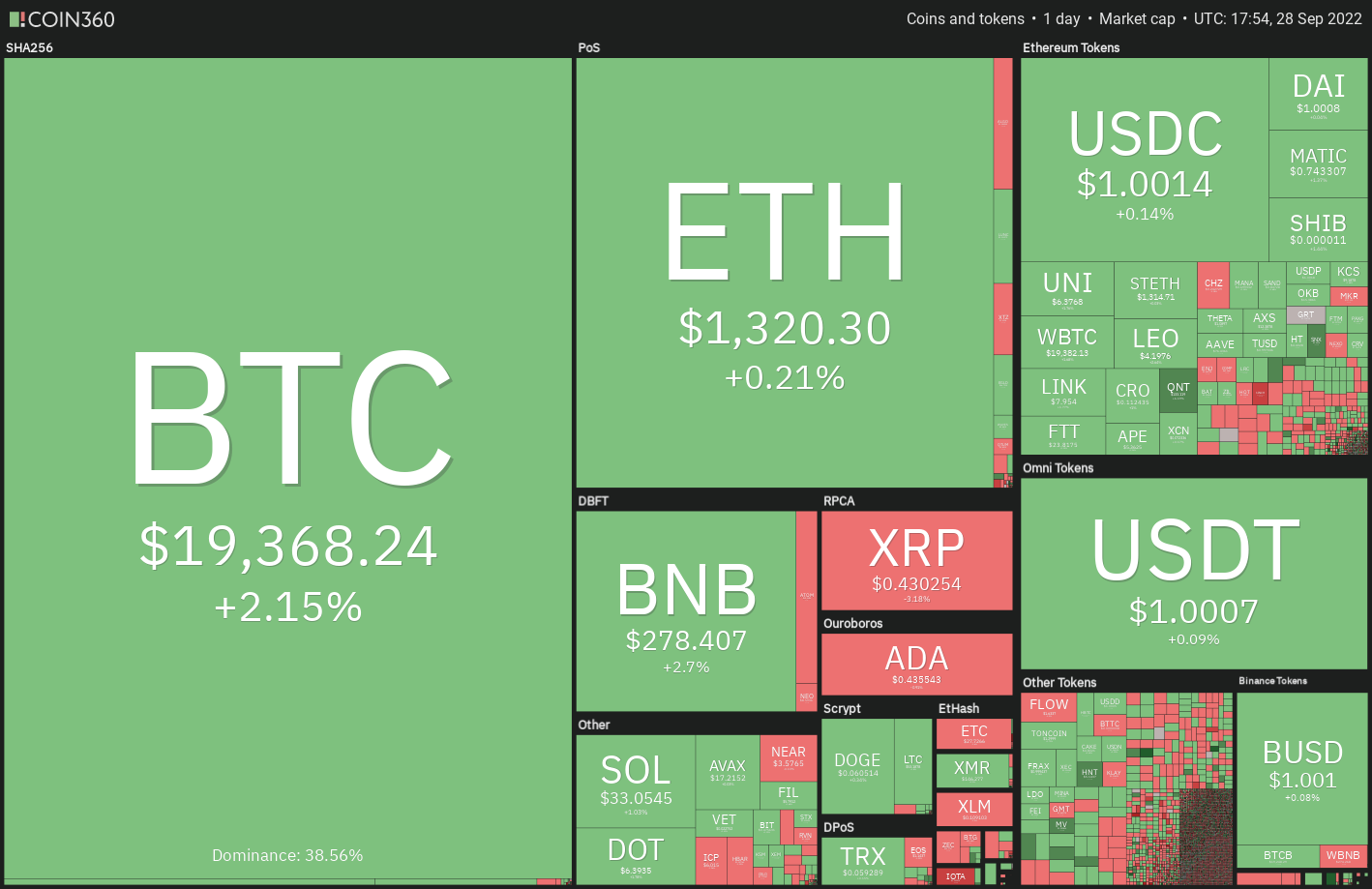

The S&P 500 fell for six days consecutively making a brand new year-to-date have less Sept. 27, but Bitcoin (BTC) maintained its outperformance and remained well above its June low. This may be an optimistic sign because markets that demonstrate strength in route lower are the type that outshine in case of a recovery.

