The Planet Bank has cautioned of the possible global recession in 2023. In an announcement on Sept. 15, the financial institution stated the current pace of rate hikes and policy decisions rarely is in enough to create inflation lower to pre-pandemic levels.

Ray Dalio, the millionaire founding father of Bridgewater Associates stated inside a blog publish on Sept. 13 that if rates would rise to around 4.5% within the U . s . States, it might “produce in regards to a 20 % negative effect on equity prices.”

The negative outlook for that equity markets doesn’t bode well for that cryptocurrency markets as have been carefully correlated in 2022.

The macroeconomic developments appear to become worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurrency exchanges on Sept. 14, based on Glassnode data. The inflow was the greatest since March 2020.

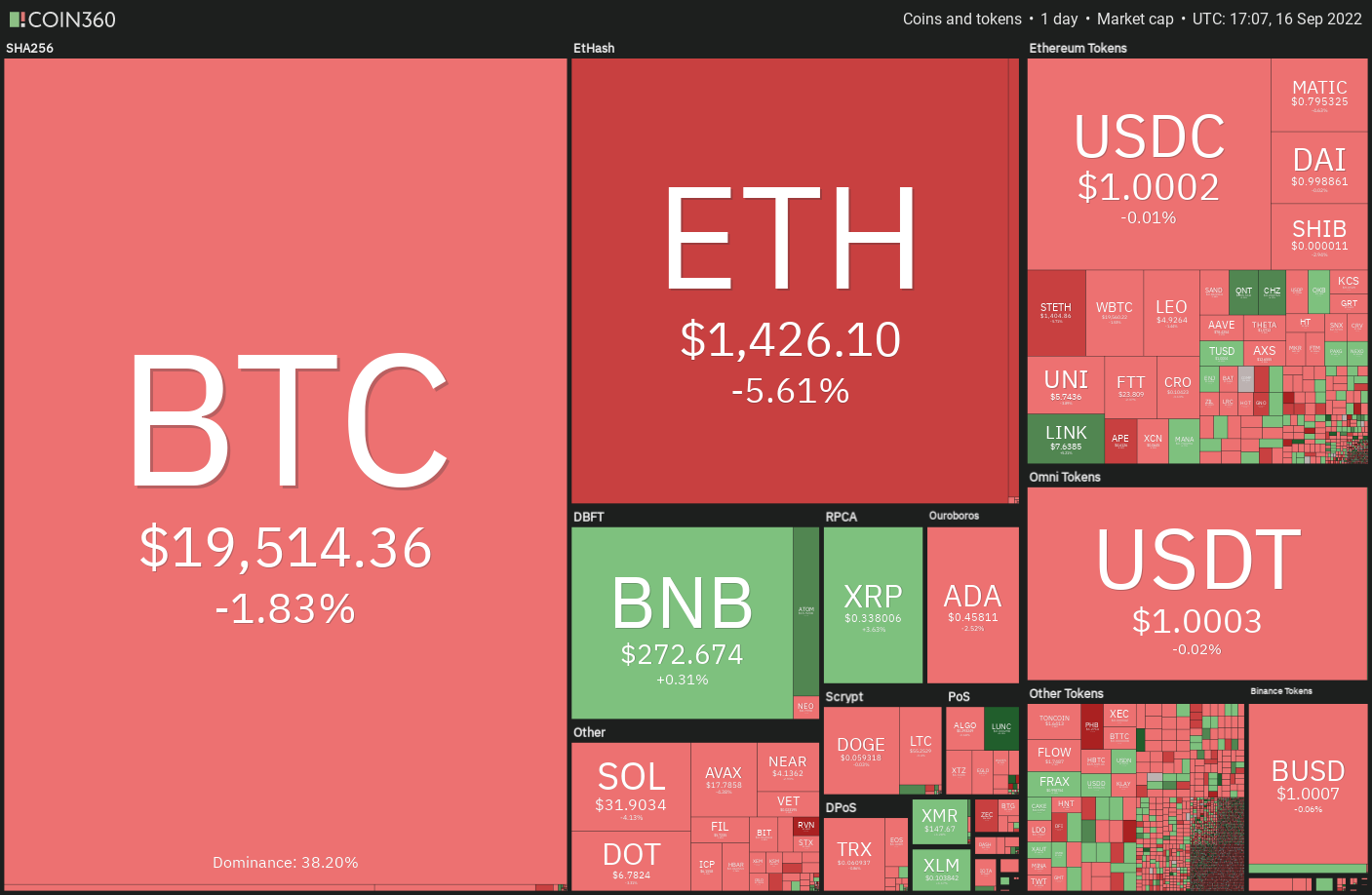

Let’s read the charts from the S&P 500 index, the U.S. dollar index (DXY) and also the major cryptocurrencies to look for the key levels that may signal the beginning of a trending move.

S&P 500

The S&P 500 index (SPX) attempted a rebound from the upward trend line on Sept. 14 however the weak rebound demonstrated too little emergency to protect the amount. Sellers required benefit of this case and pulled the cost underneath the upward trend line on Sept. 15.

The amount of 3,886 where the index had bounced on Sept. 6 also unsuccessful to supply any support, indicating that traders are in a rush to market their positions. Usually, the breakdown from an amount has a tendency to retest it.

Within this situation, the cost could rise towards the upward trend line. When the cost turns lower out of this level, it’ll claim that bears have flipped the upward trend line into resistance. That may increase the potential of a drop to three,700.

The downsloping 20-day exponential moving average (EMA) (4,006) and also the relative strength index below 37 claim that bears have been in command.

When the cost appears and increases over the upward trend line, it’ll claim that the breakdown on Sept. 15 might have been a bear trap. That may propel the index towards the downtrend line.

DXY

The DXY is within a powerful upward trend. The bears attempted to drag the cost underneath the moving averages however the bulls intensely defended the 50-day simple moving average (SMA(107) on Sept. 13.

