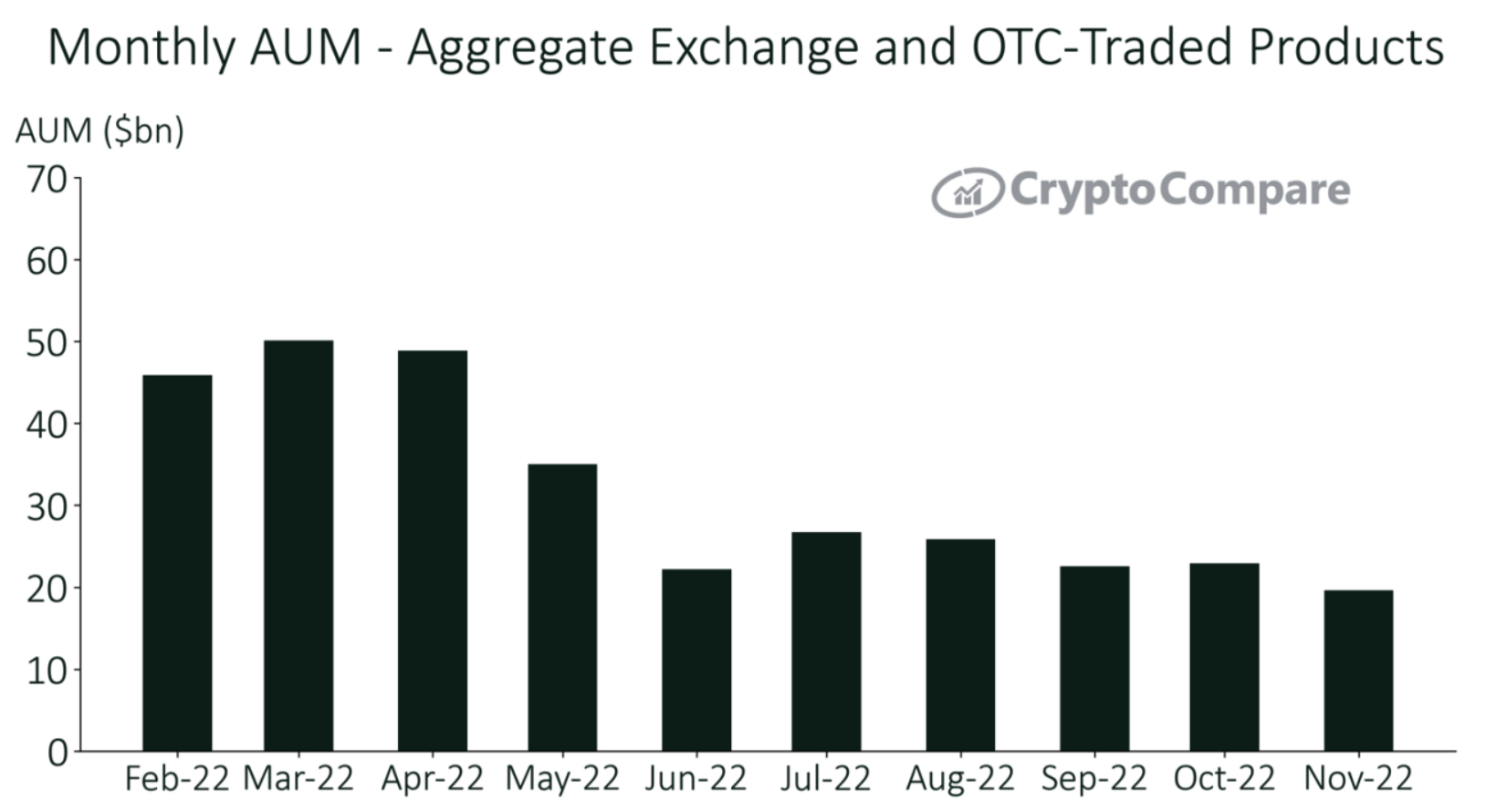

Asset management firms operating within the crypto space saw their assets under management (AUM) decline by 14.5% typically in November, marking the worst month for that industry since December of 2020.

The figures were revealed inside a new report by crypto investigator CryptoCompare, which noticed that the declines were fueled by fears surrounding contact with the collapsed crypto exchange FTX, and the opportunity of contagion with other players in the market.

The most recent data now implies that total AUM in digital asset investment products fell to $19.6bn in November, the cheapest level since December 2020. Coincidentally, December 2020 also marked the final time bitcoin (BTC) prices traded round the same level because they do today.

ETH funds gain share of the market

For bitcoin-backed investment products particularly, AUM fell by 15.9% to 13.4bn in November, the report stated. It added this marked the greatest stop by the AUM of bitcoin-backed products since June of the year.

Particularly, the share of the market held by bitcoin-backed products fell just by under 1% in November, to some share of the market of 68.9%. Simultaneously, investment products supported by ethereum (ETH) elevated their share of the market for that second consecutive month to 24.9% from the total crypto AUM.

Grayscale still dominates crypto investment space

Important to note within the report seemed to be the truth that investment products from Grayscale ongoing to dominate the entire AUM for crypto-backed products. It was even though Grayscale’s parent company, Craig Silbert’s Digital Currency Group (DCG), didn’t escape the FTX collapse untouched. Furthermore, Genesis Global – another company underneath the DCG umbrella – is apparently battling for survival after getting unsuccessful to boost enough fresh capital.

Based on the report, Grayscale’s products were built with a total AUM of $14.7bn, creating 75.5% of total market. The 2nd company out there was XBT Provider, an issuer of numerous exchange-traded crypto products in Europe, which arrived having a total AUM of $ $1.03bn, or 5.3% from the total.

Physically backed place exchange-traded funds (ETFs) and exchange-traded products (ETPs) are indexed by several europe, but attempts at doing exactly the same in america have to date been rejected through the SEC. Rather, the SEC has permitted bitcoin ETFs supported by futures contracts to become for auction on American exchanges.