Self-sovereignty is really a core principle within the cryptocurrency space: Investors have to depend on the trustless, decentralized network rather of the central entity that’s been recognized to devalue the holdings of others. One disadvantage connected with self-sovereignty, however, is inheritance.

An believed 4 million Bitcoin (BTC) is lost with time and today sits in inaccessible wallets. The number of of individuals coins fit in with HODLers who died without discussing use of their wallets with other people is unknown? Some believe Satoshi Nakamoto’s believed a million BTC fortune hasn’t been touched with this reason: Nobody else had use of it.

Research conducted in 2020 through the Crenation Institute has particularly discovered that nearly 90% of cryptocurrency proprietors are involved regarding their assets and just what may happen for them after they perish. Regardless of the concern, crypto users were discovered to be four occasions less inclined to use wills for inheritances than non-crypto investors.

The seeming insufficient an answer doesn’t appear to become broadly discussed, however. Talking with Cointelegraph, Johnny Lyu, Chief executive officer of crypto exchange KuCoin, stated that crypto inheritance continues to be “poorly understood” since most crypto holders are youthful and, as a result, aren’t considering their dying or inheritance.

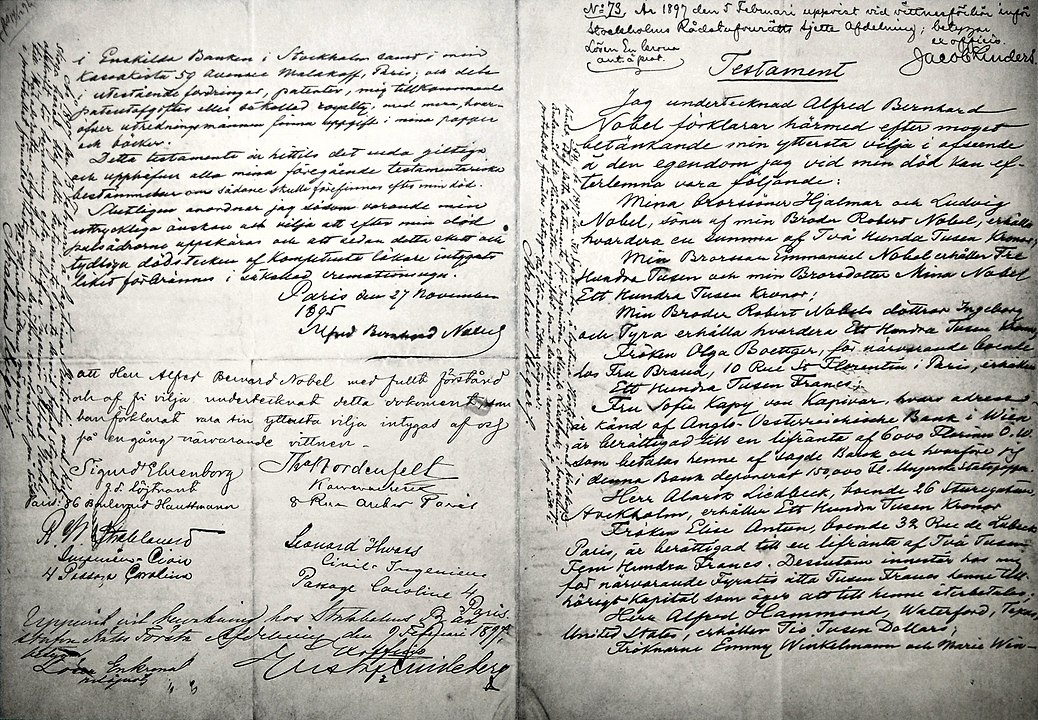

Furthermore, Lyu states we have not “come across a legislative precedent within this matter.” As a result, there isn’t enough experience “in resolving inheritance disputes as, for instance, in matters of thievery and return of cryptocurrencies.” To Lyu, crypto inheritance “comes lower to supplying relatives with private keys.” He added that it may be managed through private keys inside a cold wallet that’s then kept in a secure and held having a notary:

“If the dog owner doesn’t wish to transfer the cryptocurrency prior to the moment of dying, then they have to consider creating a will as well as an inventory from the contents essential for their heirs to spread out the wallet.”

The Chief executive officer added that investors that are looking to pass through on their own assets must “solve the issue of maintaining anonymity before the moment once the heirs may come to their own.” Simultaneously, he conceded, transferring access credentials can “compromise the security or anonymity” of holders.

To Lyu, the very best crypto inheritance option available was created by Germain notaries and includes a memory stick having a “master password, which already contains account passwords.” That memory stick is stored through the assets’ owner as the notary supports the master password, he stated.

Lyu’s proposition does, however, have a caveat: too little self-sovereignty. Trust is sacrosanct if another person can access our funds.

Recent: Indian government’s ‘blockchain not crypto’ stance highlights lack of knowledge

Keys and trust

Should crypto holders share keys with reliable organizations? Now you ask , difficult to answer.

