Bitcoin (BTC) starts a brand new week on shaky ground after its cheapest weekly near the coast 2 yrs.

The biggest cryptocurrency significantly weakened after last week’s implosion of exchange FTX, is constantly on the grapple using the fallout.

With what has become an more and more erratic market, investors are unsure what’s going to happen next as increasing numbers of firms seem the alarm over solvency and regulators step-up investigations within the crypto space.

The atmosphere one of the majority is intensely fearful, as well as a few of the industry’s best-known names warn that it’s been challenge many years because of last week’s occasions.

Simultaneously for Bitcoin, it’s business as always. FTX isn’t the first such debacle it’s weathered, and underneath the hood, the network continues to be robust as always.

Cointelegraph analyzes the standards set to help BTC cost action within the future because the average hodler will get to grips with major losses and continuing volatility.

Crypto braces for fresh FTX fallout

While little is definite in the present crypto market atmosphere, it’s reliable advice that FTX and it is aftermath has become the main supply of Bitcoin cost volatility.

The weekly chart states everything — a -$5,500 “red” candle for that 7 days through November. 13 towards the cheapest weekly close since mid-November 2020, data from Cointelegraph Markets Pro and TradingView shows.

During the time of writing, BTC/USD remains to be that close — $16,300 reappearing like a relief bounce following the pair wicked to simply $15,780 on Bitstamp overnight.

The storyline is way from over with regards to FTX, as firms with contact with the exchange and related entities finish up in trouble.

As a result, commentators forecast, there might be repeat performances within the future and days because the knock-on effects put increasingly more crypto names bankrupt.

Exchanges are particularly around the radar, with Crypto.com, KuCoin yet others becoming the origin of suspicion over liquidity.

