The crypto marketplace is up today and Bitcoin (BTC), Ether (ETH) and various altcoins rallied in front of U . s . States Fed Chairman Jerome Powell’s speech. Right now, investors are anticipating that December often see the beginning of smaller sized-sized rate of interest hikes after the newest Consumer Cost Index report arrived under market participants’ expectations.

Crypto and equities markets responded positively in front of Powell’s Federal Open Market Committee (FOMC) speech and cooling inflation figures could back the reason behind softer rate hikes. With respect to the subject material and tone of Powell’s speech, markets often see further upside, or perhaps a total retrace from the intraday gains could occur.

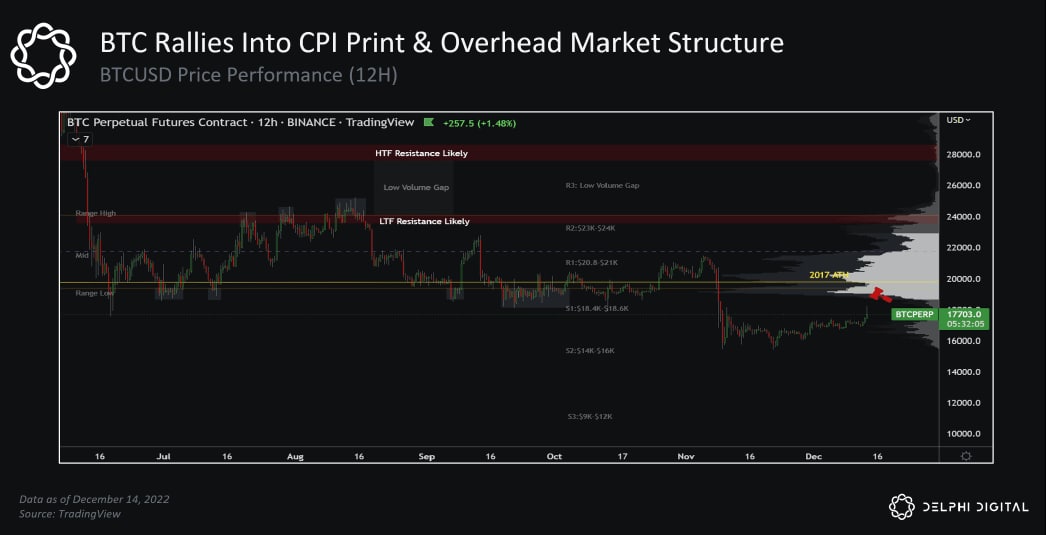

Generally, the crypto marketplace is still considerably lower all-time highs, but Bitcoin’s cost reacted positively by rallying to at least one-month high at $18,147 on 12 ,. 14. Regardless of the gains, many traders continue to be warning of the final capitulation in BTC cost.

With volatility still likely, some analysts believe the underside continues to be not in for that crypto market and BTC on-chain losses hit record highs in 2022. On the other hand, with the capitulations, some Bitcoin analysts believe the present market valuation is really a buy signal.

The image for 2023 remains muddy with growing centralized exchange (CEX) fears and also the potential of approaching rules getting an anti-crypto bent., One factor investors are wishing for is the fact that a cooling dollar (DXY), reductions within the inflation rate and smaller sized-sized rate hikes mean more curiosity about risk assets like BTC and Ether. Let’s examine three from the major factors influencing crypto market strength at the time.

FOMC takes center stage after CPI print suggests reduced inflation

High inflation is a year-lengthy problem and back-to-back negative CPI reports have provided the Given multiple good reasons to continue raising rates. Following the CPI data boosted Bitcoin upward over $18,000 on 12 ,. 13, further positive data might have confirmed that inflation peaked before Powell’s speech.

If inflation would level off, Powell recommended smaller sized hikes in subsequent several weeks may likely lead to boosted sentiment from market participants.

In the Brookings Institute speech on November. 30, Powell noted:

“It is sensible to moderate the interest rate in our rate increases approaching the amount of restraint that’ll be sufficient to create inflation lower. Time for moderating the interest rate of rate increases will come when the December meeting.”

