After rising dramatically in number in wake from the Bitcoin cost drop which was triggered because of the collapse from the FTX cryptocurrency exchange at the begining of November, the amount of so-known as Crab, Fish and Shark cryptocurrency addresses has stabilized, data from on-chain crypto analytics firm Glassnode suggests.

Crab addresses are Bitcoin wallets with between 1 and 10 BTC and tend to be assumed to be devoted retail investors (or HODLers). Fish addresses hold between 10 and 100 BTC, while Shark addresses hold between 100 to at least one,000 BTC. Both of these address cohorts are usually comprised of high-internet-worth individuals, buying and selling desks and institutional-sized entities, based on Glassnode.

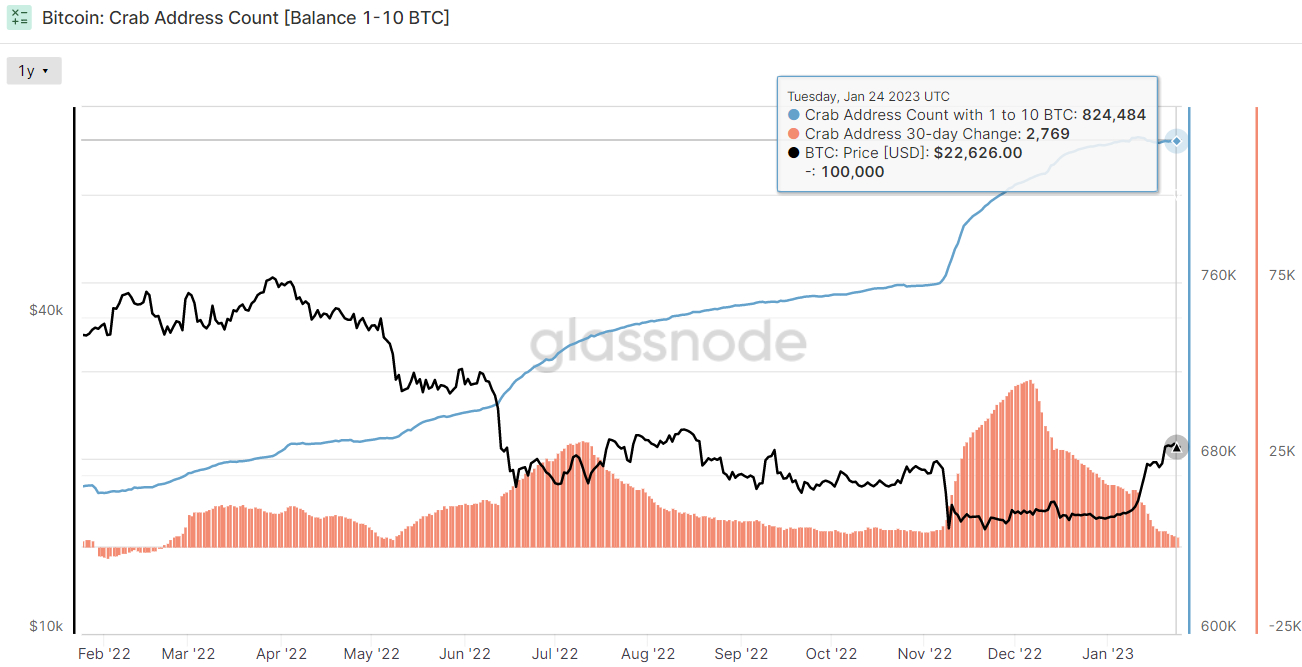

In wake from the FTX collapse, the amount of Crab addresses leaped from around 760,000 to current amounts of around 824,000. The 30-day alternation in Crab address figures peaked around 47,000 at the begining of December but has since fallen to simply a couple of 1000.

