The Doji candlepower unit, also known as a Doji star, shows indecision between consumers within the crypto market. This kind of candlepower unit is confirmed on the technical analysis chart once the frequent lowering and raising prices are nearly identical.

Exactly what is a Doji pattern around the candlepower unit chart?

Basically, a Doji implies that an asset’s consumers offset one another. By doing this, any tries to push-up the cost through the buyers get thwarted through the sellers. Similarly, efforts to crash the costs in the sellers’ finish get foiled through the buyers.

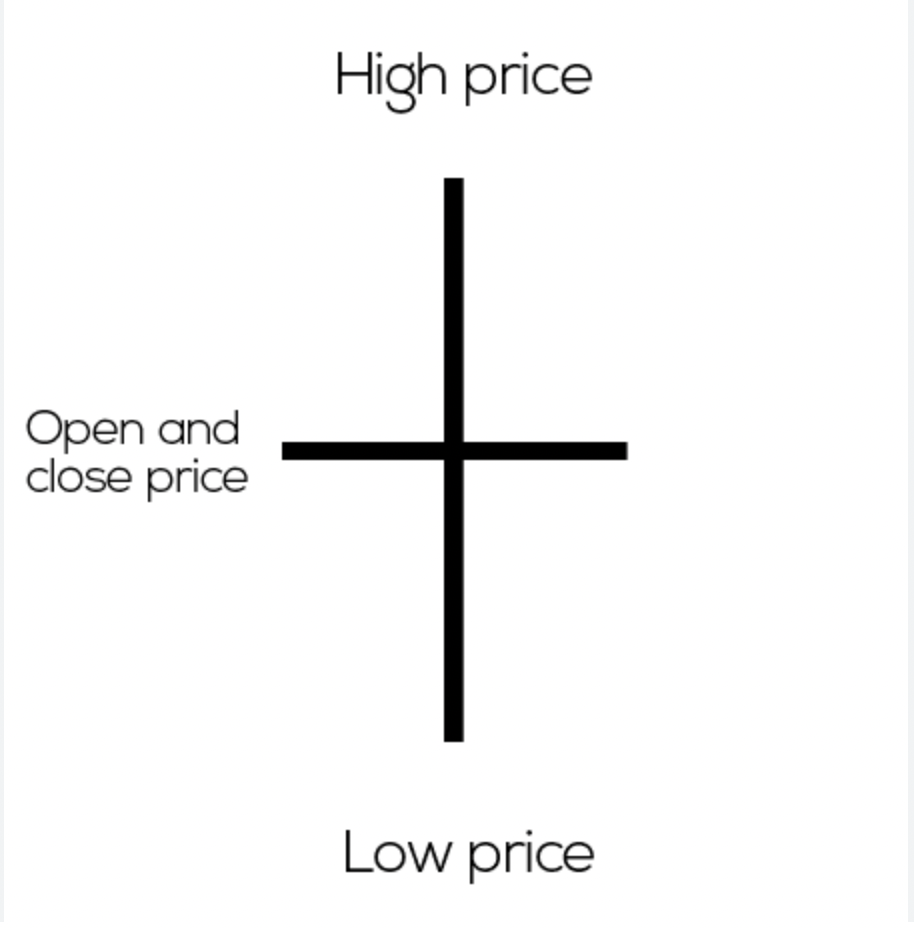

Ultimately, both sides bring the cost to some pivot level. So, for instance, when Bitcoin (BTC) opens and closes at $20,000 on the particular day even when its cost seesawed between $25,000 and $15,000 through the given24-hour period.

Therefore the $25,000 cost level — or even the intraday high — represents the Doji’s upper wick, and also the $15,000 cost level — the intraday low — represents the candlestick’s lower wick.

So how exactly does a Doji candle work?

Doji candlesticks have in the past helped traders predict market bottoms and tops as a relaxed prior to the storm of sorts.

