Bitcoin (BTC) came back to $30,500 on May 17 among hopes that the retest of 2017 highs might be prevented.

$20,000 retest ‘highly unlikely’

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD climbing following the daily near to tentatively develop $30,000.

Still, inside a multi-day range, the happy couple was yet to select a significant upward or downward trajectory, while volatility ebbed in to the new week.

Among concerns that the major retracement might take it below last week’s ten-month lows, popular analyst Credible Crypto offered a far more positive alternative. According to historic norms, he contended on Twitter, Bitcoin had little impetus to retest $20,000 or lower.

“The argument for 13K-14K $BTC around the premise that past major bear markets have brought to 80% declines in the top constitutes a major assumption- that 65k was the cycle top,” he authored.

“It’s exactly the same assumption people made at 30k in June ‘21 before we rallied to a different ATH of 65K 3 several weeks later.”

As Cointelegraph reported, contingency plans seem to be in position already for this kind of event, with MicroStrategy — the organization using the largest corporate BTC treasury — even ready to buy up supply to stem the autumn.

Requested whether BTC/USD could repeat the retracement from the 2019 highs near $14,000 towards the $3,600 floor throughout the March 2020 COVID-19 crash, Credible Crypto only agreed to be as skeptical.

“Not expecting that. Is it feasible? Yes, but because I’ve stated formerly a retest of prior cycle highs hasn’t happened before- and so i think it is highly unlikely,” he responded.

For Cointelegraph contributor Michaël van de Poppe, it had been an issue from the U.S. dollar cooling its bull run versus other fiat currencies to be able to give risk assets some breathing space.

The U.S. dollar index (DXY), he forecast, may come lower from the twenty-year highs of 105 points.

“Basically consider the current condition from the $DXY, I believe we’ll follow-through with this particular scenario. Presuming i will be seeing some corrective move, the highs happen to be taken for liquidity. Losing 103.7 points and i believe we’ll have more downwards pressure here -> risk-on assets up,” he tweeted on May 16.

Sentiment echoes March 2020 aftermath

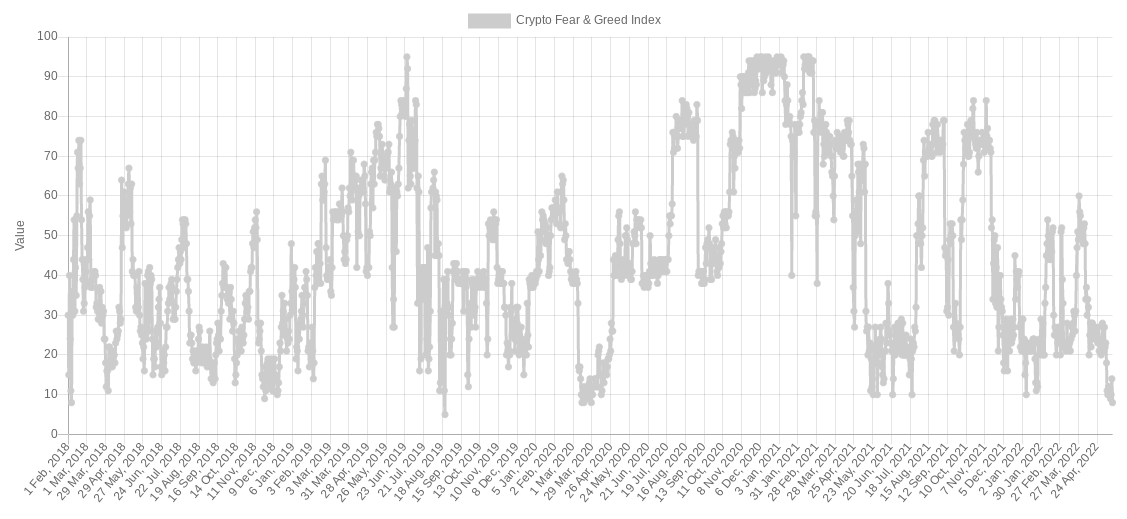

Market sentiment data meanwhile reflected most consensus across crypto — that anything could now happen, with bias firmly skewed towards the downside.

Related: First 7-week losing streak ever ― 5 items to know in Bitcoin now

The Crypto Fear & Avarice Index, a mix-market sentiment gauge, hit 8/100 on May 17, its cheapest value since March 28, 2020 — two days following the Coronavirus lockdown-caused meltdown.

Then, as now, BTC/USD had been dealing with its lows. At $30,500, the happy couple was up 28% in the week prior.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.