Over fifty percent of worldwide crypto derivatives industry representatives say they anticipate seeing a far more severe approach through the world’s regulatory agencies because of the current decreases within the prices of cryptoassets – however a decisive most of the surveyed experts reason that bitcoin (BTC) will again achieve the amount above USD 65,000, based on a report by market intelligence provider Acuiti.

Their Crypto Derivatives Management Insight report for that third quarter of 2022 comprises an research into the impact of the recent crypto cost falls, as along with the industry’s thoughts about regulation and also the impact it’ll have around the market’s structure, based on Acuiti.

The research is dependant on the views from the Acuiti Crypto Derivatives Expert Network, a worldwide number of senior executives hailing from hedge funds, banks, brokers, prop traders, asset managers, and exchanges. Laptop computer was transported out between June 30 and This summer 19.

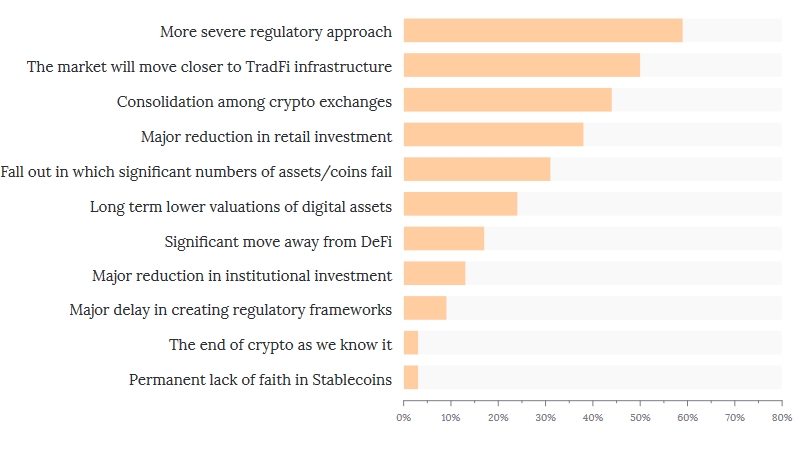

The report signifies that some 59% from the Network anticipates a far more severe regulatory approach that’ll be the main medium- to lengthy-term aftereffect of 2010 cost falls within the crypto market.

What is your opinion would be the greatest medium to lengthy-term impacts from the recent falls in crypto prices?

Despite these forecasts, the industry’s belief in bitcoin and also the crypto’s potential to go back to its top cost level appears to become unshaken with this year’s market downturn, based on Acuiti’s report.

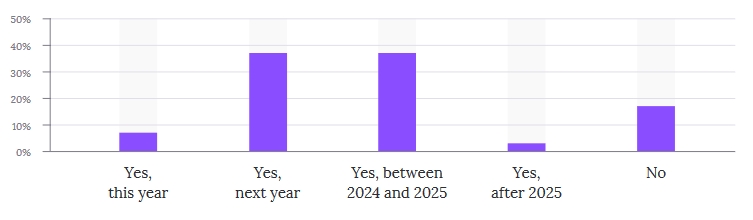

“84% from the network believes Bitcoin will rise back above USD 65,000, but opinion ranges about how lengthy it will require to get this done,” the organization stated.

Will BTC return above USD 65,000?

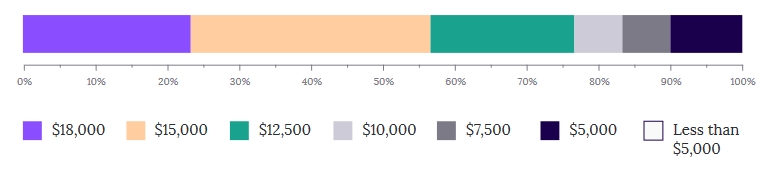

Meanwhile, another from the Network stated that BTC goes as little as USD 15,000, stated the report, noting the survey was completed prior to the recovery in prices at the begining of August.

What do you consider would be the cheapest point BTC reaches this season?

Simultaneously, 50% from the Network stated the market is going to be moving nearer to the world’s traditional banking companies, and 58% from the surveyed industry representatives stated they expect banks will begin to play a substantial role in permissioned decentralized finance (DeFi). Only 3% stated this could take place in pure DeFI, however.

____

Find out more:

– Bitcoin Cost Rally Unsuccessful to draw in Active Users, Exchange Flows Reveals ‘Lackluster’ Demand – Glassnode

– Crypto Market Regains Ground In front of Key US Jackson Hole Meeting

– Canadian Exchanges’ Cap on Annual Purchases Excludes Only Bitcoin, Ethereum, Litecoin and Bitcoin Cash

– 10 Traditional Firms that are Getting into Crypto Despite Market Downturn

– Universe Digital’s Novogratz Doubts Bitcoin Will Pass USD 30,000 Barrier Soon

– Bitcoin Could Fall to USD 13.6K This Season, Panel States After Modifying Predictions Once More