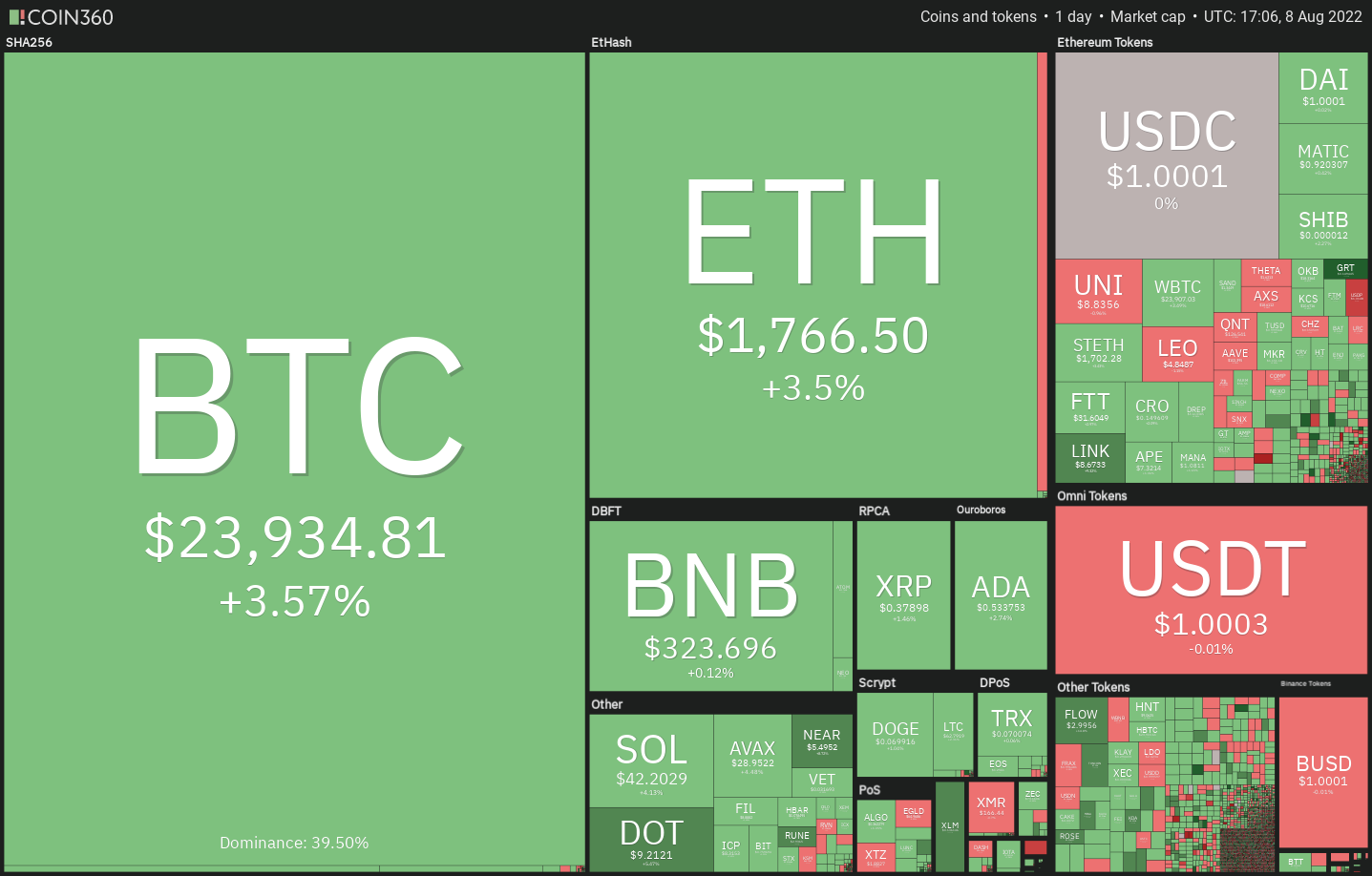

The U . s . States equities markets and also the cryptocurrency markets have began a few days on the strong note, indicating that traders aren’t concern about buying in front of the important Consumer Cost Index (CPI) data for This summer, which is released on August. 10.