With a crypto enthusiasts, if another person controls the secrets of a wallet with crypto assets inside it, they’re basically co-proprietors. If nobody else understands how to access funds, the assets might be lost within the situation of the holder’s untimely dying.

Talking with Cointelegraph, Mitch Mitchell, affiliate counsel of Estate Planning at Trust and can — a strong focusing on estate planning — stated that cryptocurrency investors should share their private keys with reliable family people “for the straightforward reason why, if they don’t, their understanding from the private key dies together.”

Mitchell added that whenever or the way they should share their private keys is an item of contention. Max Sapelov, co-founder and chief technology officer of crypto lending startup CoinLoan, told Cointepegrah that discussing private keys is really a “debatable question,” because it depends “on the depth from the relationships” and also the trust investors have in organizations.

Sapelov stated there are two primary threats to think about before discussing private keys:

“Firstly, within an remarkable situation, the nearest family people can change their back with regards to money and wealth. Next, managing private keys (or recovery seed phrase) is really a challenging task.”

Without appropriate understanding, he stated it’s “easy to get rid of access” to personal keys because of improper backup procedures in order to attacks from online hackers searching to steal crypto.

It’s important to note that prominent crypto community people have freely accepted to merely discussing their private keys with family people to make sure that they get access to their. Hal Finney, the recipient of the extremely first Bitcoin transaction, authored in 2013 that Bitcoin inheritance discussions are “of greater than academic interest,” which his BTC was kept in a security deposit box, that his boy and daughter had access.

With a, however, discussing private keys isn’t an answer. Otherwise for insufficient trust, for any potential insufficient security. Self-child custody isn’t for everybody, so much in fact that lots of crypto users have no idea move funds from exchanges.

Related: What’s Bitcoin, and just how do you use it?

Holding crypto on exchanges

Another solution frequently considered with regards to cryptocurrency inheritance is just holding assets on the leading cryptocurrency exchange. The process may initially appear dangerous, considering the amount of buying and selling platforms which have been hacked through the years, but because the marketplace matures, some have were able to stay afloat despite suffering security breaches.

To Mitchell, users may store their wallet files inside a portable hard disk rather of holding funds inside a cryptocurrency exchange and address it like a bearer bond, meaning it is associated with whomever supports the drive. It might, however, be prudent to keep an encrypted backup around the cloud to supply a dual layer of protection, he added.

The benefit of storing on exchanges like Coinbase or Binance, Mitchell stated, is they tend to be more user-friendly to see relatives people searching to extract funds. Sapelov noticed that major exchanges “have among the greatest amounts of security” within the space and therefore are legally needed to “have account inheritance processes in position.”

Coinbase, for instance, enables a relative to gain access to the account of the deceased relative after supplying numerous documents, together with a dying certificate and last will.

For beneficiaries to get into funds kept in cryptocurrency exchanges, they’ll certainly need to jump through hoops, while getting immediate access to some drive using the keys would permit them to instantly connect to the funds.

An alternate could be cryptocurrency inheritance services. To Sapelov, whether someone decides to cover this type of service “depends around the person’s preference,” as it’s a brand new industry that’s “definitely gaining popularity” but doesn’t “have an established track record yet.” Rather, he shows that users should contact the client support groups of the exchanges they will use to understand more about inheritance options before it’s far too late.

On the other hand, cryptocurrency exchanges or inheritance services may shut lower with time or lose use of funds themselves. As the possibility is remote, it’s still worth thinking about when thinking about how you can spread cryptocurrency investments.

A technical solution

There’s, nonetheless, yet another means to fix consider: special cryptography.

Talking with Cointelegraph Jagdeep Sidhu, lead developer and president of peer-to-peer buying and selling blockchain platform Syscoin, stated that it is possible to setup an answer where a users assets instantly transfer to a different wallet, that you can use for inheritance purposes:

“What can be done would be to do ‘timed’ file encryption. Special cryptography where one can secure a note that contains a personal key that’s only decryptable as time passes.”

Crypto holders may also set themselves because the beneficiary of these transactions, or generate a bigger quantity of beneficiaries, as “there isn’t any limit to the number of occasions you are able to secure your key.” Sidhu stated that crypto inheritance could be arranged while keeping self-sovereignty with this particular method.

He further mentioned that the service could be setup which needs a user to stay interactive to demonstrate he remains to be. When the user does not respond following a specific time period, a “timed file encryption message is produced to all your beneficiaries.”

Recent: UST aftermath: Can there be any future for algorithmic stablecoins?

The answer is nonetheless fairly technical and will need cryptocurrency users to stay interactive or risk accidentally delivering their assets to beneficiaries. The confusion that will arise from this type of setup might be difficult.

Overall, the way in which crypto HODLers start their will needs to vary for every person. Some might choose to go the decentralized way and self-store their while creating their very own inheritance solutions, while some may choose to trust institutions using their funds as well as their wills.

What’s important is the fact that in the finish during the day, users generate a system that enables their beneficiaries to gain access to their cryptocurrency holdings in situation anything transpires with them. In the end, existence-altering money isn’t really existence-altering if nothing can be happy with it.