After forging a small recovery of sorts earlier this year, the crypto market has came back to exhibiting high amounts of volatility in the last two days. This trend has pervaded the marketplace since late this past year, using the total market capital from the digital asset industry getting dipped from your all-time a lot of $3 trillion in November 2021 to the current amounts of $1.08 trillion, representing a small amount of over 65%.

This then begs the issue: How lengthy is that this volatility likely to last? Especially because the macroeconomic conditions all around the global finance sector have ongoing to deteriorate continuously since 2020 — i.e., following the beginning of the COVID-19 pandemic.

In connection with this, Abdul Gadit, chief financial officer of automated digital asset buying and selling platform Zignaly, told Cointelegraph that whether one wants it or otherwise, the crypto marketplace is now deeply associated with the standard finance (TradFi) economy, using the two now starting to consume a similar trajectory.

In the view, the reason behind the continuing choppy cost action and insufficient liquidity is extreme retail and institutional caution emanating from rising inflation and recessionary pressure. He continued to include any time things begin to lose their freshness using the economy, investments — especially inside the arena of crypto finance — have a tendency to start slowing lower. Gadit added:

“Right now, global financial markets are in the center of this bearish cycle using the crypto industry getting tighter when it comes to its buying and selling ranges. This cost action can go on for days, otherwise several weeks unless of course there’s a macro ecological change. Likelihood of which are fairly low.”

What is coming up next for that crypto market?

Andrew Weiner, v . p . of Very important personel services for cryptocurrency exchange MEXC Global, told Cointelegraph that although the cryptocurrency marketplace is carefully correlated with U . s . States equities, a business which has continued to be quite stable during the last couple of several weeks, there’s still lots of volatility because of growing action inside the crypto derivatives segment. However, he stated the crucial narrative dictating the cost action from the digital asset sector — for now at least — may be the Ethereum 2. Merge, adding:

“After the current discussions all around the Merge, the marketplace appears to possess totally priced in the effects. When we take a look at things from the fundamental analysis view, the marketplace has stopped bleeding and it is about to start recovering.”

To aid this claim, Weiner alluded to his company’s research data, which implies that from August. 8 to 14 alone, as many as 19 projects inside the Web3 space elevated as many as $501.3 million.

He noticed that of the figure, the Metaverse, nonfungible tokens (NFTs) and GameFi projects elevated $82, while decentralized finance (DeFi), Web3 and infrastructure projects elevated a combined $379.3 million. Lastly, various blockchain firms could accrue roughly $40 million from various investment capital firms. “Fundraising occasions are positively happening, that is a good manifestation of the marketplace,” he added.

Recent: Exactly what the Taliban attack method for crypto’s future in Afghanistan

Charmyn Ho, mind of crypto insights for digital asset buying and selling platform Bybit, described to Cointelegraph that global financial markets are experiencing volatility, as investors appear to become undecided following a Fed’s Jackson Hole speech. She noted by using equities riding many ups and downs in the last two days, the worldwide economy’s near-term outlook remains quite obscure, especially as consumers, investors and policymakers can’t appear to agree with if the U.S. is within an economic depression or maybe the Given has inflation in check. Speaking concerning the crypto market, particularly, she added:

“The primary event riding cost action is Ethereum’s Merge. Some actors, mostly miners who won’t have the ability to continue their operations around the publish-Merge chain, are intending to keep your proof-of-work Ethereum blockchain studying the hard fork. All of this is able to impact short-term prices. With Ether being the second biggest cryptocurrency within the space, its cost movements certainly possess the ability to slowly move the crypto market.”

May be the ongoing volatility likely to subside in the near future?

Himran Zerhouni, mind of economic development for decentralized creator-oriented Web3 platform Favor Labs, told Cointelegraph the ongoing turbulence is basically driven by macroeconomic factors, mainly high inflation within the U.S. and Europe and the chance of a looming global recession.

Furthermore, he believes the digital asset marketplace is also gripped by certain fears which have been triggered through the tightening of crypto regulation and also the obvious need for world regulators to completely control the money flows in cryptocurrencies. However, Zehrouni sees this trend potentially altering within the near-to-mid near term, adding:

“Over next season approximately, the regulatory turbulence around stablecoins will subside. I guess obvious legislation for stablecoin issuers within the U . s . States will emerge. The growing interest of users in the benefits of web3 and decentralization will push entire industries to consider digital assets. Lastly, the Bitcoin halving in 2024 will in the end result in a new bull cycle within the crypto market. In my opinion it’ll start somewhere within the other half of 2023.”

Andrei Grachev, managing partner at DWF Labs — an earlier-stage blockchain investment firm — highlighted to Cointelegraph that crypto volatility has ongoing to subside, although gradually, in recent days, claiming that we’re already in the downside of the present bear market cycle. That stated, in the view, Bitcoin (BTC) could still come down than its current levels, nevertheless its near-to-mid-term upside chance remains as very high.

According to DWF Lab’s in-house research data, after hitting an exciting-time a lot of near $70,000 last November, BTC could possibly scale as much as round the $80,000–$90,000 mark once the next bull cycle commences. However, he did concede that since crypto, because of its nature, is volatile, there’s little to point out that volatility levels will reduction in the immediate future. “This is mainly because of the size the marketplace, that is relatively less space-consuming than other traditional industries,” he stated.

