The crypto market turmoil joined the 3rd week of September as the majority of the cryptocurrencies began a few days on the bearish note. The entire crypto market cap dipped below $1 trillion again, with several cryptocurrencies recording a dual-digit downfall in the last 24 hrs.

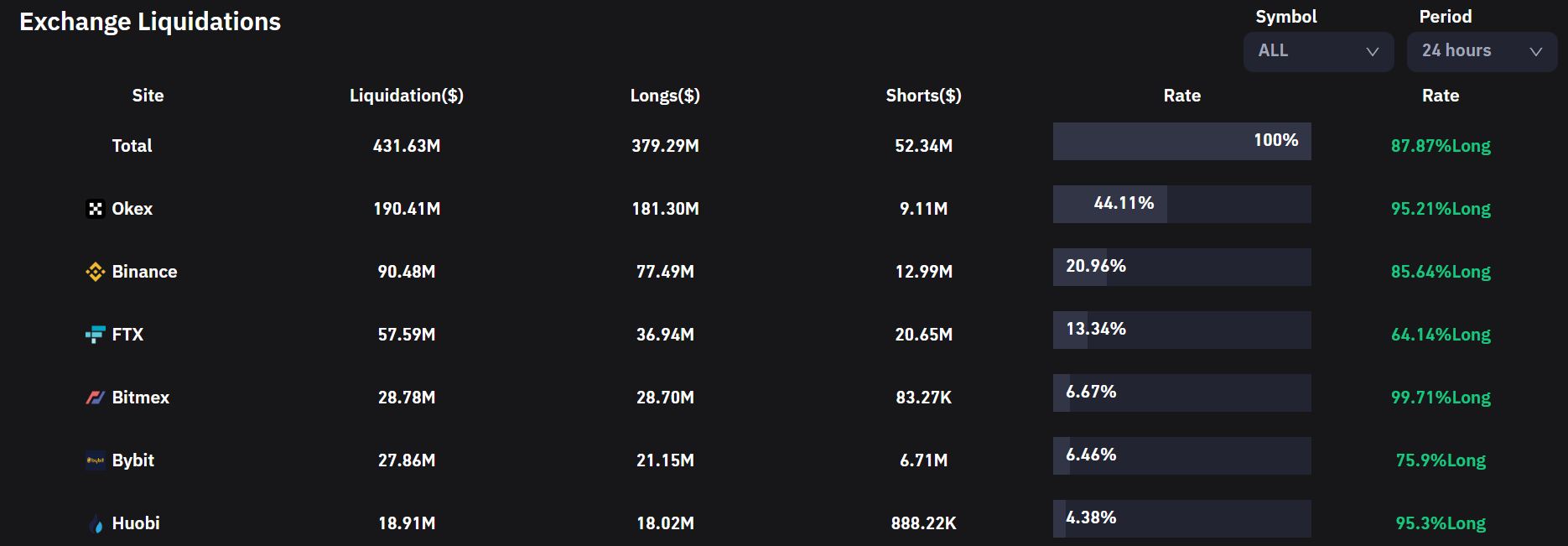

The continuing bearish turmoil has brought to almost half a billion in liquidations for that leverage crypto traders in the last 24 hrs. Data from Coinglass highlight that 130,087 traders were liquidated having a total liquidations worth of $431.51 million. Bitcoin (BTC) leverage traders lost $44.5 million, adopted by Ether (ETH) traders having a total liquidation of $8.39 million.

Lengthy traders designed a significant slice of losses on most of the exchanges using the average distinction between the quantity of lengthy and short liquidations being 10X.

The present market turmoil has been related to several macroeconomic factors, such as the lately released consumer cost index (CPI) data released on Sept. 13 that demonstrated inflation is yet to awesome off. BTC’s cost fell nearly $1,000 in a few minutes from the CPI data release. Since that time, the marketplace demonstrated many will to maneuver up over the past weekend but saw another bloodbath previously Monday.

US inflation shows persistent US retail inflation w/acceleration at August core. Headline drops under forecast to eight.3%, while Core CPI rose to six.3%. pic.twitter.com/ZAhxPUlvjn

— Holger Zschaepitz (@Schuldensuehner) September 13, 2022

The greater CPI information is likely to be adopted with a Given rate hike within the approaching meeting scheduled for Sept. 21. Market pundits have predicted the rate hike may be the greatest in 4 decades like a measure to manage the soaring inflation.

Based on the CME FedWatch Tool, the marketplace has fully priced inside a minimum 75-basis-point hike for that Given funds rate and isn’t discounting the likelihood of 100 basis points. One Hundred-point increase will be the Fed’s first such action because the early 1980s.

Related: Here’s why a .75% Given rate hike might be bullish for Bitcoin and altcoins

The lately concluded Ethereum Merge seemed to be blamed by many people like a purchase the rumor, sell the news” event, in which the cost of Ether (ETH) rose up to $2,000 within the run-to the Merge, but has declined to $1,300 publish Merge.

Most was right. The #Ethereum Merge would be a sell this news event.

— MMCrypto (@MMCrypto) September 15, 2022

Using the stock and crypto markets visiting a similar bearish trend, popular trader Clark was quick to suggest toward the similarities of market conditions to that particular from the 1970s.

Also important to note, leading into this, market behavior is on componen with previous years when it comes to recognized vol.

November-December ought to be good several weeks.

(Past returns not predictive of future results) pic.twitter.com/KKOKEIIvis

— Clark (@CanteringClark) September 18, 2022

In the tweet, Clark noted the market could turn bullish again for the finish of the season within the several weeks of November and December. Thus, the crypto market often see another bullish rally together with the stock exchange for the finish of 2022.