Bitcoin (BTC) preserved $20,000 for an additional day on June 23 with requires another 20% drop still surfacing.

Bitcoin under $10,000 not possible

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD varying just over the $20,000 mark within the 24 hrs towards the duration of writing.

As always, the behaviour reflected moves in U . s . States equities markets, which remained flat at the time.

Remarks by Fed chair Jerome Powell had provided only brief volatility. Cointelegraph noted that Powell’s Congress testimony provided no new specifics of macro policy.

As a result, crypto commentators stuck to previous assertions — the outlook was uncertain, they stated, however a potential fresh drawdown may involve a vacation to $16,000.

“Consolidating $BTC inside a wide range after which rising. MDD (maximum drawdown) isn’t that big like -20%,” Ki Youthful Ju, Chief executive officer of on-chain analytics platform CryptoQuant, authored partly of the Twitter publish.

Ki retweeted analysis from popular account Il Capo of Crypto, whose BTC takes had lengthy known as for cost downside.

Inside a separate publish, Ki claimed that “most Bitcoin cyclic indicators say the underside” is within, which shorting BTC at current levels was therefore ill-advised.

“Unsure how lengthy it might require consolidation within this range tho. Opening a large short position here sounds not recommended unless of course you believe $BTC will zero,” he authored.

For monitoring resource Material Indicators, however, there is induce to become more risk averse.

“At this time, nobody can tell with certainty whether BTC holds this range or maybe it’ll visit sub $10K cost levels again, but it might be foolish to not have an agenda for your possibility,” a tweet contended.

“‘Never’ does not age well in crypto. Plan accordingly.”

Given doesn’t intend to “de-COVID” balance sheet

In fresh macro news, growing pressure around the Eurozone came by means of surging gas prices on the dwindling supply outlook.

Related: Bitcoin hodler data hints BTC cost ‘really close’ to bottom — analysts

Within the U . s . States, meanwhile, Powell delivered fresh comments within the Fed’s financial tightening policy.

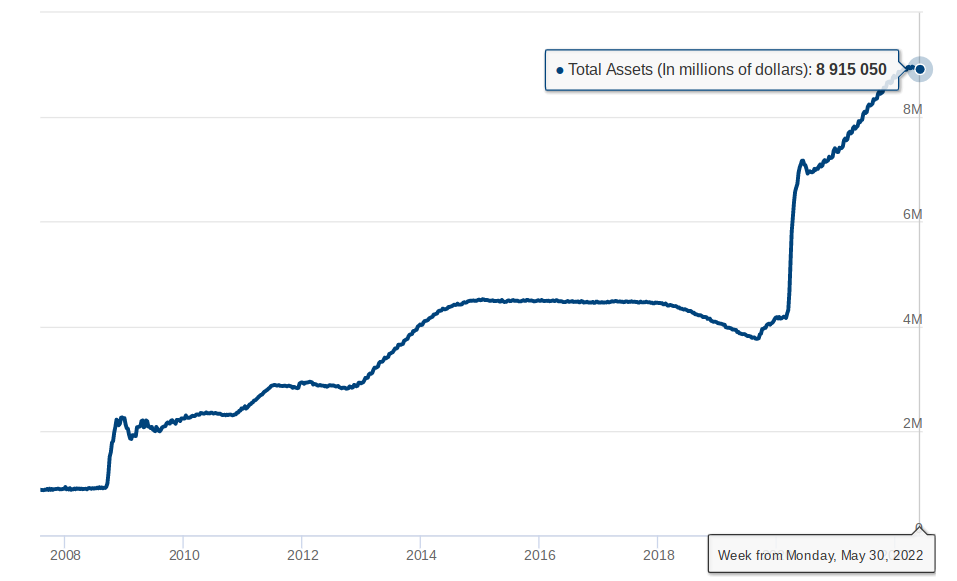

The central bank’s balance sheet reduction, he stated in comments reported by media sources during the time of writing, now only planned to shave as much as $3 trillion off its near $9 trillion of asset purchases.

Since Feb 2020, the Fed’s balance sheet has acquired $4.8 trillion, and therefore despite the reductions, it will likely be greater than its pre-pandemic levels.

The Ecu Central Bank’s balance sheet, meanwhile, hit fresh all-time highs now despite rampant inflation.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.