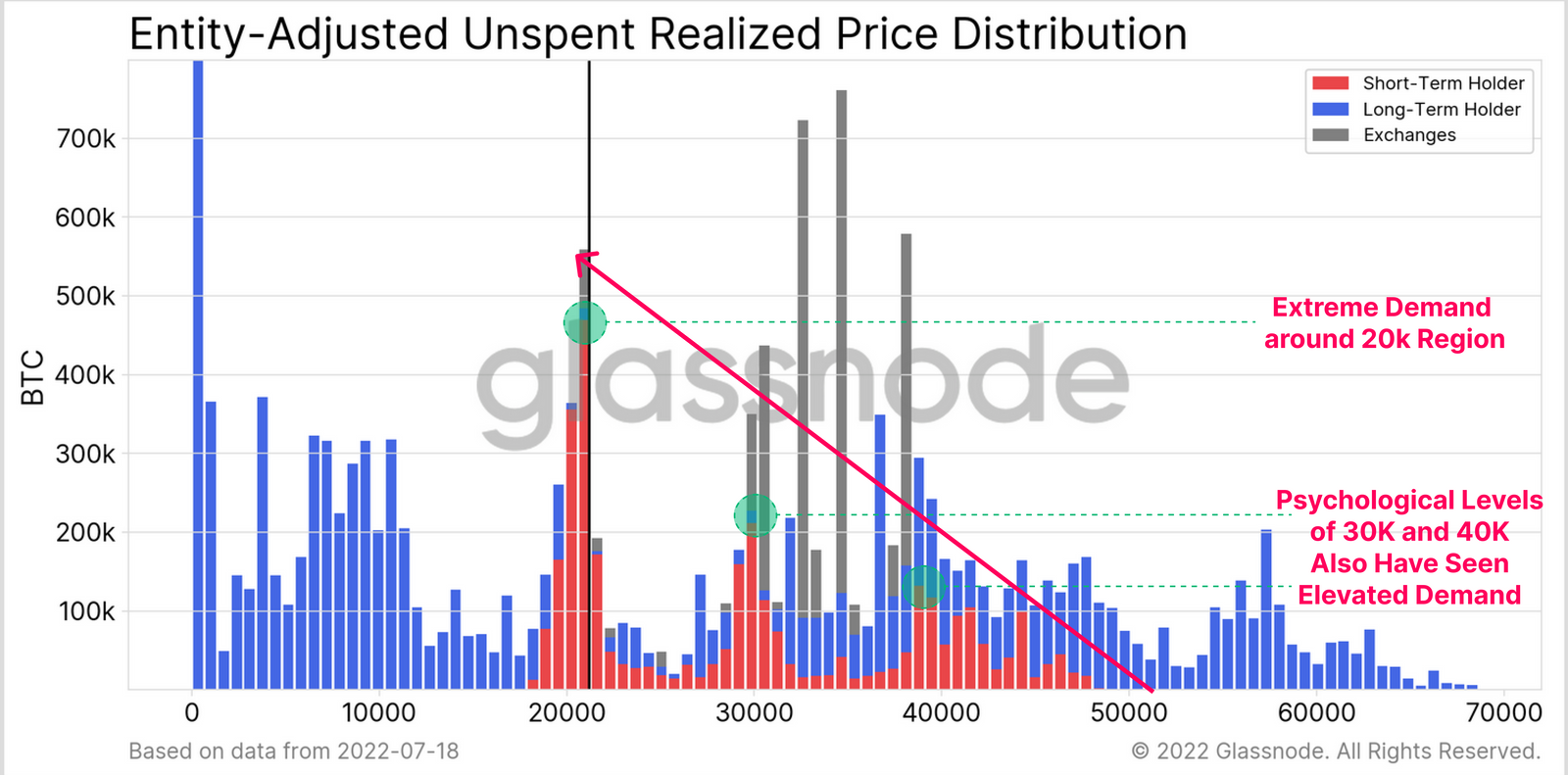

“Extreme” demand in the $20,000 cost point for Bitcoin (BTC) seems to possess forced the coins into the hands of investors who care less about cost while developing a new recognized cost level.

Within the latest A Few Days OnChain E-newsletter printed on Monday, Glassnode’s UkuriaOC pointed to “extreme demand” round the $20,000 region, noting that every mental cost level from $40,000 to $30,000 to $20,000 results in a new number of short-term holders (STHs).

The Glassnode analyst noted much from the supply that new STHs bought in that drawdown is not offered despite the fact that costs are considerably lower. This can be because of less cost-sensitive buyers or individuals who care much more about Bitcoin fundamentals than investment gains, driving demand.

Between late April through June, the BTC cost has fallen 55% from $40,000 to some low of approximately $18,100, according to CoinGecko.

Glassnode authored this suggests the recently-minted STHs are cost insensitive buyers with increased confidence in Bitcoin, adding their conversion from the STH to some lengthy-term holder (LTH), who is not purchased not less than 155 days, is needed confirm this:

“It could be constructive to determine these STH held coins in the $40k-$50K level begin to mature to LTH status over coming days, assisting to bolster this argument.”

