears in the current level and increases over the $.000017 to $.000018 overhead resistance zone, the happy couple could rise to $.000022. If bulls obvious this hurdle, the rally could include $.000026.

AVAX/USDT

Avalanche (AVAX) is constantly on the slide toward the breakout degree of $26.38. The bulls will probably purchase the dip and try to switch this level into support.

When the cost rebounds off $26.38 with strength, the buyers will again attempt to push the AVAX/USDT pair over the overhead resistance at $31. When they succeed, the happy couple could rally to $33 and then towards the pattern target of $39.05.

Unlike this assumption, when the cost breaks underneath the breakout level, several aggressive bulls could get trapped. That could cause a decline towards the 50-day SMA ($22.70) after which towards the support type of the climbing triangular.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.