“When does it finish?” may be the question that’s around the mind of investors who’ve suffered the present crypto winter and observed the demise of multiple protocols and investment funds in the last couple of several weeks.

Now, Bitcoin (BTC) once more finds itself testing resistance at its 200-week moving average and the real challenge is whether or not it may push greater when confronted with multiple headwinds or maybe the cost will trend lower into the range it’s been held in since early June.

Based on the newest e-newsletter from on-chain market intelligence firm Glassnode, “duration” may be the primary distinction between the present bear market and former cycles and lots of on-chain metrics are actually similar to these historic drawdowns.

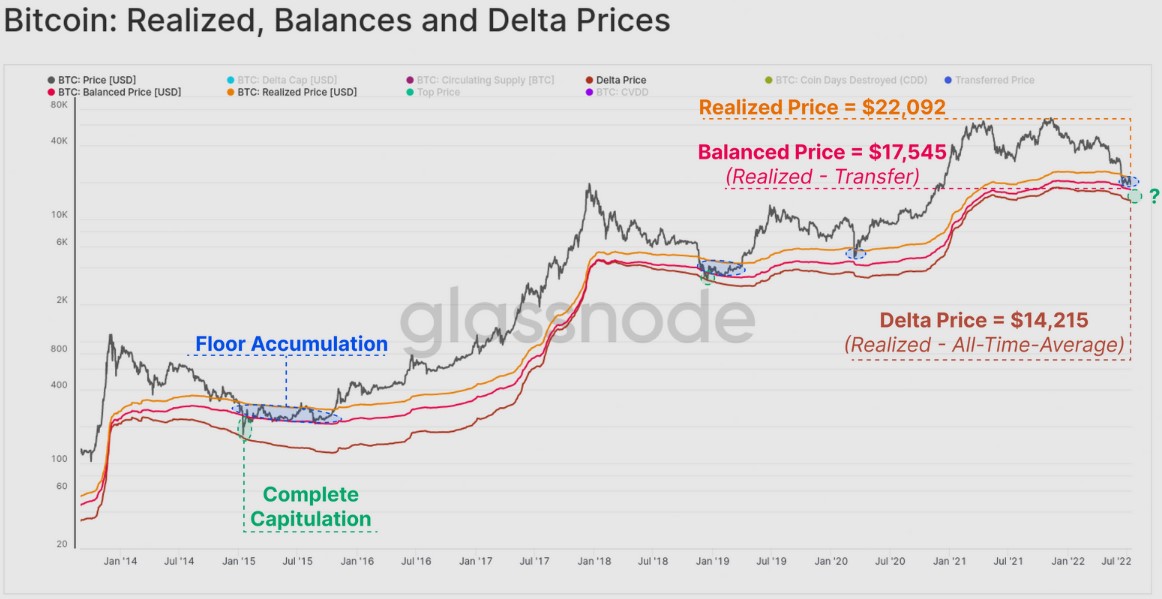

One metric which has shown to be a dependable indicator of bear market bottoms is recognized cost, the worth of all Bitcoin in the cost these were bought divided by the amount of BTC in circulation.

As proven around the chart above, except for the flash crash in March 2020, Bitcoin has traded below its recognized cost to have an long time during bear markets.

Glassnode stated,

“The average time spent underneath the Recognized Cost is 197-days, when compared to market with only 35-days around the clock.”

This could claim that the present requires an finish from the crypto winter are premature because historic data suggests the marketplace continues to have several several weeks of sideways cost action to visit prior to the next major upward trend.

Will the underside be nearer to $14,000?

With regards to what traders should look for your would signify an finish towards the winter, Glassnode highlighted the Delta cost and Balance cost as “on-chain prices models which have a tendency to attract place prices during late stage bears.”

As proven around the chart above, the prior major bear market lows were set following a “short-term wick lower towards the Delta cost,” that is highlighted in eco-friendly. An identical relocate today’s market indicate a BTC low near $14,215.

These bearish periods also saw the BTC cost exchange a build up range “between the Balanced Cost (range low) and also the Recognized Cost (range high),” that is in which the cost presently finds itself.

