Ethereum’s native token, Ether (ETH), looks poised to log a significant cost rally versus its top rival, Bitcoin (BTC), dads and moms leading toward early 2023.

Ether includes a 61% possibility of breaking out versus Bitcoin

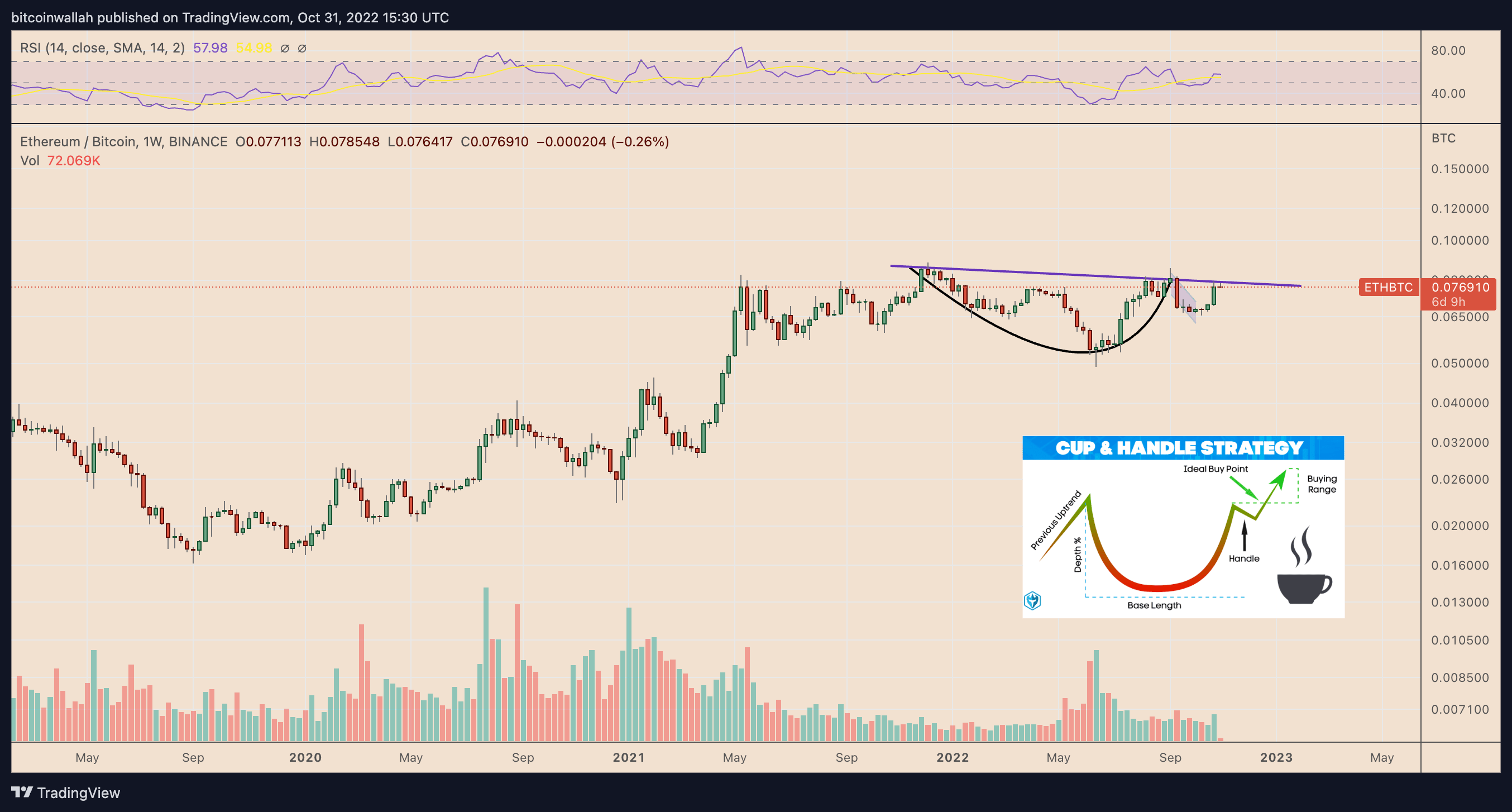

The bullish cues emerge mainly from the classic technical setup dubbed a “cup-and-handle” pattern. It forms once the cost undergoes a U-formed recovery (cup) adopted with a slight downward shift (handle) — all while keeping a typical level of resistance (neckline).

Traditional analysts see the cup and take care of like a bullish setup, with veteran Tom Bulkowski noting the pattern meets its profit target 61% ever. Theoretically, just one cup-and-handle pattern’s profit target is measured with the addition of the space between its neckline and cheapest indicate the neckline level.

The Ether-to-Bitcoin ratio (or ETH/BTC), a broadly tracked pairing, has midway colored an identical setup. The happy couple now awaits an outbreak above its neckline level of resistance close to .079 BTC, as highlighted within the chart below.

