Cryptocurrency prices lurched greater on Wednesday in wake more dovish than expected remarks from Given Chairman Jerome Powell, who had been speaking as always within the publish-Given policy announcement press conference. Risk assets, including stocks, surged as Powell acknowledged the central bank makes progress in the combat inflation and stated the “disinflation process has started”.

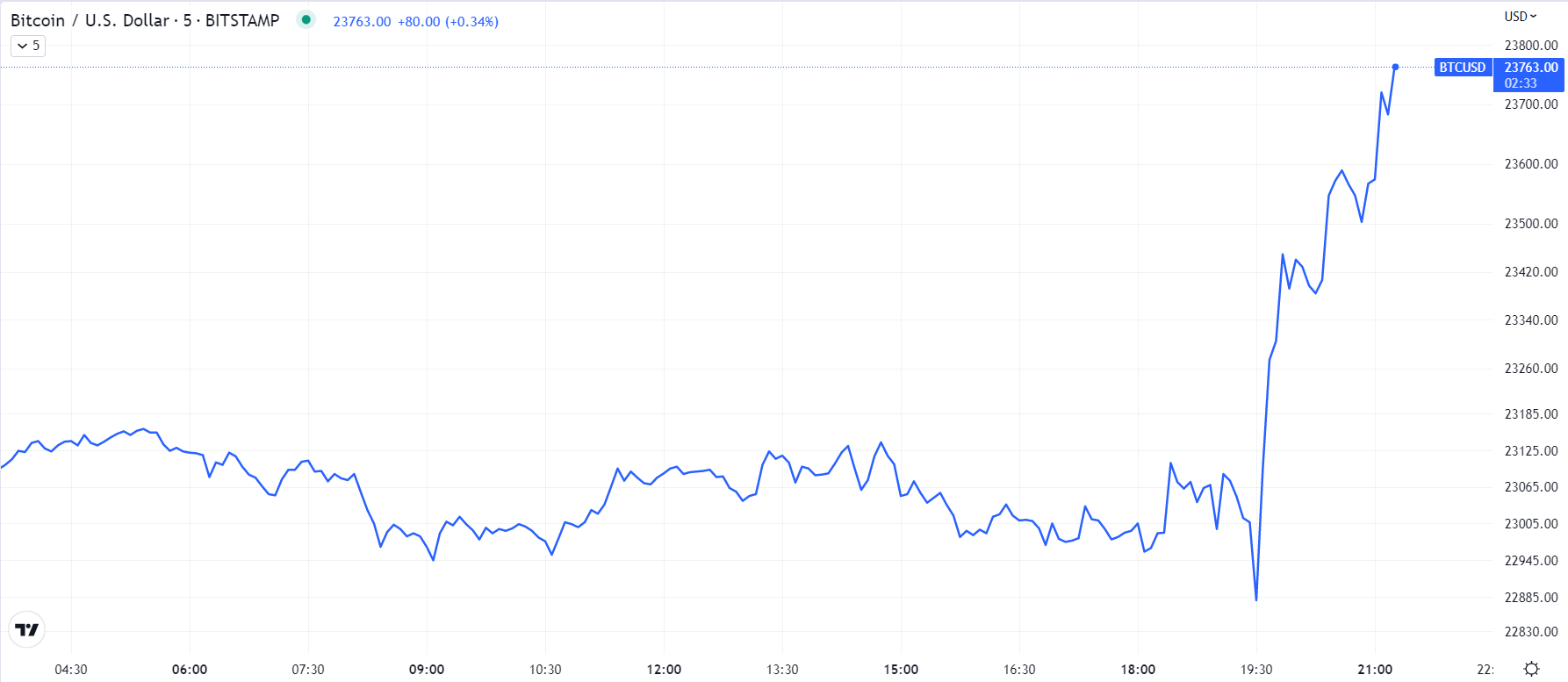

Powell’s comment came soon after the Given announced a broadly expected 25 bps hike towards the Federal Funds target range to 4.50-4.75%. Bitcoin was last buying and selling near to $23,700s, now up around 2.7% at the time or more nearer to 4.% versus its prior publish-Given lows within the $22,700s.

Ethereum was last up a much more impressive over 3.5% at the time within the $1,640s. The world’s second-largest cryptocurrency by market capital has become threatening an upside break of the short-term pennant structure that will open the doorway to some quick run greater towards resistance within the $1,800 area. Meanwhile, major altcoins like Cardano, Solana, Polygon and Polkadot are up 4-8% versus their pre-Given policy announcement levels.

Powell Passes Up Opportunity to Send Markets Lower

Powell had the opportunity to break the rules from the recent easing in financial conditions (i.e. the The month of january move greater in stocks and crypto minimizing in america dollar and yields). However, he stated the Fed’s focus was on longer-term economic trends, not short-term market moves.

Many strategists have been warning just before today’s Given meeting that Powell might turn to increase the tough commentary to be able to dampen “animal spirits” on the market, in line with the assumption the Given doesn’t desire a premature easing of monetary conditions to create their job of having inflation to the two.% target harder.

Because it happened, harsh words made to trip in the market weren’t there, therefore, the bounce in assets like crypto. However, in the statement, the Given stated that ongoing rate increases remained as needed along with a “couple” more hikes would probably be warranted. That could be at odds using the market’s base situation assumes that you will see just another 25 bps rate hike (in March) prior to the hiking cycle has ended.

In either case, crypto now apparently has got the eco-friendly light to rally for the short term. Short positions thus stay at risk, getting been obliterated during the last couple of hrs in wake of Wednesday’s publish-Given rally over the crypto space. Coinglass.com data demonstrates short-position liquidations spiking in wake from the Given meeting, suggesting that the short squeeze could still offer the market.

But Could Crypto Rally when the US is Going to Recession?

It’s all regulated smiles among crypto investors on Wednesday. However the publish-Given rally could rapidly come unstuck. Big tech giants including the kind of Meta Platforms, Amazon . com, Apple and Alphabet are reporting earnings within the next 2 days. And Q4 earnings out to date for S&P 500 companies have generally pointed for the same factor – an earnings recession.

That’s since the US economy is quickly stagnating, largely because of the lagged impact from the Fed’s aggressive hiking cycle of 2022. The consensus among macro analysts would be that the US economy may have fallen into recession sometime over the following couple of quarters. Popular macro analyst Alfonso Peccatiello lately outlined within an in-depth Twitter thread why he expects an economic depression in four or five several weeks.

Basically, lead economic indicators such as the Global Credit Impulse, the Conference Board’s Leading Index, the Housing Industry and Philly Given New Orders Index are pointing within this direction. An American recession implies that the income recession for corporate America will probably worsen.

There’s a danger this prevents stocks from benefitting from the optimism in regards to a less hawkish Given. And crypto has generally been carefully correlated to stocks within the last couple of years. The issue for investors is thus whether crypto can weather an american recession, even when economic weakness does pressure the Given right into a harder dovish pivot.

Searching at the expertise of the final couple of years, the solution may be yes. The pandemic lockdowns of 2020 sent the united states economy right into a short but deep recession. After a preliminary sell-off among the panic brought on by multiplication of Covid-19, crypto returned more powerful than ever before because the Given axed rates of interest to zero and the federal government started unparalleled fiscal stimulus.

Every cycle differs. The Given is not likely to axe rates to zero as quickly as in 2020. And the federal government doesn’t be capable of press ahead with the type of stimulus it did in 2020 and 2021. But an easing of monetary conditions in 2023 may underpin crypto, even when an american recession implies that we don’t get as aggressive of the bull market as with late 2020/2021.