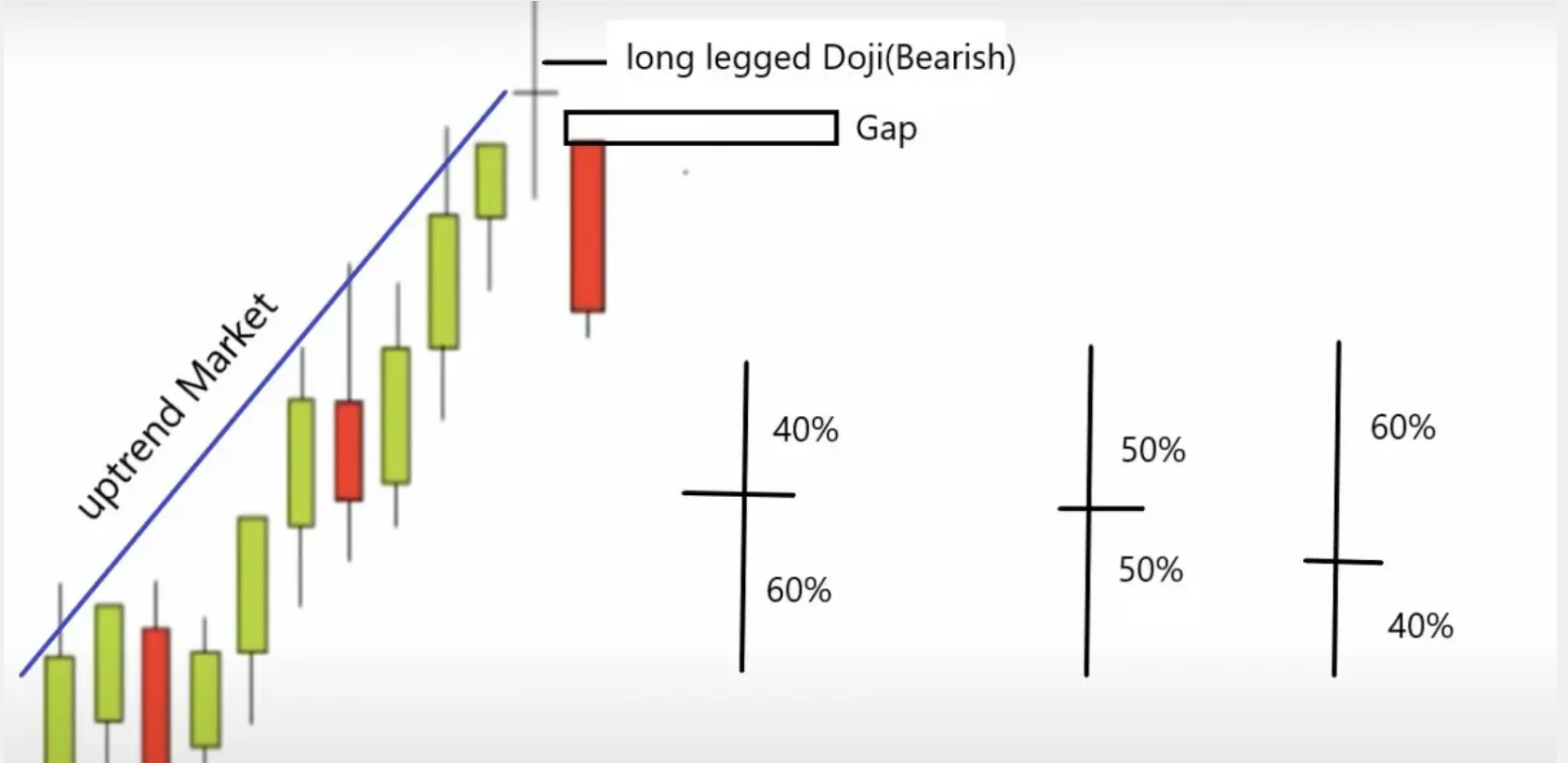

For instance, a Doji candlepower unit that forms throughout an upward trend could signify bullish exhaustion, i.e., more buyers relocating to the sellers’ side, typically resulting in a pattern reversal.

It’s valid to notice the Doji pattern doesn’t always imply that there’ll always be a pattern reversal. Rather, it shows indecision among traders about future trends.

Hence, it’s easier to read the Doji candlepower unit signal with the aid of additional technical indicators. For example, a technical indicator such as the relative strength index (RSI) and/or Bollinger bands can provide excess fat as to the the Doji pattern suggests.

Related: 5 More Bullish Candlepower unit Patterns Every Bitcoin Trader Have To Know

Kinds of Doji patterns and the way to trade them

Doji patterns can differ with respect to the position and entire shadow. Fundamental essentials most widely used variations:

Neutral Doji

The neutral Doji includes a candlepower unit by having an almost invisible body located in the center of the candlepower unit, using the lower and upper wicks of comparable lengths. This pattern seems when bullish and bearish sentiments are balanced.

