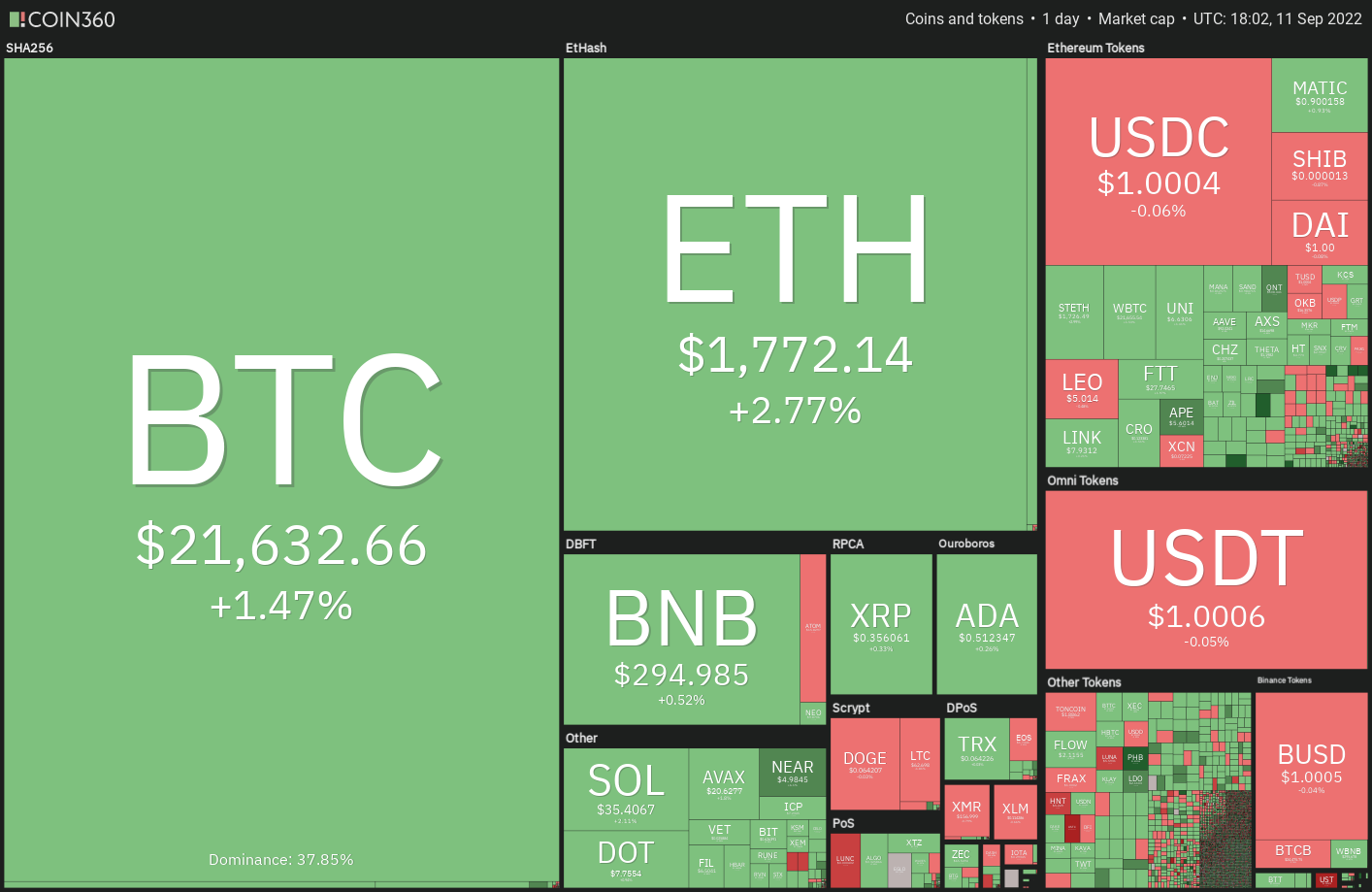

The U . s . States equities markets rallied dramatically a week ago, ending a 3-week losing streak. The S&P 500 rose 3.65% a week ago as the Nasdaq Composite soared 4.14%. Ongoing its close correlation using the U.S. equities markets, Bitcoin (BTC) also designed a strong comeback and it is attempting to finish a few days with gains in excess of 7%.

