Bitcoin (BTC) enters a brand new week in an instant after sealing its greatest weekly close since mid-June — can the great occasions continue?

Following a volatile weekend, BTC/USD were able to restrict losses in to the later area of the weekend to make a solid eco-friendly candle on weekly timeframes.

With what could shape up is the last “quiet” week from the summer time, bulls have time available even without the major macro market motorists relating to the U . s . States Fed.

Fundamentals remain strong on Bitcoin, which is a result of a rise in its mining difficulty for that second time consecutively within the future.

On derivatives markets, encouraging signs will also be present, with greater cost levels supported by bullish data over sentiment.

The issue for hodlers now’s thus how robust the rally is and whether it’s exactly that: a bullish countermove inside a broader bear market.

Cointelegraph presents five factors which might influence cost now which help choose Bitcoin’s next steps.

Bitcoin embraces volatility after multi-week high close

Around $24,300, the August. 14 weekly close was the very best in 2 several weeks for BTC/USD.

The weekly chart shows a stable grind upwards ongoing to consider shape following the June lows, and last week’s candle totaled around $1,100 or 4.8%.

A remarkable move by 2022, increases sparked some volatility overnight in to the first Wall Street buying and selling day, BTC/USD ongoing hitting $25,200 on exchanges before reversing noticeably underneath the weekly close level.

Such moves characterized recent days, resulting in little surprise for traders who still act very carefully on shorter timeframes.

“A new week begins, using the bears walking in to date to retest some key levels,” popular buying and selling account Crypto Tony summarized partly of his latest Twitter at the time:

“Once again, we ought to see a fascinating week with cost action. Been all around the shop around the lower periods.”

Should unpredictability continue to come, the likelihood of a downmove are obvious, based on on-chain monitoring resource Material Indicators.

Following a close, the weekly chart started signaling “downward momentum,” it cautioned, while daily timeframes were “flat” according to its proprietary buying and selling tools.

Its creator, Material Researcher, described now because the “final week from the bear rally” in the own comments.

Still entertaining a significantly much deeper correction — possibly unsurprisingly — was gold bug Peter Schiff, who maintained that $10,000 was still being around the cards.

Simply to place the #Bitcoin rally into perspective, check out this chart. The pattern remains very bearish. There’s both a dual top along with a mind and shoulders top. There is a rising wedge developing underneath the neckline. At least support is going to be tested below $10K. Watch out below! pic.twitter.com/OHNhwsgxxs

— Peter Schiff (@PeterSchiff) August 14, 2022

On the longer-term basis, however, fellow trader and analyst Rekt Capital was calm on BTC cost action.

A place cost below $25,000, he stated, should be employed to dollar cost average (DCA) into Bitcoin — buying a set fee per period of time — before the next block subsidy halving event in 2024.

“To flourish in Crypto, you’ll need a dollar-cost averaging strategy, an investing thesis, an image, & persistence,” he told Twitter supporters over the past weekend:

“My DCA technique is anything sub $25000. My thesis is dependant on the 2024 Halving event Vision is seeing Bull peak a ~year publish-Halving. Now I’m just patient.”

Macro remains on the “knife edge”

After last week’s U . s . States inflation print, the approaching five buying and selling days look comparatively calm from the macro perspective.

The Given is quiet, departing only unpredicted occasions in Europe or Asia to affect market performance.

The probability of crypto ongoing knee-jerk reactions to macro triggers beyond inflation would be able to be less than many think, however, based on a very common analyst.

Inside a fresh market update for his buying and selling suite, DecenTrader Filbfilb eyed decreasing correlation between BTC and just what he known as “legacy markets” more broadly.

“Bitcoin was carrying out a high correlation with legacy markets as proven below using the S&P500 in white-colored and NASDAQ in blue, however since reaching the newest bottom, all the downside around the legacy markets continues to be obtained and Bitcoin has unsuccessful to follow along with suit,” he authored alongside a comparative chart.

Since June’s $17,600 lows, Bitcoin hasn’t actually rallied as strongly since it’s prior correlation would dictate, Filbfilb added, quarrelling that place cost ought to be above $30,000.

The main reason is based on the Terra and Celsius debacles, supplying something of the perfect storm if drawn in tandem with concerns over inflation and also the Fed’s response to it.

“What hasn’t altered, is Bitcoin’s tendency to become subject to the Fed’s policy to combat the inflation. Much better than anticipated inflation data on Wednesday being the newest example, which let Bitcoin have a leap north, alongside equities,” the update ongoing:

“Moving forwards, the CPI data and following financial policy decisions are likely to continue being vital in figuring out what goes on next.”

Geopolitical factors such as the Russia-Ukraine conflict, tensions over Taiwan and also the looming European energy crisis provide further risks. The macro market situation, Filbfilb concluded, therefore remains on the “knife edge.”

Bucking the popularity at the time, meanwhile, is news from China, which enacted easy rate cut on disappointing economic data.

