Bitcoin cost expires on 12 ,. 13, along with a market-wide rally in crypto prices has some investors hopeful the intra-day high at $18,105 is an indication that BTC has bottomed.

A principal catalyst for that rally seems is the Consumer Cost Index report which demonstrated energy decreasing by 1.6%, which needs to be welcomed news for battling Bitcoin miners. Using the overall CPI report showing easing inflation at 7.1% in comparison to the formerly expected 7.3%, equities traders are reacting by driving prices greater.

The stock exchange can also be flashing eco-friendly, using the Dow jones showing a 600-point increase and also the S&P 500 registering one hundred-point gain. Reported by Cointelegraph, Bitcoin’s cost action remains carefully correlated to U.S. equities and today’s rally isn’t any exception towards the trend.

Listed here are a couple of explanations why Bitcoin cost expires today.

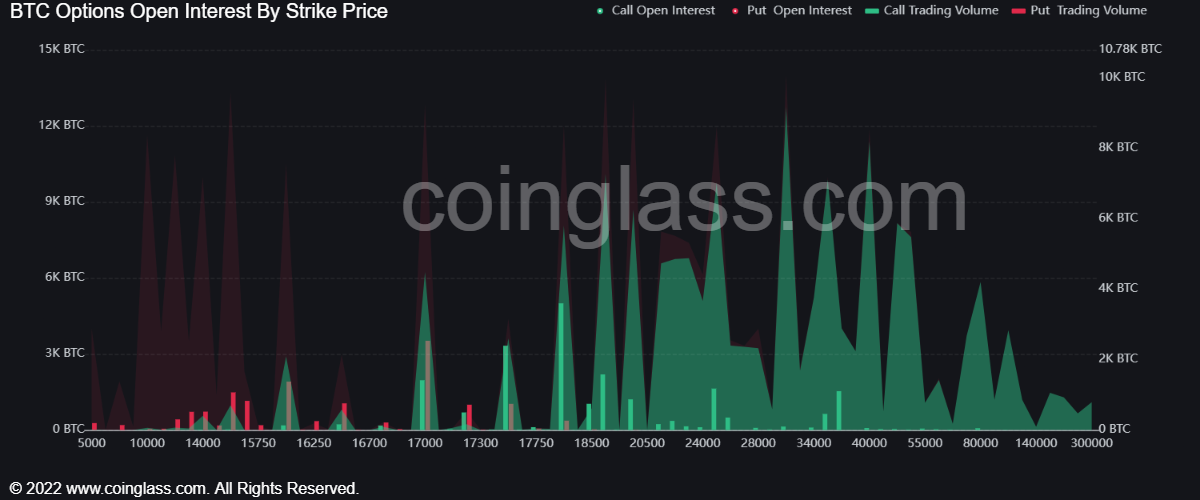

Bitcoin open interest remains tilted toward short traders

Since Bitcoin cost crashed under $16,000 on November. 22, outdoors interest on BTC futures contracts continues to be surging. Sharp cost moves in Bitcoin cost might trigger another liquidation event, but it’s hard to see whether the move is always to the upside or downside.

If inflation has peaked, there’s the potential of the Fed pivoting from growing rates of interest. Many traders agree when the Fed would pivot on its current policy of quantitative tightening and rate of interest hikes, BTC cost could surge towards the upside and liquidate a substantial area of the short curiosity about futures contracts.

The FTX implosion was adopted with a wave of liquidations which sent Bitcoin cost toward an annual low at $15,476. Historic data implies that $549 million in mix-crypto longs were liquidated on November. 7, delivering the Bitcoin cost below $16,000.

Inversely, short liquidations directly help push Bitcoin cost greater by forcing automated buy pressure. On 12 ,. 12, $93 million in shorts were liquidated which might help boost Bitcoin cost.

The Government Reserve’s Federal Open Market Committee (FOMC) begins meeting on 12 ,. 13 having a decision on rates of interest expected the very next day. The positive CPI results will change up the FOMC decision and may put major pressure on open shorts.

Longer-term information is in Bitcoin’s favor, based on market analysts

Investors’ confidence within the crypto market may be rising because of their thought that the U . s . States Fed could unveil smaller sized-sized rate of interest hikes within the next two several weeks and throughout 2023 because of positive CPI figures.

Within the Fed’s statement, the potential of an insurance policy shift remains open and associated with inflation:

“In to achieve a stance of financial policy that’s sufficiently restrictive to come back inflation to two percent with time. In figuring out the interest rate of future increases within the target range, the Committee will look at the cumulative tightening of financial policy, the lags that financial policy affects business activities and inflation, and economic and financial developments.”