Among the classic signs that the bear market is due an finish is a major capitulation event that exhausted the final remaining sellers.

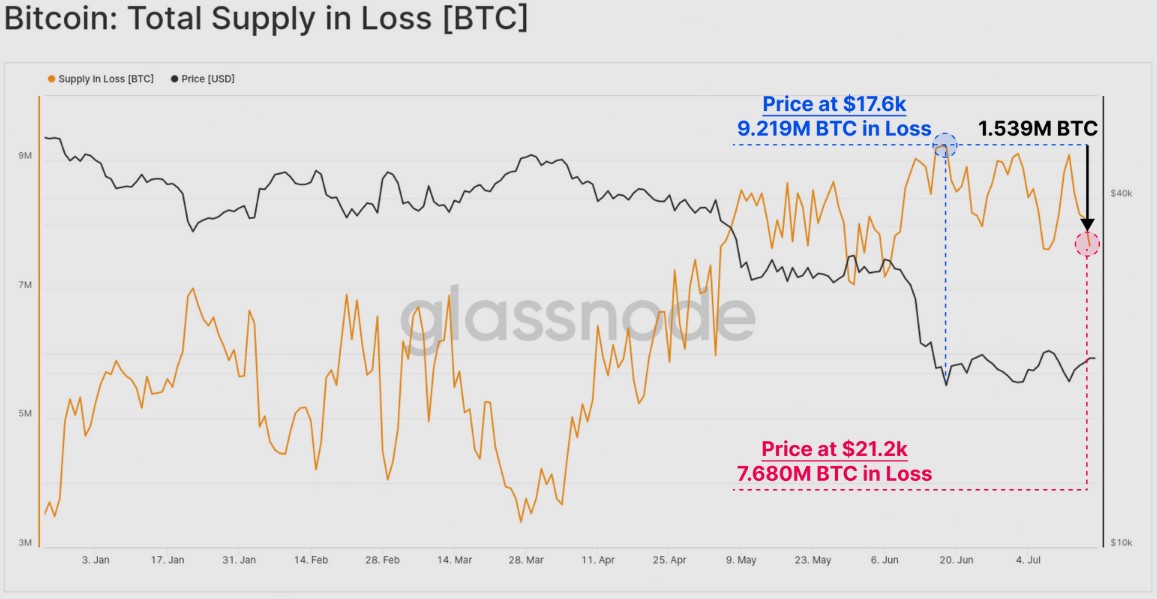

Although some continue to be debating whether it has happened, Glassnode highlighted the on-chain activity throughout the June plunge to $17,600 just as one sign that capitulation has indeed occurred.

At that time that BTC fell to $17,600, there is a complete amount of 9.216 million BTC holding an unrealized loss. Following a capitullation event on June 18, per month of consolidation along with a cost rally to $21,200, this volume has declined to 7.68 million BTC.

Glassnode stated,

“What this means is the fact that 1.539M BTC were last transacted (possess a cost-basis) between $17.6k and $21.2k. This signifies that around 8% from the circulating supply has altered hands within this cost range.”

Further proof of capitulation getting already occurred was the “staggering amount of BTC” that kept in a recognized loss between May and This summer.

The collapse of Terra triggered a complete recognized lack of $27.77 billion as the June 18 plunge underneath the 2017 cycle all-time high led to a complete recognized lack of $35.5 billion.

Related: Sub-$22K Bitcoin looks juicy in comparison with gold’s market capital

Is that this the finish from the bear market?

The last metric that implies capitulation has happened may be the Adjusted Spent Output Profit Ratio (aSPOR), which compares the need for outputs at that time they’re spent to once they were produced.

Based on Glassnode, when profitability is declining (as symbolized through the blue arrows), investors being to understand large losses which eventually results in “a final waterfall moment of capitulation,” that is highlighted in red.

Glassnode stated,

“The market eventually reaches seller exhaustion, prices begin to recover, and investor discomfort begins to subside.”

To be able to verify that capitulation has indeed occurred and accumulation is going ahead, Glassnode established that the aSOPR value would ideally have to recover back above 1..

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.