The U . s . States equities markets and also the cryptocurrency markets have been rising prior to the Sept. 13 discharge of the August Consumer Cost Index data, however the rally fell apart when the data demonstrated inflation rising, instead of falling.

The negative data dashed any hope of the Fed pivot soon also it triggered a clear, crisp loss of dangerous assets. The marketplace capital of U.S. stocks stepped by about $1.6 trillion on Sept. 13 and also the market cap from the cryptocurrency markets tucked below $1 trillion.

Statistician and independent market analyst Willy Woo believes that Bitcoin (BTC) might have to fall further before it reaches the utmost discomfort experienced during previous bottoms. Woo expects Bitcoin cost to say no below $10,000.

Could Bitcoin and altcoins resume their downtrend? Let’s read the charts from the top ten cryptocurrencies to discover.

BTC/USDT

Bitcoin broke over the 50-day simple moving average (SMA)($21,902) on Sept. 12, however this demonstrated to become a bull trap. Buyers tried to extend the recovery on Sept. 13 however the rally reversed direction from $22,799.

Aggressive selling through the bears pulled the cost back underneath the 20-day exponential moving average (EMA) ($20,722). A small positive would be that the bulls are trying to stall the decline at $20,000.

If buyers push the cost back over the 20-day EMA, it’ll claim that ‘abnormal’ amounts still attract buyers. The BTC/USDT pair will make an effort to rise towards the 50-day SMA and then retest $22,799. A rest and shut above this resistance could open the doorways for any possible rally to $25,211.

Unlike this assumption, when the cost slips below $19,860, the happy couple could drop towards the $18,510 to $17,622 zone. The bulls are anticipated to protect this zone with vigor.

ETH/USDT

Ether (ETH) switched lower and plummeted underneath the moving averages on Sept. 13, tilting rapid-term advantage in support of the bears. A small positive would be that the bulls are trying to defend the support type of the increasing wedge pattern.

When the cost rebounds from the current level and increases over the moving averages, the ETH/USDT pair could rally towards the resistance type of the wedge. The bulls will need to push and sustain the cost over the wedge to obvious the road for any possible rally to $2,030.

Alternatively, when the cost does not mix over the moving averages, the probability of a drop underneath the bearish wedge pattern increases. In the event that happens, the selling pressure could get and also the pair could drop to $1,422 and then to $1,280. Buyers are anticipated to mount a powerful defense only at that level.

