A golden mix pattern around the charts excites crypto traders because of its promises of lucrative possibilities ahead, largely because of its impressive rate of success in traditional markets.

The golden mix has a tendency to preceded sustained uptrends in comparison using the bearish dying mix pattern. For example, since 1970, the S&P 500 has been coming back about 15% gains typically in under annually following a golden cross’s occurrence.

The golden cross’s record within the benchmark crypto asset Bitcoin (BTC) is similarly impressive. Particularly, the indicator has made an appearance seven occasions on Bitcoin daily charts since 2010, of that five have brought to massive bull runs.

Exactly what is a golden mix pattern?

Before discussing the golden mix, let us discuss its core component referred to as moving averages (MA).

A moving average records the typical alternation in an asset’s cost more than a specific period. In past statistics, they’re measured after adding some prices (recorded in a fixed time-frame for example hourly, four-hour, daily, weekly, monthly, etc.) — by dividing the sum by the amount of prices within the set.

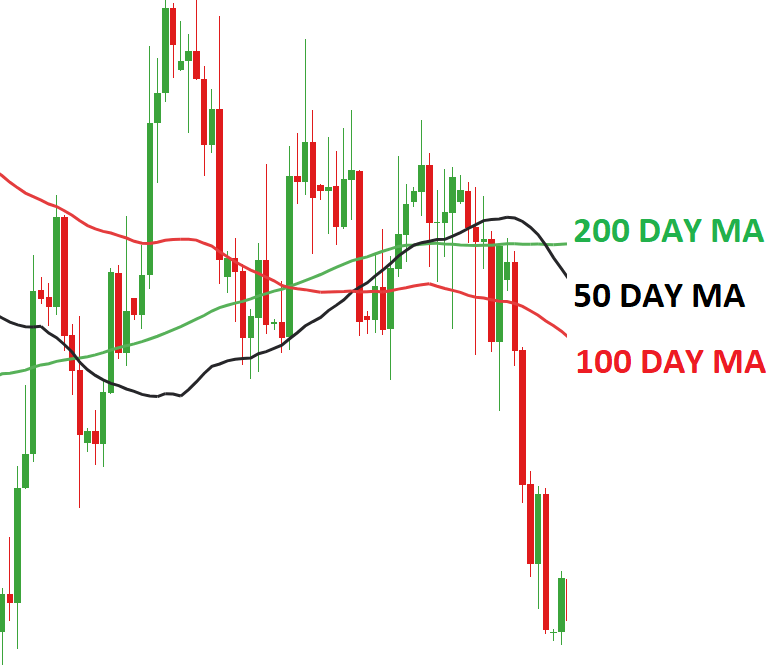

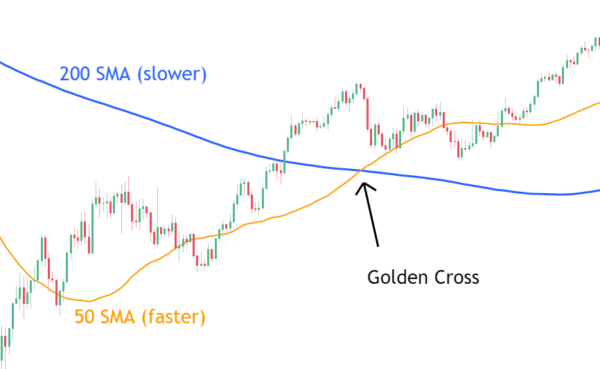

Typically, golden mix watchers concentrate on two specific moving averages: the 50-day moving average, which becomes rapid-term MA, and also the 200-day MA because the lengthy-term moving average.

A golden mix pattern forms once the short-term MA crosses over the lengthy-term MA. Quite simply, the pattern implies that buying curiosity about a specific market has risen within the previous 50 days, when compared to previous 200 days.

So how exactly does a golden mix work?

Golden crosses typically precede significant cost rallies across traditional and crypto markets, grounds why traders see them as buy signals.

But there has been cases where golden crosses happen to be adopted by fake breakouts. Therefore, you ought to think about the golden mix pattern alongside other technical indicators before making the decision.

To begin with, traders can employ the relative strength index (RSI), a momentum oscillator that determines an asset’s overbought and oversold conditions, to calculate potential cost pullbacks.

Related: Exactly what is a Doji candle pattern and the way to do business with it?

In Feb 2020, this tactic might have helped many traders avoid much deeper losses. Let us understand why.

On February. 1, 2020, Bitcoin’s 50- and 200-day MA created a golden mix if this traded for approximately $9,500. A modest excitement adopted, and also the cost moved up to $10,500 within the next two days. The time also saw Bitcoin’s daily RSI go above its overbought threshold of 70.

Bitcoin’s overbought conditions led to a decline toward its 50- and 200-day MA (the $8,500-$9,200 range). Nevertheless its cost eventually collapsed below $4,000 entering March, consistent with a worldwide market meltdown brought by the start of the Covid-19 pandemic.

The situation study explains that golden crosses aren’t 100% accurate in predicting future trends. Rather, they might just assist traders and analysts by using momentum indicators in addition to fundamentals to forecast cost actions within the short and lengthy term.

These momentum indicators could include Moving Average Convergence Divergence (MACD), Stochastic RSI, Rate of Change (ROC), Average Directional Index (ADI), yet others.

Quite simply, traders are advised to not buy too soon right into a golden mix formation. Rather, they might wait for a cost to consolidate sideways or lower and discover short-term support before choosing to enter a trade.

You can also alter the phrase a golden mix in volatile market conditions by altering moving averages.

For example, while using 20-period MA for that short-term MA and also the 50-period MA for t lengthy-term MA. The 20-50-day MA combination has in the past helped traders determine short-term crypto market trends, as proven below within the March 2020-November 2021 bull run.

Golden crosses don’t mean guaranteed gains

While golden crosses frequently do indeed appear before major cost rallies in Bitcoin and cryptocurrency markets, the chance of bulls falling right into a trap remains.

Ultimately, traders ought to be careful with crossover signals, as blindly following them might lead to losses. As discussed above, false signals can happen and you need to confirm any golden mix with a lot more technical indicators prior to making any trades.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.