Bitcoin (BTC) came back to $16,500 in the November. 14 Wall Street open as bulls attempted and unsuccessful to interrupt greater.

Snowden hints BTC cost echoes March 2020

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD varying below $17,000 at the time following a dismal weekly close.

The biggest cryptocurrency had unsuccessful to exhibit convincing indications of recovery after losing greater than 25% a few days prior because of the debacle around exchange FTX.

That debacle was ongoing during the time of writing, with revelations fanning to include other firms with significant contact with the defunct exchange.

With little light in the finish from the tunnel visible, BTC cost action continued to be unsurprisingly weak.

“Markets consolidating,” Michaël van de Poppe, founder and Chief executive officer of buying and selling platform Eight, summarized.

“Would assume we’d attend $10K really, following the terrible news we have received past days.”

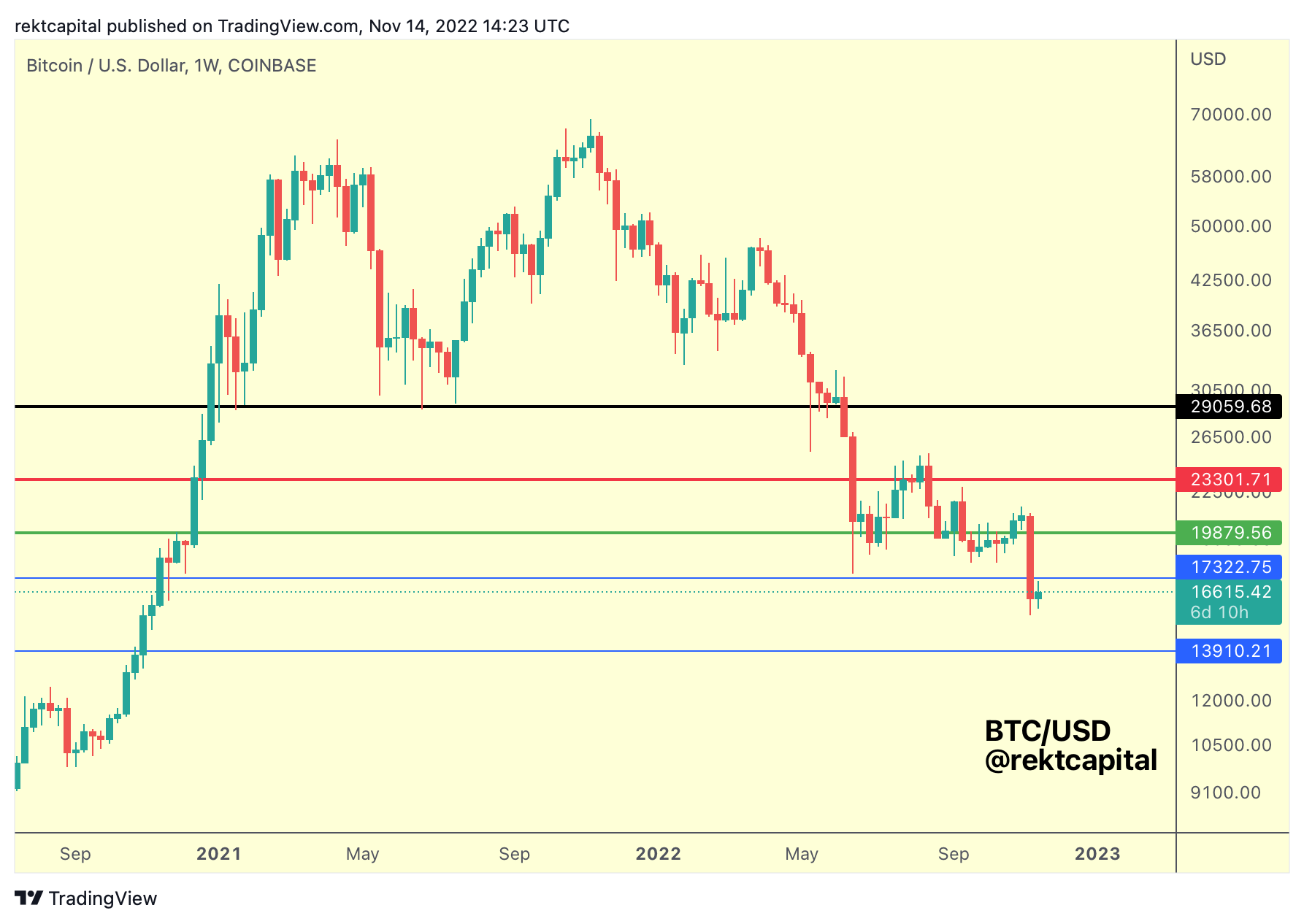

Trader and analyst Rekt Capital meanwhile cautioned of support-resistance flips within the making because of the weekly close, Bitcoin’s cheapest in 2 years.

“These are BTC Monthly levels proven around the Weekly time-frame,” he tweeted alongside a chart of important focal levels.

“From this chart, we are able to observe that $BTC has performed a brand new Weekly Close underneath the Monthly degree of ~$17300. Initial indications of this level flipping into new resistance now.”

Other posts at the time cautioned of the opportunity of “additional downside wicking” on BTC/USD, while noting that in the past, prior bear markets had still been worse with regards to the pair’s descent from cycle highs.

A fascinating counterpoint originated from Edward Snowden. Inside a tweet of their own, he signaled he will be a BTC buyer at current levels, sentiment he last openly published following the March 2020 COVID-19 mix-market crash.

“There’s still lots of trouble ahead, but the very first time shortly I am beginning to have the itch to lessen in,” he mentioned.

Another tweet stressed the previous one was “not financial advice.”

Dollar gives ‘perfect’ path to BTC upside

Stocks offered little respite to crypto bulls at the time, using the S&P 500 and Nasdaq Composite Index lower .3% and .8%, correspondingly, throughout the first hour.

Related: Elon Musk states BTC ‘will make it’ — 5 items to know in Bitcoin now

The U.S. dollar index (DXY) ongoing consolidation of their own while refusing to increase the last weeks’ significant retracement.

Popular buying and selling account Bet on Trades noted the daily chart’s relative strength index (RSI) for DXY had set a brand new record low for 2022.

“SPX is showing strength and DXY is crashing,” a hopeful Bloodgood, another well-known Twitter trader, authored partly of the fresh update at the time.

“Perfect situation to determine some upside.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.