An climbing triangular formation has driven the entire crypto market capital toward the $1.2 trillion level. The problem with this particular seven-week-lengthy setup may be the diminishing volatility, that could last until late August. After that, the pattern can break in either case, but Tether and futures markets data show bulls missing enough conviction to catalyze an upside break.

Investors very carefully await further macroeconomic data around the condition from the economy because the U . s . States Fed (Given) raises rates of interest and places its asset purchase program on hold. On August. 12, the Uk published a gdp (GDP) contraction of .1% year-over-year. Meanwhile, inflation within the U.K. arrived at 9.4% in This summer, the greatest figure observed in 4 decades.

China property market is responsible for the Fitch Ratings legal action to issue a “special report” on August. 7 to evaluate the outcome of prolonged distress on the potentially less strong economy in China. Analysts expect asset management and smaller sized construction and steel-producing companies to suffer probably the most.

In a nutshell, risk asset investors are seriously awaiting the Fed and Central Banks around the globe to signal the policy of tightening is due an finish. However, expansionary coverage is better for scarce assets, including cryptocurrencies.

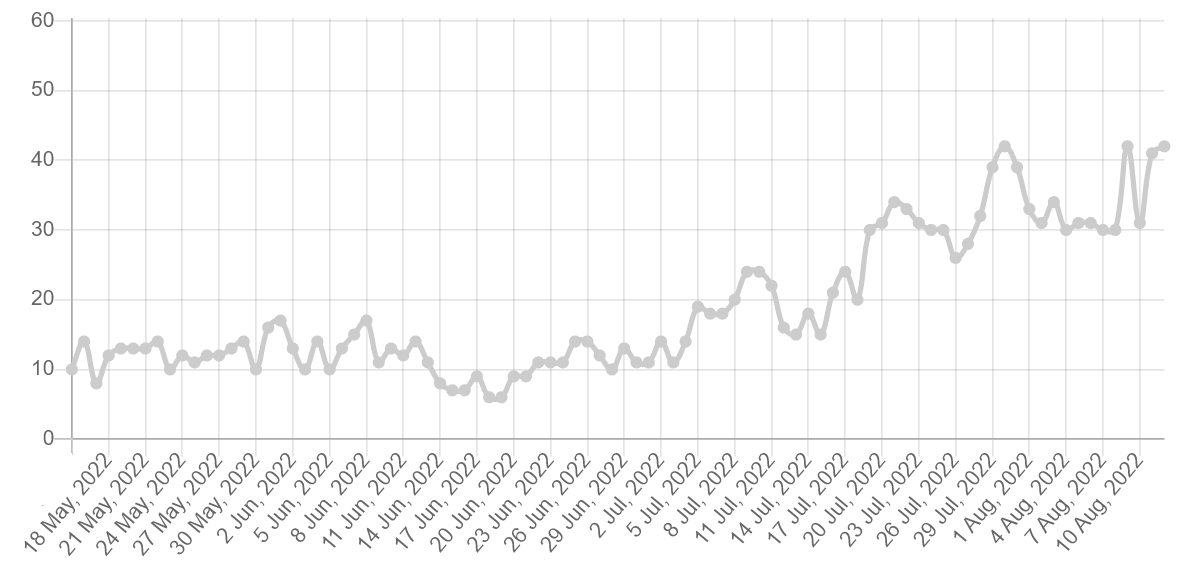

Sentiment improves to neutral after 4 several weeks

The danger-off attitude brought on by elevated rates of interest has instilled a bearish sentiment into cryptocurrency investors since mid-April. Consequently, traders happen to be reluctant to allocate to volatile assets and searched for shelter in U.S. Treasuries, despite the fact that their returns don’t make amends for inflation.

The Worry and Avarice Index hit 6/100 on June 19, close to the cheapest ever studying with this data-driven sentiment gauge. However, investors moved from the “extreme fear” studying during August because the indicator held a 30/100 level. On August. 11, the metric finally joined a “neutral” area following a fou-month-lengthy bearish trend.

