Mike Bankman-Fried, founder and Chief executive officer from the troubled cryptocurrency exchange FTX, seems to possess retracted his words concerning the safety of client holdings on FTX.

Bankman-Fried has deleted a Twitter thread where he attempted to make sure customers that FTX and also the assets around the platform were “fine.”

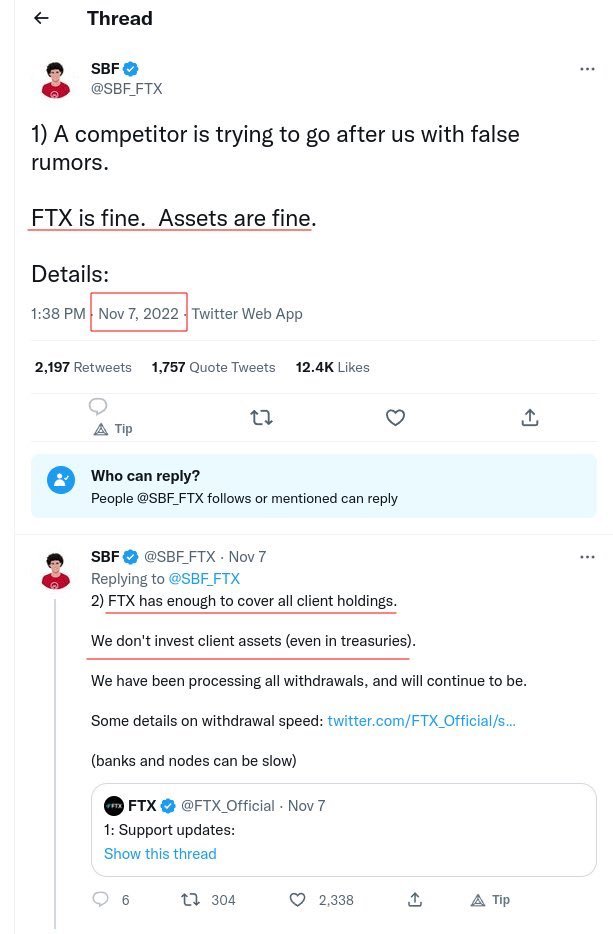

FTX Chief executive officer required to Twitter to publish the thread of 4 different tweets on November. 7, claiming that FTX had “enough to pay for all client holdings.” Bankman-Fried also mentioned the firm didn’t invest client assets and it has been processing all withdrawals and “will continue being.”

“We possess a lengthy good reputation for safeguarding client assets, which remains true today,” one now-deleted tweet stated.

Based on multiple sources on Twitter, FTX Chief executive officer removed his “assets are fine” thread on November. 8 around 10:30 pm UTC, or perhaps a couple of hrs after announcing a proper transaction with Binance. Included in the deal, Binance decided to acquire FTX inside a proceed to assist the troubled exchange overcome a “significant liquidity crunch.”

The purchase news came soon after several reports hinted that FTX had temporarily stopped withdrawals for almost all coins. Many within the crypto community anticipated these occasions among sluggish FTX withdrawals, concerns concerning the leaked balance sheet of FTX’s sister firm Alameda Research in addition to Binance’s decision to liquidate its FTX Token (FTT) holdings.

The city continues to be outraged about SBF opting to delete the tweets, with lots of blaming the FTX founder for “blatant lies” concerning the status of assets around the exchange.

One Twitter user, handle Pledditor, also noticed that SBF formerly retweeted an arbitrary account that implied an airdrop for individuals who don’t withdraw their coins from FTX. The crypto enthusiast recommended the U . s . States Registration must pursue such actions, stating: “An implicit promise that SBF does not really to become attributed for while he themself didn’t tweet it.”

Related: Saying ‘not financial advice’ won’t help you stay from jail — Crypto lawyers

Some crypto observers aren’t too positive concerning the future occasions for FTX users that still store their holdings around the exchange. Based on Dylan LeClair, senior analyst at UTXO Management, FTX clients are now unsecured creditors.

Don’t mean is the bearer of not so good news here, but when it is not obvious already, if you’ve still got funds on FTX, they are gone. You are a creditor.

The probable result’s Chapter 11 & a class action lawsuit suit that pulls out for a long time, in which you get $.10-$.30 around the dollar.

— Dylan LeClair (@DylanLeClair_) November 8, 2022

The FTX news triggered another massive crash around the crypto market that was already already decreasing this season, with Bitcoin (BTC) tanking to below $18,000. The entire market price lost about 10% in the last 24 hrs during the time of writing, based on CoinGecko.