Traders can combine the neutral Doji with momentum indicators such as the RSI or Moving Average Convergence Divergence (MACD) to assist identify potential market tops and bottoms.

For example, an unbiased Doji occurrence within an upward trend coinciding by having an overbought RSI (>70) could indicate an imminent market correction. Similarly, the candlestick’s occurrence inside a downtrend once the RSI has switched oversold (

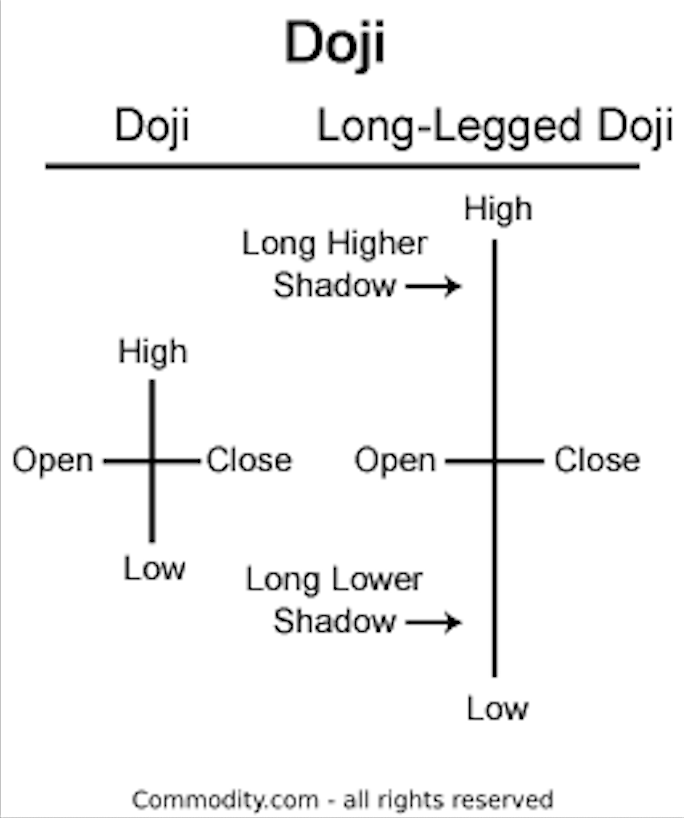

Lengthy-legged Doji

The lengthy-legged doji has longer wicks, suggesting that consumers have attempted to seize control from the cost action strongly sooner or later throughout the candle’s time-frame.

Traders should carefully monitor the candlestick’s closing cost when identifying a possible lengthy-legged Doji.

Particularly, the Doji is really a bearish signal when the closing cost is below the center of the candle, especially if it’s near to resistance levels. On the other hand, when the closing cost is above the center of the candle, it’s bullish, because the formation resembles a bullish pin bar pattern.

When the closing cost is in the actual middle, it may be considered a pattern continuation pattern. Within this situation, it’s possible to always make reference to previous candle lights to calculate future trends.

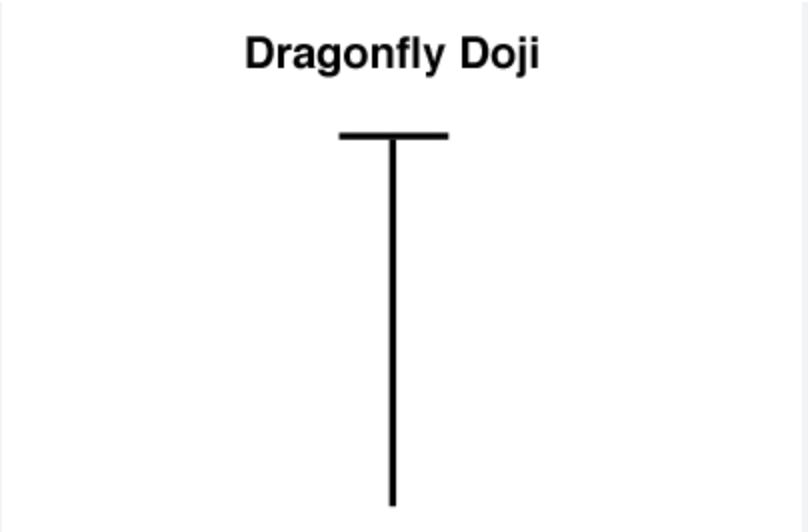

Dragonfly Doji

The Dragonfly Doji seems just like a T-formed candle having a lengthy lower wick and very little upper wick. This means the open, the close, and also the high cost are nearly in the same level.