Both moving averages are sloping up and also the RSI is incorporated in the positive territory indicating benefit to buyers. The bulls will next make an effort to push the cost over the overhead resistance at 110.78. It is really an important level to keep close track of if the cost sustains above this level, the rally could include 115.

When the cost turns lower in the current level or even the overhead resistance and breaks underneath the 20-day EMA (109), it’ll advise a consolidation soon. The cost could then range from 107.58 and 110.78 for any couple of days. A possible trend change might be signaled if bears sink the cost below 107.58.

BTC/USDT

Bitcoin created a Doji candlepower unit pattern on Sept. 14, indicating indecision one of the bulls and also the bears. The uncertainty resolved towards the downside on Sept. 15 however the bears have unsuccessful to construct this advantage. This signifies the selling pressure reduces at ‘abnormal’ amounts.

Buyers will endeavour to salvage the problem by pushing the cost over the 20-day EMA ($20,529). In the event that happens, the BTC/USDT pair could rise towards the overhead resistance at $22,799. The bears may defend this level strongly but when bulls thrust the cost above it, the happy couple could rally to $25,211.

Contrarily, when the cost turns lower in the current level or even the 20-day EMA, it’ll claim that the sentiment remains negative and traders are viewing rallies like a selling chance. That may sink the happy couple towards the strong support at $18,510. The zone between $18,510 and $17,622 could witness aggressive purchasing from the bulls since the failure to protect this zone may begin the following leg from the downtrend.

ETH/USDT

Ether (ETH) bounced from the support line on Sept. 14 however the pleasure from the bulls demonstrated to become short-resided. The cost switched lower dramatically in the 20-day EMA ($1,609) and stepped underneath the support line on Sept. 15.

The 20-day EMA has began to show lower and also the RSI has tucked below 39, indicating that bears have been in control. The sellers have pulled the cost to $1,422 and when this support cracks, the ETH/USDT pair could drop to $1,280.

When the cost appears in the current level, the happy couple could recover towards the moving averages, which might behave as a powerful resistance. The bulls will need to obvious this hurdle to point out the selling pressure might be reducing.

BNB/USDT

The bears pulled BNB below the immediate support at $275 but they’re battling to help keep the cost lower. This signifies that ‘abnormal’ amounts are attracting buyers.

