Bitcoin (BTC) has declined by greater than 55% six several weeks after it arrived at its record a lot of $69,000 in November 2021.

The huge drop leaves investors inside a predicament about whether or not they should purchase Bitcoin when it’s cheaper, around $30,000, or watch for another market selloff.

The greater you appear at prior $BTC cost history the greater it’s possible to think it isn’t the underside

After 190 days in the all-time high, Bitcoin still had another 150 to 200 days until it flattened past few cycles (red box)

If time is any indicator, might be another six to eight several weeks pic.twitter.com/C1YHnfOzxC

— Rager (@Rager) May 20, 2022

This really is mainly because rates of interest are lower despite Federal Reserve’s recent .5% rate hike. Meanwhile, cash holdings one of the global fund managers have surged by 6.1% to $83 billion, the greatest because the 9/11 attacks. This means risk aversion one of the biggest pension, insurance, asset and hedge funds managers, the most recent Bank of the usa data shows.

Many crypto analysts including Carl B. Menger see greater buying possibilities within the Bitcoin market since it’s cost searches for any bottom.

But, rather of suggesting a lump-sum investment (LSI), in which investors throw lower an enormous sum to go in an industry, there is a apparently safer alternative for that lay investor, known as the dollar-cost averaging, or DCA.

Bitcoin DCA strategy can beat 99.9% of asset managers

The DCA technique is when investors divide their funds holdings into twelve equal parts and purchase Bitcoin with every part each month. Quite simply, investors purchase more BTC when its prices decline and fewer of the identical asset when its prices rise.

The process has to date provided incredible results.

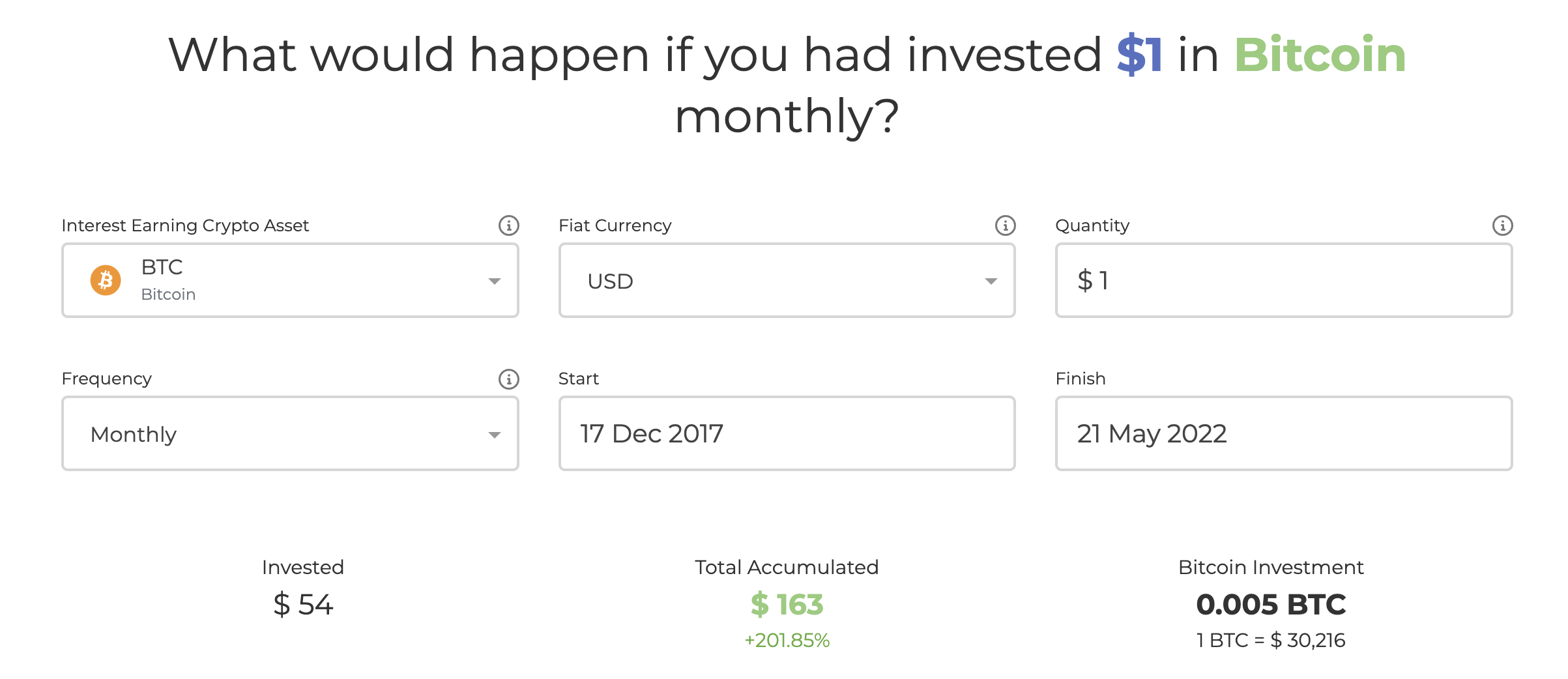

For example, a dollar invested into Bitcoin each month after it capped in December 2017 — near $20,000 — has provided investors a cumulative return of $163, based on CryptoHead’s DCA calculator. Which means around a 200% make money from consistent investments.

The Bitcoin DCA strategy also arises from a viewpoint that BTCs lengthy-term trend would always remain skewed towards the upside. Menger claims that purchasing Bitcoin regularly for any certain amount of money might have investors “beat 99.99% of investment managers and corporations in the world.”

This chart speaks everything #btc DCA may be the smartest and the best way of beating the marketplace #bearmarket https://t.co/ndKyzAi6FT

— ahmad (@albazzi02) May 13, 2022

Cracks within the DCA strategy

Historic returns in traditional markets, however, don’t support DCA because the best investment strategy. Rather, the LSI strategy turns out to be better.

For example, a study of 60/40 portfolios by Vanguard, which checked out every 12-month time-frame from 1926 until 2015, demonstrated that-at-once investments outperformed the DCA two-thirds of times, averaging 2.4% in calendar form year basis.

Related: Bitcoin ends week ‘on the edge’ as S&P 500 formally enters bear market

This somewhat raises the chance that Bitcoin, whose daily positive correlation using the benchmark S&P 500 index surged to .96 in May, would show similar results between its DCA and LSI strategies later on.

Thus, investing regularly in Bitcoin having a fixed cash amount may not always provide better profits compared to all-in method.

But, how about mixing both?

Ray Swedroe, chief research officer for Buckingham Wealth Partner, believes investors should invest having a “glass is half full” perspective, meaning a mixture of LSI and DCA.

“Invest one-third from the investment immediately and with remainder one-third at any given time throughout the next two several weeks or next two quarters,” the analyst authored on SeekingAlpha, adding:

“Invest one-quarter today and with remainder spread equally within the next 75 %. Invest one-sixth every month for six several weeks or almost every other month.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.