The sharp rally within the stock markets and cryptocurrency financial markets are showing indications of a bottoming formation but it might be too soon to calculate the beginning of a brand new bull move. The equities markets may stick to the advantage prior to the discharge of the U.S. inflation data on Sept. 13 and also the Fed meeting on Sept. 20-21.

Together with taking cues in the equities markets, the cryptocurrency space features its own important occasions to expect to. Both Ethereum Merge and Cardano’s Vasil hard fork scheduled within the next couple of days could heighten volatility in a number of cryptocurrencies.

Although choppy markets boost the risk, they might offer short-term buying and selling possibilities to nimble traders. Let’s read the charts of 5 cryptocurrencies that appear to be interesting soon.

BTC/USDT

Bitcoin soared over the 20-day exponential moving average (EMA) of $20,662 on Sept. 9, that was the very first indication the selling pressure might be reducing. The bears are trying to stall the recovery in the 50-day simple moving average (SMA) of $21,946, however a positive sign would be that the bulls haven’t quit much ground.

The 20-day EMA has began to slope up progressively and also the relative strength index (RSI) is incorporated in the positive territory indicating the road to least resistance would be to the upside. When the bulls propel the cost over the 50-day SMA, the BTC/Tether (USDT) pair could rally toward the stiff overhead resistance at $25,211. The bears are anticipated to protect this level with vigor.

Another possibility would be that the cost turns lower in the 50-day SMA. In the event that happens, the happy couple may drop towards the 20-day EMA. It is really an important level to keep close track of just because a break and shut below it might open the doorways for any drop to $18,626. Alternatively, when the cost rebounds from the 20-day EMA, it will raise the probability of a rest over the 50-day SMA.

The happy couple selected up momentum after rising over the breakdown degree of $19,520. The sharp rally pressed the RSI in to the overbought territory, suggesting a small consolidation or correction. Buyers are facing a stiff challenge near $22,000 but they haven’t yet ceded ground towards the bears. This means that each minor dip has been purchased.

When the bulls propel the cost above $22,000, the happy couple could rapidly rally toward $23,500 in which the bears may again make an effort to stall the up-move.

Unlike this assumption, when the cost turns lower and breaks underneath the 20-EMA, the happy couple could drop to $20,576. A rest below this level will claim that the happy couple may consolidate in a wide range between $22,000 and $18,626 for a while.

ATOM/USDT

Cosmos (ATOM) broke over the overhead resistance of $13.45 on Sept. 8, indicating demand at greater levels. The following stiff resistance reaches $20.30, which leaves room for any rally.

However, before that, the bears will attempt to drag the cost underneath the breakout degree of $13.45. It is really an important level to keep close track of just because a break and shut below it’ll indicate the recent breakout might have been a bull trap.

However, when the cost appears in the current level or rebounds off $13.45, it’ll claim that the bulls have been in control and therefore are buying on every dip. When the bulls thrust the cost above $17.20, the up-move may get momentum and achieve $20.30.

Some-hour chart implies that the ATOM/USDT pair surged after breaking over the overhead resistance at $13.45. That pressed the RSI deep in to the overbought territory and began a correction, however a positive sign would be that the bulls haven’t quit much ground.

When the cost rebounds from the current level, the potential of a rest above $17.20 increases. In the event that happens, the up-move may continue and also the pair may rally toward $20.30.

This positive view could invalidate soon when the cost continues lower and plummets underneath the 20-EMA. In the event that happens, the happy couple could decline towards the 50% Fibonacci retracement degree of $14.36.

APE/USDT

ApeCoin (APE) rebounded strongly from the support at $4.17, indicating aggressive buying at ‘abnormal’ amounts. This means the corrective phase might be ending, which makes it a fascinating candidate for a while.