Consequently, a decisive breakout move over the cup-and-handle neckline of .079 BTC could push Ether’s cost toward .123 BTC, or higher 50%, by early 2023.

Time for you to turn bullish on ETH?

Ether’s strong interim fundamentals in contrast to Bitcoin further improve its chance of having a 50% cost rally later on.

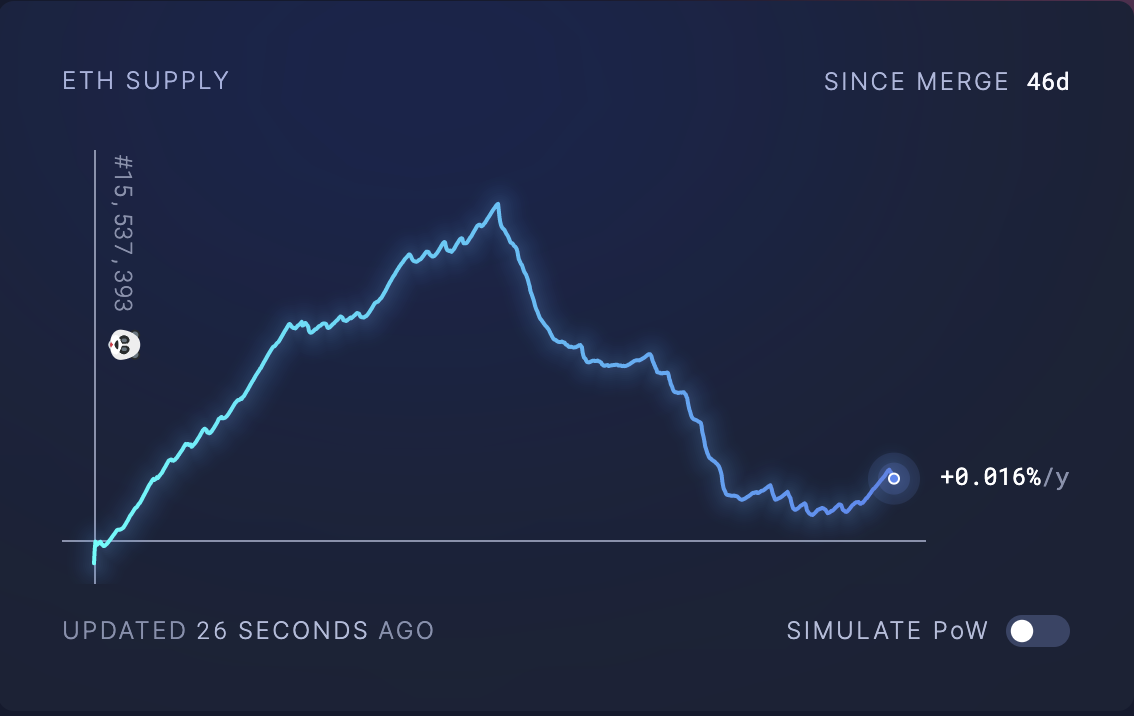

To begin with, Ether’s annual supply rate fell drastically in October, partially as a result of fee-burning mechanism known as EIP-1559 that removes some ETH from permanent circulation whenever an on-chain transaction occurs.

XEN Crypto, a social mining project, was mainly accountable for raising the amount of on-chain Ethereum transactions in October, resulting in a greater quantity of ETH burns, as Cointelegraph previously covered.

Over 2.69 million ETH (roughly $8.65 billion) is going of circulation because the EIP-1559 update went survive Ethereum in August 2021, based on data from EthBurned.info.

It implies that the greater clogged the Ethereum network becomes, the greater Ether’s possibility of entering a “deflationary” mode will get. So, a depleting ETH supply may prove bullish, when the coin’s demand increases concurrently.

Additionally, Ethereum’s transition to some proof-of-stake consensus mechanism via “the Merge” has acted being an Ether-supply sucker, considering that each staker — whether a person or perhaps a pool — is needed to lock away 32 ETH inside a smart contract to earn annual yields.

The entire supply held by Ethereum’s PoS smart contract arrived at an exciting-time a lot of 14.61 million ETH on March. 31.

In comparison, Bitcoin, an evidence-of-work (Bang) blockchain that needs miners to resolve complex mathematical algorithms to earn rewards, faces persistent selling pressure.

Related: Public Bitcoin miners’ hash rates are booming — But could it be really bearish for BTC cost?

Quite simply, there’s a somewhat greater selling pressure for Bitcoin versus Ether.

ETH/BTC must break the number resistance

Ether’s route to a 50% cost rally versus Bitcoin has one strong resistance area halfway, serving as a possible pleasure killer for bulls.

At length, the .07 BTC–0.08 BTC range has offered like a strong resistance area since May 2021, as proven below. For example, the December 2021 pullback that began after testing the stated range as resistance led to a 45% cost correction by mid-June 2022.

An identical pullback might have ETH test the .057–0.052 range since it’s primary support target through the finish of the year or early 2023.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.