The spectacle that’s the World Economic Forum (WEF) ended in Davos, Europe on Friday, May 27. Nearly 3,000 individuals from over 110 countries required planes, trains and helicopters towards the greatest town in Europe to lobby leaders and push and query the WEF agenda.

And, as the war in Ukraine required center stage throughout the WEF, global warming performed the hero and economic recovery was the damsel in distress. Meanwhile, blockchain and cryptocurrency featured as — at the minimum — a supporting role.

As Soramitsu Chief executive officer Makoto Takemiya described throughout a Global Blockchain Business Council (GBBC) panel happening around the WEF promenade, the bigwigs and “financial elites” accumulated in Davos. The WEF 2022 had “barbarians” in the gate within the type of crypto and blockchain enthusiasts.

It was the very first in-person WEF because the start of the COVID-19 pandemic and the existence of blockchain companies many participants was large. All lower the Davos boulevard, shops and cafes temporarily changed into showrooms for corporations and large business as the crypto companies stuck out.

Alex Fazel, chief partnership officer at Swissborg told Cointelegraph that “back at WEF 2018, there is just one major pro-crypto event and various other talks were stressing the dark sides of crypto.”

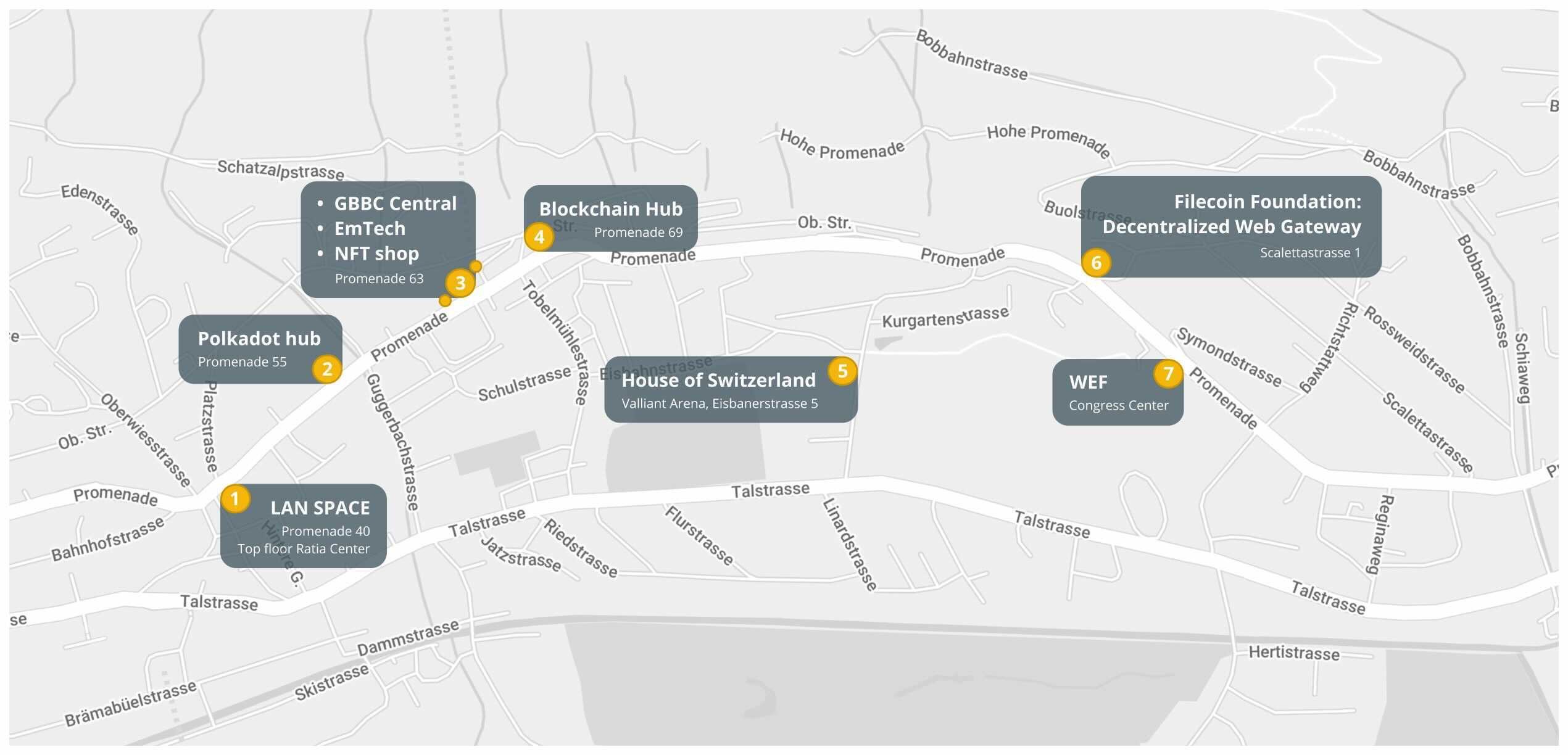

In 2022, world leaders and financial disruptors applied shoulders in the Crypto House, the Blockchain Hub, Polkadot Hub, LAN Space, the NFT Shop, GBBC Central and also the Filecoin Foundation — which in fact had converted an old Catholic church right into a crypto conference hall. Conspicuous at the best, crypto was difficult to miss.