“July’s economic information is very alarming,” Raymond Yeung, Greater China economist at Australia & Nz Banking Group Limited, told Bloomberg in reaction:

“Authorities have to generate a full-fledged support from property to Covid policy to be able to arrest further economic decline.”

Lex Moskovski, Chief executive officer of Moskovski Capital, meanwhile, forecasted that all central banks would finish up lowering, not raising, rates of interest:

“They all will pivot,” he reacted.

Funding rates healthy despite go to $25,000

Considering the outcome of current place cost action on buying and selling habits, meanwhile, it seems that conditions can always favor further upside.

Analyzing derivatives markets, Philip Quick, a builder at DecenTrader and founding father of data resource Consider Bitcoin, highlighted negative funding rates.

Indicating growing conviction among traders that bad thing is due, moderate negative minute rates are, actually, frequently the building blocks for more gains. It is because the marketplace expects downside and doesn’t excessively bet on gains materializing, permitting short positions to become “squeezed” by smarter money.

Bitcoin, together with crypto markets generally, includes a practice of doing the precise complete opposite of what is anticipated through the majority.

“Interesting to determine Funding Rate dip negative at occasions about this recent grind up for $BTC,” Quick commented, uploading a chart showing cost behavior during similar setups previously:

“Note how cost has pumped after each occasion.”

Meanwhile, data from analytics resource Coinglass demonstrated the level of negative funding in accordance with the days following the June place cost lows.

Difficulty due another straight increase

For Bitcoin network fundamentals, meanwhile, it’s a situation of slow recovery as opposed to a race greater.

The most recent data from statistics resource BTC.com shows miners progressively coming back to historic amounts of activity.

Difficulty, after several weeks of decline, is placed to improve for that second time consecutively in the approaching automated readjustment now.

While modest, the forecast .9% increase implies that competition among miners is nevertheless growing which greater costs are cathartic as to the is a highly pressured area of the Bitcoin ecosystem this season.

Simultaneously, hash rate estimates — a manifestation from the processing power focused on mining — remain flat below 200 exahashes per second (EH/s).

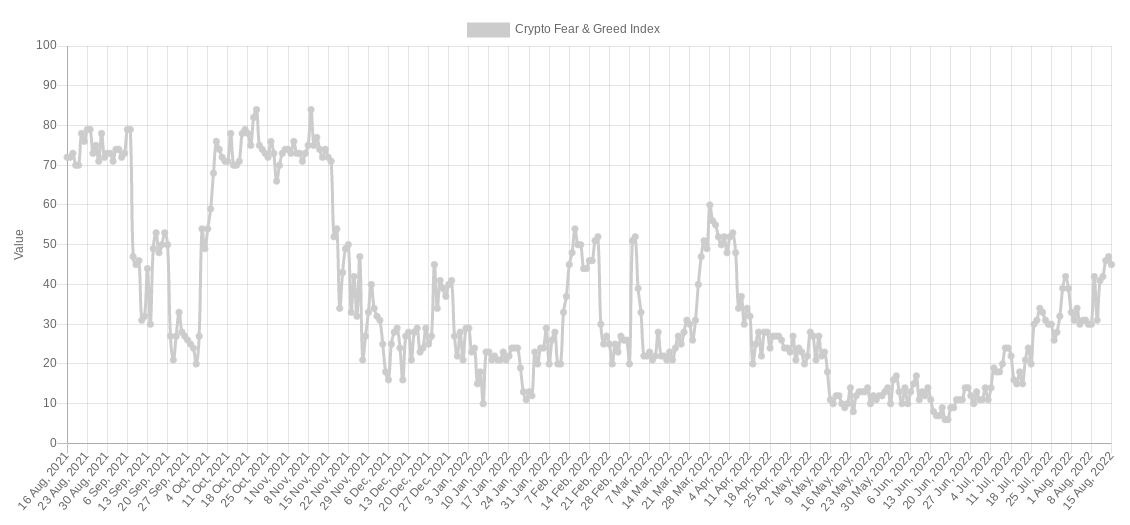

4-month highs for Crypto Fear & Avarice Index

A 2-month high for Bitcoin place cost action might be nice to check out, but it’s only some of the part of the market clawing back some serious lost ground now.

Related: 5 Best cryptocurrencies to look at now: BTC, ADA, UNI, LINK, CHZ

Based on the sentiment gauge the Crypto Fear & Avarice Index, there’s less “fear” among crypto market participants than at any time since early April.

The most recent data shows the Index, which results in a normalized score from the basket of mood factors, has retraced all of the losses engendered through the Terra blowout and beyond.

Over the past weekend, that score hit 47/100, its best since April 6, declining to 45/100 at the time.

Although this matches “fear” to be the overriding market pressure, the amount is far in the depths of “extreme fear” which lingered for any record time period in 2022. The Index’s lows this season were in mid-June, which printed a score of just 6/100.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.