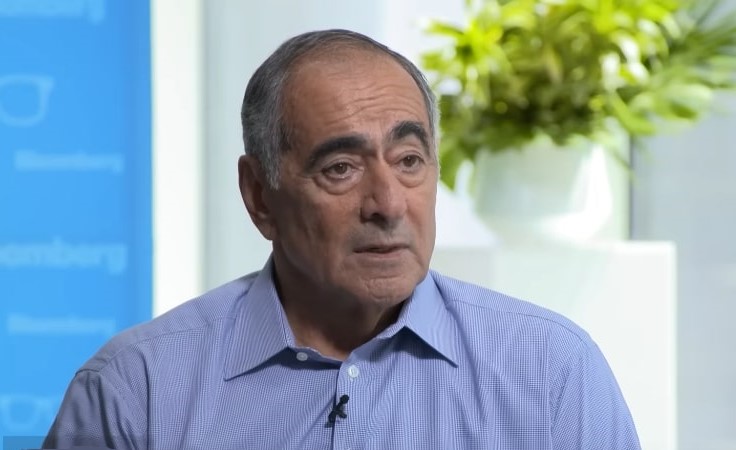

John Mack, an old Chief executive officer in the major US-headquartered investment bank Morgan Stanley, shows that bitcoin (BTC) and crypto may explore the more and more digitized realm of buying and selling – and a lot of us may live to determine it.

Speaking to CNBC about whether Wall Street would become digitized later on, Mack stated that he doesn’t think “it disappears,” but that it’ll change “dramatically.”

“Take crypto. It’s hard that i can realise why is there value,” he stated and added:

“So half a century from now, maybe that’ll be an enormous method in which financial transactions occur.”

Crypto is simple to wire, Mack contended. As things are online, people don’t need to bother about putting their cash in banks, but “you reached make certain it’s insulated, protected, and no-one can enter it,” he mentioned.

That stated, he continued to point out that, within the not-so-distant future, crypto and digitization in the realm of buying and selling could be the norm.

“Fifty years from now, I believe things is going to be much more electronic and driven increasingly more by input from humans within the computers regarding how to trade, how to get risks, and also to make certain it normally won’t review their limits.”

Mack is a crypto investor for some time now. Requested if he still owns any bitcoin, he responded: “I do.”

Among his investments, he shared that through his family office, “we possess some outright positions in crypto.”

Mack is really a senior consultant towards the investment firm Kohlberg Kravis Roberts and also the former Chief executive officer and Chairman from the board at Morgan Stanley. He’d experienced the Chief executive officer position in the bank from 2005 until 2010, and Chairman from 2005 until 2012. Between 2001 and 2004, he offered because the Chief executive officer from the global investment bank Credit Suisse.

You can view the job interview here:

Meanwhile, Morgan Stanley itself joined the crypto game some time back. For instance, in March 2021, it announced its intends to offer three bitcoin funds to the wealthy clients.

Just lately, as reported in October, Morgan Stanley Chief executive officer James Gorman was less critical of crypto than his fellow investment banking executives. “I don’t think crypto is really a fad. I do not think it’s going disappear,” Gorman stated throughout an earnings call. “I have no idea what the need for bitcoin should or should not be. However these things aren’t disappearing,” the Chief executive officer stated.

In addition, twelve institutional funds, managed by Morgan Stanley, might have had exposure to bitcoin not directly through cash-settled futures or through investments in Grayscale Bitcoin Trust, the financial institution stated in a filing on March 31.

____

Find out more:

– Morgan Stanley Professional States Bitcoin is originating for that US Dollar

– ‘Time To Obtain Educated’: Morgan Stanley Brings BTC Funds To Wealthy Clients

– Cardano Chief executive officer Hoskinson Argues VC Money Will Ton to Ecosystem by 2024

– Crypto is prospering Through Offshore Corporate Structures