The WEF itself now includes a dedicated website for blockchain technology. Plus, bankers freely discussed digital currencies throughout a panel around the WEF primary stage. In a video interview with Cointelegraph in Davos, Kaira Garlinghouse, Chief executive officer of Ripple Labs, described that although crypto was once a grimy word, the trendline has become “positive.” Garlinghouse told Cointelegraph the “presence of crypto is dramatically different.

Swissborg’s Fazel summarized the bubbling crypto sentiment as newbies and nocoiners (individuals yet to purchase crypto), required their steps in to the space. “There was more attendance in the Web3 pavillions than Web2 like Meta:”

“During WEF 2022, on the top of a large number of crypto conferences, occasions and parties, the crypto space occupied between 10–20% from the entire promenade over the private sector, excluding the governmental pavillions.”

Ultimately, once the Chief executive officer of MasterCard features on the blockchain panel perched alongside Bank for Worldwide Settlements researchers and crypto enthusiasts to freely debate the demise of Quick, as along with the beginning of central bank digital currencies (CBDCs), it’s obvious that digital currencies make the mainstream.

For Thierry Aryz Ruiz, Chief executive officer of AgAu, blockchain as a focus from the WEF is obvious: The problem involves the way the world’s elite manages the innovation. Ruiz told Cointelegraph, “with CBDCs and growing regulation, we might see more dark applying Blockchain like a tool of control.”

Daniela Barbosa, gm at Hyperledger along with a WEF veteran, concurs with Ruiz. The WEF is unquestionably smitten with blockchain technology. However, she also posits that people should not be “scared” of CBDCs. Barbosa decodes the sentiment within an approaching Cointelegraph Youtube interview. Subscribe here.

Cryptocurrencies for example Bitcoin (BTC) are hatched from a wish to split up money in the state — not embolden fiat money. Yet, the WEF, blockchain and crypto are more and more entangled. Ruiz expanded around the point: “Great minds come across one another, genuinely with higher intentions” in the WEF. Cellular looming regulatory concerns, however, he shares “they may also pave the direction to hell if left unchallenged.” Ruiz signals some caution:

“The pandemic has evidenced this too frequently, people sacrifice their freedom in return for an incorrect feeling of security. We shall always remember that this type of trade likely leads to losing both.”

On regulation, throughout a decentralized finance (DeFi) panel discussion moderated by Cointelegraph, Mike Yim, 1inch network advisor and former banker, described that regulation is really a speeding train. “Either you climb onboard or else you step taken care of.” For bad or good, regulating the crypto space is originating.

Around the upside, regulation may reassure the curious and also the coy concerning the rigidity and durability from the space. Indeed, for many WEF attendees, it had been the very first time they interacted with crypto. In the Cointelegraph farewell party held together with Polygon, Davos gold coin stole the show. Partygoers could spend Davos coins in the bar, having a “seamless checkout experience,” because of an airplane pilot project pioneered by Ammer technologies.

Whether regulation impedes or stimulates growth, the theme that Bitcoin and crypto is perfect for everybody permeated through. In an exciting-women panel located by Cointelegraph editor-in-cheift Kristina Lucrezia Cornèr, questions for example “Bitcoin creator Satoshi Nakamoto, who remains pseudonymous, may be a woman” were elevated.

For many WEF attendees, closeness to power and also to the regulators attending the WEF could gain top of the hands. Nas Daily, Youtuber, social networking influencer along with a recent crypto convert, told Cointelegraph he thought about being in the WEF to bond with regulators.

Related: United nations agency mind sees ‘massive opportunities’ in crypto: WEF 2022

“The true influencers are here. They are this is not on your Instagram newsfeed,” he told Cointelegraph. He shared his Bitcoin investment strategy with Cointelegraph which started in March — taking his Youtube funnel along for that ride.

In most, whether crypto may be the “barbarians” in the gate, the next tool for that WEF’s disposal or perhaps a method for economic empowerment for those, the vista from Davos is the fact that crypto is not going anywhere soon. Once the WEF returns to the usual wintry service in The month of january 2023, regulation will probably be the burning issue. Now you ask ,, what face does it put on?