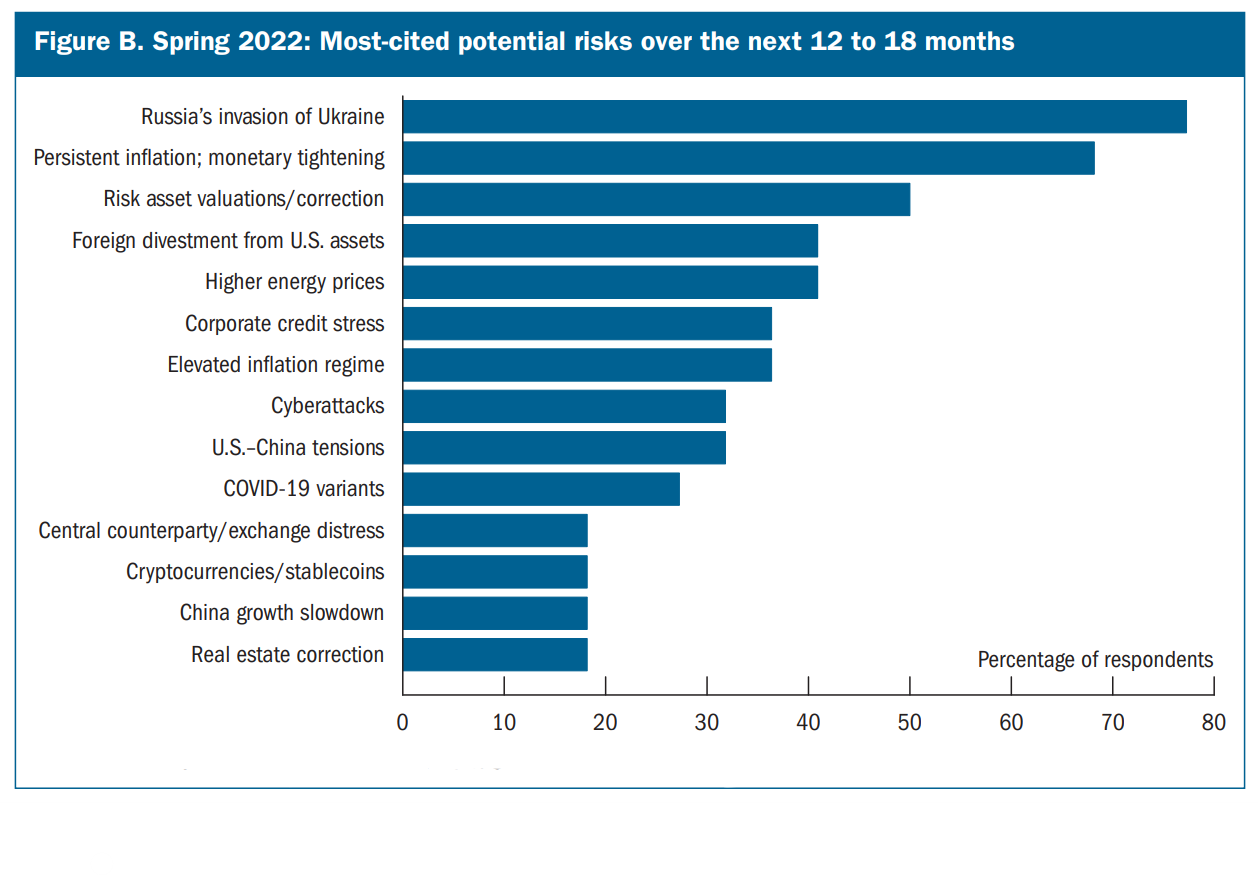

While advocates of traditional finance remain interested in dismissing Bitcoin (BTC) and also the crypto ecosystem as financial risks, market research conducted through the Fed Bank of recent You are able to — among the 12 fed banks from the U . s . States — revealed 11 factors that overshadow crypto when it comes to risk in 2022.

Geopolitical tensions, foreign divestments, COVID-19 and energy prices were discovered to be probably the most-reported potential risks for that US economy, according to some central bank survey printed through the Fed System.

From the 14 factors that pose an economic risk, crypto is the eleventh position — revealing a general change in investor mindset because of the ongoing efforts of crypto entrepreneurs to teach everyone.

A few of the pressing risk concerns elevated through the respondents were associated with the ability struggle of worldwide economies, including the U.S.-China tensions, the Russia-Ukraine war, greater energy prices, rising inflation, the COVID-19 pandemic and cyberattacks, to mention a couple of.

However, the U.S central maintains its anti-cryptoposition with regards to evaluating the potential risks in crypto investment. It stated within the are convinced that selected cryptocurrencies — including BTC, Ether (ETH), Binance Gold coin (BNB), Cardano (ADA) and XRP — are lower about 69 percent in value when compared to November. 2021 peak, adding that:

“Speculation and risk appetite seem to be the main driving forces of crypto-asset prices, that have recorded big swings recently.”

The central bank also reported the collapse from the Terra (LUNA) ecosystem, highlighting that entities which had subjection towards the in-house stable TerraUSD (UST) found themselves in bankruptcy, sometimes resulting in personal bankruptcy.”

Related: Joe Biden unhappy with Elon Musk for purchasing a platform that “spews lies”

On the other hand around the globe, India launched its home-grown central bank digital currency (CBDC) for that wholesale segment.

As the country continues to be against the thought of mainstreaming cryptocurrencies, the pilot project saw the participation of nine local traditional banks, including the Condition Bank asia, Bank of Baroda, Union Bank asia, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC.

Related reports recommended that India’s central bank — the Reserve Bank asia (RBI) — intends to launch digital rupee for that retail segment inside a month in select locations.