Crypto cost action continues to be rough in the last couple of several weeks, however a couple of eco-friendly shoots are finally starting to emerge.

While Bitcoin (BTC) remains inside a downtrend, its cost has lately found support in the $17,000 level, and ping-pong cost action within the $16,700–$17,300 range seems to become allowing traders to pursue some interesting setups inside a couple of altcoins.

Let’s have a quick look at some enticing patterns turning up around the weekly time period.

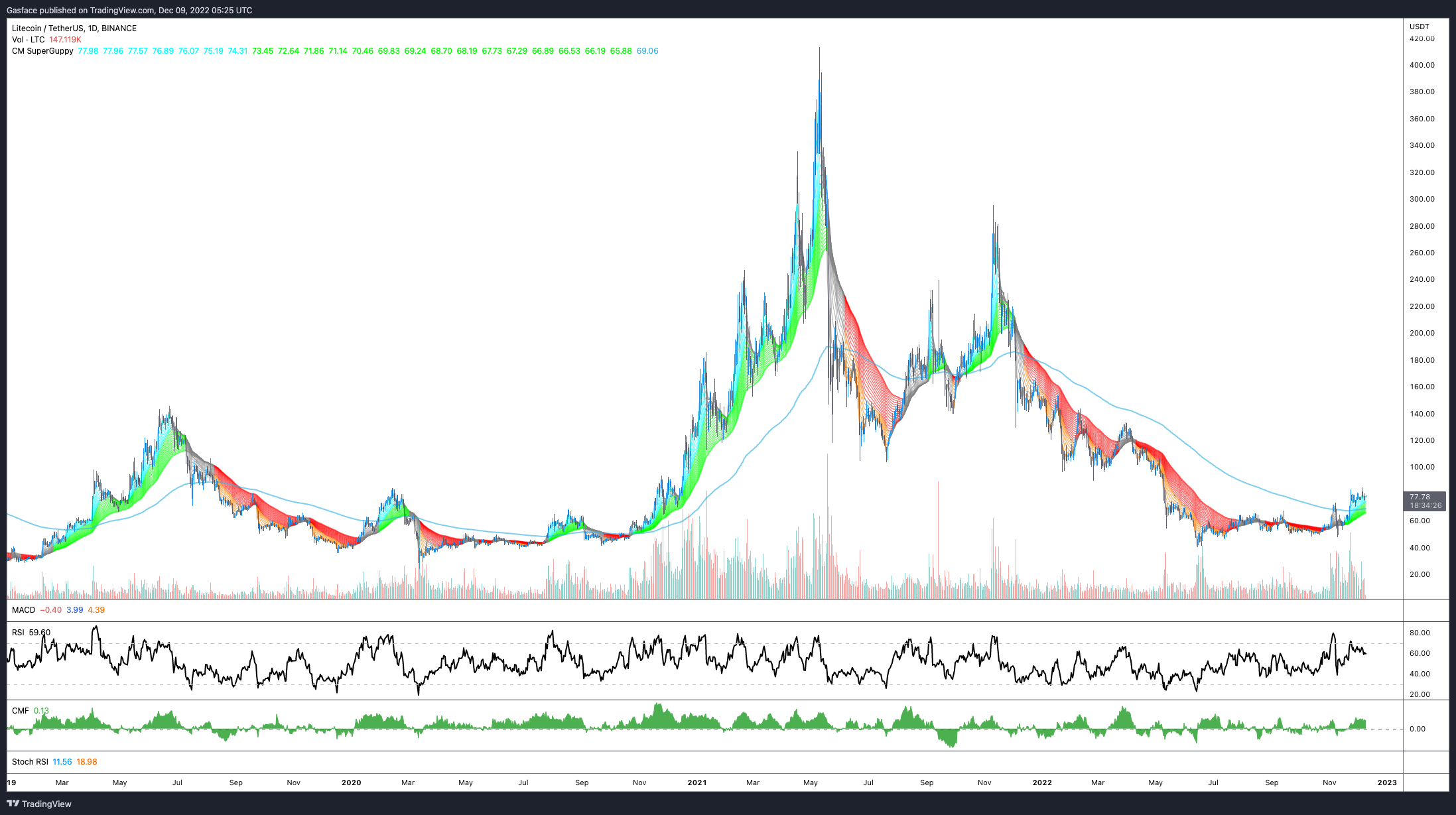

Here we are at Litecoin’s halving hopium?

