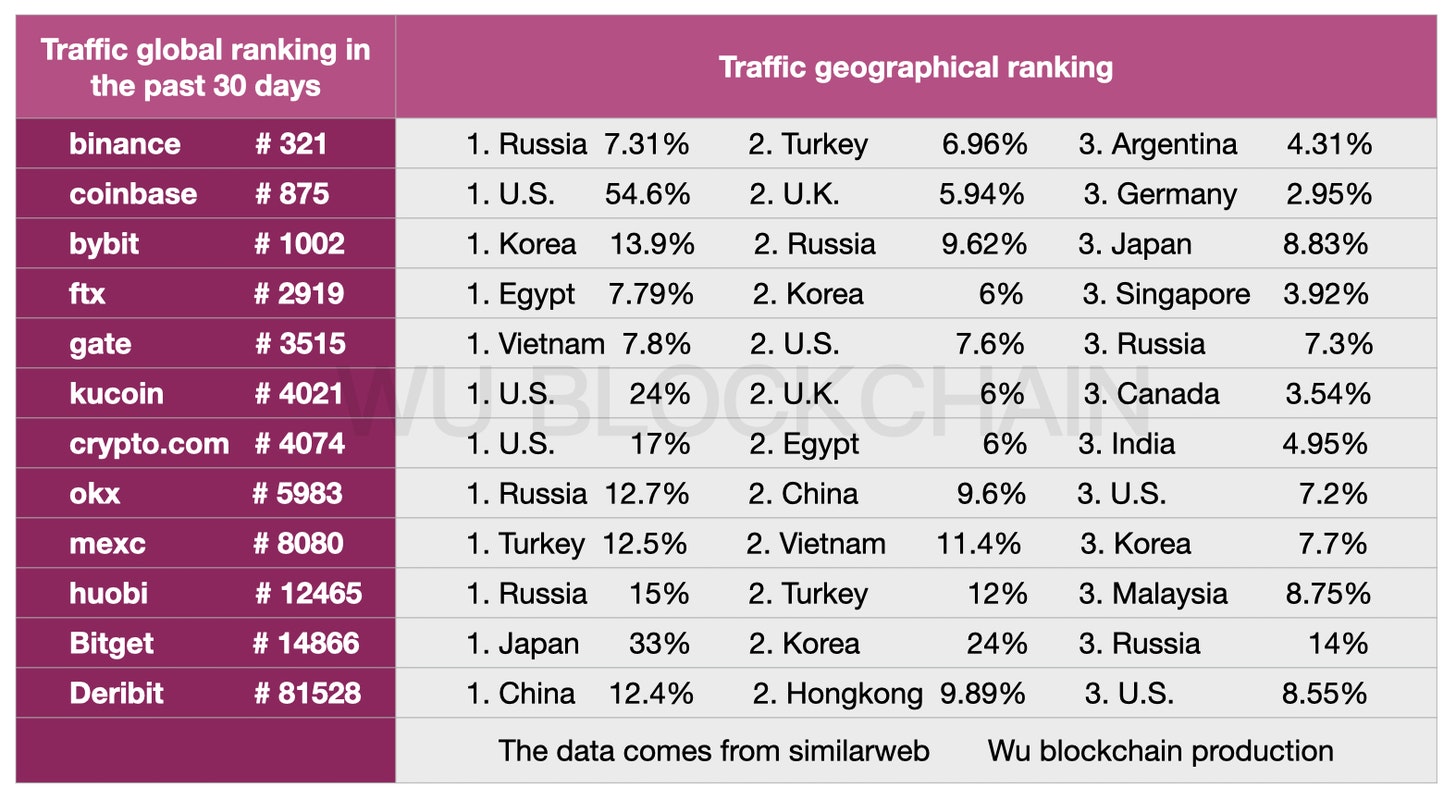

Data from web site traffic metric provider Similarweb implies that Deribit and OKX still attract significant traffic sources from China despite a blanket ban on crypto transactions and foreign exchanges this past year.

China has banned using cryptocurrencies greater than a dozen occasions within the last decade, however, the main one enforced in September this past year was considered the harshest one.

Several crypto exchanges including Huobi and Binance had shut doorways for that Chinese traders in anxiety about regulatory action. The strict regulatory reforms ensured that Chinese traders mainly shifted their focus to decentralized exchanges and protocols.

Chinese crypto traders usually have found a method to bypass strict crypto regulatory measures enforced through the government. Even though many believed the blanket ban on crypto use will be a dying nail for that largely subterranean crypto market in China, geographical traffic data shows otherwise.

A Cointelegraph exclusive report highlighted the increase in using virtual private systems among Chinese traders following the blanket ban. Recent data from Similarweb verifies that Chinese traders continue to be flocking to centralized derivatives platforms for example OKX and Deribit.

Related: Residents of three Chinese metropolitan areas having to pay taxes and expenses with digital yuan

Huobi was the main selection of Chinese crypto traders because they taken into account greater than 30% from the buying and selling volume around the exchange prior to the blanket ban. However, now Deribit leads the chart when it comes to Chinese traffic having a 12% share adopted by OKX with 9.6%.

Another prominent reason behind the increase in traffic on derivative exchanges may be the insufficient strict KYC measures in comparison to the likes of Huobi and Binance.

The geographical data implies that Russia, Columbia, the U . s . States, and Poultry were the greatest traffic source on centralized exchanges like Binance and Coinbase. Bybit and FTX were probably the most visited crypto exchanges within the month of April.