Bitcoin (BTC) and crypto are an endeavor solely for 13.7% of american citizens, however they generate more exchange volume than other people.

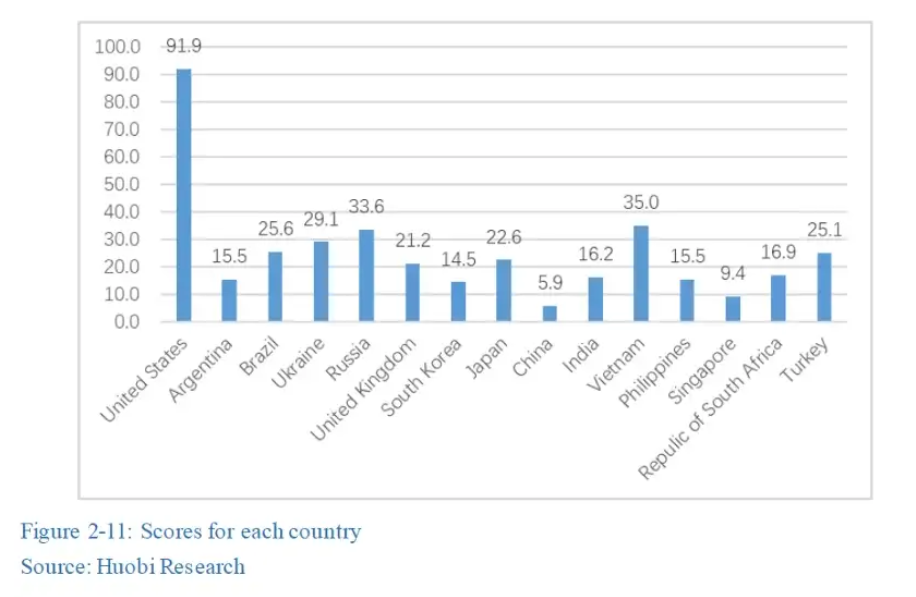

The latest data published by exchange Huobi confirms that in 2022, the U . s . States is easily the most “mature” cryptocurrency market.

U.S., Vietnam lead the way in which on crypto

Regardless of the heavy drawdowns in cost for Bitcoin and altcoins this season, interest around the world remains “extremely active,” and also the leaders has come about as an unexpected.

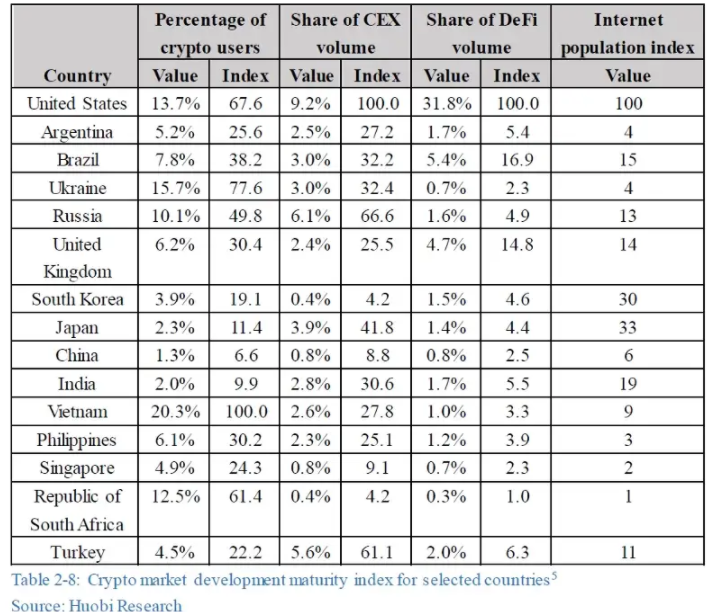

In the latest annual report, Huobi Research, a joint venture partner of Huobi Global, says the U.S. makes up about 9.2% of worldwide centralized exchange (CEX) volume. With regards to DeFi, the figure is even greater — 31.8% of worldwide volumes.

Simultaneously, the proportion of people using crypto isn’t as high as with another jurisdictions. 13.7% of american citizens use crypto, the report stated, when compared with 20.3% Vietnam, the best choice from the 15 countries examined.

Overall, however, the U.S. achieved the greatest normalized score for “crypto market maturity,” far in front of any competitor. Second out there is Vietnam, having a score of 35 versus 91.9 for that U.S.

Nevertheless, Huobi describes Vietnam because the country using the “highest adoption rate in cryptocurrency” and calls the crypto buying and selling scene both in Columbia and Japan “extremely active.”

“Japan and Columbia have contributed tremendous visitors to exchanges. Particularly, Columbia rated second with 7.4% and Japan rated sixth with 3.85% in Asia,” the report noted.

In the other finish from the spectrum, the countries using the cheapest maturity score are China, Singapore and Columbia, with 5.9, 9.4 and 14.5, correspondingly.

Singapore sticks out using its position, because of the rate of regulatory expansion and acceptance of cryptocurrency like a technology.

“Singapore is just about the best place to go for technology startups, luring a lot of innovators and unicorn companies, which naturally includes the crypto players,” Huobi authored.

“Singapore maintains highly tolerance and openness for that crypto industry: rules are enforced, but there’s still lots of space for innovation.”

The report nevertheless identifies only 4.9% of Singapore’s population buying and selling crypto, adding .8% of worldwide CEX volumes, by having an internet population index of just 2/100.

“Appropriate” regulation would prevent FTX black swan

The report meanwhile acknowledges the regulatory scenario is tenuous for crypto within the wake from the FTX scandal.

Related: Will Grayscale function as the next FTX?

Regardless of this, FTX isn’t the greatest catastrophe of the season for crypto, it states, using the Terra LUNA debacle and Three Arrows Capital (3AC) insolvency more pressing.

“The FTX personal bankruptcy may be the third-most influential occurrences in 2022 following the collapses of Terra and 3AC,” it commented.

“The primary problems with the FTX situation would be the misappropriation of funds, affiliate transactions with Alameda Research, etc. At that time, some U.S. regulators expressed that they are investigating or had already began investigating the problems a couple of several weeks ago. However, the FTX incident won’t happen if rules of crypto assets in a variety of countries are appropriately in position.”

Cointelegraph is constantly on the report extensively around the latest occasions surrounding FTX and it is effect on the crypto market.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.