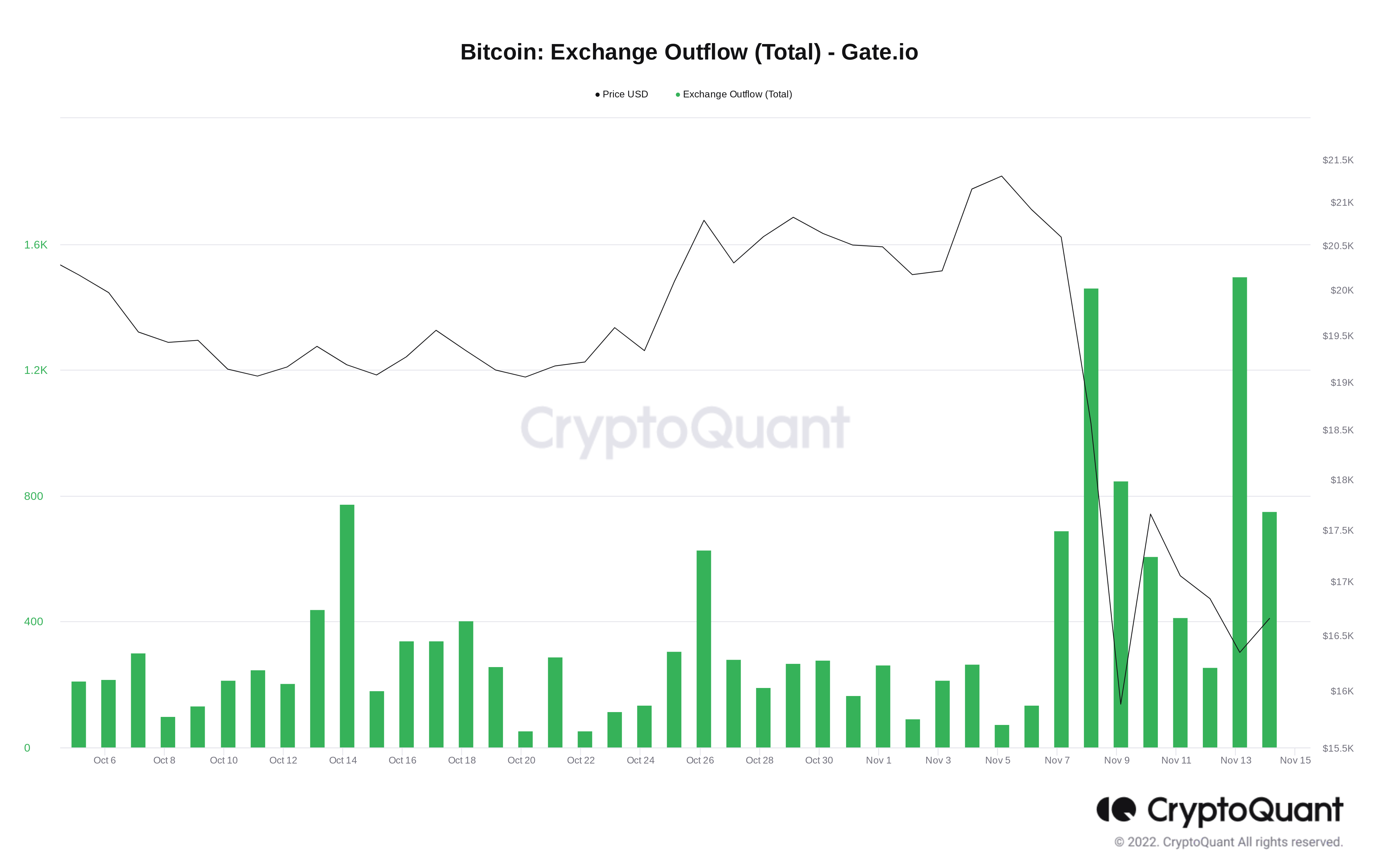

At the time, an increase in withdrawal transactions at Crypto.com and Gate.io brought to warnings that it could function as the latest exchange to determine a “bank run” as investors aim to seize control of the funds.

Data from on-chain analytics firm CryptoQuant demonstrated 1,500 BTC departing Gate.io on November. 13, with November. 14 presently at nearly 800 BTC and rising.