Like a fork of Bitcoin, Litecoin (LTC) has a tendency to turn bullish several several weeks before its reward halving happens, as was the situation in 2015 and 2019.

Litecoin’s next reward halving is 237 days away, also it seems the altcoin is having a little pre-halving hype. Since November. 6, LTC has acquired 58.6%, which is beginning to reflect the triple cost action that happened in the past halvings.

The Guppy Multiple Moving Averages (GMMA) indicator around the daily time period has additionally switched eco-friendly — something which rarely happens.

From the technical analysis perspective, LTC keeps a trend of greater lows, consolidation and bull flag breakouts, that are then adopted by further consolidation.

If LTC maintains its market structure and is constantly on the ride across the 20-day moving average, its cost often see a pre-halving run to the $100–$125 area.

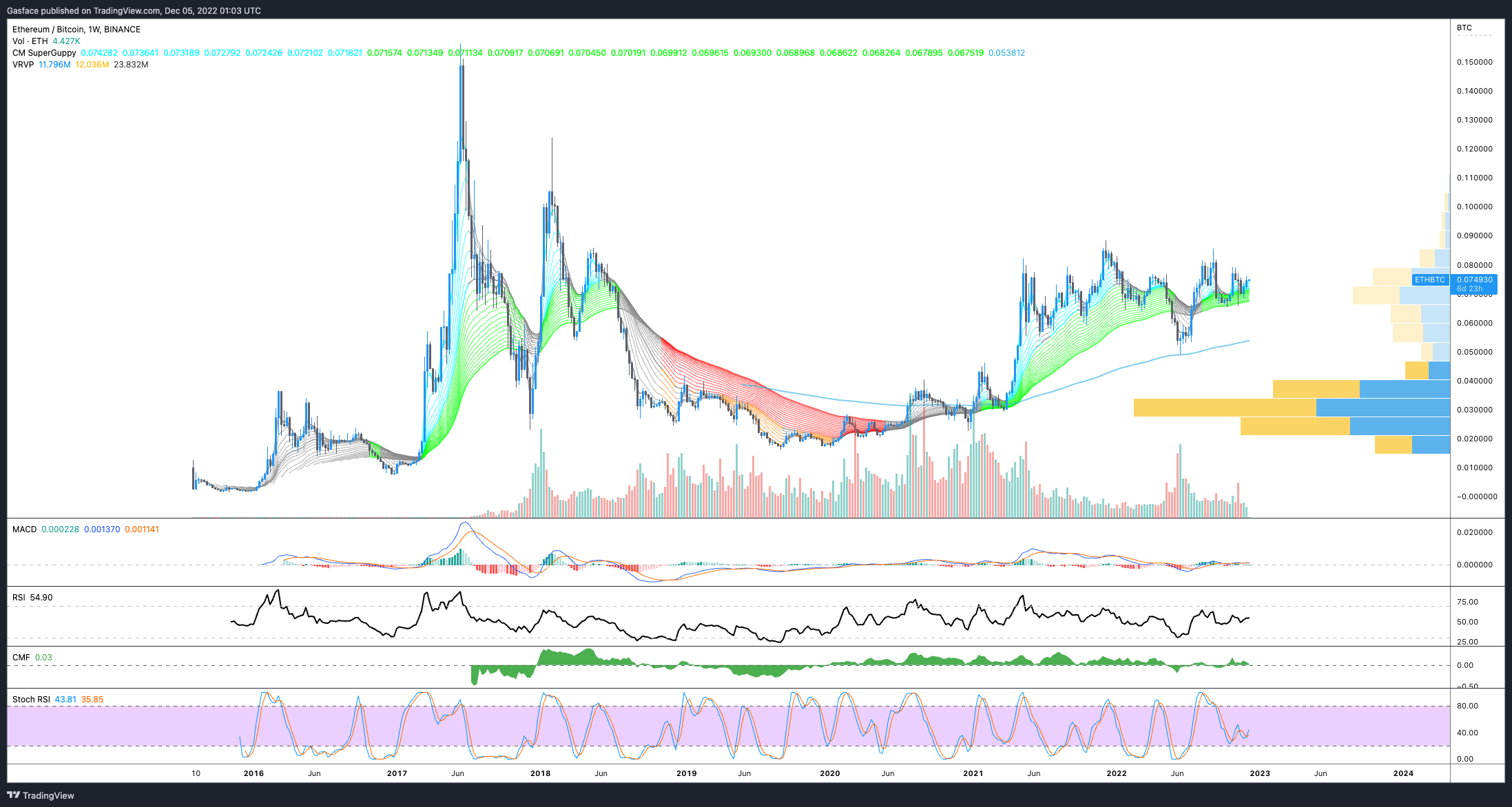

Ether plots its very own course

The ETH/BTC weekly time-frame shows some notable developments. For the way one sees it, there might be a pleasant inverse mind and shoulders developing.

You could also reason that the ETH/BTC weekly is flashing an enormous cup-and-handle pattern.

Like Litecoin, the GMMA indicator within the ETH/BTC weekly pair continues to be vibrant eco-friendly since August. 8, that is nearly four several weeks.

Ether’s cost action in the U.S. dollar and BTC pair raise eyebrows, especially because of the condition from the broader market.

Regardless of this short-term bullish outlook, ETH’s cost could have warning flags for example Ethereum blockchain censorship, U.S. Office of Foreign Assets Control compliance, ETH’s performance in the supposedly deflationary publish-Merge atmosphere, and concerns over the potential of the U.S. Registration and Commodity Futures Buying and selling Commission altering their perspective on Ether as being a commodity.