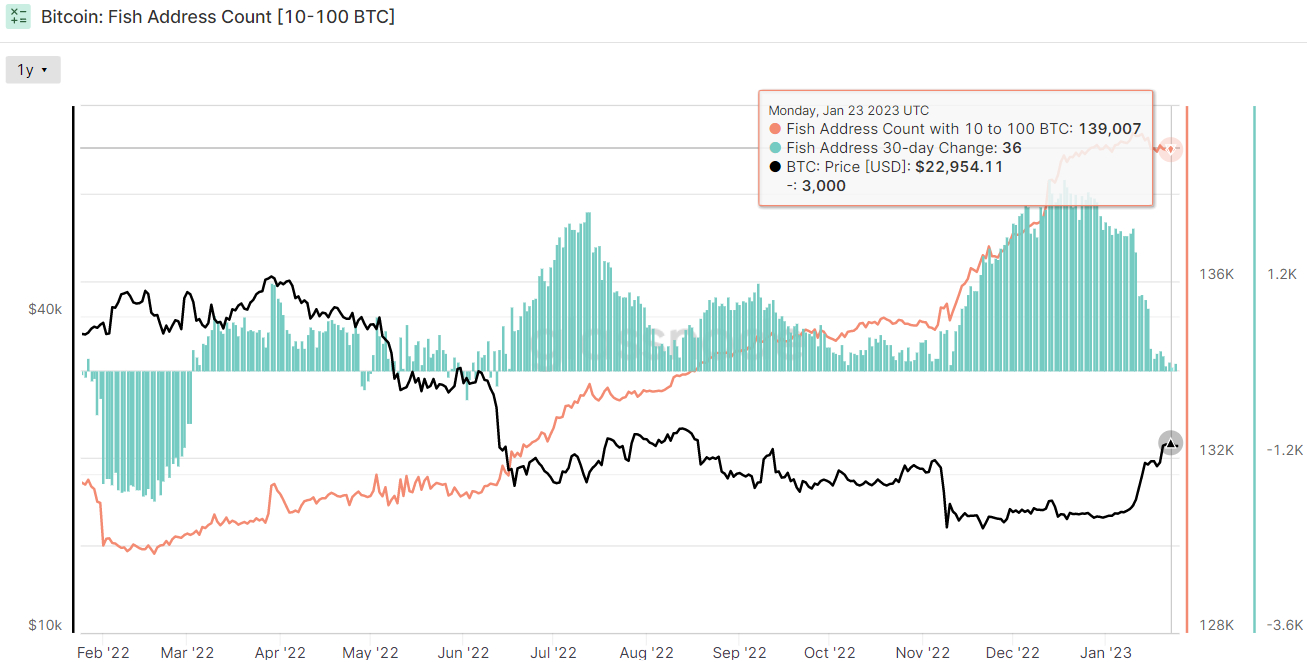

Over the same time frame period, the amount of Fish and Shark addresses have leaped from 135,000 to 139,000 and 13,700 to 14,050 correspondingly. However, as continues to be the popularity with Crab addresses, the 30-day rate of alternation in both has dropped to around zero.

Exactly What The Slowdown In Crab, Fish and Shark Address Accumulation Method for BTC Cost

Mid to large-sized crypto investors, including large retail investors, high-internet-worth individuals, buying and selling desks and institutions – generally considered a properly-informed cohort – clearly used the publish-FTX collapse-caused cost drop being an chance to purchase the dip. Bulls will say this can be a show of confidence in Bitcoin being an asset class.