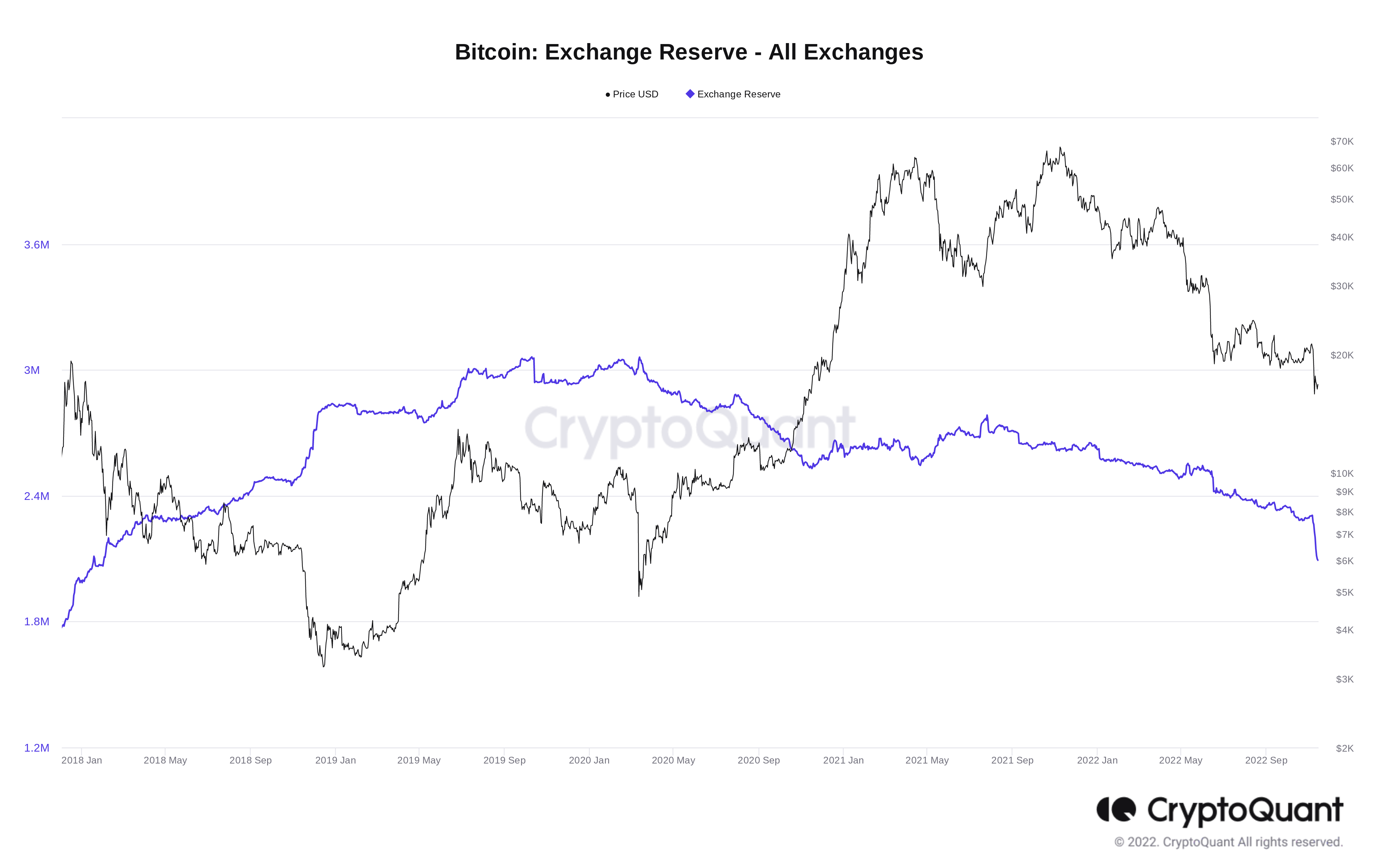

More broadly, data demonstrated exchange BTC reserves in an believed 2.09 million BTC, CryptoQuant noting that because of the turmoil it might not reflect the real condition of matters.

The final time that reserves were so low is at early 2018.

Bitcoin bounces from $15,700 as Musk puts belief in BTC

From the backdrop of ongoing uncertainty, making BTC cost predictions is thus very difficult task.

Embracing the moving average convergence divergence (MACD), analyst Matthew Hyland cautioned the BTC/USD 3-day chart involved to repeat a bearish setup, which brought to losses both occasions it made an appearance in 2022.

“Bitcoin 3-Day MACD is within position to mix Bearish tomorrow the very first time since April,” he authored:

“It could be prevented if BTC could possibly get positive cost action prior to the 3-Day closes. Previous two crosses previously year led to further downward cost action.”

Hyland nevertheless noted that whenever the 2014 Mt. Gox hack, Bitcoin required several months to locate a macro cost bottom following the initial shock.

“It hasn’t even been 11 days since FTX closed up,” he added.

Fellow analyst Il Capo of Crypto meanwhile contended the market was ready for a “final capitulation,” which might come at some point.

This, he stated in a number of tweets, will come by means of a “bull trap” first then firm rejection, delivering the marketplace to new lows.

For altcoins, he stated, the comedown would add up to “40-50% typically.”

On shorter timeframes, popular trader Crypto Tony feared that the cheapest weekly near the coast 2 yrs might neglect to hold as support.

“Nice breakout, but when we can’t contain the swing low at $16,400 this only agreed to be an imitation out so we wait for test lower,” he commented concerning the recovery from $15,780 intraday lows.

The move came as Twitter Chief executive officer, Elon Musk, arrived on the scene in tacit support.

“BTC can make it, but may well be a lengthy winter,” he authored at the time inside a Twitter debate.

An additional short-term cost catalyst came by means of the biggest exchange, Binance, opting to produce a dedicated recovery fund to assist shield companies.