The U . s . States equities markets rebounded sharply on Sept. 28 following the Bank of England announced a bond-buying program and also the U.S. Treasury yields retracted from multi-year highs. Because this happened, strong buying in Bitcoin required place, but BTC was not able to interrupt above its overhead resistance.

A ray of expect cryptocurrency traders is the fact that October has in the past been a powerful month for Bitcoin. Barring 2014 and 2018, Bitcoin has managed an optimistic near the coast October each year since 2013, based on data from Coinglass.

Although history favors a bounce in October, traders ought to be careful since the macroeconomic scenario is unparalleled and stays challenging.

Could Bitcoin and altcoins close September on the strong note? Let’s read the charts from the top ten cryptocurrencies to discover.

BTC/USDT

Bitcoin soared over the 20-day exponential moving average (EMA) ($19,576) on Sept. 27 however the bulls couldn’t sustain the greater levels. This evaporated all intraday gains. The bears pounced about this chance and attempted to sink the cost underneath the immediate support of $18,626 on Sept. 28 however the lengthy tail around the day’s candlepower unit shows strong buying at ‘abnormal’ amounts.

The positive divergence around the relative strength index (RSI) remains intact and it is pointing to the recovery. When the cost breaks and sustains over the 20-day EMA, the probability of a rally towards the downtrend line increases. The bears will probably defend this level with vigor.

When the cost turns lower in the downtrend line, the BTC/USDT pair could drop towards the 20-day EMA. A bounce off this level will claim that the sentiment might be altering from selling on rallies to purchasing on dips. If buyers push the cost over the downtrend line, the happy couple could achieve $22,799.

To invalidate this bullish bias, the bears will need to sink the cost below $18,125. The happy couple could then retest the June low of $17,622. A rest below this support could signal the resumption from the downtrend. The happy couple could then decline to $14,500.

ETH/USDT

Ether (ETH) switched lower dramatically in the 20-day EMA ($1,411) on Sept. 27 but rebounded from the $1,262 support on Sept. 28. This implies that bears can sell on rallies and bulls are purchasing on dips.

The ETH/USDT pair is presently stuck between $1,250 and $1,410. If bulls push the cost over the overhead resistance, the happy couple could rally towards the resistance type of the climbing down funnel. The bulls will need to get over this obstacle to point out a possible trend change.

When the cost turns lower in the current level or even the overhead resistance and breaks underneath the support at $1,250, it’ll claim that the selling pressure is accumulating. This might increase the probability of a rest underneath the funnel. The happy couple could then slide towards the mental degree of $1,000.

BNB/USDT

The bulls nudged BNB over the resistance type of the climbing down funnel pattern on Sept. 27 but they couldn’t go beyond the 50-day SMA ($287). This attracted heavy selling and also the cost tucked back underneath the 20-day EMA ($276).

The lengthy tail around the Sept. 28 candlepower unit implies that the bulls haven’t quit and could make another make an effort to pierce the overhead resistance in the 50-day SMA. Whether they can accomplish it, it’ll advise a potential trend change for the short term. The BNB/USDT pair could first progress to $300 after which chance a sprint to $338.

However, when the recovery turns lower in the moving averages, it’ll claim that the bears are active at greater levels. The happy couple could then retest the immediate support at $258.

XRP/USDT

XRP’s sharp rally to $.56 has retraced towards the breakout degree of $.41. The 61.8% Fibonacci retracement level is near to this level and also the 20-day EMA ($.41) can also be nearby. Hence, buyers will probably defend the amount with all of their might.

When the cost rebounds from the current level, the XRP/USDT pair could chance a rally to $.47 after which to $.52. The bears could provide a stiff resistance within this zone. When the cost turns lower out of this zone, the happy couple could consolidate inside a range for any couple of days.

The failure to protect the breakout degree of $.41 will claim that the current rally might have been a bear trap. The happy couple could then drop towards the 50-day SMA ($.37). If the support also cracks, the happy couple could develop a 100% retracement and tumble to $.32.