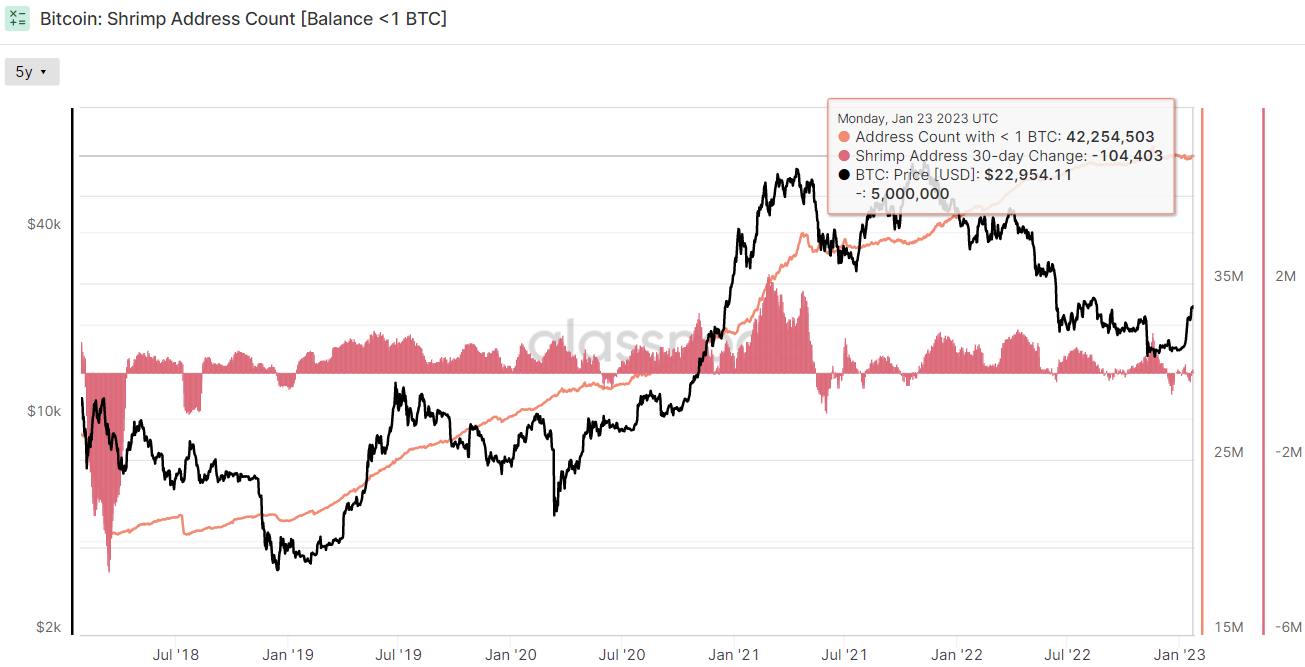

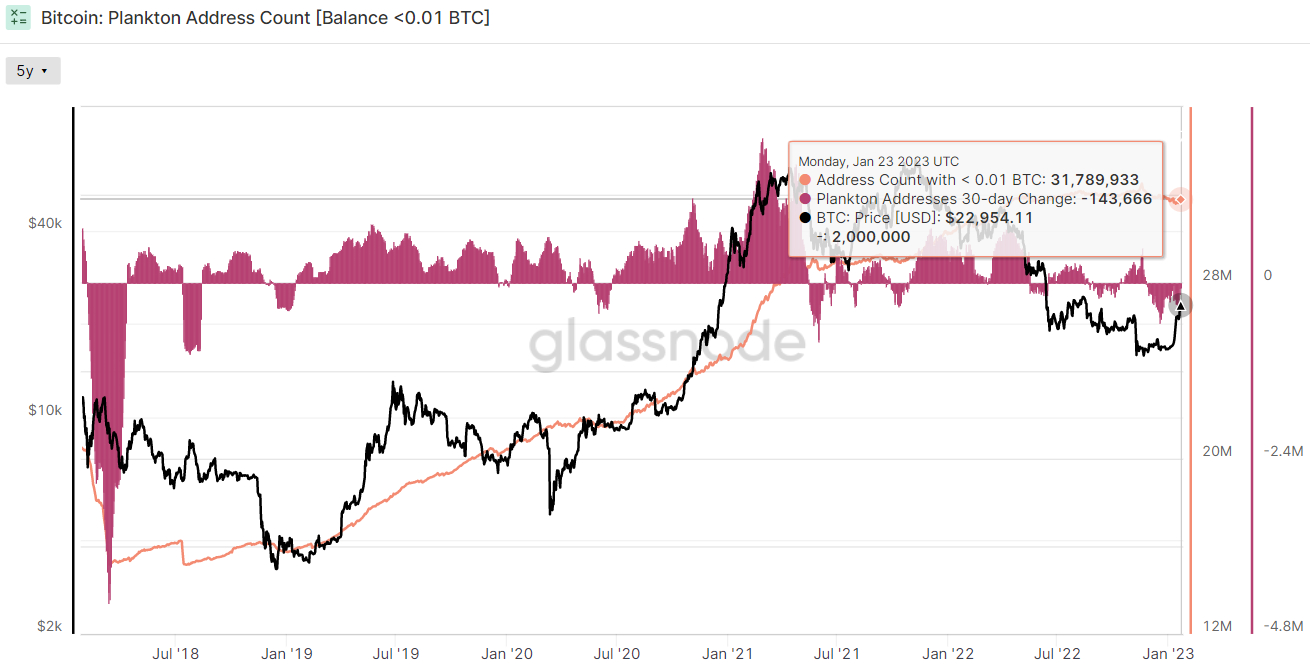

Simultaneously these cohorts were accumulating, the figures of smaller sized Shrimp and Plankton addresses (with under 1 BTC) started to stagnate/decline. This can be a sign that less well smaller sized and sure informed investors were bowing from the market, leading to flows in BTC towards the bigger, better-informed investors.

Stagnation within the latter groups’ accumulation shows that this trend has likely arrived at an finish as Bitcoin’s cost has rebounded in The month of january. This may be considered a sign that small investor capitulation has eased. But Shrimp and Plankton address figures haven’t yet start obtaining again. Considering that Bitcoin bull markets have in the past been characterised with a boost in demand from small investors (along with a subsequent boost in small address figures), this means sentiment continues to have a lengthy method to recover.

Many Bitcoin bulls aren’t worried. Lots of on-chain and technical indicators are actually screaming the Bitcoin bottom with this market cycle may certainly be in. Data-driven crypto-focused Research Provider lately shared 6 on-chain metrics that demonstrate Bitcoin is presently a “generational lengthy-term buying opportunity”.