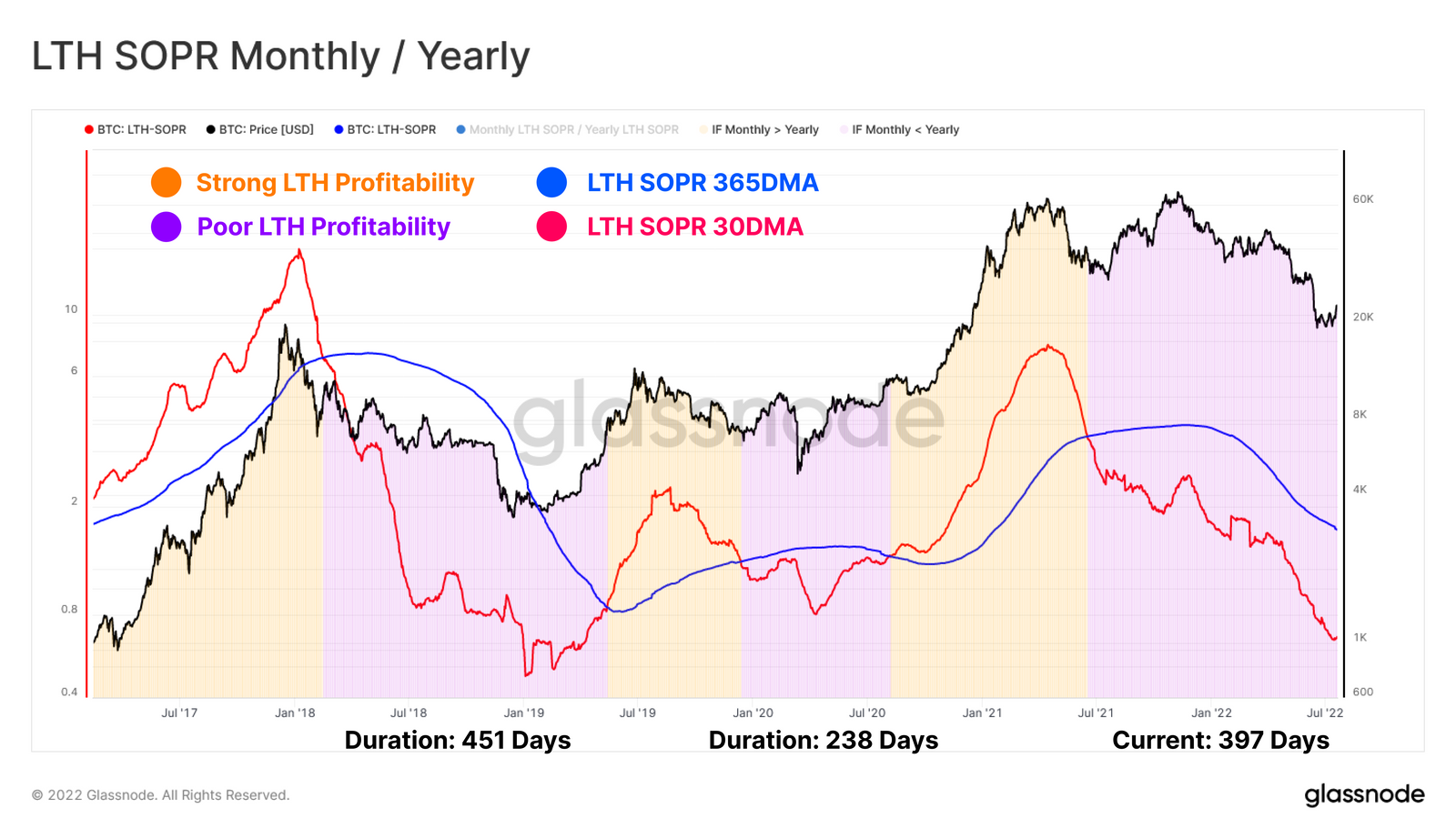

Within this current bear market, confirmed LTHs have kept in nearly 400 days straight of yearly profitability, performing much better than 30-day profitability.

This really is nearly exactly the same duration that LTHs experienced throughout the 2018 bear market. Glassnode authored this suggests losses are now being kept in by LTHs which, when the previous argument holds, implies that the brand new buyers tight on cost sensitivity compared to cohort who offered, meaning they might end up being the newest number of LTHs.

Another reason for note within the report is the fact that “unprecedented forced selling” from crypto companies among mass liquidations and bankruptcies produced conditions ripe for any relief pump.

Related: The fight between crypto bulls and bears shows hope for future years

The report concludes by proclaiming that as the “worst from the capitulation might be over,” BTC could stay in this low range for a while because the cost grounds for new gold coin buyers has diverged underneath the recognized cost for just about 17 days straight. Previous bear cycles have suffered low divergences between 248 and 575 days.

BTC has retreated 3.1% in the last 24 hrs to trade at $21,146 during the time of writing.