When the cost sustains above $275, the BNB/USDT pair might be in early stages of developing a symmetrical triangular. This means uncertainty concerning the next directional move one of the bulls and also the bears. That may keep your cost within the triangular for a while.

When the cost increases over the 20-day EMA ($283), the happy couple could rally towards the resistance type of the triangular. A rest over the triangular could push the happy couple to $338.

Another possibility would be that the cost turns lower in the 20-day EMA and plummets underneath the support type of the triangular. That may begin a decline to $258 and then to $239.

XRP/USDT

Ripple (XRP) continues to be range-bound between $.30 and $.39 within the last several days. Previously couple of days, the number has reduced further with bulls purchasing the dips to $.32 and bears selling the recovery towards the 50-day SMA ($.35).

The cost action in the range is generally volatile and hard to. Still, because the buyers had effectively defended the $.32 support between August. 28 and Sept. 7, they’ll again try to achieve that. When the cost increases in the current level, the XRP/USDT pair could rally towards the 20-day EMA ($.34) and then towards the 50-day SMA.

If bulls drive the cost over the 50-day SMA, the probability of a rally to $.39 increases. The bears are anticipated to protect this level strongly. Around the downside, when the cost slips below $.32, the important support of $.30 might be retested.

ADA/USDT

The bears are trying to build upon their advantage in Cardano (ADA). They offered the recovery towards the 20-day EMA ($.48) on Sept. 14 and are attempting to pull the cost underneath the immediate support at $.45.

Although moving averages aren’t an invaluable tool inside a varying market, they are usually useful to look for the short-term trend. The 20-day EMA has began to show lower and also the RSI is incorporated in the negative territory, indicating benefit to bears. When the cost slips and sustains below $.45, the ADA/USDT pair could drop to $.42.

If bulls wish to gain top of the hands, they’re going to have to arrest the decline and push the cost over the moving averages. That may obvious the road for any rally towards the downtrend line. A rest above this resistance could indicate the bulls are during the driver’s seat.

Related: Does Ethereum’s new ETHPoW fork stand an opportunity? ETHW cost falls 65% publish-Merge

SOL/USDT

Solana (SOL) switched lower in the 20-day EMA ($33.84) on Sept. 15, indicating the sentiment remains negative and bears can sell on minor rallies.

The SOL/USDT pair could decline towards the strong support at $30. This level was resilient throughout the onslaught between August. 28 and Sept. 7 and gave a bounce to $39 on Sept. 13. Short-term traders may again expect a bounce off $30 and will probably purchase the dips for this level.

The rebound from the support could still face hurdles in the 20-day EMA and on the other hand in the 50-day SMA ($36.95). When the cost closes above this resistance, it might open the doorways for any possible up-proceed to $48. On the other hand, when the $30 level cracks, the happy couple could slide towards the vital support at $26.

DOGE/USDT

Dogecoin (DOGE) has ongoing its slide and it is close to the strong support of $.06. The cost rebounded off this level on Sept. 7 hence, it might again attract buyers.

A rest and shut over the 20-day EMA ($.06) would be the first manifestation of demand accumulating at greater levels. The DOGE/USDT pair could then rise to $.07. This level may again behave as a resistance but when bulls push the cost above it, the happy couple could rise to $.08 and after that to $.09.

When the cost slips underneath the immediate support at $.06, the happy couple could slide towards the June low near $.05. The bears will need to sink and sustain the cost below this level to signal the beginning of the following leg from the downtrend. The happy couple could then extend the decline to $.04.

Us dot/USDT

The bulls tried to start arecovery on Sept. 14 but greater levels attracted selling through the bears. Polkadot (Us dot) switched lower on Sept. 15 and also the bears are attempting to sink the cost underneath the immediate support of $6.75.

Buyers had effectively defended the $6.75 level on two previous occasions hence, a rest and shut below it might intensify selling. The Us dot/USDT pair could first drop to $6.50 and then towards the crucial support at $6.

Because the previous three recoveries have switched lower in the 50-day SMA ($7.86), it continues to be the key level to take into consideration around the upside. The bulls will need to overcome this barrier to begin a rally to $9.17 after which to $10.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.