Quiet macro week sees concentrate on stocks correlation

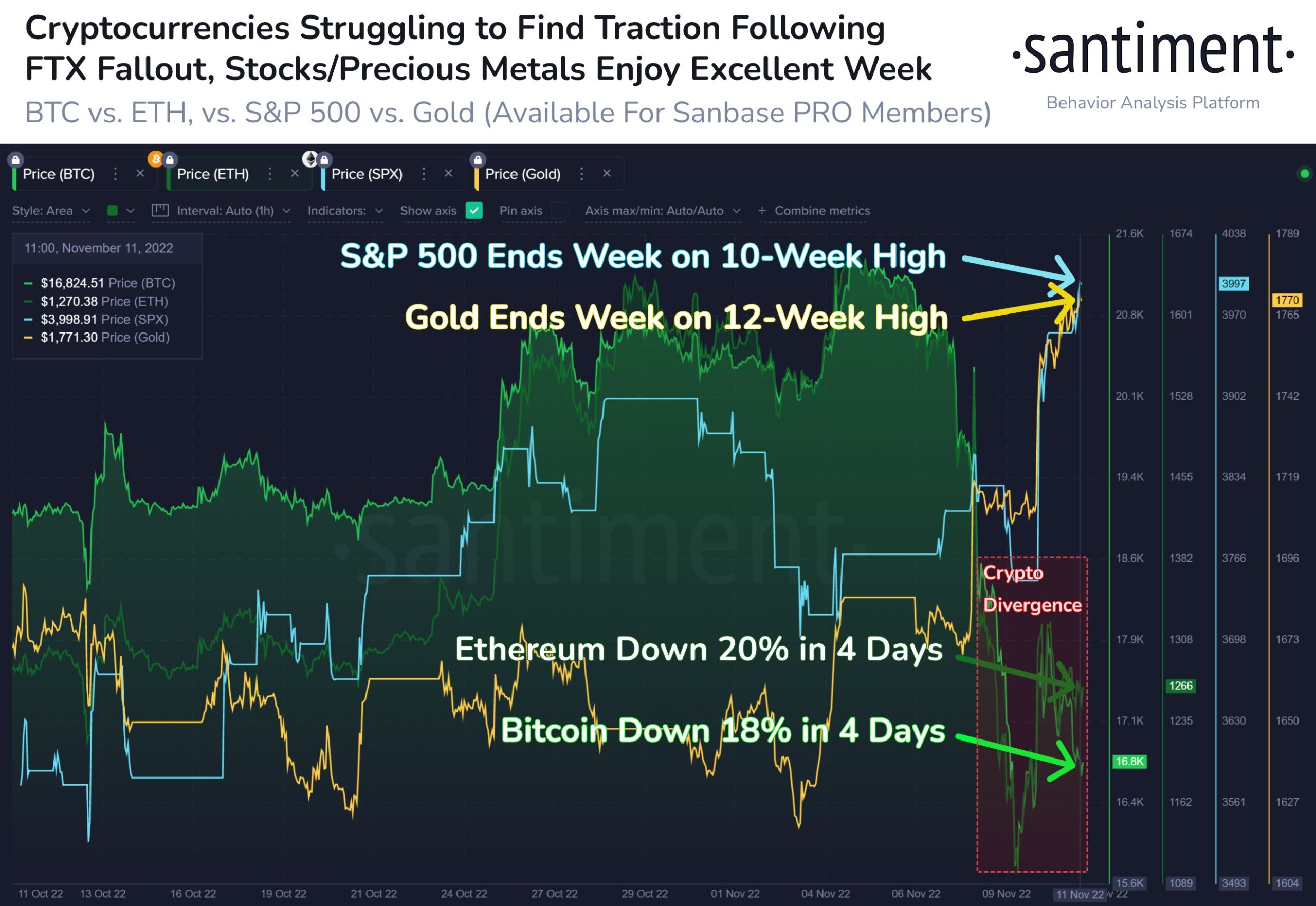

The image outdoors of crypto further underscores the level that FTX has marked a “black swan” event for that industry.

While Bitcoin and altcoins were busy shedding more than 25% in days, U . s . States stock markets retrieved from losses earlier within the month.

As a result, as research firm Santiment notes, there’s a obvious divergence occurring between Bitcoin and risk assets, this assisting to break a correlation which has suffered through the past year.

“As the buying and selling workweek closes, the week’s story may be the distinct separation between crypto (after FTX’s fall from elegance) & equities,” it summarized inside a tweet a week ago:

“Should $BTC traders’ trust recover after unfortunate occasions, there’s a bullish divergence developing using the SP500.”

Markets commentator Holger Zschaepitz furthermore noted the widening gap in performance of Bitcoin in comparison to the Nasdaq.