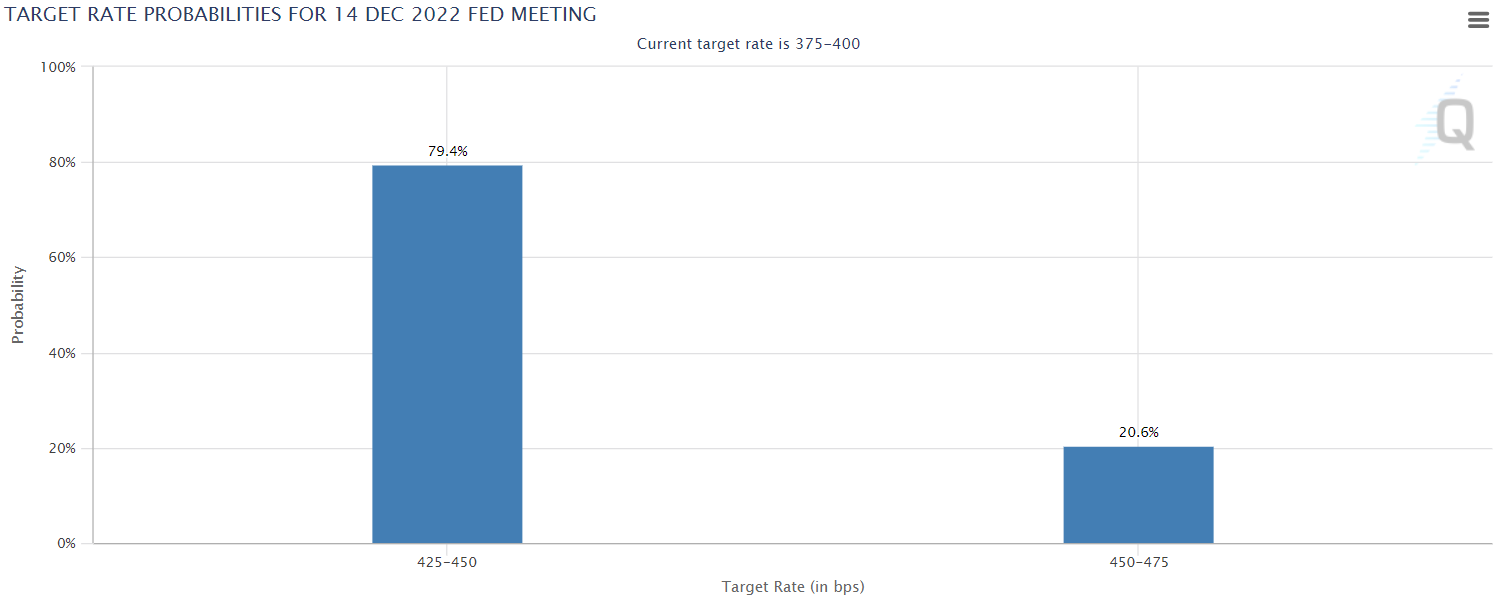

December’s Federal Open Market Committee (FOMC) is presently expected to yield a hike of 25 to 50 basis points, and not the usual 75 basis points, based on CME Group’s FedWatch Tool.

Powell has cautioned that aggressive financial policy may continue before the 2% target inflation rates are arrived at:

“Despite some promising developments, there exists a lengthy approach to take in restoring cost stability”

Analysts and traders analysts celebrate the “positive” CPI news

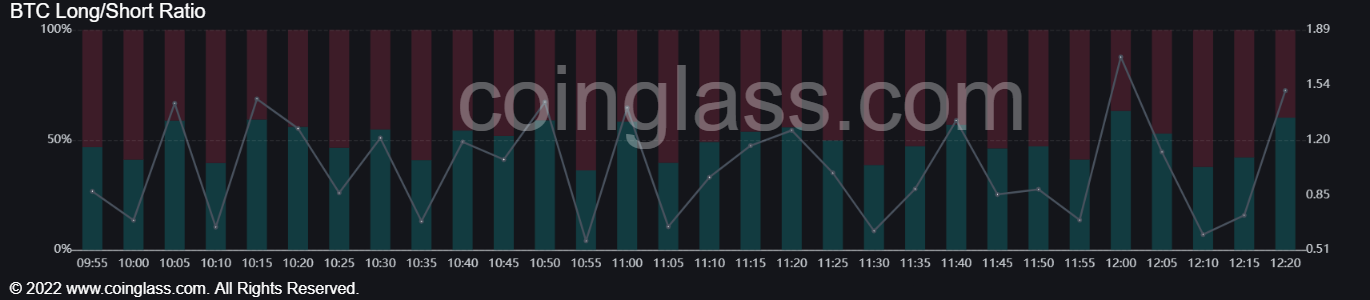

While Bitcoin continues to have risk occasions that may change up the cost, BTC futures are showing traders switch from majority short to lengthy. Based on Coinglass, 60.16% of traders are lengthy Bitcoin in a ratio of just one.51 when compared with BTC shorts.

