Crypto prices bounced today but exactly how lengthy can the reprieve last and can FTX survive?

Well, the sport isn’t up for FTX at this time, as various reports suggest the crypto exchange teetering around the fringe of personal bankruptcy is within talks with investors because it seeks a save deal.

Now market participants worry that contagion could spread like wildfire.

However, there is some reprieve for crypto prices today when US CPI inflation figures arrived soft, resulting in a surge available indices, using the Nasdaq composite jumping 6%.

Bitcoin reversed its losses during the day and it is up nearly 1% at $17.756.

US CPI Inflation a level for crypto prices crash?

Inflation decelerated to some 7.7% annual rise in October from 8.2% recently, with the headline and core readings underneath the median of economists’ forecasts.

Which was taken like a sign the worst might be behind us, which may be great news for crypto.

The bounce could buy energy for FTX founder and Chief executive officer Mike Bankman-Fried (SBF), even while US regulatory agencies circle and also the exchange’s legal team flees the sinking ship

He tweeted about two hrs ago, inside a lengthy thread, that the organization is at talks with numerous players regarding LOIs [letters of intent] and term sheets.

SBF claimed that FTX.US, the exchange for all of us customers, was “100% liquid” and “not influenced by this shitshow”:

All of those other exchange – which operates underneath the brand FTX Worldwide – may be the business that’s looking insolvency hard.

Today FTX.com place a notice on its website which reads: “FTX is presently not able to process withdrawals. We strongly advise against depositing.”

SBF has additionally managed to get known that Alameda Studies have stopped buying and selling and will also be closing. Additionally, it transpires that FTX.US may also halt buying and selling inside a couple of days.

Justin Sun, the founder and Chief executive officer of crypto project Tron, is regarded as in talks with FTX. He tweeted earlier today that holders of Tron-based tokens on FTX would be produced whole.

However, it’s unlikely that Sun may have the sources to succeed around $4 billion that FTX have to meet its immediate liabilities. The entire hole within the FTX balance sheet is believed to become around $8 billion.

Crypto contagion: Tether hit by $700 million in redemptions, Coinshares loses $30m, Sequoia $150m

Meanwhile, stablecoin Tether at some point fell to $.96, losing its 1:1 peg towards the US dollar. It’s since retrieved but around $700 million was redeemed today.

Once the peg slips, individuals seeking redemptions can produce a profit, as Tether needs to recognition the peg whatever the market rate.

Elsewhere, longstanding crypto fund manager Coinshares revealed it had become responsible for $$ 30 million of losses linked to FTX, while Sequoia Capital authored lower a loss of revenue of $150 million.

The Kaiko research team underscored the ramifications from the collapse of FTX and why it’s had this type of profound effect on confidence. Kaiko authored in email commentary:

“FTX’s collapse has shaken the to the core, partly since it is a essentially different kind of business than the usual crypto loan provider like Celsius. FTX is really a cryptocurrency exchange. The service it offers is a company of trades: they earn a transaction fee for each trade performed by certainly one of their customers. FTX is neither a buying and selling firm nor a loan provider, so theoretically, they should whatsoever occasions have accessibility same as 100% of the client’s funds.”

The truth that FTX cannot meet deposit withdrawals is suggestive of the chance that it’s been using client funds in its very own buying and selling and lending activities.

As well as worse, a number of that lending activity looks strongly enjoy it ended up being to sister company Alameda Research, used the buying and selling arm of FTX.