“Gap in weekly performance of sliding Bitcoin, rallying Nasdaq largest since 2020. Crypto world shrank to the same as 1% of worldwide equities,” a part of new comments read at the time.

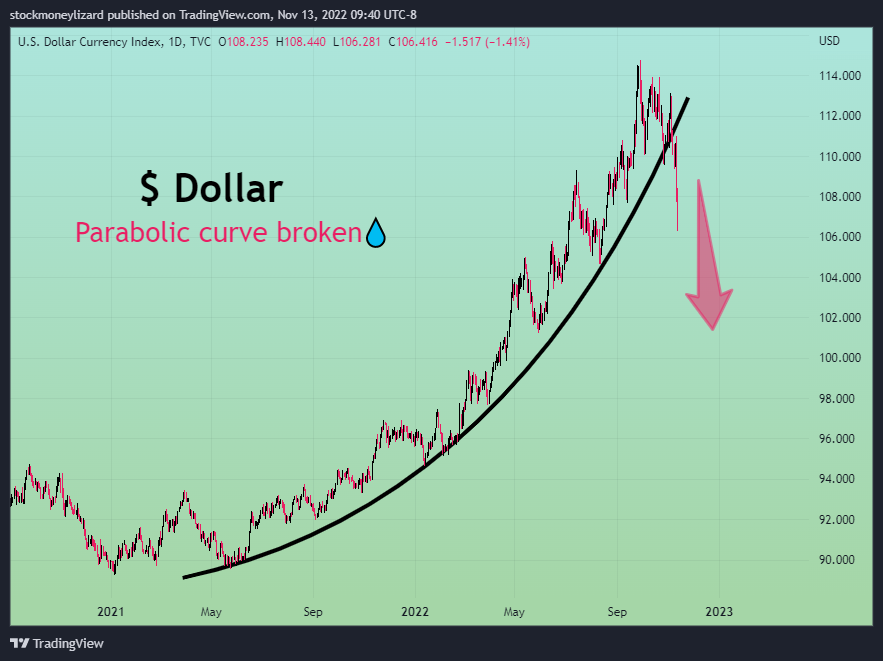

That decreasing correlation will come in a helpful time macro-wise, as U.S. dollar strength makes some erratic moves of their own.

The U.S. dollar index (DXY), getting attempted a rebound past 107, unsuccessful before the November. 14 Wall Street open, using the implication that risk assets should rise consequently.

Any return towards recent highs, however, and also the picture could quickly look completely different.

The intraday DXY lows nevertheless saw the index go back to support not tested since mid-August.

Commenting around the longer-term performance, however, popular buying and selling outfit Stockmoney Lizards stated that DXY had damaged a parabolic curve in position since 2021.

“Correction is going to be great for Bitcoin,” a part of Twitter comments added.

“Buy the dip” fever hits as miner sales slow

Even though many existing hodlers are trying to withdraw coins from exchanges or learn how to nurse losses, not everybody is doing nothing.