Another positive sign would be that the recent recovery in Bitcoin (BTC) hasn’t enticed investors to exit their positions in anxiety about another leg lower. Glassnode data implies that the proportion of supply which has remained dormant for 3 or more years rose to a different all-time a lot of 38.426% on August. 8.

BlackRock Chief executive officer Ray Fink offered 44,000 BlackRock shares in August, the greatest purchase because the COVID-19 crash. Some analysts are speculating the current recovery within the equities markets is just a bear market rally. If that’s the situation, a downturn within the equities markets may also boost the selling in crypto prices as both remain carefully correlated.

Could Bitcoin and choose altcoins climb above their particular overhead resistance levels and extend the recovery for the short term? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin bounced from the 20-day exponential moving average (EMA)($22,846) on August. 7 and also the momentum selected on August. 8. The buyers pressed the cost above $24,000 and may challenge the overhead resistance at $24,668.

The 20-day EMA is sloping up and also the relative strength index (RSI) is incorporated in the positive territory, indicating that bulls have been in control. If buyers propel the cost over the overhead resistance, the BTC/USDT pair could get momentum and rally to $28,000 as there’s no significant resistance among. The bears may attempt to stall the recovery only at that level but when bulls overcome this barrier, the up-move could achieve $32,000.

Unlike this assumption, when the cost turns lower from $24,668, the happy couple could drop towards the 20-day EMA. It is really an important level to take into consideration just because a break below it might drag the cost towards the 50-day simple moving average (SMA($21,594). A rest below this level could place the bears back on the top.

ETH/USDT

Buyers pressed Ether (ETH) over the overhead resistance at $1,700 on August. 5 and also the bulls effectively defended the breakout level on August. 6 and seven. Buying started again on August. 8 and also the bulls pressed the cost over the overhead resistance at $1,785.

If bulls sustain the cost above $1,785, the ETH/USDT pair could get momentum and rally towards the mental level at $2,000. This level may attract selling through the bears but when bulls arrest the following decline above $1,700, the probability of a rest above $2,000 increases. In the event that happens, the happy couple could rally towards the downtrend line.

This positive view could invalidate for the short term when the cost turns lower and breaks underneath the 20-day EMA ($1,606). The happy couple could then slide towards the 50-day SMA ($1,362).

BNB/USDT

BNB recovery has arrived at the strong overhead resistance zone between $338 and $350 in which the bears are anticipated to mount a powerful defense.

When the cost turns lower in the current level, the BNB/USDT pair could decline towards the 20-day EMA ($289). It is really an important level to keep close track of just because a strong bounce off it’ll claim that the positive sentiment remains intact and traders are viewing dips like a buying chance.

The bulls will make yet another make an effort to obvious the overhead zone. When they succeed, the BNB/USDT pair could further get momentum and rally toward $414. This positive view could invalidate for the short term when the cost turns lower and breaks underneath the 20-day EMA.

XRP/USDT

Ripple’s (XRP) price continues to be squeezed between your 20-day EMA ($.36) and also the overhead resistance at $.39 within the last couple of days. Usually, such tight ranges result in a range expansion.

The increasing 20-day EMA and also the RSI within the positive area indicate benefit to buyers. If bulls push and sustain the cost above $.39, it’ll suggest the beginning of a brand new up-move. The XRP/USDT pair could then rise to $.48 and then to $.54.

This positive view will invalidate soon when the cost turns lower and breaks underneath the 20-day EMA. The happy couple could then drop towards the 50-day SMA ($.35). This type of move will claim that the happy couple may take the additional time within the range.

ADA/USDT

Cardano (ADA) bounced from the 20-day EMA ($.50) on August. 5 and it has arrived at the strong overhead resistance at $.55.

