The most popular Bitcoin (BTC) and crypto on-chain analyst Willy Woo has predicted that the foot of the present Bitcoin bear marketplace is close, because of the share from the BTC supply that’s considered “underwater.”

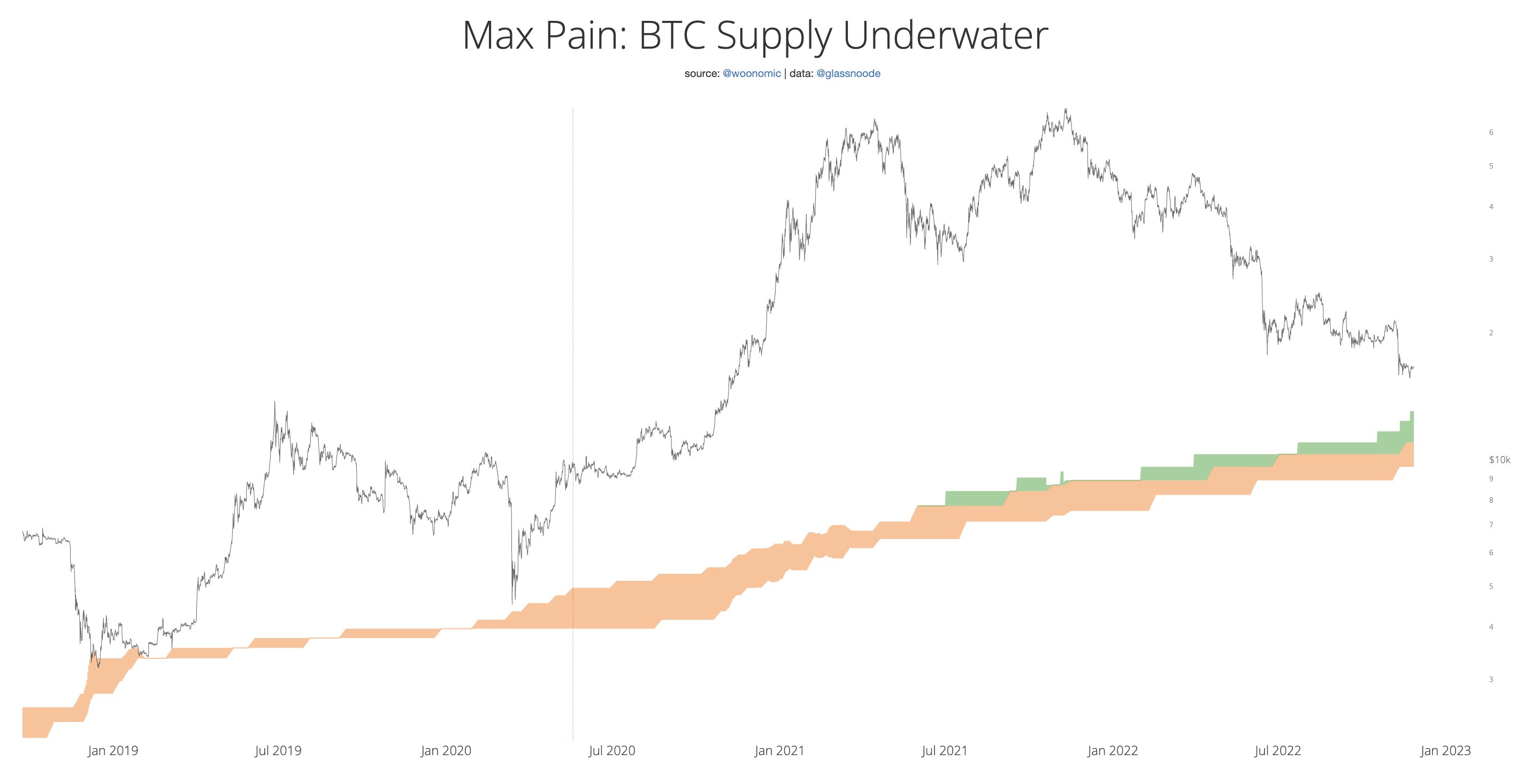

Using his so-known as “Max Pain” model, Woo stated on Twitter a few days ago that the macro cycle bottom for bitcoin in the past continues to be seen when 58% to 61% from the BTC supply is underwater, or held by investors located on an unrealized loss.

Knowing from Woo’s model, that much cla has become getting close.

Requested with a commenter where precisely the model predicts the underside to become, Woo accepted the cost could still fall further, saying top of the area of the shaded section of his model reaches $13,000 “and rising rapidly.”

“Not all bottoms have hit, however for individuals that didn’t, they were given close,” he added.

Willy Woo’s “Max Pain” model properly predicted the foot of the bitcoin bear markets at the end of 2018 as well as in 2015. Within the bear market of 2011 – during bitcoin’s early years – the cost got fairly near to the model’s predicted bottom cost, but didn’t hit it.

Unsuccessful predictions this season

In March this season, Woo predicted a “decoupling” between bitcoin and stocks, given his view that bitcoin fundamentals still reason for a bullish direction despite “macro headwinds.”

With place interest in BTC ongoing to climb, along with a go back to more interest in bitcoin futures, the marketplace has become “fully reset” and “accumulation has happened,” Woo authored on Twitter at that time.

To date, Woo’s conjecture in regards to a bullish decoupling for bitcoin has – regrettably – not arrived at fruition.