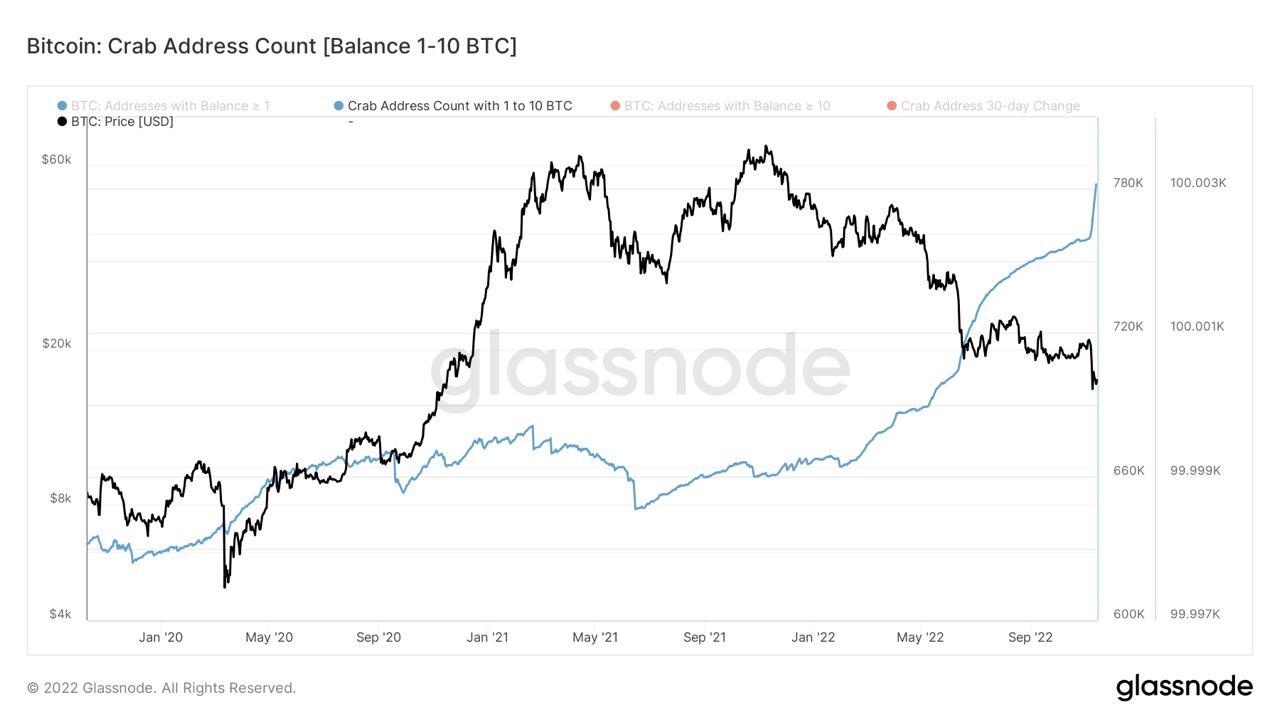

On-chain data shows that as BTC/USD hit multi-year lows a week ago, investors both large and small required the chance to “buy the dip.”

Based on on-chain analytics firm Glassnode, wallets that contains between 1 and 10 BTC saw an impressive increase.