The 20-day EMA is sloping up and also the RSI is incorporated in the positive territory, indicating the road to least resistance would be to the upside. If buyers thrust the cost above $.55, the ADA/USDT pair could start its northward march toward $.63 after which to $.70. The bears may pose a powerful challenge only at that level.

To invalidate this positive view, the bears will need to sink and sustain the cost underneath the 50-day SMA. That may extend the stay from the pair within the range from $.40 and $.55 for any couple of more days.

SOL/USDT

Solana (SOL) rose over the 20-day EMA ($40) on August. 5 and also the bulls thwarted attempts through the bears to sink the cost back underneath the level. The buying started again on August. 8 and also the bulls will endeavour to push the cost towards the overhead resistance at $48.

The 20-day EMA is booming up progressively and also the RSI is incorporated in the positive zone, indicating the bulls possess the upper hands. If buyers drive the cost above $48, the bullish climbing triangular pattern will complete. The happy couple could then begin a rally to $60 and after that towards the pattern target at $71.

Alternatively, when the cost turns lower from $48 such as the previous two occasions, it’ll claim that bears are protecting the amount strongly. That may keep your pair stuck within the triangular for any couple of more days. The bullish setup will invalidate away underneath the support line.

DOGE/USDT

Dogecoin (DOGE) bounced from the 20-day EMA ($.07) on August. 7, indicating that bulls are protecting the moving averages with vigor. However, the lengthy wick around the August. 8 candlepower unit shows that bears can sell at greater levels.

The flattish moving averages indicate an account balance between demand and supply however the RSI within the positive territory suggests a small benefit to the buyers. If bulls push the cost over the overhead resistance at $.08, it’ll complete the climbing triangular pattern. The happy couple could then begin a rally towards the mental resistance at $.10.

On the other hand, when the cost turns lower in the overhead resistance, the DOGE/USDT pair could stay within the triangular for any couple of more days. The bears will need to sink the cost underneath the trendline to invalidate the bullish setup.

Related: Metaverse housing bubble bursting? Virtual land prices crash 85% among waning interest

Us dot/USDT

Polkadot (Us dot) switched lower in the overhead resistance at $9 on August. 6 however the bulls didn’t cede ground towards the bears. They started again their purchase on August. 7 and pressed the cost over the overhead resistance on August. 8.

The 20-day EMA is sloping up and also the RSI is incorporated in the positive territory, indicating that bulls possess the upper hands. If buyers sustain the cost above $9, the bullish momentum could get and also the Us dot/USDT pair could rise to $10.80 and then to $12.

Unlike this assumption, when the cost turns lower and breaks back below $9, it’ll claim that the breakout might have been a bull trap. The happy couple could then decline towards the 20-day EMA ($8.07) and then towards the 50-day SMA ($7.49).

MATIC/USDT

Polygon (MATIC) created a Doji candlepower unit pattern on August. 7, which resolved towards the upside on August. 8. This means that bulls are purchasing the dips towards the 20-day EMA ($.86).

The upsloping moving averages and also the RSI within the positive territory indicate benefit to buyers. The MATIC/USDT pair could rise towards the overhead resistance at $1.02 in which the bears may mount a powerful defense.

If bulls tendency to slack up much ground from $1.02, the probability of a rest above zinc heightens. The happy couple could then rally to $1.26 after which to $1.50. The very first manifestation of weakness is a break and shut underneath the 20-day EMA. That may open the doorways for any possible drop to $.75.

AVAX/USDT

Avalanche (AVAX) broke and closed over the strong overhead resistance at $26.38 on August. 6, indicating the conclusion from the bullish climbing triangular pattern.

The AVAX/USDT pair could rise to $33 and then towards the pattern target of $39.05. As the upsloping moving averages indicate benefit to buyers, the RSI has risen in to the overbought zone, suggesting a small correction soon.

If bulls switch the $26.38 level into support throughout the next correction, it’ll signal a possible trend change. This positive view might be invalidated soon when the cost turns lower and breaks underneath the moving averages.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.