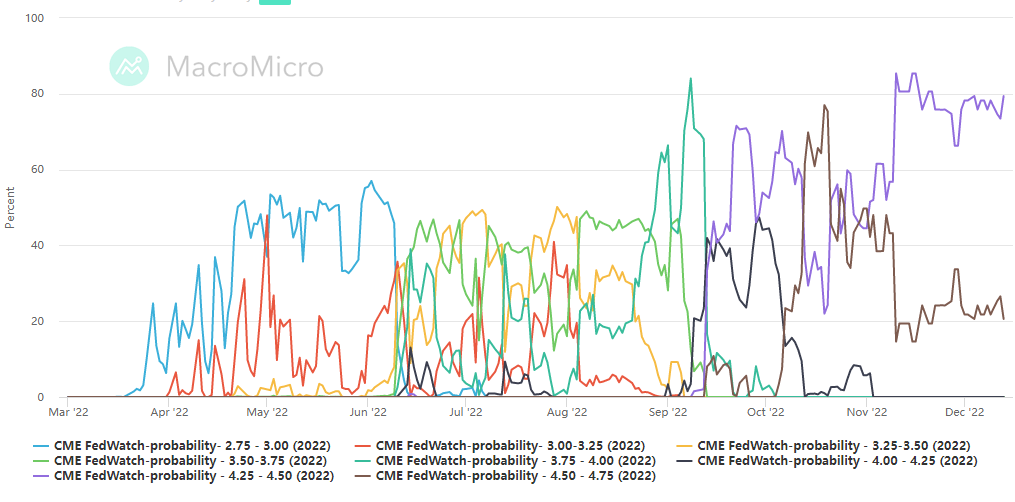

Based on MacroMicro, a strong that publishes investors’ consensus estimates on expected alterations in rates of interest, implies that rates of interest might be less than formerly anticipated soon.

The graph points to the slowdown within the rate of interest hikes. The general public sentiment implies that future rates may fall and investors think that it has produced the chance for any broad crypto market recovery.

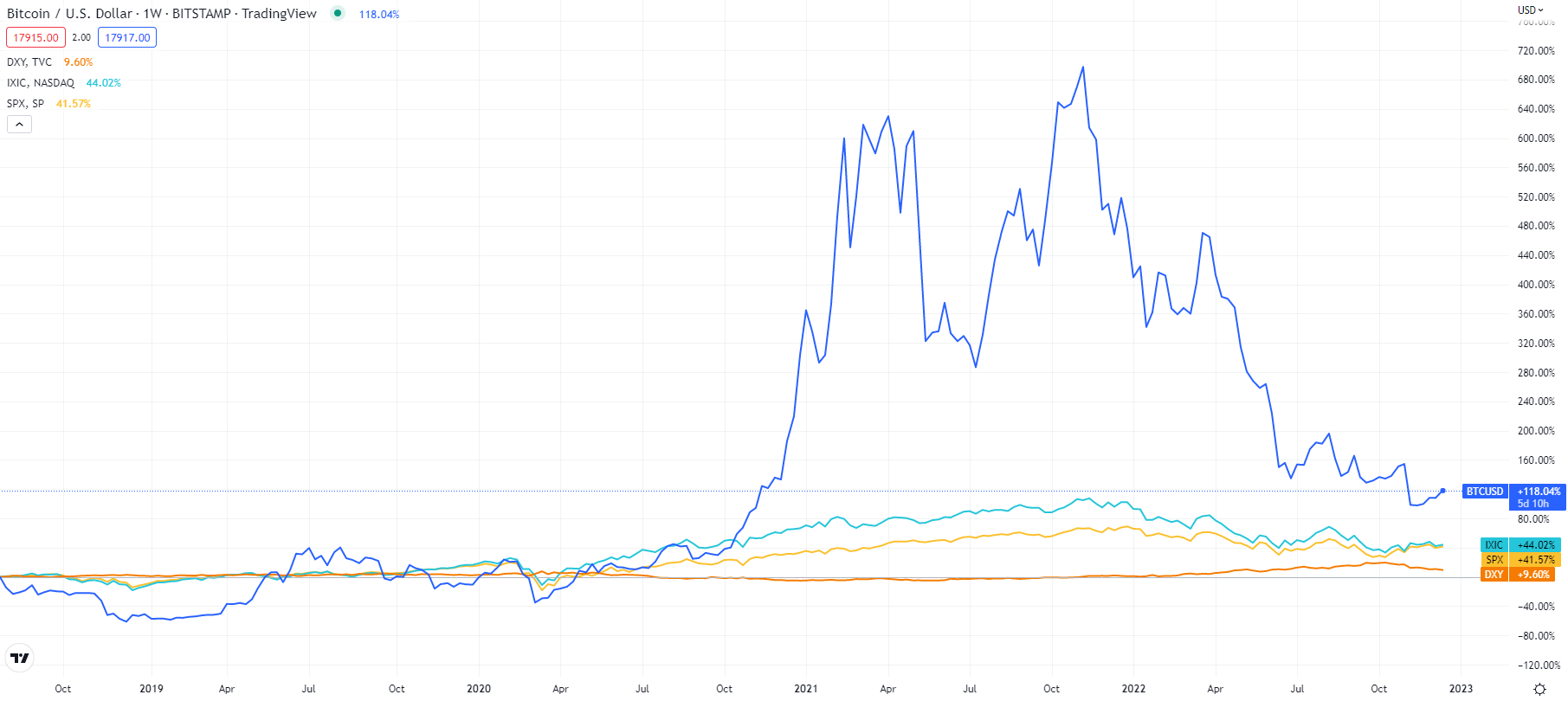

The S&P 500 and also the Nasdaq give a general overview for that economy generally. Presently, Bitcoin, the Nasdaq and also the S&P 500 share a higher correlation coefficient.

If rates of interest ease and also the economy grows, Bitcoin could continue the development course if your similar rally would occur in equities markets. The greater the macro climate, the greater for Bitcoin cost.

Related: Bitcoin sees CPI volatility as lower inflation transmits BTC cost to $18K

While Bitcoin cost is showing some bullish momentum within the short-term following the CPI report, the bigger challenges of centralized exchange insolvencies, contagion stemming from recent bankruptcies, reduced inflow and liquidity within the crypto market and also the threat presented by Grayscale’s growing GBTC discount.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.