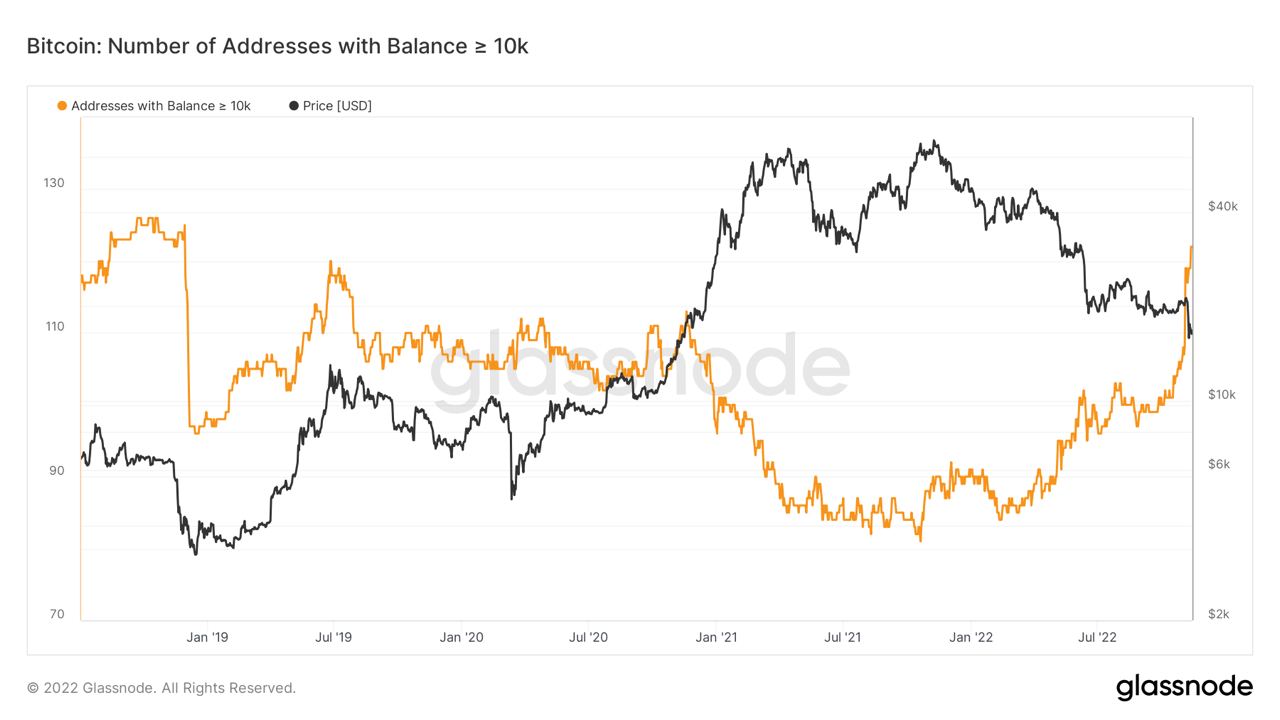

The popularity also seems to become happening one of the largest hodler cohort, the “mega whales” of Bitcoin. These entities having a wallet balance of 10,000 BTC or even more will also be growing, and today number almost 130, Glassnode shows.

“Whales are accumulating in a pace never witnessed before,” popular social networking commentator Crypto Rover reacted.