The marketplace is also trending lengthy for Ether. Based on Coinglass, 56.17% of traders are lengthy Ethereum in a ratio of just one.28 when compared with Ether shorts.

Charles Edwards, the founding father of crypto asset management firm Capriole Investments is very bullish around the approaching FOMC news.

Inflation has peaked. Alternation in money supply is negative for brand spanking new in over fifty years. Pivot coming. pic.twitter.com/Y7ZUBjTjoi

— Charles Edwards (@caprioleio) December 14, 2022

Related: Ethereum rallies to $1,350, but derivatives metrics remain neutral to bearish

Today’s Bitcoin gains still put BTC underneath the 5-month buying and selling range. When the FOMC results in a Bitcoin upswing, Delphi Digital believes the cost will still encounter resistance within the $18,400 to $18,600 range.

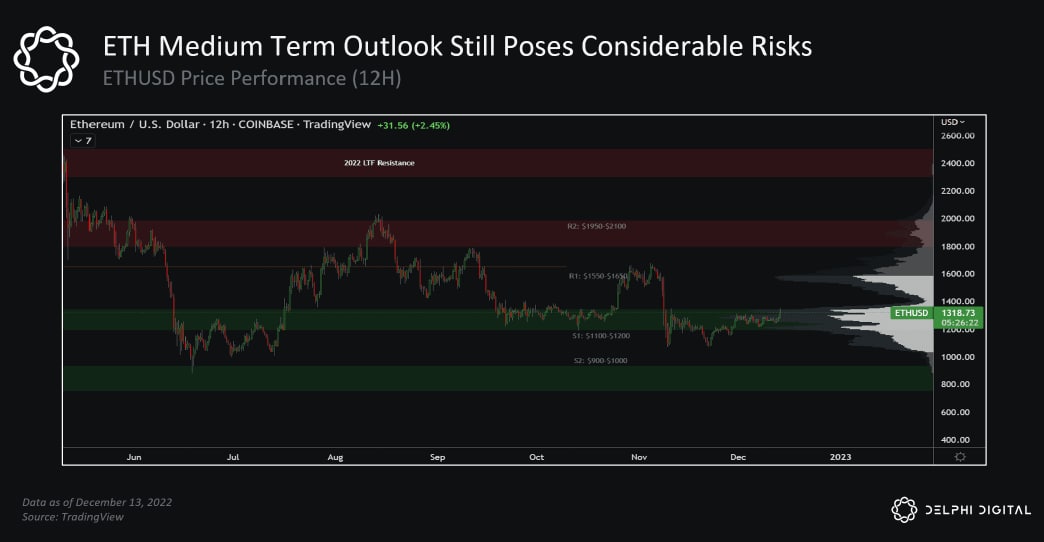

Based on Delphi Digital, the Ethereum network acquired volume within the wake of FTX collapse and it has faired much better than Bitcoin with Ether cost still not revisting the height yearly lows observed in June.

Additionally to potentially positive FOMC news, on 12 ,. 14 Ether seemed to be declared an investment through the Commodity Futures Buying and selling Commission, that could be positively impacting the cost.

While Bitcoin and Ethereum cost has been influenced by the endless flow of negative news, today’s rally shows a flash of bullish sentiment.

The dollar is constantly on the awesome off

Following a parabolic upward trend throughout 2022, the U.S. dollar index has become starting to show indications of cool down.

The U.S. dollar index (DXY) lately hit its greatest levels since 2002, and momentum might have cooled following the recent CPI and PPI print demonstrated the Given making some progress with run-away inflation. Inside a perfect world, investors would ideally notice a retracting DXY like a need to increase sentiment for risk assets like cryptocurrencies.

Meanwhile, DXY is pressurized and it is descent arrived lockstep having a go back to form for Bitcoin and altcoins. In the past, a cooling DXY is adopted by Bitcoin cost relocating the alternative direction.

Overall, crypto markets will probably continue seeing cost whipsaws and many analysts agree that there are many volatile days ahead. As the positive news of easing inflation in front of the FOMC is supplying a pleasant short-term bump in crypto prices, the market’s response to Powell’s concluding decision on 12 ,. 14 would be the true determinant which direction the marketplace decides to take.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, and you ought to conduct your personal research when making the decision.