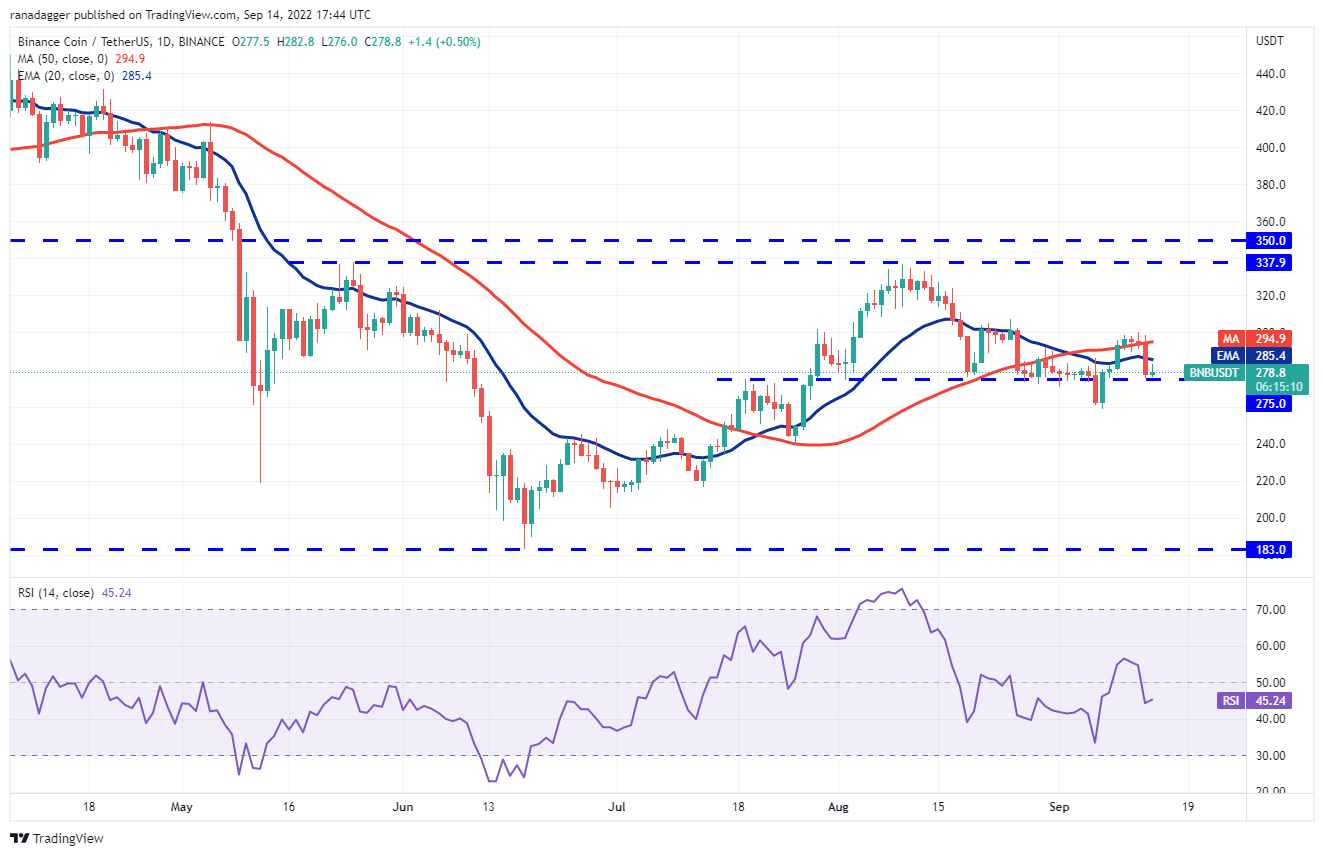

BNB/USDT

BNB turned lower from $300 on Sept. 12 and stepped underneath the moving averages on Sept. 13. This tilted rapid-term advantage in support of the bears however the bulls haven’t yet quit.

Buyers are trying to defend the immediate support at $275 and push the cost over the 20-day EMA ($285). When they succeed, the BNB/USDT pair could challenge the $300 to $307.50 resistance zone. If buyers obvious this zone, the rally could get momentum.

On the other hand, if bulls neglect to push the cost over the 20-day EMA, it’ll claim that bears can sell on minor rallies. That may boost the prospects of the break below $275. In the event that happens, the happy couple could decline to $258 after which to $240.

XRP/USDT

After buying and selling close to the 50-day SMA ($.35) for 3 days, Ripple (XRP) switched lower and broke underneath the moving averages on Sept. 13. This pulled the cost underneath the breakout degree of $.34.

Buyers are attempting to push the cost back over the 20-day EMA ($.34) on Sept. 14. When they succeed, it’ll claim that the XRP/USDT pair has created a greater low at $.33. The happy couple could then retest the overhead resistance at $.36. A rest and shut above this level could push the happy couple toward $.39.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that bears can sell on minor rallies. That may pull the cost lower towards the strong support at $.32.

ADA/USDT

Cardano (ADA) rose over the 50-day SMA ($.49) on Sept. 9 however the bulls couldn’t continue the recovery and push the cost towards the downtrend line. This signifies hesitation through the bulls to purchase at greater levels.

The failure to increase the recovery might have enticed short-term traders to reserve profits. That pulled the cost back underneath the moving averages on Sept.13.