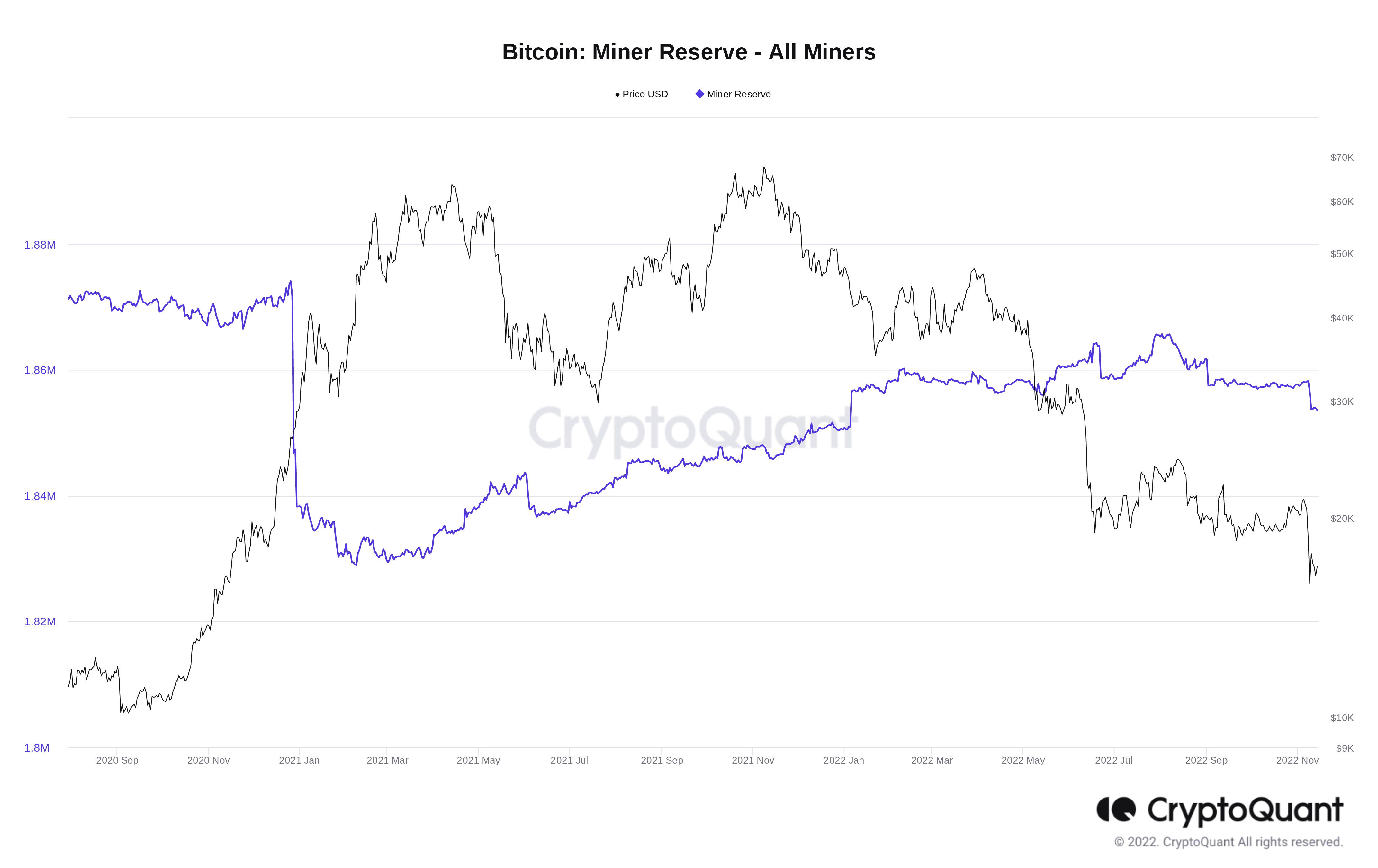

An organization firmly not in accumulation mode at the moment, meanwhile, is miners. Following a sharp decrease in their reserves a week ago, the BTC hodled by miners tracked by CryptoQuant continues to be trending downward.

From 1,858,271 BTC on November. 8, miners’ reserves now total 1,853,606 BTC as of times of writing on November. 14.

Regardless of this, reserves remain greater than at the beginning of 2022, and up to date sales add up to an minor part of miners’ overall position.

Sentiment data provides a modicum of hope

Predictably, overall crypto market sentiment required a significant hit because of FTX — but could it be really everything bad?

Related: $3 billion in Bitcoin left exchanges now among FTX contagion fears

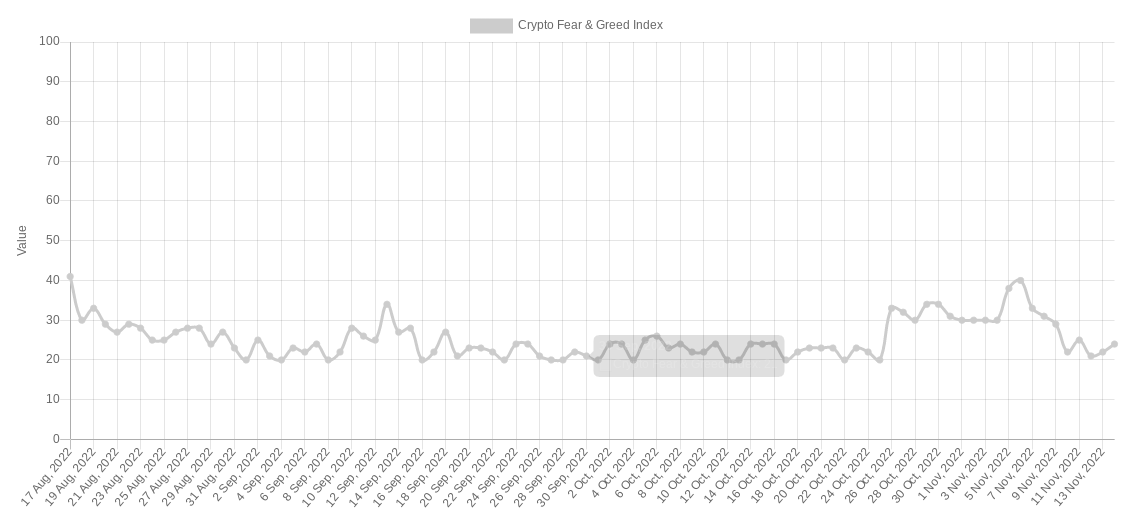

Based on the Crypto Fear & Avarice Index, the may actually be using the slew of not so good news in the stride.

Over the past weekend, the Index’s score touched a nearby low of 20/100 — firmly characterizing the marketplace mood among “extreme fear.”

That is representative of a 50% drop in comparison to the peak of 40/100 seen on November. 6, marking a three-month sentiment high.

Nevertheless, 2022 has witnessed reduced scores, using the Fear & Avarice reaching just 6/100 during the period of the entire year.

Should further fallout hit, a fresh 50% dive from current levels would just take sentiment towards the area which normally marks macro cost bottoms for BTC/USD — around 10/100.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.