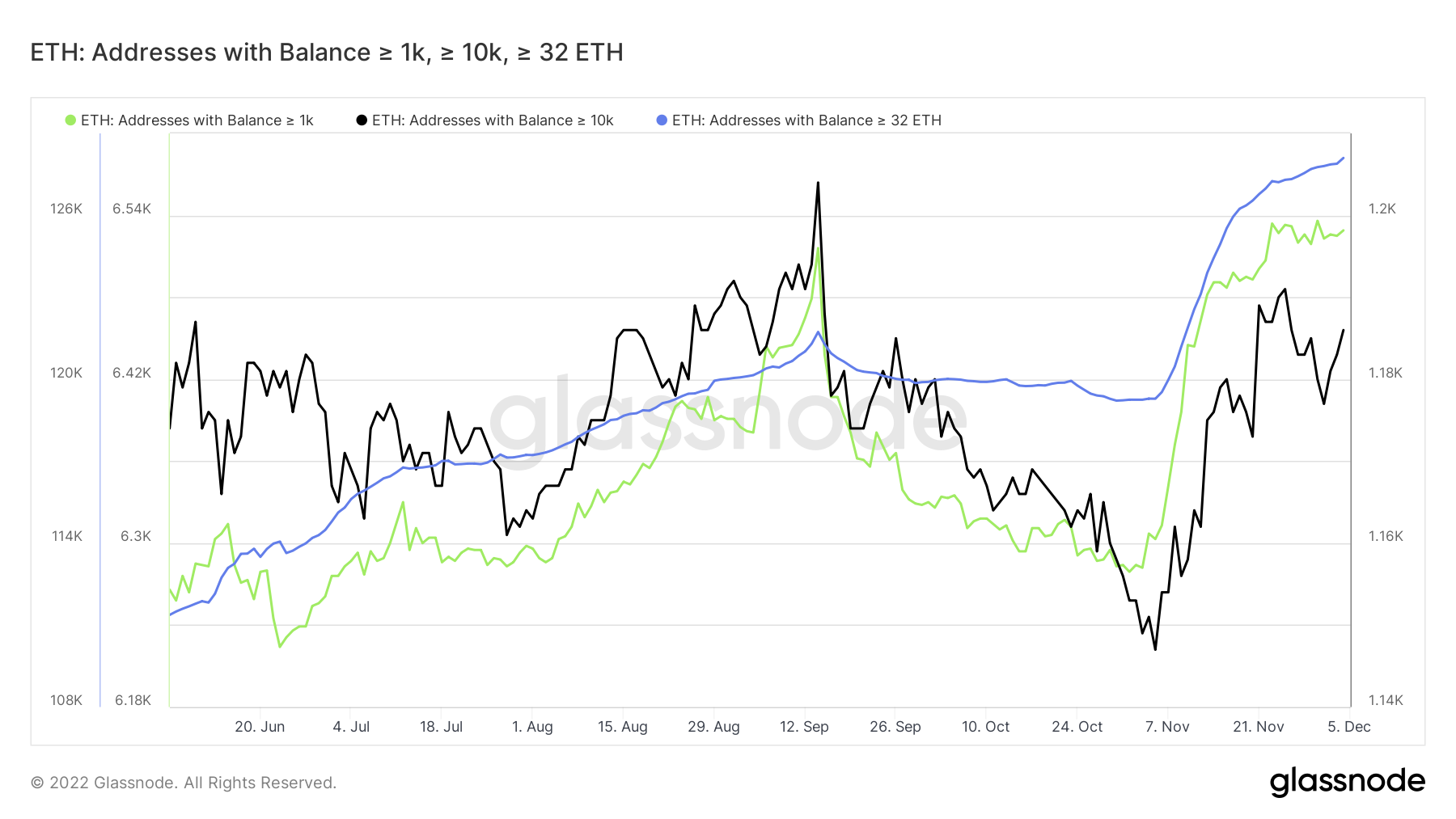

On-chain data informs a fascinating tale

Searching at on-chain data provides a little bit of color. Data from Glassnode implies that since November. 7, Ethereum addresses with balances more than 32 ETH, 1,000 ETH and 10,000 ETH have been receiving an upward trend.

As the rebound is small, it’s vital that you keep close track of growth metrics new Ethereum addresses, daily active users, increases in a number of balance cohorts and also the number of holders in profit simply because they may ultimately mark a general change in trend and sentiment.

Contrasting these metrics against buying and selling volumes, cost along with other technical analysis indicators might help investors achieve a far more comprehensive look at whether opening a situation in ETH may be beneficial.

ETH’s MVRV Z-Score can also be flashing a couple of signals. Much like Bitcoin on-chain analysis, the MVRV Z-Score examines the present market capital from the asset in comparison to the cost where investors bought it.

The metric can suggest when a good thing is overvalued or undervalued in accordance with its fair value, also it has a tendency to signal market tops once the market cap is considerably greater compared to recognized cap.

Based on the three-year MVRV Z-Score chart below, the Z-Score is during the eco-friendly zone.

Related: Approach carefully: US banking regulator’s crypto warning

Thinking about the uncertainty on the market, worries associated with stringent crypto regulation, and also the unresolved threats of insolvency, personal bankruptcy and contagion in the FTX debacle, it’s hard to see whether it’s time for you to go lengthy on ETH.

Risk-averse traders searching to drag the trigger might consider going place lengthy and short through futures. This way, if your are lengthy-term bullish on ETH, they are able to develop a position whilst hedging against short-term downside.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey writes market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.