ADA/USDT

The lengthy wick on Cardano’s (ADA) Sept. 27 candlepower unit implies that bears still sell the recovery towards the 20-day EMA ($.46). The bears are attempting to cement their advantage by sustaining the cost underneath the upward trend line.

When they manage to achieve that, the ADA/USDT pair could slide towards the crucial support of $.40. It is really an important level for that bulls to protect if they fail within their endeavor, the happy couple could resume its downtrend. The happy couple could then decline to $.33.

Around the upside, buyers will need to push the cost over the moving averages to point out the selling pressure might be reducing. The happy couple could then rise towards the downtrend line. A rest above this level could open the doorways for any possible recovery to $.60.

SOL/USDT

Solana (SOL) tried to break over the 50-day SMA ($35) on Sept. 27 however the bears were in no mood to forget about their advantage. They offered strongly and pulled the cost back underneath the 20-day EMA ($33).

When the SOL/USDT pair doesn’t quit much ground in the current level, the buyers may again make an effort to push the cost over the 50-day SMA. The repeated retest of the level of resistance has a tendency to weaken it and increases the prospects of the break above it. When the cost increases over the 50-day SMA, the happy couple could rally to $39.

The bears might have other plans because they will attempt to sink the happy couple towards the strong support at $30. If the support collapses, the happy couple could retest the June low at $26.

DOGE/USDT

Dogecoin’s (DOGE) recovery faded just over the 50-day SMA ($.07) on Sept. 24 and also the cost tucked back close to the strong support at $.06 on Sept. 28.

The 20-day EMA ($.06) is flattening out and also the RSI is simply underneath the midpoint, suggesting an account balance between demand and supply. If bears wish to assert their dominance, they’re going to have to sink and sustain the cost underneath the immediate support near $.06. That could cause a retest from the June low near $.05.

If bulls wish to tilt the benefit within their favor soon, they’re going to have to push and sustain the cost over the overhead resistance at $.07. The DOGE/USDT pair could then start its journey to $.09.

Related: Bitcoin holds $19K, but volatility expected as Friday’s $2.2B BTC options expiry approaches

Us dot/USDT

Polkadot’s (Us dot) rebound from the strong support at $6 fizzled out close to the 20-day EMA ($6.68) on Sept. 27. This signifies the bears haven’t quit and therefore are selling on every minor rally.

The cost gets squeezed between your 20-day EMA and also the support at $6. This uncertainty could resolve having a strong range breakout but it’s hard to predict the direction with certainty. Therefore, it is best to wait for a breakout to occur before you take directional bets.

When the cost plummets below $6, the Us dot/USDT pair could start the following leg from the downtrend and dive to $4. On the other hand, when the cost explodes over the 20-day EMA, the happy couple could climb towards the 50-day SMA ($7.37) after which towards the overhead resistance at $8.

MATIC/USDT

Polygon (MATIC) switched lower in the 20-day EMA ($.78) on Sept. 27, indicating the sentiment remains negative and traders can sell on rallies to resistance levels.

The bears will endeavour to bolster their position by pulling the cost underneath the $.72 to $.69 support zone. If the zone gives way, the selling could get momentum and also the MATIC/USDT pair could drop to $.62. The downsloping moving averages and also the RSI within the negative territory indicate a small benefit to bears.

Alternatively, when the cost rebounds from the support zone, the bulls will again attempt to drive the happy couple over the 20-day EMA. When they succeed, the happy couple could rise towards the 50-day SMA ($.84).

SHIB/USDT

Shiba Inu (SHIB) continues to be buying and selling close to the 20-day EMA ($.000011) within the last couple of days, indicating the bulls aren’t dumping their positions because they anticipate the cost to maneuver greater.

If bulls propel the cost over the 20-day EMA, the SHIB/USDT pair could rise towards the overhead resistance at $.000014. The bears may mount a powerful resistance only at that level but when bulls overcome this barrier, the happy couple could start its march toward $.000018.

This positive view could invalidate soon when the cost turns lower in the current level and breaks underneath the support at $.000010. The happy couple could then drop toward the key support at $.000007.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.