When the Dragon Doji pattern forms in the finish of the downtrend, it may be considered a buy signal, as proven below.

On the other hand, the candlestick’s occurence throughout an upward trend shows a possible reversal.

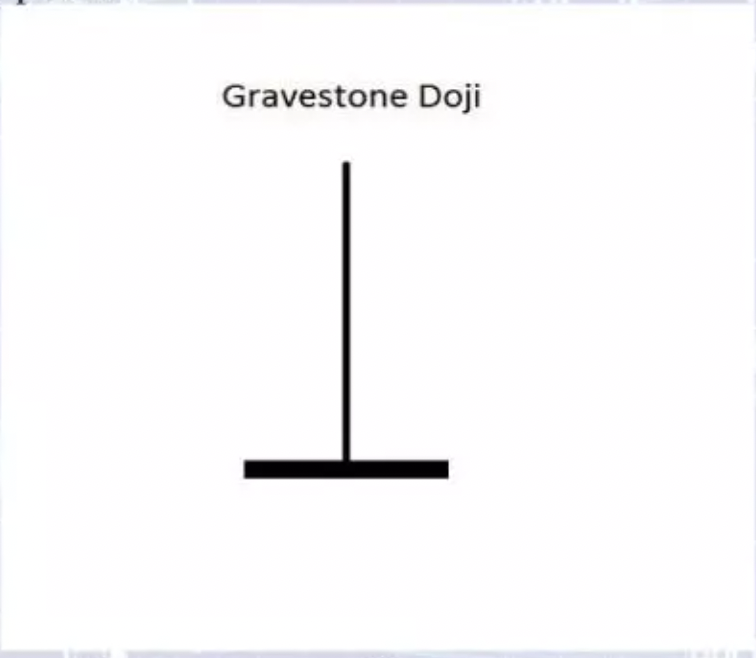

Gravestone Doji

A Gravestone Doji represents an inverted T-formed candlepower unit, using the open and shut coinciding using the low. The candlepower unit signifies the buyers tried to boost the cost but tend to not sustain the bullish momentum.

Once the Gravestone Doji seems within an upward trend. it may be considered a reversal pattern. However, its occurrence inside a downtrend shows a possible upside retracement.

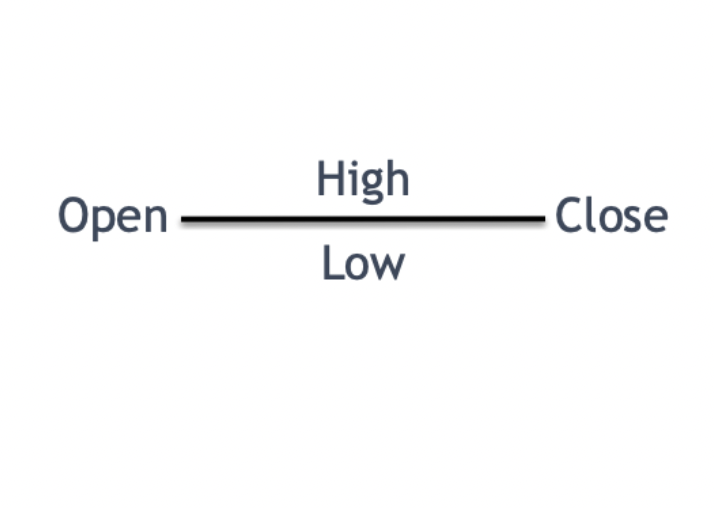

Four Cost Doji

The 4 Cost Doji is really a pattern that rarely seems on the candlepower unit chart with the exception of low-volume conditions or very short periods. Particularly, it appears as though a minus sign, suggesting that four cost indicators (open, close, everywhere) are in exactly the same level more than a given period.

Quite simply, the marketplace didn’t move throughout the period taught in candlepower unit. This kind of Doji isn’t a reliable pattern and could be overlooked. It simply shows a minute of indecision on the market.

How reliable may be the Doji candle pattern?

The Doji candlepower unit pattern might not supply the most powerful purchase or sell signals in technical analysis, and really should be used alongside other metrics. Nonetheless, it’s a helpful market signal to think about when gauging the quality of indecisiveness between consumers.

Creating a buying and selling strategy according to Doji candle patterns is most effective for skilled intermediate or professional traders who are able to easily identify and precisely interprthe given signals.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.