Bitcoin (BTC) continues to be attempting to get out of a climbing down trend within the last week and also the first attempt on June 16 unsuccessful to interrupt the $22,600 resistance. The 2nd attempt for $21,400 on June 21 was adopted by an 8% cost correction. After two unsuccessful breakouts, the cost presently trades below $20,000 and raises questions about whether $17,600 really was the underside.

The more it requires for BTC to interrupt out of this bearish pattern, the more powerful the resistance line becomes and traders are following a trend carefully. That’s the key reason why it’s essential for bulls to exhibit strength in this week’s $2.25 billion monthly options expiry.

Regulatory uncertainty is constantly on the weigh lower on crypto markets after European Central Bank (ECB) president Christine Lagarde voiced her conviction on involve tighter scrutiny. On June 20, Lagarde expressed her ideas around the sector’s staking and lending activities: “[…] the possible lack of regulation is frequently covering fraud, completely illegitimate claims about valuation and incredibly frequently speculation in addition to criminal dealings.”

Bitcoin miners having to liquidate their BTC holdings is adding more negative pressure to BTC cost and knowledge from Arcane Studies have shown that openly-listed Bitcoin mining firms offered 100% of the BTC production in May when compared to usual 20% to 40% in the past several weeks. With each other, miners hold 800,000 BTC, which creates concerns in regards to a possible sell-off. The Bitcoin cost correction drained miners’ profitability since the production cost has, at occasions, exceeded their margins.

The June 24 options expiry is going to be especially alarming for investors because Bitcoin bears will probably gain $620 million by suppressing BTC below $20,000.

Bulls placed their bets at $40,000 and greater

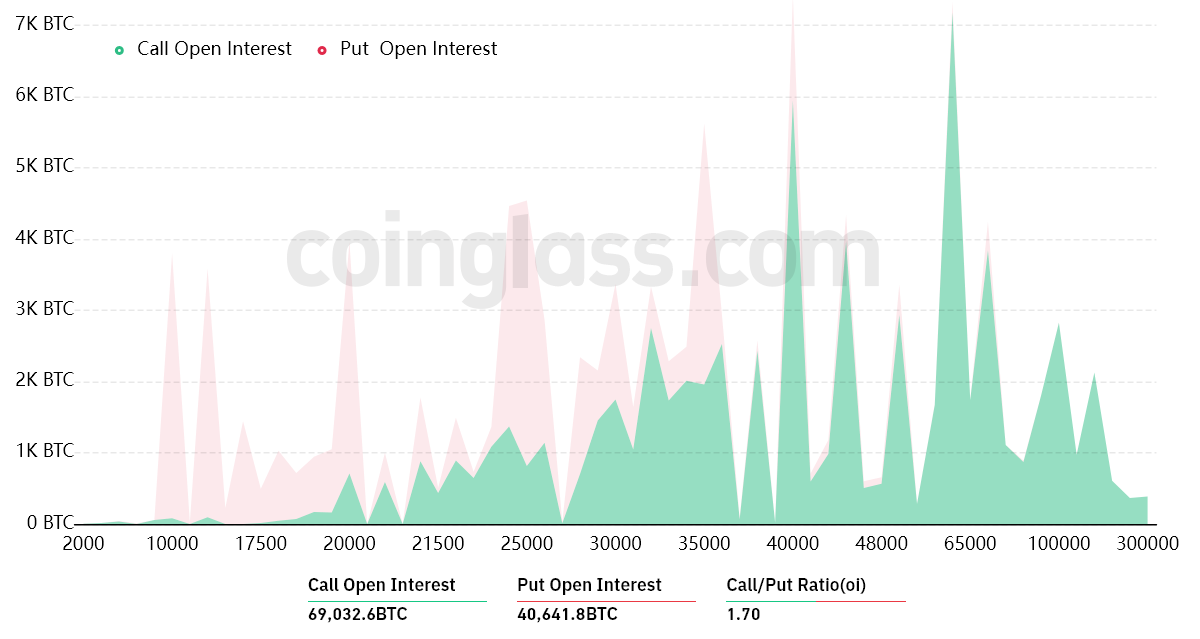

Outdoors interest for that June 24 options expiry is $2.25 billion, however the actual figure is going to be reduced since bulls were excessively-positive. These traders completely missed the objective after BTC dumped below $28,000 on June 12, however their bullish bets for that monthly options expiry extend beyond $60,000.

The Fir.70 call-to-put ratio shows the dominance from the $1.41 billion call (buy) open interest from the $830 million put (sell) options. Nonetheless, as Bitcoin stands below $20,000, most bullish bets will probably become useless.

If Bitcoin’s cost remains below $21,000 at 8:00 am UTC on June 24, only twoPercent of those call options is going to be available. This difference is really because the right to purchase Bitcoin at $21,000 is useless if BTC trades below that much cla on expiry.

Bears possess the bulls through the horns

Here are the 3 probably scenarios in line with the current cost action. The amount of Bitcoin options contracts on June 24 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $18,000 and $20,000: 500 calls versus. 33,100 puts. The internet result favors the put (bear) instruments by $620 million.

- Between $20,000 and $22,000: 2,800 calls versus. 27,00 puts. The internet result favors bears by $520 million.

- Between $22,000 and $24,000: 5,900 calls versus. 26,600 puts. The internet result favors the put (bear) instruments by $480 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

A couple of more dips below $20,000 wouldn’t be suprising

Bitcoin bears have to push the cost below $20,000 on June 24 to have a $620 million profit. However, the bulls’ best situation scenario needs a pump above $22,000 to lessen the outcome by $140 million.

Bitcoin bulls had $500 million in leveraged lengthy positions liquidated on June 12 and 13, so that they must have less margin than is needed they are driving the cost greater. Thinking about this data, bears have greater likelihood of pinning BTC below $22,000 in front of the June 24 options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.