Bitcoin News

Bitcoin News - Over $87.45 million in Bitcoin was liquidated within the last 24 hrs.

- BTC cost was lower by 5% per day.

Following prominent crypto exchanges like the Coinbase announcement, which made its distance with Silvergate bank, Bitcoin, Ethereum, and all of those other cryptocurrency market have recently taken a substantial blow. A clear, crisp loss of the cost of Bitcoin and over the global crypto market has sparked a ton of liquidations.

The March madness within the crypto market has witnessed an abrupt plunge within the Bitcoin cost following the initial appearance from the not so good news around the likely collapse of cryptocurrency-related bank Silvergate. That triggered deluge of liquidations over the crypto markets.

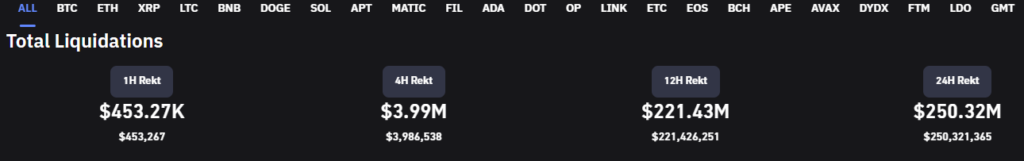

Based on data from CoinGlass, greater than $221 million in crypto assets were liquidated in only 12 hrs. Also, the information shows that previously 24 hrs, 84,133 traders liquidated $255 million in cryptocurrency holdings.

Probably the most seriously affected traders were individuals who have been lengthy-term holders of Bitcoin and Ethereum, with $76 million and $40 million in liquidations, correspondingly. Over $76.51M BTC and $41.08M ETH happen to be liquidated.

Sudden Shake in Crypto Market

The biggest crypto Bitcoin’s (BTC)cost travelled from $23K to $22K within minutes. During the time of writing, Bitcoin traded at $22,363 having a 24-hour buying and selling amount of $34B. BTC was lower by 5% per day and 6.6% per week. Also, the biggest altcoin Ethereum (ETH) traded at $1,569, decreased by 4.5% within the last 24 hrs and 5% per week. ETH holds a buying and selling amount of around $10M, according to CoinGecko data.

Further, Elon Musk’s favorite cryptocurrency Dogecoin (DOGE) also facing massive liquidation. Around $4.77M DOGE gold coin liquidated by traders. During the time of writing, the memecoin’s cost declined by over 6% per day and 10% per week.

Suggested for you