On 12 ,. 2, the U . s . States dollar index (DXY), a catalog that measures the dollar’s strength against a gift basket of top foreign currency, arrived at 104.40 that was the cheapest level observed in 5 several weeks.

In conclusion, the U.S. dollar’s weight from the basket of top foreign currency increased by 19.6% in 2022 until late September as investors searched for protection from the impact of the hawkish Fed and, more lately, the increasing energy costs and aftereffect of high inflation.

The U.S. dollar’s retreat might have been an interim correction to neutralize its “overbought” condition, because the 114.60 peak was the greatest level in twenty years. Still, its inverse correlation with Bitcoin (BTC) remains strong, as pointed out above by analyst Thecryer on Twitter:

$DXY $BTC pic.twitter.com/jG9HmYN8Mg

— Thecryer (@HumpBackCrypto) December 2, 2022

Notice the way the intraday DXY retrace to 105.50 in the 104.40 low happened when Bitcoin faced a $230 flash crash to $16,790. Such movements reinforce how cryptocurrencies’ performance remains codependent on traditional markets.

Bitcoin enthusiast Aldo the Apache observed the DXY “bullish divergence at support” happened because the S&P 500 stock exchange index battled having a vital level of resistance.

$DXY with bullish divergence at support while $SPX is originating reaches major resistence.

Exactly what does this suggest for $BTC? Another leg lower IMO. pic.twitter.com/PK3Ku0zZrl

— Aldo the Apache (@AldotheApache77) December 2, 2022

Based on the analyst, the internet impact for Bitcoin is negative when the expected trajectory confirms using the U.S. dollar gaining strength against major fiat currencies, and the stock exchange faces another leg lower.

On-chain metrics will also be painting a potentially bearish picture as Bitcoin miners, feared to become entering a new wave of capitulation, have upped sales of BTC reserves. For example, the record hash rate and elevated energy costs have drastically severed miners’ profitability.

Glassnode’s miner output multiple, which measures BTC outflows from miner wallets in accordance with their one-year moving average, has become at its greatest in six several weeks.

Let us take a look at derivatives metrics to know better how professional traders are situated in the present market conditions.

Bitcoin margin longs visit a drastic reduction

Margin markets provide understanding of how professional traders are situated since it enables investors to gain access to cryptocurrency to leverage their positions.

For example, it’s possible to increase exposure by borrowing stablecoins to purchase Bitcoin. However, Bitcoin borrowers are only able to short the cryptocurrency because they bet on its cost declining. Unlike futures contracts, the total amount between margin longs and shorts is not always matched.

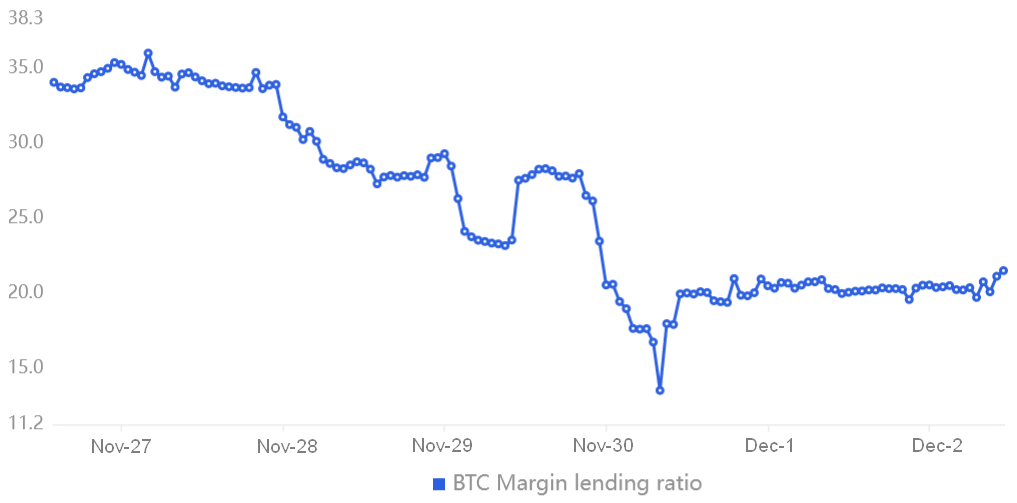

The above mentioned chart implies that OKX traders’ margin lending ratio firmly declined from November. 27 to November. 30, signaling that professional traders decreased their leverage longs throughout the dip toward $16,000.