Buyers pressed the cost over the 20-day EMA of $5.00 on Sept. 9 and also the APE/USDT pair created an internal-day Doji candlepower unit pattern on Sept. 10. This uncertainty resolved towards the upside on Sept. 11 having a strong rally towards the 50-day SMA of $5.85. The bears may attempt to stall the recovery only at that level.

When the cost turns lower in the current level but rebounds from the 20-day EMA, it’ll claim that the sentiment has switched positive and traders are purchasing on dips. The bulls will on the other hand make an effort to drive the cost over the 50-day SMA. When they do this, the happy couple could soar toward the overhead resistance at $7.80.

This positive view could invalidate soon when the cost turns lower and breaks underneath the 20-day EMA. For the reason that situation, the happy couple may drop to $4.17.

The 20-EMA around the 4-hour chart has began to show up and also the RSI has risen in to the overbought territory. This signifies the bulls possess the upper hands however a short-term pullback can be done.

When the cost turns lower in the current level but rebounds off $5.30, it’ll suggest strong demand at ‘abnormal’ amounts. The bulls will make another make an effort to push the cost above $5.83 and extend the recovery to $6.44.

Alternatively, when the cost turns lower and breaks underneath the 20-EMA, the benefit may tilt in support of the bears.

Related: Terra away from the dead? LUNA cost increases 300% in September

CHZ/USDT

Chiliz (CHZ) broke over the 20-day EMA of $.20 on Sept. 9, that was the very first indication the corrective phase might be ending. Hence, this token went to their email list.

The bears attempted to drag the cost back underneath the 20-day EMA on Sept. 10, however the bulls have held their ground. Buyers are trying to push the cost toward the overhead resistance at $.26, however the up-move may face strong headwinds near $.23.

When the cost turns lower but doesn’t fall underneath the 20-day EMA, it will raise the probability of a rally to $.26. Unlike this assumption, when the cost turns lower and breaks below $.20, it’ll claim that the bears are active at greater levels. That may pull the cost towards the 50-day SMA of $.18.

Some-hour chart implies that the bears are protecting the downtrend line. When the cost turns lower in the current level but rebounds from the moving averages, it’ll claim that the bulls try a comeback.

Buyers will on the other hand make an effort to drive the cost over the downtrend line. When they succeed, the happy couple may begin its northward march toward $.23 and then to $.26.

Alternatively, when the cost plummets below $.20, it’ll claim that the happy couple may remain within the falling wedge pattern. That may pull the cost lower to $.18.

QNT/USDT

Quant (QNT) didn’t break underneath the strong support at $87.60, indicating the sentiment is positive and also the bulls are purchasing on dips. That’s the reason because of its selection.

The sharp rebound off $87.60 broke over the 20-day EMA of $100 on Sept. 8, that was the very first indication the corrective phase might be ending. The bears posed a powerful challenge close to the 50-day SMA of $105 but tend to not sink the cost back underneath the 20-day EMA.

This established that the sentiment had switched positive and also the bulls are purchasing on dips. Buyers pressed the QNT/USDT pair over the 50-day SMA on Sept. 11. When the bulls sustain the greater levels, the happy couple could rise to $117 after which to $124. A rest above this level could open the doorways for any rally to $130.

This bullish view might be invalidated when the cost turns lower and breaks underneath the 20-day EMA. In the event that happens, the happy couple could drop towards the strong support at $87.60.

Some-hour chart implies that the happy couple rebounded dramatically from the support at $87.60. The bears posed a powerful challenge near $108 however a positive sign would be that the bulls purchased the dip towards the 20-EMA. This signifies that traders are viewing dips like a buying chance.

Buyers started again the recovery by pushing the cost over the overhead resistance at $108. The happy couple could rally to $113 and then to $117. On the other hand, when the cost turns lower and plummets underneath the 20-EMA, the happy couple could drop towards the 50-SMA.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.