Bitcoin (BTC) mining may be the backbone from the BTC ecosystem and miners’ returns offer understanding of BTC’s cost movements and the healthiness of the broader crypto sector.

It’s well-documented that Bitcoin miners are battling in the present bear market. Blockstream, a number one Bitcoin miner lately elevated funds in a 70% discount.

Current mining activity shares similarities to historic BTC bear markets having a couple of caveats.

Let’s explore what this signifies for that current Bitcoin cycle.

Analysis implies that according to previous cycles the bear market may continue

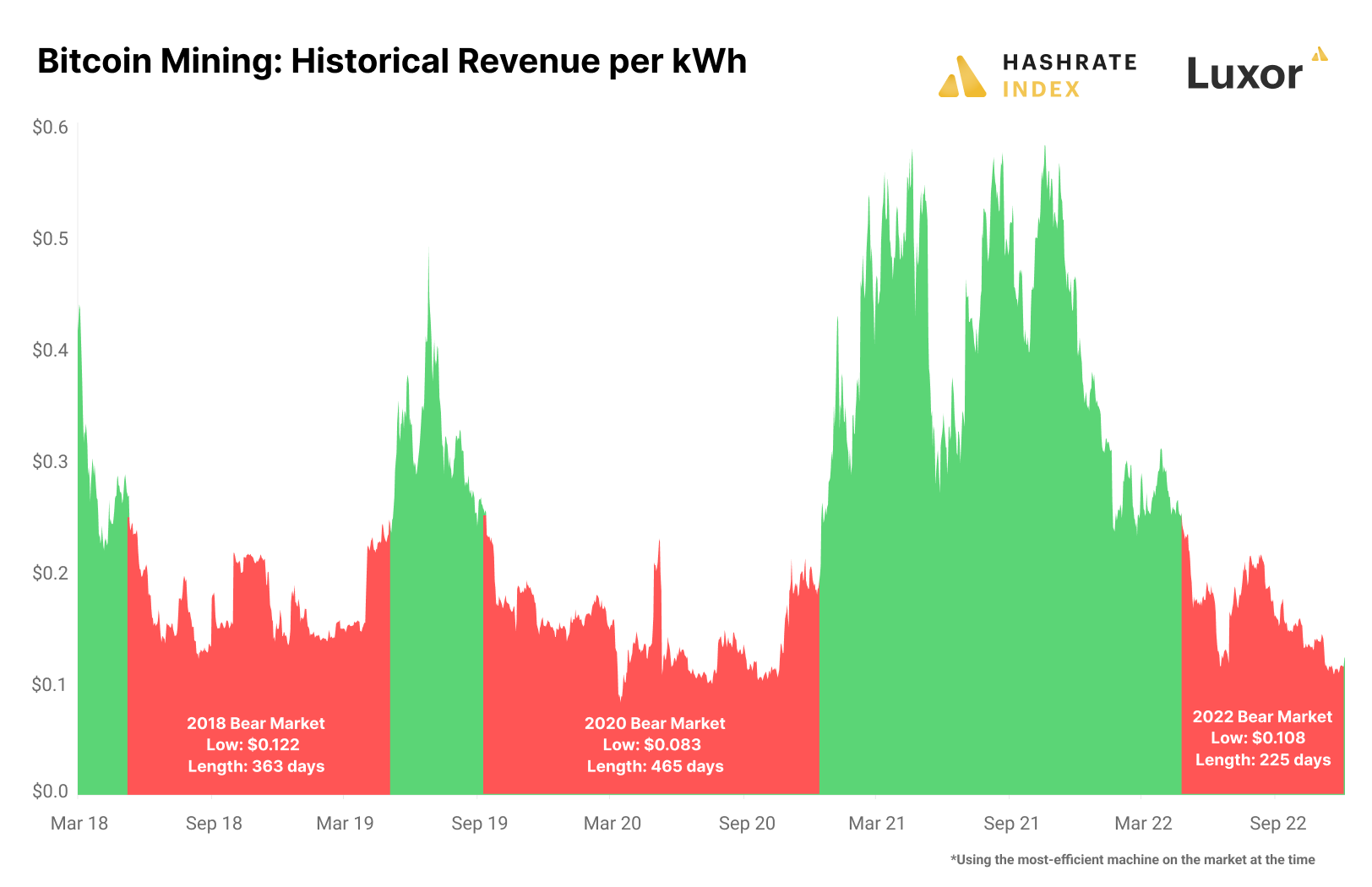

Bitcoin mining profitability could be measured if you take the miner’s revenue per kilowatt hour (kWh). Based on Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market includes a sustained duration of revenue per kWh of under $.25. Under his assumption, he calculates using the best Bitcoin mining machine available on the market.

The 2018 bear market lasted nearly annually, delivering kWh to some bottom of $.12. Following a downtrend, a brief bull market commenced before the 2019 bear market started.

Based on Mellerud, the 2019 bear market created all-time low revenue per kWh of $.083 and lasted 463 days, while Bitcoin cost dropped to $5,000.

The newest mining bear market began in April 2022 based on Mellerud’s analysis of revenue per kWh. By 12 ,. 8, the present bear market has lasted for 225 days having a minimum revenue of $.108 per kWh. The amount is greater compared to previous bear cycles because of high energy prices.