Technical information is giving mixed signals about Bitcoin’s future

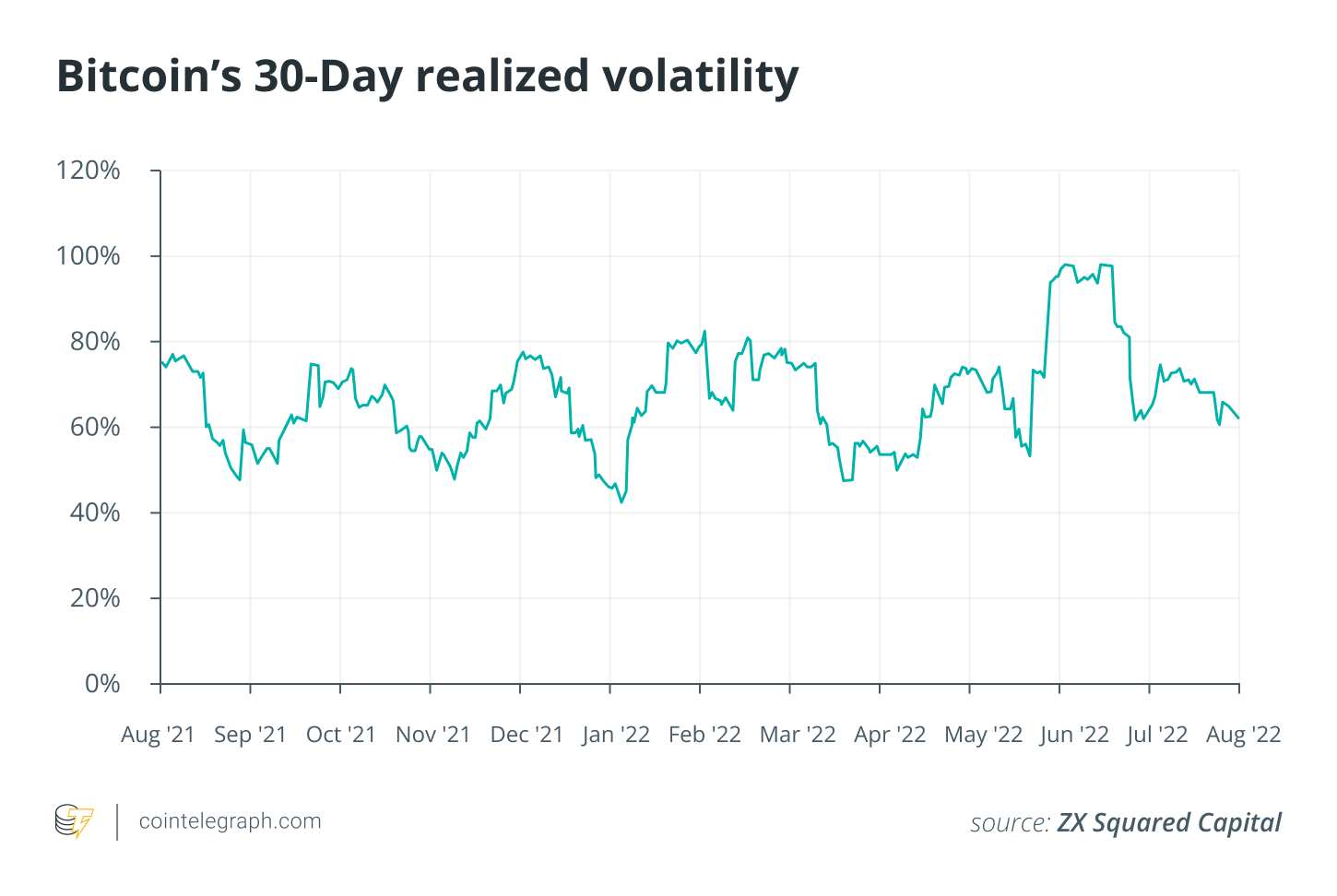

Based on CK Zheng, partner and chief investment officer for crypto hedge fund ZX Squared Capital, when analyzing Bitcoin’s 30-day recognized volatility during the last twelve several weeks, it’s possible to observe that it’s ongoing to range from 40% to 100%, remaining at typically around 70%. Recognized volatility refers back to the variation in returns connected, calculated by analyzing its historic returns inside a defined period of time.

As seen in the chart below, volatility spiked immediately after Singapore-based crypto hedge fund Three Arrows Capital — which in fact had about $10 billion in assets under management — declared personal bankruptcy at the end of This summer. Zheng to Cointelegraph:

“The current volatility is all about 10% underneath the average. However, we feel the volatility increases throughout the Sept-March period of time to become over the average. This really is mainly because of the market’s response to the Given along with a potential re-test from the June low.”

Similarly, Weiner believes by using BTC getting dropped underneath the $22,000 level but ongoing to locate strong support for the reason that range, he sees the flagship crypto — along with the market in particular — forging a pattern reversal and scaling as much as around $25,000 to $26,000 by mid-September.

Recent: Crypto market turmoil highlights perils of leverage in buying and selling

Lastly, Ho believes the stabilization of digital asset prices soon isn’t safe from macro market uncertainty, what is obvious is the fact that, because the crypto market matures, investors and market makers can rely on much deeper liquidity, better buying and selling and security infrastructure overall and much more stable crypto space. She mentioned much from the turbulence felt by the crypto market is a result of the little market capital from the asset class, stating:

“Bitcoin may be the largest crypto asset and it has an industry cap well over $400 billion. This is extremely less space-consuming than most mature markets. Take gold, for instance, with a market cap of $11.6 trillion. Once the crypto market actually reaches that much cla, possibly volatility will reduce drastically. For the time being, you should observe that much like other markets, there’ll always be a range of factors that may lead to promote volatility.”

Therefore, once we mind right into a future affected by an increasing quantity of financial uncertainty, it will likely be interesting to determine the way the digital asset industry is constantly on the respond to the current pressure and whether it may forge an upward trend in the near future.