More to the point, the following $1,250 gain that brought Bitcoin to $17,250 on November. 30 weren’t enough to instill confidence in Bitcoin buyers using stablecoin borrowing. Still, presently at 23, the metric favors stablecoin borrowing with a wide margin — indicating shorts aren’t confident about building bearish leveraged positions.

Related: Crypto miners in Russia take advantage of the bear market by hoarding ASIC devices

Option traders remain risk-averse

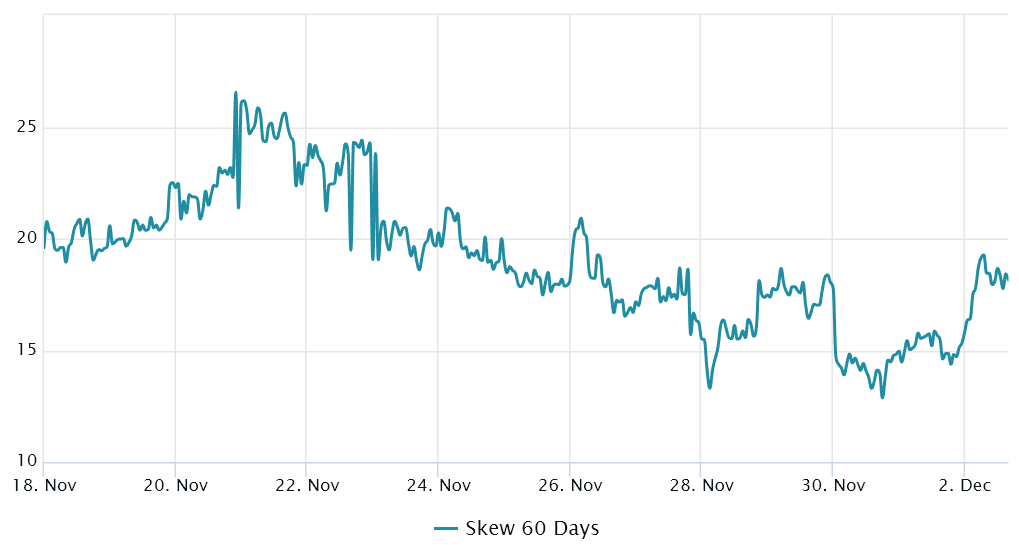

Traders should evaluate options markets to know whether Bitcoin will effectively break the $17,250 resistance. The 25% delta skew is really a telling sign whenever arbitrage desks and market makers are overcharging for upside or downside protection.

The indicator compares similar call (buy) and set (sell) options and can turn positive when fear is prevalent since the protective put options fees are greater than risk call options.

The bottom line is, the skew metric will move above 10% if traders fear a Bitcoin cost crash. However, generalized excitement reflects an adverse 10% skew.

As displayed above, the 25% delta skew declined between November. 21 and November. 30, indicating options traders reduced their bets of unpredicted cost dumps. However, the popularity inverted on 12 ,. 1 following the $17,250 resistance demonstrated more powerful than expected.

Presently at 18%, the delta skew signals that investors continue to be fearful also it reflects too little interest from whales and market makers in offering downside protection.

Consequently, pro traders aren’t certain that Bitcoin will recapture $18,000 in the near future, which may be described through the high correlation with traditional markets.

Before the DXY index sets a far more precise direction and also the S&P 500 shows strength at 4,000, the popularity favors Bitcoin bears.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.