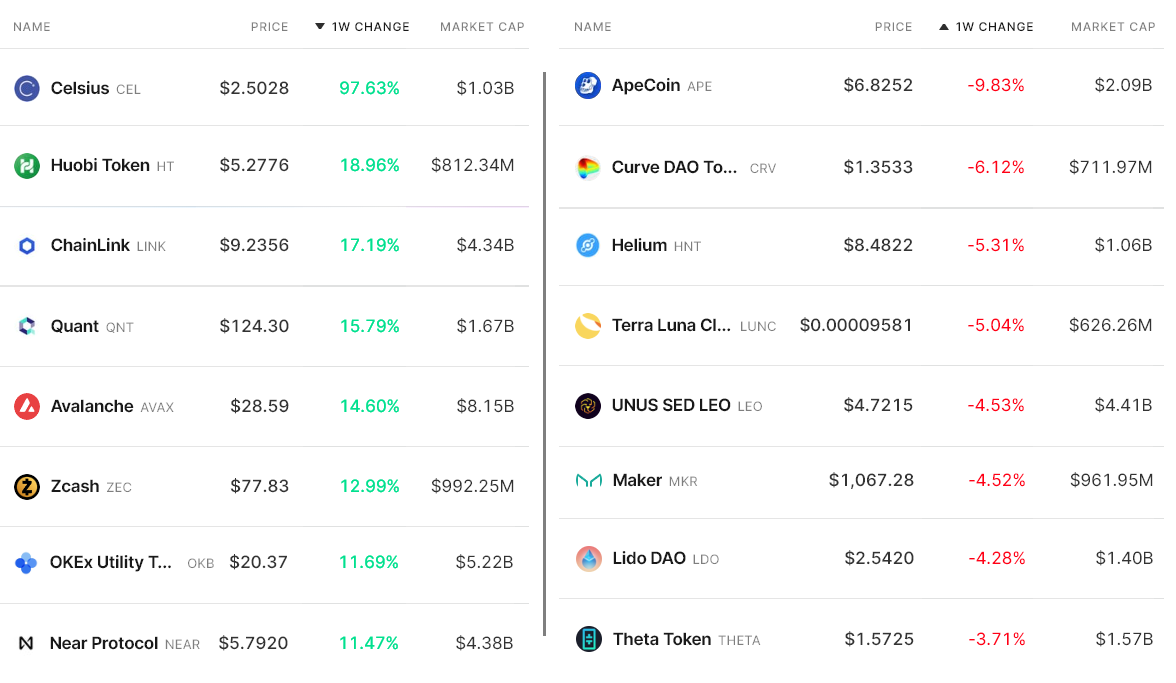

Here are the winners and losers in the past 7 days because the total crypto capital elevated 2.8% to $1.13 trillion. While Bitcoin (BTC) presented only 2% gain, a number of mid-capital altcoins leaped 13% or even more at that time.

Celsius (CEL) leaped 97.6% after Reuters reported that Ripple Labs displayed curiosity about obtaining Celsius Network and it is assets that are presently under personal bankruptcy.

Chainlink (LINK) rallied 17% after announcing on August. 8 it would no more offer the approaching Ethereum proof-of-work (Bang) forks that occur throughout the Merge.

Avalanche (AVAX) acquired 14.6% after being listed for buying and selling on Robinhood on August. 8.

Curve DAO (CRV) lost 6% following the nameserver for that Curve.Fi website was compromised on August 9. They rapidly addressed the issue, however the front-finish hack caused a number of its users’ losses.

