The crypto markets will be in decline since the beginning of the 2nd quarter of 2022. Every time it appeared such as the apparent crypto winter would notice a minor thaw, another notable collapse happened: Celsius, Three Arrows Capital, and much more lately, FTX.

Approaching the finish of 2022, it seems the same negative sentiments will probably remain. Although some analysts state that Bitcoin (BTC) and Ether (ETH) derivatives are presently flashing positive signals for that market because of their high volatility, that very same volatility is impacting the sentiment of other locations, including regulation, mining, nonfungible tokens (NFTs) and crypto stocks. Despite all of this, companies for example Porsche are becoming in to the Web3 and NFT space and South america passed legislation legalizing crypto payments nationwide. Over 60 deals from investment capital remained as finished in November, getting $800 million of capital inflows in to the space. There are lots of excellent achievements being built during this period of uncertainty, but it’s admittedly difficult to disregard the market conditions.

Download and buy this set of the Cointelegraph Research Terminal.

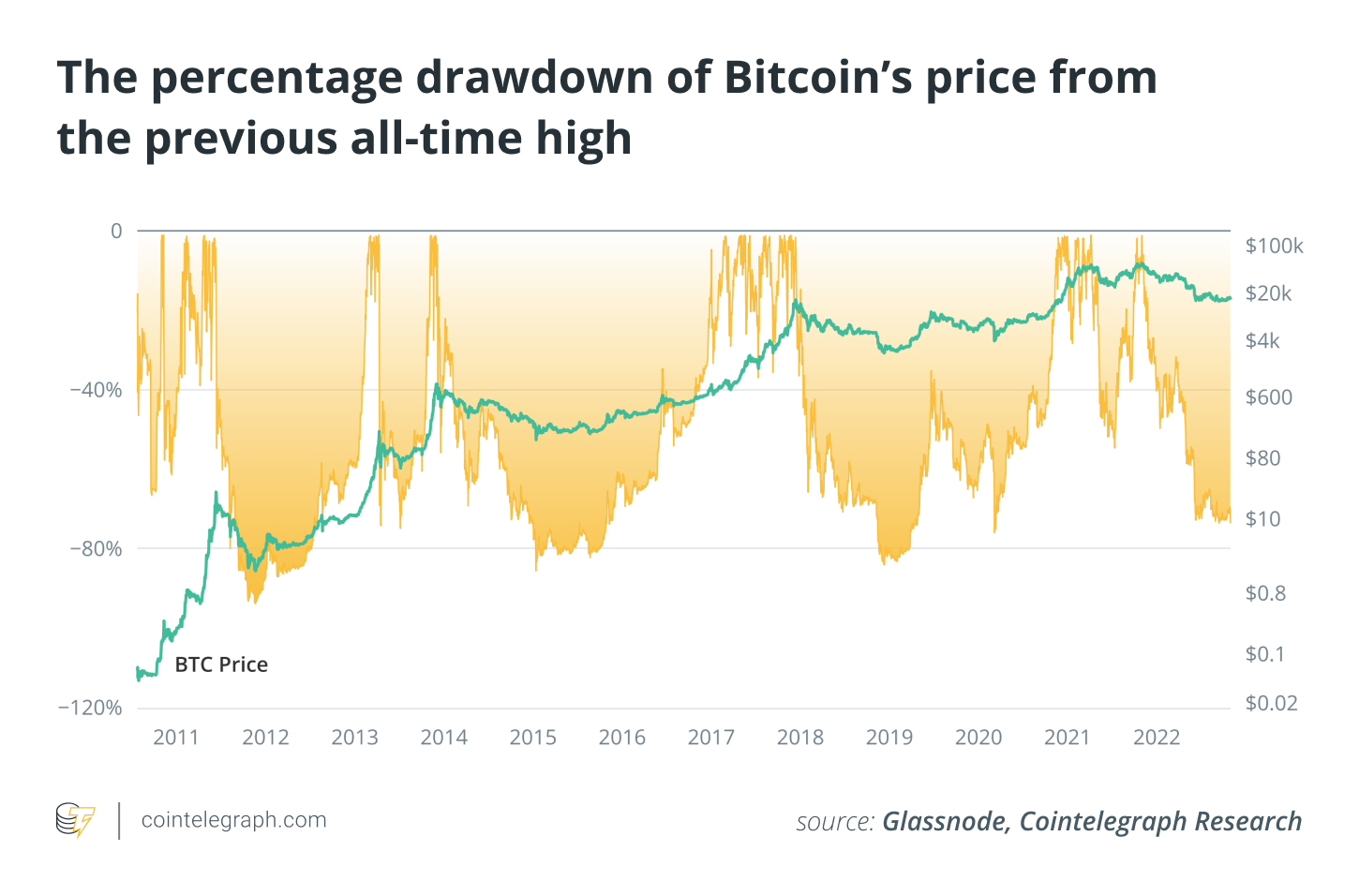

Bitcoin may be the bellwether from the entire crypto industry, and also the market bottom might not yet maintain. Historic bear market cost drawdowns suggest BTC could still visit a drop towards the $12,000–$14,000 range.

With all of this uncertainty, it’s helpful to possess subject material pros who might help navigate the various areas of the cryptoverse. For this reason each month, Cointelegraph Research releases its Investor Insights Report analyzing key indicators from multiple sectors from the blockchain industry, including regulation, crypto mining, security tokens, Bitcoin and Ether derivatives and VC activities — all explored by individuals working carefully with the topic.

Potential further downside in Bitcoin cost

All eyes use Bitcoin because the market looks for all kinds of clues in the past that may inform the long run. Bitcoin has organized astonishingly well regardless of the constant speed bumps which have become in the way.

As observed in the chart below, Bitcoin has in the past arrived at drawdowns of 80% or greater from the previous highs throughout the halving cycle before climbing because it heads in to the next bull market. Although this cycle might be different because of all the positive things Bitcoin and crypto have achieved in the last couple of years, it’s still likely that it’ll a minimum of touch the $12,000–$14,000 range before rebounding within the short to medium term.

The Cointelegraph Research team

Cointelegraph’s Research department comprises the best talents within the blockchain industry. Getting together academic rigor and filtered through practical, hard-won experience, they around the team are dedicated to getting probably the most accurate, insightful content in the marketplace.

Demelza Hays, Ph.D., may be the director of research at Cointelegraph. Hays has compiled a group of subject material experts from over the fields of finance, financial aspects and technology to create towards the market the premier source for industry reports and insightful analysis. They utilizes APIs from a number of sources to be able to provide accurate, helpful information and analyses.

With decades of combined experience of traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to place its combined talents to proper use using the latest Investor Insights Report.

The opinions expressed in the following paragraphs are suitable for general informational purposes only and aren’t meant to provide specific advice or recommendations for anyone or on any sort of security or investment product.