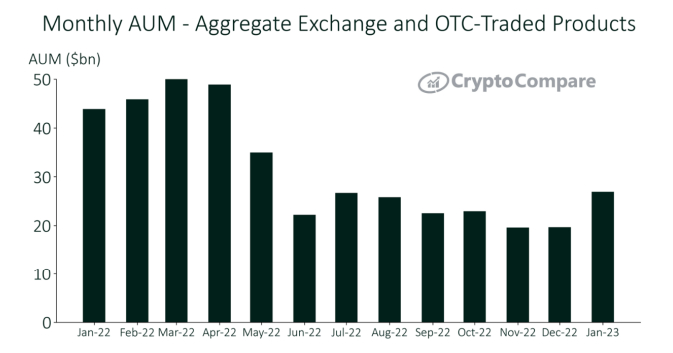

Total assets under management (AUM) for digital asset investment products surged an astonishing 36.8% to $19.7 billion in The month of january, its greatest level since May 2022, CryptoCompare stated in the latest monthly Digital Asset Management review report. Based on the crypto intelligence firm, “bullish sentiment was driven by liquidated short positions along with a favorable macro atmosphere, reflected in the newest CPI announcement, which saw Bitcoin’s cost achieve $23,000 its greatest level since August 2022”.

However, CryptoCompare noted that AUM continues to be 38.7% below its level in The month of january 2022 “due to some difficult year for Bitcoin, the broader cryptocurrency market, and traditional assets”. It’s broadly agreed among analysts the primary trigger of 2022’s risk asset and crypto bear markets would be a surprisingly aggressive hawkish transfer of the insurance policy stance of america Fed along with other major central banks to be able to clamp lower on the more powerful-than-expected boost in global cost pressures.

Grayscale Situation Delicate Despite Market’s Revival

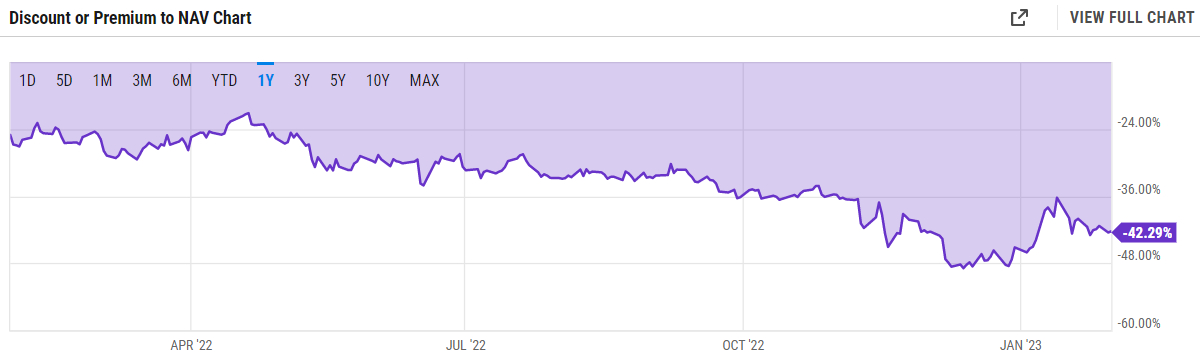

Regardless of the The month of january revival in crypto market sentiment which has also led to a rebound on crypto investment product AUM, CryptoCompare noted the situation associated with Grayscale’s Bitcoin Trust (GBTC) remains delicate. While GBTC continues to be the dominant Bitcoin investment trust product when it comes to AUM, having a share of the market of 69.3%, CryptoCompare noted that “the discount connected with Grayscale’s GBTC Trust only has slightly narrowed” in The month of january.

The GBTC discount refers back to the percentage that GBTC shares are buying and selling below their internet asset value. By the 31st of The month of january, the GBTC discount would be a staggering 42.29%, only slightly above record lows printed last December within the 48% area. CryptoCompare explains that “the situation remains delicate” with Grayscale facing challenges including “the personal bankruptcy announcement of their sister company Genesis because of contact with FTX in The month of january, and also the ongoing suit from the SEC to transform its Bitcoin Trust into an ETF”.

Will the Given Scare Investors From Crypto Again?

The most recent CryptoCompare report chimes using the latest weekly fund flows report from CoinShares. Based on CoinShares, digital asset investment products saw their largest inflows since This summer 2022 a week ago, with Bitcoin dominating and comprising $116 million from the inflows. The month of january clearly saw an upsurge of appetite among institutional investors for crypto investments.

However that resurgence looks set to become put firmly towards the test this Wednesday. The Given is scheduled to produce its latest financial policy decision at 1900GMT and it is likely to raise rates of interest by 25 bps to some 4.50-4.75% target range. That will mark another slowdown within the pace of rate hikes following the Given lifted rates by 50 bps at its last meeting and 75 bps each and every of their previous four conferences just before that.

Optimism in regards to a less aggressive Given as inflation shows significant indications of cooling and forward-searching economic indicators point to a probable US recession later this season would be a key pillar of January’s rally. But macro strategists are warning that market optimism might have gone too much. Markets expect just another 25 bps rate hike after today’s move and rate cuts later this season, but Given Chair Jerome Powell may signal more hikes ahead, and could break the rules against the thought of rate cuts later this season.

Traders should brace for the chance of a hostile short-term pullback in crypto prices – for that longer-term bulls this may present a brand new chance to purchase the dip, given growing signs the 2022 bear marketplace is over.