Market might have rallied, but retail traders are neutral

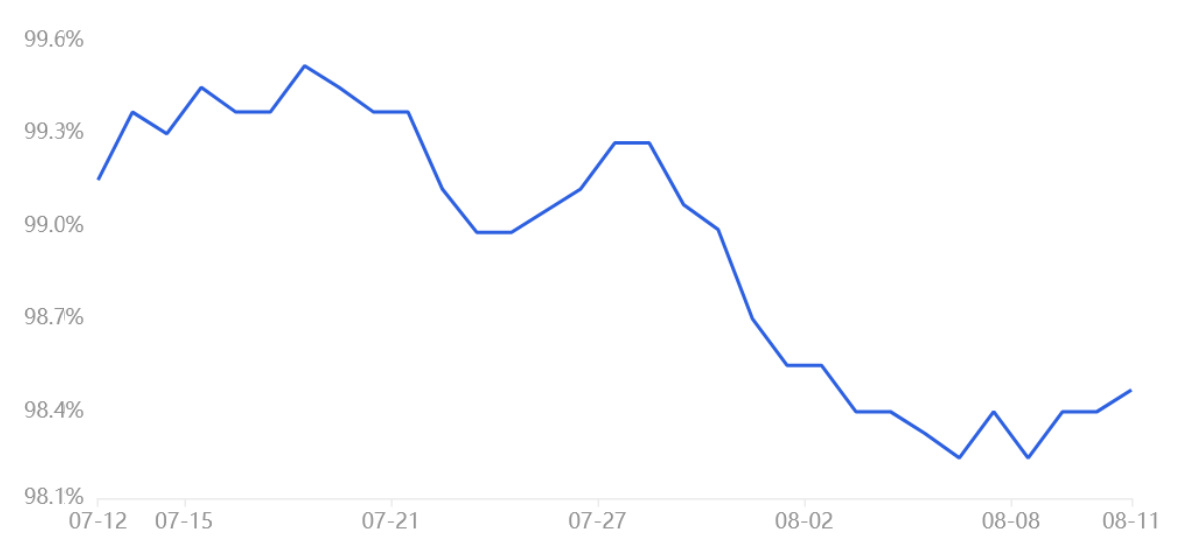

The OKX Tether (USDT) premium is a great gauge of China-based retail crypto trader demand. Its dimensions are the main difference between China-based peer-to-peer (P2P) trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100% and through bearish markets Tether’s market offers are flooded and results in a 4% or greater discount.

On August. 8, the Tether cost in Asia-based peer-to-peer markets joined a couplePercent discount, signaling moderate retail selling pressure. More to the point, the metric has unsuccessful to enhance as the total crypto capital acquired 9% in ten days, indicating weak demand from retail investors.

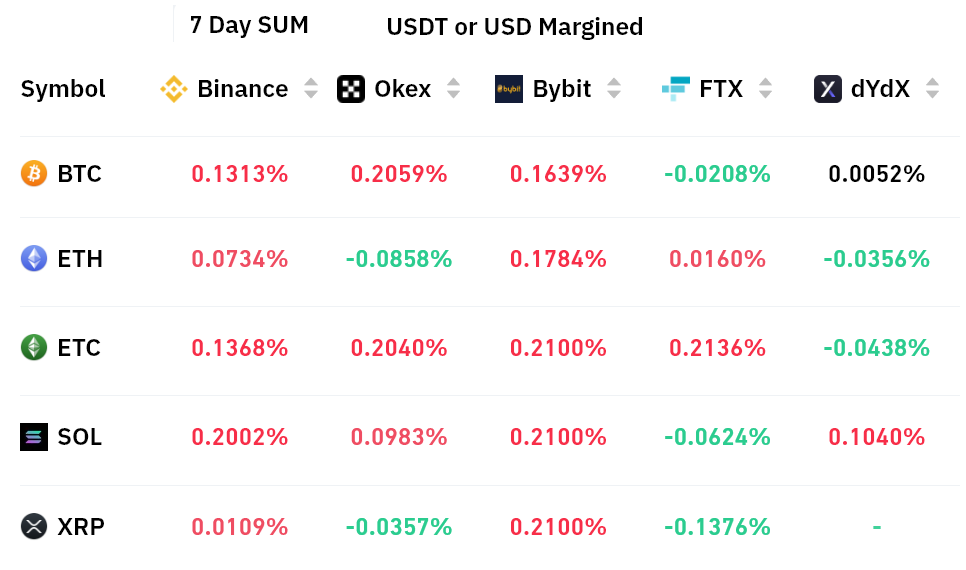

To exclude externalities specific towards the Tether instrument, traders should also evaluate futures markets. Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts reflected an unbiased sentiment after Bitcoin and Ether held a rather positive (bullish) funding rate. The present charges enforced on bulls aren’t concerning and led to a well-balanced situation between leveraged longs and shorts.

Further recovery depends upon the Fed

Based on derivatives and buying and selling indicators, investors are less inclined to improve their positions at current levels, as proven through the Tether discount in Asia and the lack of an optimistic funding rate in futures markets.

These neutral-to-bearish market indicators are worrisome, considering that total crypto capital has been around a seven-week upward trend. Investors’ distress over Chinese property markets and additional Given tightening movements is easily the most likely explanation.

For the time being, the chances from the climbing triangular breaking over the forecasted $1.25 trillion mark appear low, but further macroeconomic data is required to estimate the direction central banks usually takes.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.