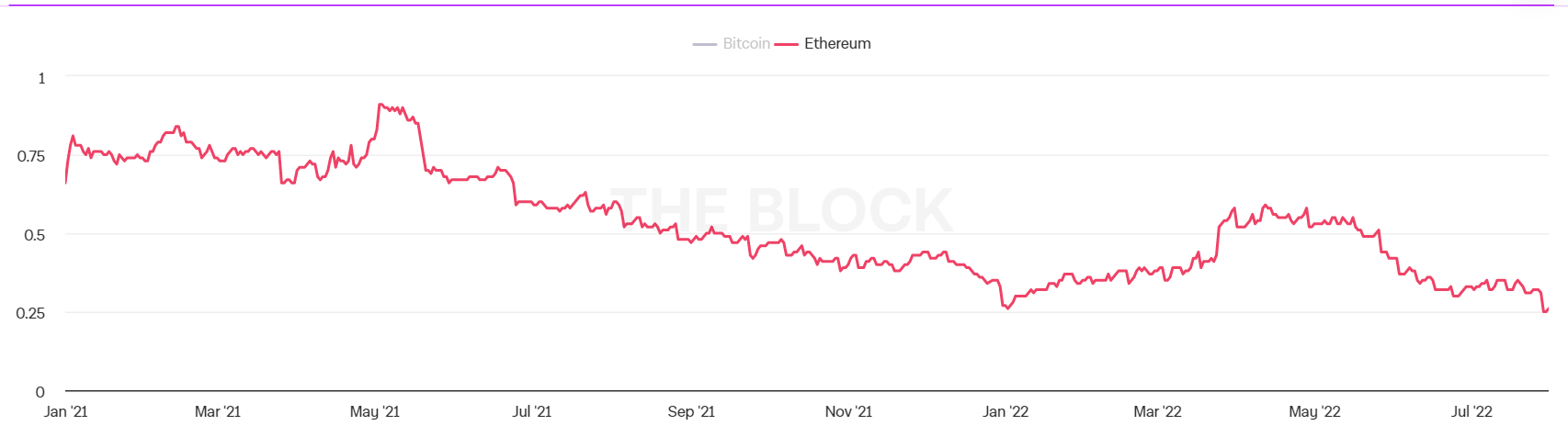

Ether (ETH) has had over Bitcoin (BTC) within the options market the very first time ever because the open interest (OI) of Deribit Ether options, having a worth of $5.6 billion, exceeded the OI of Bitcoin options worth $4.6 billion by 32%.

OI is calculated with the addition of all of the contracts from opened up trades and subtracting the contracts whenever a trade is closed. It’s utilized as an indication to find out market sentiment and also the strength behind cost trends. Deribit may be the world’s greatest BTC and ETH options exchange, accounting in excess of 90% from the global buying and selling volume.

The information in the Deribit exchange highlighted that ETH choices are mainly call options, having a put/call ratio of .26. The ETH Put/Call ratio has hit a brand new yearly little as the Merge date gets near.

Underneath the put option, buyers possess the right although not the duty to market the actual asset in a predetermined cost on or before a particular date. Overall, put buyers are unconditionally bearish, while a phone call option trader is bullish.

A put/call ratio more than .7 or exceeding one signifies bearish market sentiment, while a put/call ratio value less than .7 and falling near to .5 signifies a growing bullish trend.

Related: Ethereum Merge: How can the PoS transition change up the ETH ecosystem?

The current rush of ETH OI within the options market by having an underlying bullish sentiment among traders has been related to the approaching Merge slated for that third week of September.

While ETH is constantly on the see growing dominance within the options market, the ETH futures quarterly contracts, scheduled to run out in December 2022, have tucked into backwardation, in which the futures cost becomes less than the place cost. Ether’s place and futures cost increased to -$8 on Monday. Although this might appear just like a bearish outlook, BTC surged 15% after cost backwardation in June.

In addition to the growing bullish anticipation for that approaching proof-of-stake (PoS) transition, analysts also have pointed toward the potential airdrop scenario in situation of the chain split. A survey from Galois Capital says 33.1% of respondents believe the upgrade would result in a hard fork, while 53.7% anticipated an even network transition.