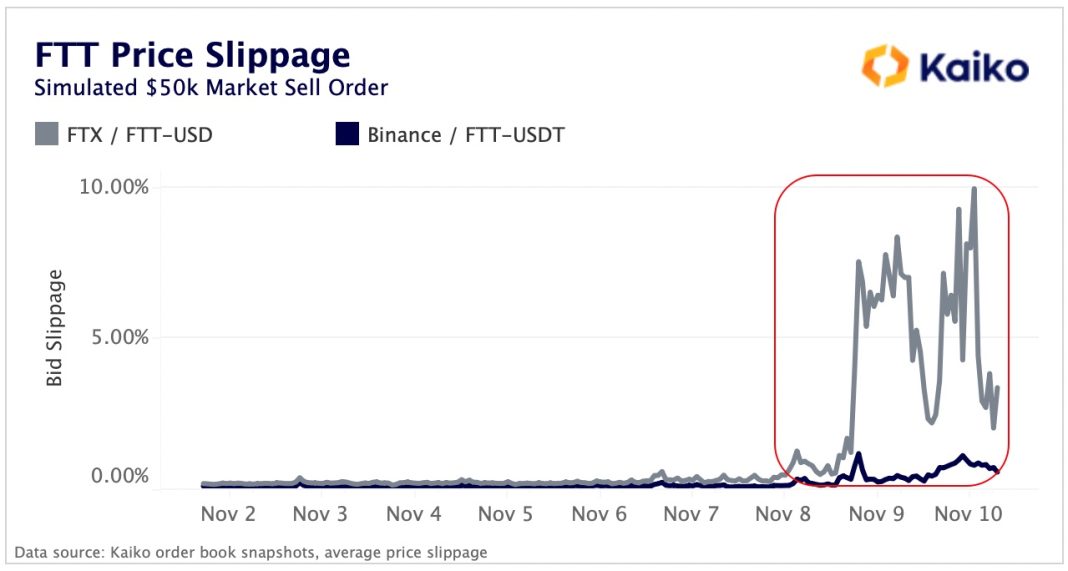

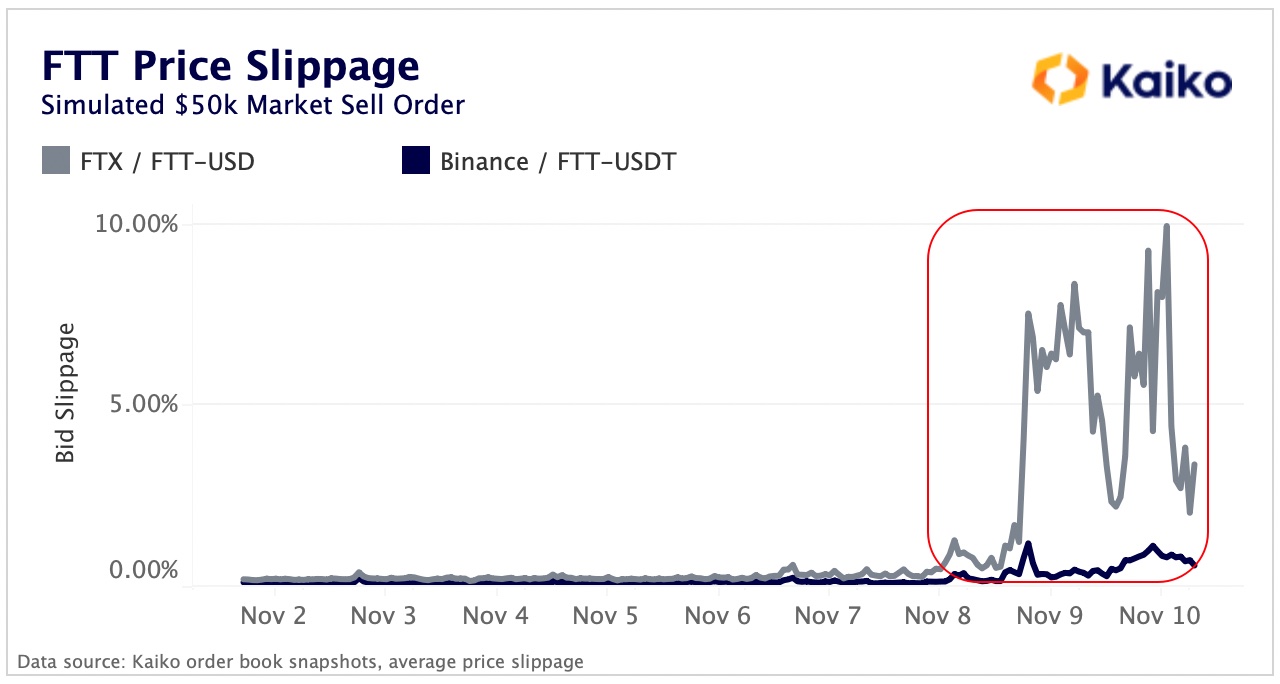

Also trembling the may be the sheer speed from the collapse. On 6 November FTT cost slippage – the web site market order and also the cost really compensated – started to look after which ballooned on 8 November and went stratospheric on 9 November.

Put some money to utilize these promising presale tokens

A few coins that may suit you perfectly for the reason that regards are Dash 2 Trade that is a buying and selling analytics and signals platform by having an access token in presale known as D2T.

The ‘Bloomberg Terminal for traders is made by traders for traders and it is supported by they at Learn 2 Trade, which already includes a community of 70,000 traders.

D2T has guaranteed an inventory around the LBank exchange following the presale ends.

You have to buy early to obtain the great deals, as there’s a cost ladder with 10 stages. D2T costs $.0513 and it is in the 3rd stage.

Another is RobotEra, which has similarities towards the Sandbox but in which you build planet worlds using robots.

Its TORA token presale started yesterday and also the token costs $.020, but because with D2T there is a cost ladder so early wild birds can grab a reduced cost today. RobotEra is supported by LBank Labs.