Evaluating the present bear mining cycles, no less than 138 bear market days may continue prior to the market turns. The main difference between this era and past cycles is the fact that formerly, miners were mainly self-funded whereas now, there are lots of miners that funded their rapid growth with debt.

Public mining stocks have the discomfort

At its peak, Bitcoin mining stocks arrived at a cumulative worth of over $17 billion within the 2021 bull market. The bull market elevated investor interest and spurred development in BTC mining stocks skyrocketed from $2 billion in November. 2020.

After reaching the bull market peak in 2021, crypto mining stocks they are under immense pressure, with lots of falling by 90%.

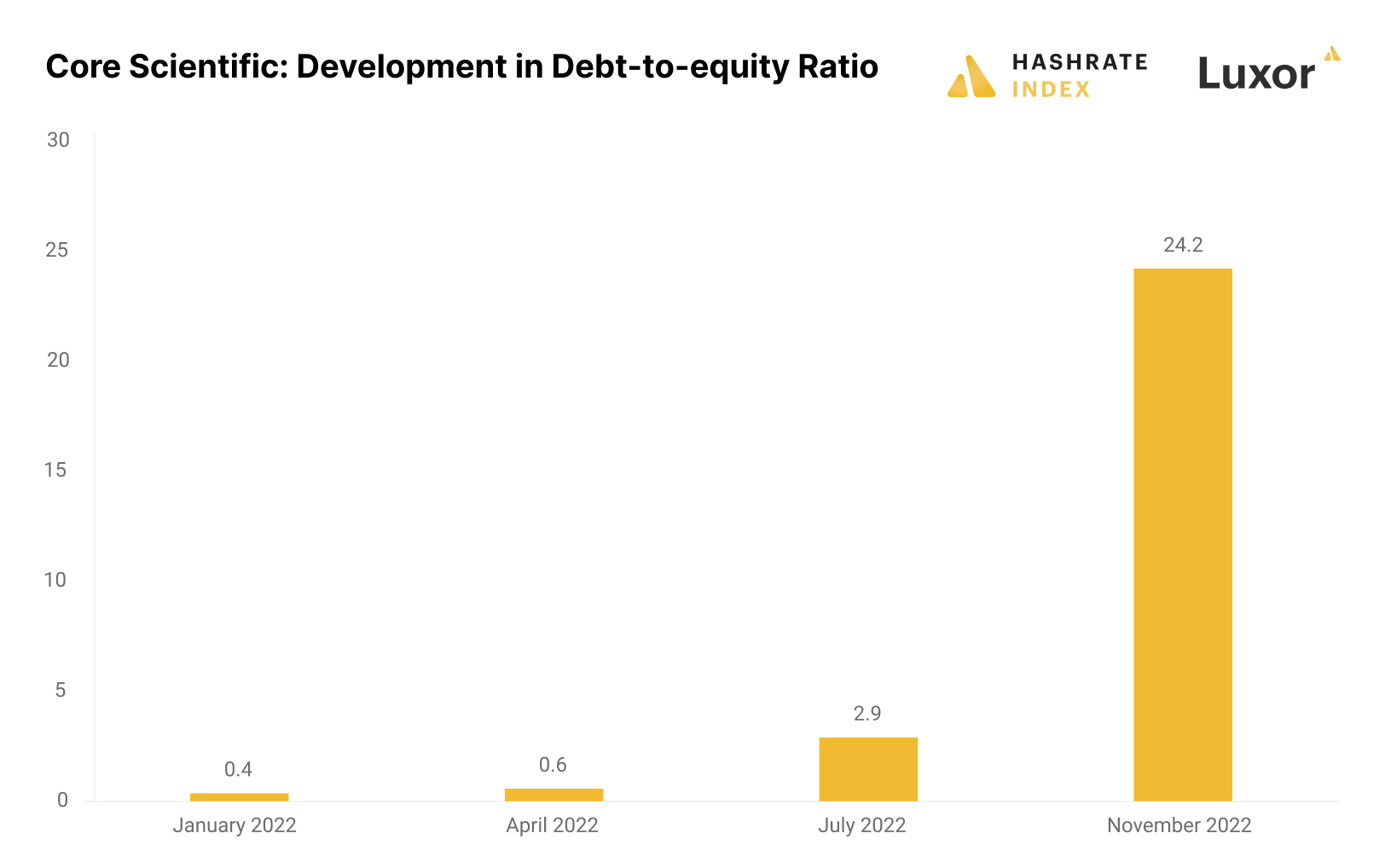

The immense quantity of debt adopted by public mining firms taken at Bitcoin’s all-time high is developing a massive debt-to-equity ratio.

Mirror, mirror on your wall, who’re the most powerful public #bitcoin miners of all of them? pic.twitter.com/pnpypsxcAu

— Jaran Mellerud (@JMellerud) December 5, 2022

An excellent illustration of the way the bear marketplace is growing miners’ reliance upon debt, is to check out Core Scientific. Prior to the mining bear market in April, Core Scientific were built with a mere .6 debt-to-equity ratio. Since the beginning of the bear market, time is continuing to grow to in excess of 24.2 debt-to-equity.

Using the Bitcoin mining bear market likely to continue according to past historic BTC trends, more public miners will face equity squeezes. As miner debt keeps growing, investors could get spooked, creating much more depressed prices in the stock exchange.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.