A small positive would be that the ADA/USDT pair rebounded off $.46 and also the bulls are trying to push the cost back over the moving averages. This signifies that ‘abnormal’ amounts still attract strong buying through the bulls. When the cost increases over the 50-day SMA, the happy couple could achieve the downtrend line.

This view will invalidate soon when the cost turns lower in the moving averages and plummets below $.45. The happy couple could then decline to $.42.

SOL/USDT

Buyers pressed Solana (SOL) over the 50-day SMA ($37.30) on Sept. 13 and 14 however the bulls couldn’t sustain the greater levels. This implies that bears are protecting the 50-day SMA with vigor.

Strong selling on Sept. 13 pulled the cost underneath the 20-day EMA ($34). The bears will attempt to sink the SOL/USDT pair towards the immediate support at $30. The repeated retest of the support level has a tendency to weaken it. When the $30 level cracks, the happy couple could start its descent towards the vital support at $26.

Unlike this assumption, when the cost appears in the current level and breaks over the 20-day EMA, the happy couple could rise towards the 50-day SMA. The bulls will need to obvious this overhead hurdle to point the beginning of an up-proceed to $48.

DOGE/USDT

Dogecoin (DOGE) bounced from the support zone near $.06 on Sept. 7 however the recovery fizzled out in the 20-day EMA ($.06). This signifies that bears are protecting the moving averages strongly.

The cost switched lower in the 20-day EMA on Sept. 13 and arrived at the support at $.06. The bulls are anticipated to protect the amount strongly like a break and shut below it might sink the DOGE/USDT pair towards the June low at $.05. If the support cracks, it might signal the resumption from the downtrend.

This negative view could invalidate when the cost rebounds from the current level and increases over the moving averages. In the event that happens, the happy couple could chance a rally to $.09.

Related: Ethereum’s Merge will affect not only its blockchain

Us dot/USDT

Polkadot (Us dot) frequently attempted to increase and sustain over the 50-day SMA ($7.90) Sept. 9–13 however the bears held their ground. This signifies the sentiment remains negative and bears can sell on rallies to resistance levels.

The failure to increase over the 50-day SMA might have attracted strong selling through the bears and profit-booking through the short-term bulls. That pulled the cost back underneath the 20-day EMA ($7.43) on Sept. 13. The bears will make an effort to sink the Us dot/USDT pair underneath the immediate support at $6.75 and challenge the important level at $6.

Alternatively, when the cost rebounds from the current level and increases over the 20-day EMA, it’ll claim that bulls still buy on dips. The bulls will on the other hand attempt to overcome the barrier in the 50-day SMA and begin a rally toward $10.

MATIC/USDT

Polygon (MATIC) continues to be stuck inside a wide range between $.75 and $1.05 within the last several days. Both moving averages have flattened out and also the relative strength index is close to the midpoint, indicating an account balance between consumers.

The MATIC/USDT pair continues to be trying to rise in a climbing funnel within the last couple of days. When the cost plummets underneath the funnel, it’ll signal a small benefit to the bears. The happy couple could then decline towards the strong support at $.75.

Unlike this assumption, when the cost rebounds from the current level and increases over the moving averages, the happy couple could achieve the resistance type of the funnel. A rest and shut over the funnel could open the doorways for any possible rally to $1.05.

SHIB/USDT

Shiba Inu (SHIB) were able to stay over the moving averages between Sept. 9 and12 however the bulls couldn’t build this strength and obvious the overhead hurdle in the downtrend line. This signifies too little demand at greater levels.

The cost stepped back underneath the moving averages on Sept. 13 and also the bears will make an effort to pull the SHIB/USDT pair underneath the strong support at $.000012. When they succeed, the happy couple will develop a climbing down triangular pattern. This bearish setup includes a target purpose of $.000009.

Unlike this assumption, when the cost rebounds from the current level and breaks over the moving averages, the happy couple could achieve the downtrend line. A rest and shut above this level will invalidate the bearish setup and obvious the road for any rally to $.000018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.