If FTX is sparking new Bitcoin (BTC) bear market lows, BTC cost action has further to fall to complement Mt. Gox.

Data from on-chain analytics firm Glassnode confirms the “Mt. Gox bear market” almost about ten years ago still beats the 2022 lows.

FTX versus. Mt. Gox: Same, same but different

Using the fallout in the FTX personal bankruptcy scandal still unfolding, questions remain over the number of major crypto entities is going to be affected and just how big industry losses is going to be.

BTC/USD fell over 25% a week ago because the ramifications grew to become known and has unsuccessful to recuperate much lost ground.

Simultaneously, multiple comparisons to Mt. Gox have emerged: alleged mismanagement, poor security and insider buying and selling activity have been reported as examples.

The raw data, however, reveals some interesting additional figures to keep in mind.

Mt. Gox imploded because of a huge 840,000 BTC hack in Feb 2014. Just several weeks before, Bitcoin saw a brand new all-time a lot of around $1,100, with Mt. Gox handling around 70% of buying and selling activity.

Within the several weeks that adopted, Bitcoin lost as much as 85% of their value versus that top, bottoming in The month of january 2015 — several months following the hack.

This cycle grew to become the very first Bitcoin bear market observed on the wide scale by hodlers, also it required until December 2017 for an additional all-time high to emerge.

Go forward to 2022, and also at its recent two-year lows, BTC/USD was lower 77% in only within year against its latest all-time highs of $69,000.

Using the timeframes similar between FTX and Mt. Gox, the issue facing analysts is whether or not BTC cost action will prove to add another 10% to the drawdown versus its prior peak — or worse.

As Cointelegraph reported, requires coming back to $10,000 were already in position before the FTX episode. The black swan personal bankruptcy, others cautioned, has, meanwhile, set the crypto industry back many years.

What’s inside a $400 million wipeout?

Evaluating FTX to some similar black swan event from almost 10 years ago may appear unnatural. However, the figures involved are eerily similar in certain respects.

Related: Bitcoin will shrug off FTX ‘black swan’ much like Mt. Gox — analysis

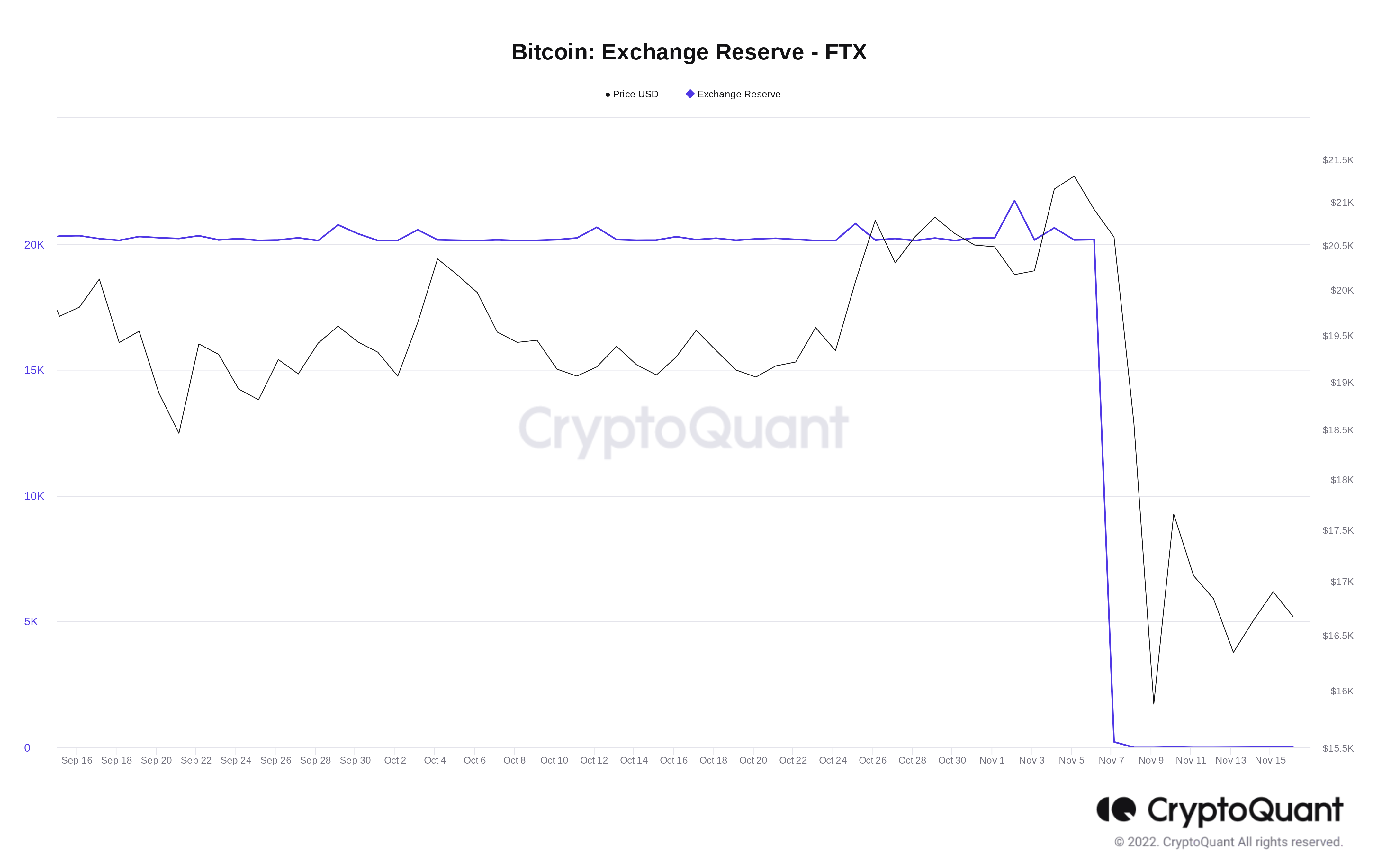

Mt. Gox lost 840,000 BTC, worth at that time around $460 million. Prior to going lower, FTX were built with a Bitcoin balance of 20,000, according to data from on-chain analytics platform CryptoQuant — also worth approximately $400 million.

As a small fraction of market cap, however, 2010 losses pale as compared to the 2014 drawdown.

Bitcoin’s market cap at the beginning of March 2014 was $6.9 billion when compared with $320 billion today. The general crypto market cap today is $834 billion, data from CoinMarketCap confirms.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.